Wealth management helps you organize, grow, and protect your money with personalised financial strategies. You gain more than just investment advice; you receive a structured approach that supports your financial stability and long-term goals. Research shows that financial literacy and strong decision-making skills lead to better wealth management outcomes and improved financial well-being in Malaysia. In fact, individuals who use wealth management services often see dramatic asset growth over time.

| Group / Condition | Asset Improvement Metric | Percentage Increase |

|---|---|---|

| Individuals receiving financial advice | More liquid financial assets | 39% |

| Households with 15+ years of advisory | Asset accumulation | 290% |

![3[1].jpg](https://media.finebi.com/strapi/3_1_bc9fd7d516.jpg)

Wealth management is a comprehensive approach to organizing your finances. You use it to bring together all aspects of your money, including investments, savings, insurance, and taxes. This process goes beyond just picking stocks or bonds. You work with professionals who help you create a plan that fits your goals and lifestyle.

You might think of wealth management as a toolkit. In this toolkit, you find investment advice, retirement planning, tax strategies, and risk management. Each tool helps you build a stronger financial future in Malaysia. When you use wealth management, you get a clear picture of where your money stands and where it can go.

Wealth management services often include:

You do not need to be a millionaire in Malaysia to benefit from wealth management. Many people in Malaysia use these services to make smarter choices with their money. You can start with simple steps, like setting up a budget or choosing a mix of investments that match your comfort with risk.

Tip: A good wealth management plan adapts as your life changes. You might get married, start a business in Malaysia, or plan for your children’s education. Your plan should grow with you.

Wealth management matters because it gives you control and confidence over your financial life in Malaysia. You avoid common mistakes, such as putting all your money in one place or ignoring tax consequences. Instead, you use a structured approach to reach your goals in Malaysia.

When you use wealth management, you protect yourself from unexpected events. For example, you might lose your job or face a medical emergency. With a solid plan, you have savings and insurance to help you through tough times.

Empirical studies show that basic wealth management strategies, like diversifying your investments, play a key role in protecting and growing your money. During the COVID-19 pandemic, investors in Malaysia who spread their money across different types of assets saw better results. Low correlations between assets and careful selection of investments helped reduce risk. Some investors even used alternative strategies, such as Islamic finance indices, to lower risk and shield themselves from market crashes.

You also benefit from portfolio optimization. Research shows that when you choose investments based on multiple reward and risk factors, you can achieve higher returns than just following the market. For example, using advanced selection methods, investors outperformed the S&P 500 and other common strategies. These methods may involve more active management and higher turnover, but they often lead to better risk-adjusted returns.

Here is a quick summary of why wealth management matters for you:

| Benefit | How It Helps You |

|---|---|

| Goal Achievement | You set and reach clear financial goals |

| Risk Reduction | You avoid big losses by spreading out investments |

| Tax Efficiency | You keep more of your money through smart planning |

| Peace of Mind | You feel secure about your financial future |

| Adaptability | You adjust your plan as your life changes |

You do not have to manage everything alone. Wealth management services give you access to experts who understand the latest trends, laws, and strategies. They help you make informed decisions, so you can focus on what matters most to you.

Note: Financial planning is not just for the wealthy. Anyone who wants to make the most of their resources can benefit from a structured approach to managing money.

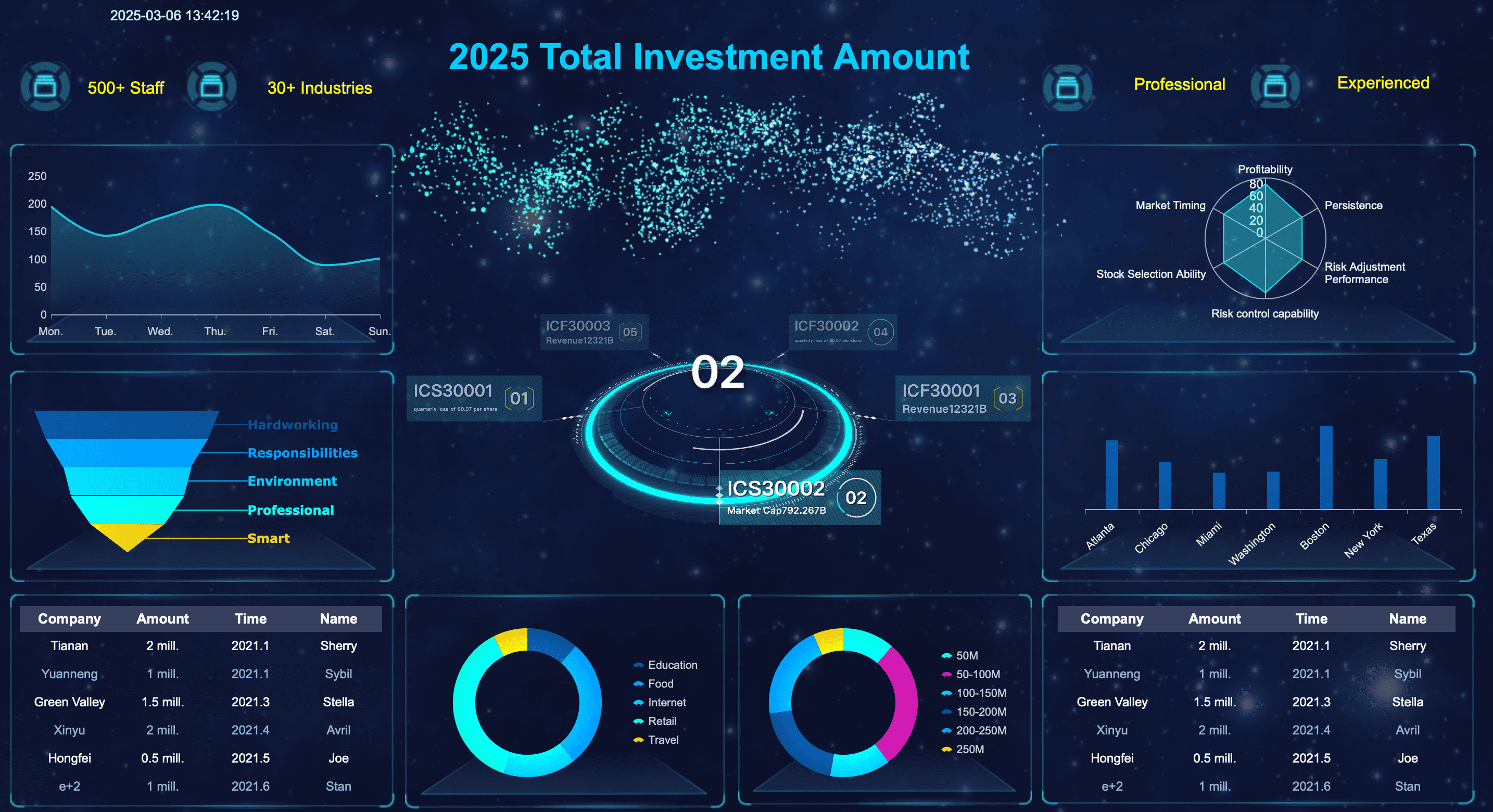

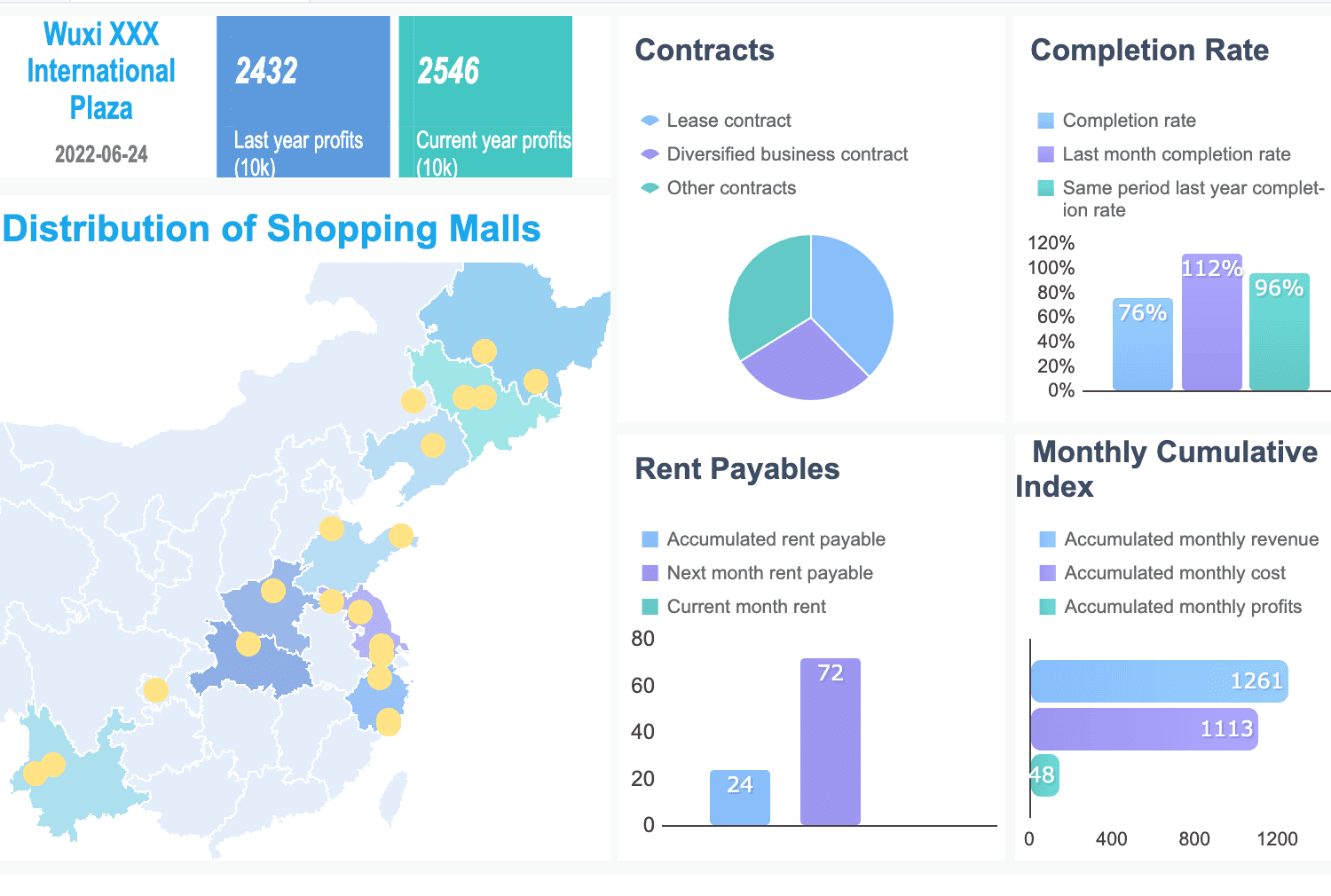

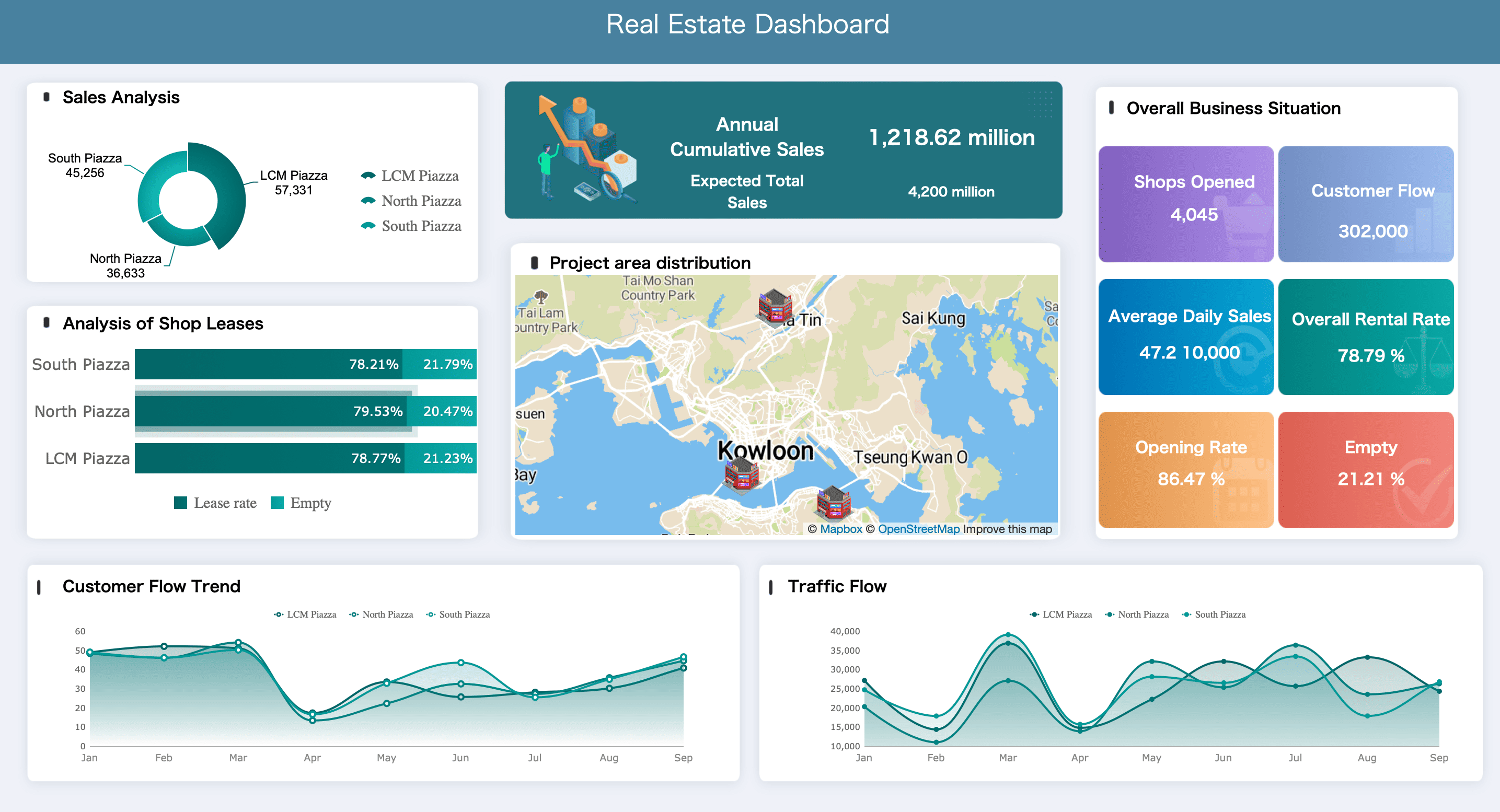

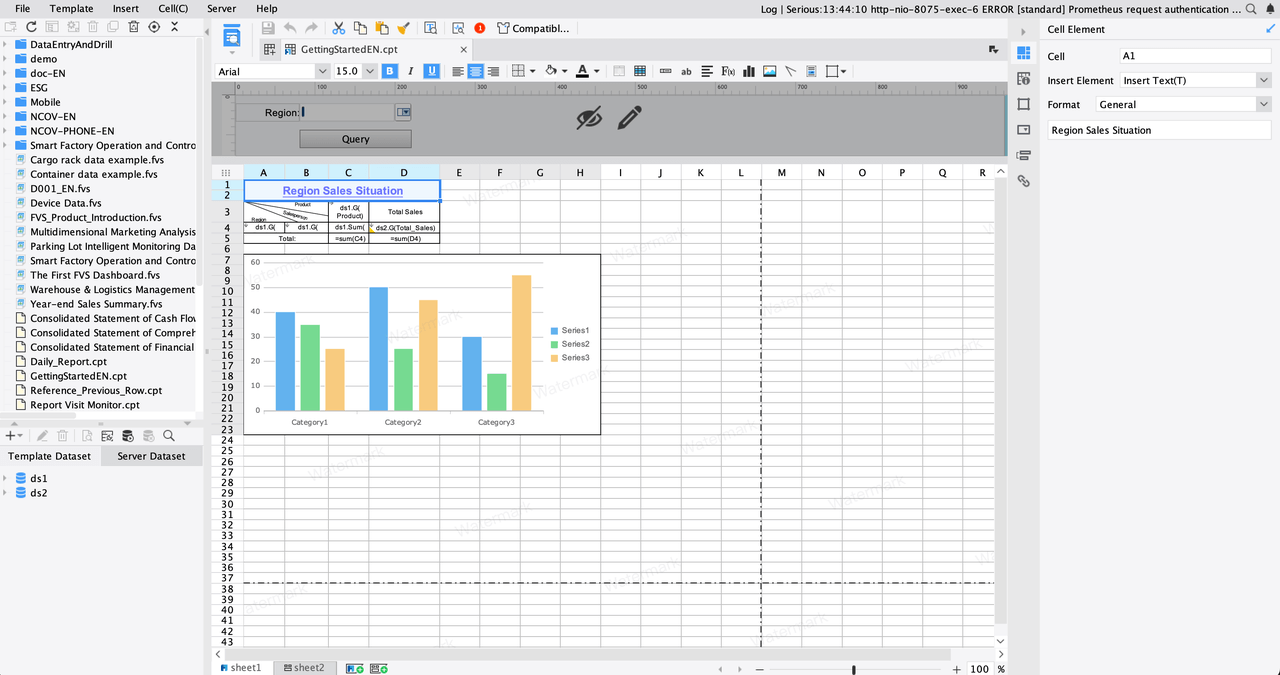

When you use wealth management services, you gain access to a range of specialized support. Each service area helps you build a stronger financial future and make smarter choices with your money. Today, technology and data-driven tools like FineReport by FanRuan make these services even more effective. FineReport helps you integrate financial data, create clear reports, and analyze trends, so you can make decisions with confidence.

Investment management focuses on growing your assets through careful selection and monitoring of investments in Malaysia. You work with experts who help you choose investment strategies that match your goals and risk tolerance. Digital investment platforms have made it easier for everyone in Malaysia to access these services. A recent study in China found that using digital investment management led to greater wealth accumulation, especially for people in less developed areas. This happened because digital tools made it easier to diversify investments and earn higher returns. When you use investment management, you benefit from professional financial advice, portfolio diversification, and ongoing monitoring. FineReport supports this process by helping you track your investments, analyze performance, and adjust your strategies as needed in Malaysia.

Financial planning helps you set clear goals and create a roadmap to reach them in Malaysia. You might plan for retirement, a child’s education, or a major purchase. A good plan considers your income, expenses, savings, and investments. When you use financial planning, you can see how each decision affects your future. FineReport makes it easy to visualize your progress and adjust your plan as your life changes. You get a complete view of your finances, which helps you stay on track and avoid surprises in Malaysia.

Tax and estate planning protect your wealth and ensure you pass it on according to your wishes. You use these services to reduce taxes, plan inheritances, and manage legal documents. With the right strategies, you keep more of your money and avoid costly mistakes. FineReport helps you organize tax records, track deadlines, and generate reports for your advisors in Malaysia. This makes it easier to stay compliant and make informed decisions about your estate in Malaysia.

Insurance management shields you from unexpected events in Malaysia. You review your needs and choose policies that protect your health, income, and assets. When you manage insurance well, you avoid financial setbacks from accidents, illness, or loss. FineReport helps you keep track of your policies, premiums, and claims. You can spot gaps in coverage and make sure your protection matches your needs.

Tip: Using technology like FineReport gives you a real-time view of your finances. You can spot trends, catch problems early, and make better decisions for your future in Malaysia.

You might wonder if wealth management is only for the very rich. In reality, many people and organizations benefit from these services. Wealth managers work with a wide range of clients, each with unique needs and goals. Here are some groups who often use wealth management:

You can see how wealth management serves many types of clients in Malaysia. The table below shows some common segments:

| Demographic Category | Segments / Groups |

|---|---|

| Wealth Segments | Mass Affluent (US$250k–$1m), High Net Worth (US$1m–$4.9m), Very High Net Worth (US$5m–$29.9m), Ultra High Net Worth (US$30m+) |

| Age Groups | Millennials (25–41), Gen X (42–57), Boomers (58+) |

| Geographic Regions | North America, Latin America, Europe, Nordics, Middle East, Asia-Pacific, ASEAN |

Wealth managers understand the needs of each group and create strategies that fit their situation.

You should think about wealth management when your finances become more complex or your goals change. If you receive a large inheritance, start a business in Malaysia, or plan for retirement, you may need expert advice. Wealth managers help you make sense of new challenges and keep you on track.

You might also consider these services if you want to protect your assets, grow your investments, or plan for your family’s future. When you face big life changes, such as marriage, having children, or moving to another country, wealth managers can guide you through the process. They use their knowledge to help you achieve financial stability and peace of mind.

Note: You do not need millions to benefit from wealth management. If you want to organize your finances, reach your goals, or prepare for the unexpected, a wealth manager can help you make smart choices.

When you choose wealth managers in Malaysia, you want to know they have the right skills and experience. Look for professionals with at least seven years of experience as an advisor. Many top firms use both interviews and data to evaluate their teams in Malaysia. They check revenue trends, assets under management, compliance records, and best practices. Some even use algorithms to compare advisors against their peers in Malaysia. You can see how these criteria stack up in the table below:

| Criterion | Description / Numerical Data |

|---|---|

| Minimum Experience | At least 7 years as an advisor |

| Interview Types | Telephone, virtual, and in-person interviews |

| Nominations Received | 44,990 nominations based on high thresholds |

| Survey Completion | 23,876 advisors completed a 140-question survey |

| Interviews Conducted | 20,412 telephone, 1,507 virtual, 4,926 in-person interviews |

| Quantitative Criteria | Assets under management, revenue trends, compliance records |

| Qualitative Criteria | Client impact, best practices, business models, credentials, community involvement |

| Compliance | Acceptable compliance record required |

| Revenue Source | Over 50% of revenue must be with individuals |

![4[1].jpg](https://media.finebi.com/strapi/4_1_a81a8e4d01.jpg)

You should also check for credentials, such as CFP or CFA, and ask about their approach to client service. Reliable wealth managers in Malaysia will always put your interests first.

Understanding fees is important when you select wealth managers in Malaysia. Some charge a percentage of assets, while others use flat fees or hourly rates. Studies show that pricing affects how satisfied you feel with the service. When you know what you pay and why, you feel more confident in your choices. Transparent fee structures help you avoid surprises and build trust with your advisor.

Tip: Always ask for a clear breakdown of all costs before you sign any agreement.

You want wealth managers who offer more than just investment picks. Look for those who use technology to give you a clear view of your finances. Tools like FineReport by FanRuan help you see all your accounts, track performance, and spot trends. These platforms make it easy to get real-time reports and make informed decisions. Good wealth managers use data-driven tools to keep you updated and help you reach your goals in Malaysia.

Here are some qualities to look for:

Choosing the right wealth manager gives you peace of mind and helps you build a secure financial future.

When you look at wealth management, you see a service that brings together many parts of your financial life. It stands apart from other financial services because it offers a complete, personalized approach. Let’s see how it compares to financial planning, investment advisory, and technology solutions.

Financial planning helps you set goals and map out steps to reach them. You might use it to plan for retirement, save for college, or buy a home. This service focuses on your income, expenses, and savings. Wealth management includes financial planning, but it goes further. You get help with taxes, investments, insurance, and estate planning—all in one place. With tools like FineReport by FanRuan, you can track your progress, visualize your goals, and adjust your plan as your life changes. This makes your financial journey clearer and more manageable.

An investment advisory service gives you advice on where to put your money. Advisors in Malaysia help you choose stocks, bonds, or funds based on your risk level and goals. While this service is valuable, it often focuses only on your investments. Wealth management covers your whole financial picture, not just your portfolio. Advanced analytics and reporting tools, such as those in FineReport, give you real-time insights and help you make smarter choices. These tools use AI to adapt to market changes, automate portfolio management, and improve risk control. You benefit from sharper market insights and better after-tax returns.

Note: Wealth management uses technology to connect all your financial data, making it easier to spot trends and avoid mistakes.

Modern technology solutions, like FineReport, play a key role in wealth management. You can integrate data from many sources, create custom dashboards, and automate reports. This gives you a clear view of your finances at any time. With AI-powered analytics, you get personalized advice, faster reporting, and improved compliance. The table below shows how technology can boost performance:

| Solution Level | Features | Outcomes |

|---|---|---|

| Basic | Scheduled reporting, simple analytics | Track key metrics |

| Medium | Real-time processing, ML diagnostics | Faster reporting, better insights |

| Advanced | AI optimization, big data analytics | Higher ROI, real-time risk alerts |

When you use these tools, you gain control, save time, and make better decisions. Wealth management stands out because it brings all these services together, supported by powerful technology.

Wealth management gives you a clear path to financial security and growth in Malaysia. Many investors in Malaysia who use these services report better investments, higher returns, and greater confidence during economic downturns. You can see measurable improvements when you combine wealth management with data-driven tools like FineReport. These platforms help you track key metrics, spot trends, and make faster, smarter decisions. Take time to review your finances. Consider working with a professional or exploring advanced reporting tools to reach your goals.

Click the banner below to try FineReport for free and empower your enterprise to transform data into productivity!

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

What is a data management platform in 2025

A data management platform in 2025 centralizes, organizes, and activates business data, enabling smarter decisions and real-time insights across industries.

Howard

Dec 22, 2025

Top 10 Database Management Tools for 2025

See the top 10 database management tools for 2025, comparing features, security, and scalability to help you choose the right solution for your business.

Howard

Dec 17, 2025

Best Data Lake Vendors For Enterprise Needs

Compare top data lake vendors for enterprise needs. See which platforms offer the best scalability, integration, and security for your business.

Howard

Dec 07, 2025