Factual data refers to verified information used to make decisions. In mortgage lending, it plays a critical role in evaluating financial risks and ensuring transparency. For lenders, it simplifies decision-making by providing easy-to-read credit reports and innovative verification tools. Borrowers benefit from accurate assessments that improve approval chances.

Here’s how factual data supports both parties:

|Benefit Type|Description|

|---|---|

|Assesses Borrower’s Creditworthiness|Factual data helps in evaluating the credit risk of borrowers, ensuring lenders make informed decisions.|

- Provides lenders with easy-to-read consumer credit reports.

- Offers innovative verification tools to streamline the mortgage process.

Key Takeaways

- Factual data is checked information that helps lenders decide if you can repay loans.

- Correct credit reports are important; even small mistakes can cause loan rejections or bad terms.

- Check your credit report often to fix mistakes and improve your chances of getting a mortgage.

- Tools like FineDataLink help make data correct and make the mortgage process easier for everyone.

- A good credit record, made by paying on time and having little debt, helps you get better loan deals.

- Knowing how lenders use factual data helps you manage your money better.

- Taking care of your factual data early can get you faster approvals and less stress when getting a mortgage.

- Work with your lender to fix data problems quickly for a smoother mortgage process.

Understanding Factual Data in Mortgage Lending

What is Factual Data?

Factual data refers to verified and objective information that supports decision-making. In mortgage lending, this data includes details about your credit history, income, employment, and property value. Lenders rely on this information to assess your financial stability and determine your eligibility for a loan. Factual data ensures that decisions are based on facts rather than assumptions, creating a fair and transparent process for everyone involved.

You might wonder why this matters. When lenders evaluate your application, they need accurate data to measure your ability to repay the loan. This data helps them avoid risks and ensures you receive a loan that aligns with your financial situation.

Key Characteristics of Factual Data

Factual data has several defining features that make it essential in mortgage lending:

- Accuracy: The data must be precise and free from errors. Even small inaccuracies can lead to incorrect decisions.

- Relevance: Only data directly related to your financial profile and the property should be considered. Irrelevant information can complicate the process.

- Timeliness: Outdated data can misrepresent your current financial situation. Lenders need the most recent information to make informed decisions.

- Objectivity: The data should be unbiased and verifiable. Subjective opinions or assumptions have no place in factual data.

Emerging trends in factual data usage highlight its evolving role. For example:

| Feature | Description | | --- | --- | | Credit Simulation | Helps lenders identify opportunities for applicants across all credit ranges. | | Score Potential | Provides data on an applicant’s score potential. | | Automated Plans | Creates automated plans for credit improvement. | | Scenario Modeling | Models multiple credit scenarios for better decision-making. |

These features enhance the accuracy and efficiency of the mortgage process, benefiting both you and the lender.

Why Accuracy in Factual Data Matters

Accurate factual data is the foundation of a successful mortgage application. Errors in your credit report or income verification can lead to delays or even loan denial. For lenders, inaccuracies increase the risk of approving non-conforming loans, which can result in financial losses.

You can see how accuracy impacts every step of the process. For instance, lenders use factual data to ensure loans meet strict underwriting standards. They also require final credit verification before closing to confirm your financial status. This reduces the risk of errors and ensures compliance with regulations.

To protect yourself, you should regularly review your credit reports and correct any mistakes. Tools like credit simulation and scenario modeling can help you understand your score potential and create a plan for improvement. These proactive steps ensure your factual data reflects your true financial health, increasing your chances of approval.

Tip: Accurate factual data not only improves your loan approval chances but also helps you secure better terms and interest rates.

Sources of Factual Data in the Mortgage Process

Credit Reports and Credit Bureaus

Credit reports are one of the most critical sources of factual data in the mortgage process. These reports provide a detailed overview of your financial history, including payment records, outstanding debts, and credit inquiries. Lenders use this information to assess your creditworthiness and determine whether you qualify for a loan.

Credit bureaus, such as Equifax, Experian, and TransUnion, compile these reports. They follow strict legal guidelines to ensure accuracy. For example, the Fair Credit Reporting Act (FCRA) requires credit bureaus to use "reasonable procedures to assure maximum possible accuracy." If you find errors in your credit report, you can dispute them, and the bureau must investigate.

In recent years, credit bureaus have improved their standards. They now exclude incomplete tax liens and civil judgments from reports. Medical debts are also excluded until they are at least 180 days past due, giving you time to resolve billing issues. These changes enhance the reliability of the factual data lenders rely on.

| Service Type | Description | | --- | --- | | Prequalification Reports | Soft inquiry reports for assessing eligibility. | | Hard Inquiry Credit Reports | Detailed credit reports for mortgage applications. | | Debt Monitoring | Ongoing tracking of consumer debt status. |

Employment and Income Verification

Lenders need to verify your employment and income to ensure you can repay the loan. This step involves gathering factual data about your job stability and earnings. Verification can occur through several methods:

- Manual verification, such as contacting your employer via phone or email.

- Automated systems that access payroll information directly from HR departments.

- Third-party verification providers that streamline the process and reduce errors.

Lenders often perform this verification twice—once during underwriting and again before closing. This ensures your employment status hasn't changed. Automated systems have become popular because they speed up the process and minimize human error. Accurate employment and income data give lenders confidence in your ability to meet mortgage obligations.

Property Appraisals and Public Records

Property appraisals and public records provide another essential source of factual data. Appraisals determine the market value of the property you want to purchase. Licensed appraisers evaluate factors like location, condition, and comparable sales in the area. This ensures the property value aligns with the loan amount, protecting both you and the lender.

Public records offer additional insights. These include property tax records, ownership history, and zoning information. Lenders use this data to confirm the property's legal status and ensure there are no unresolved issues, such as liens or disputes. Accurate property data reduces risks and ensures a smooth mortgage process.

Tip: Regularly review your credit report and employment records to ensure they reflect accurate factual data. This proactive approach can help you avoid delays and improve your chances of approval.

The Role of Data Integration Platforms like FineDataLink

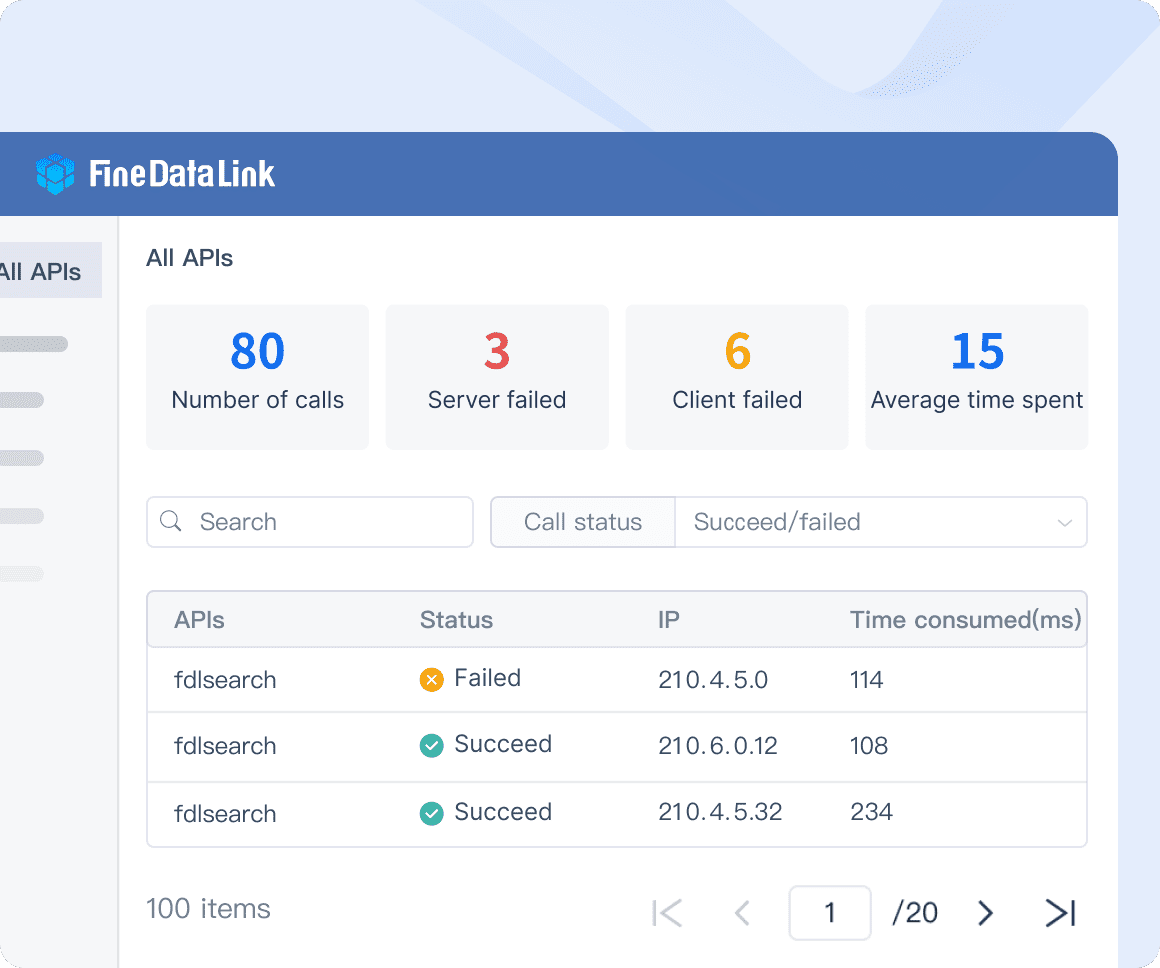

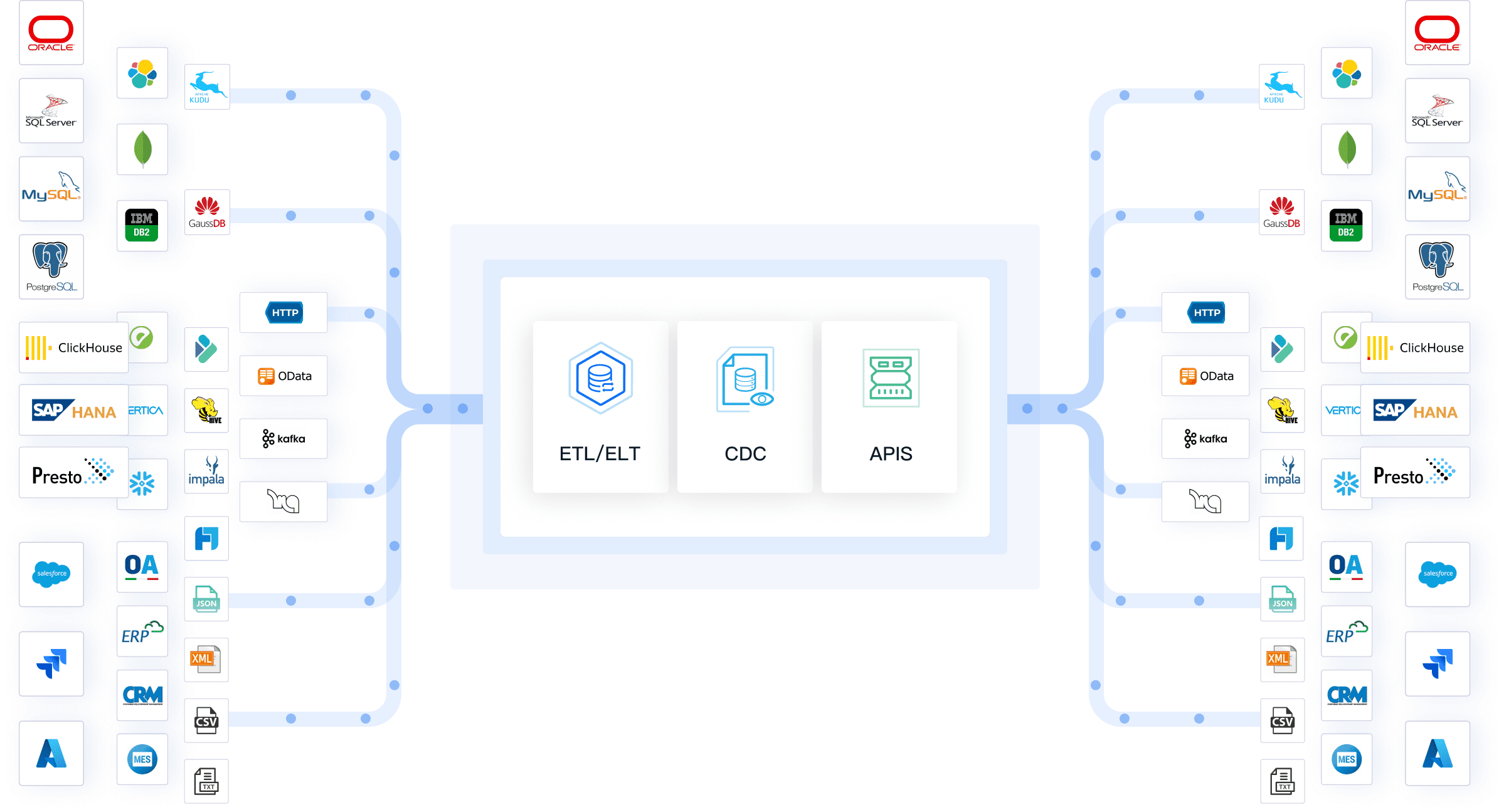

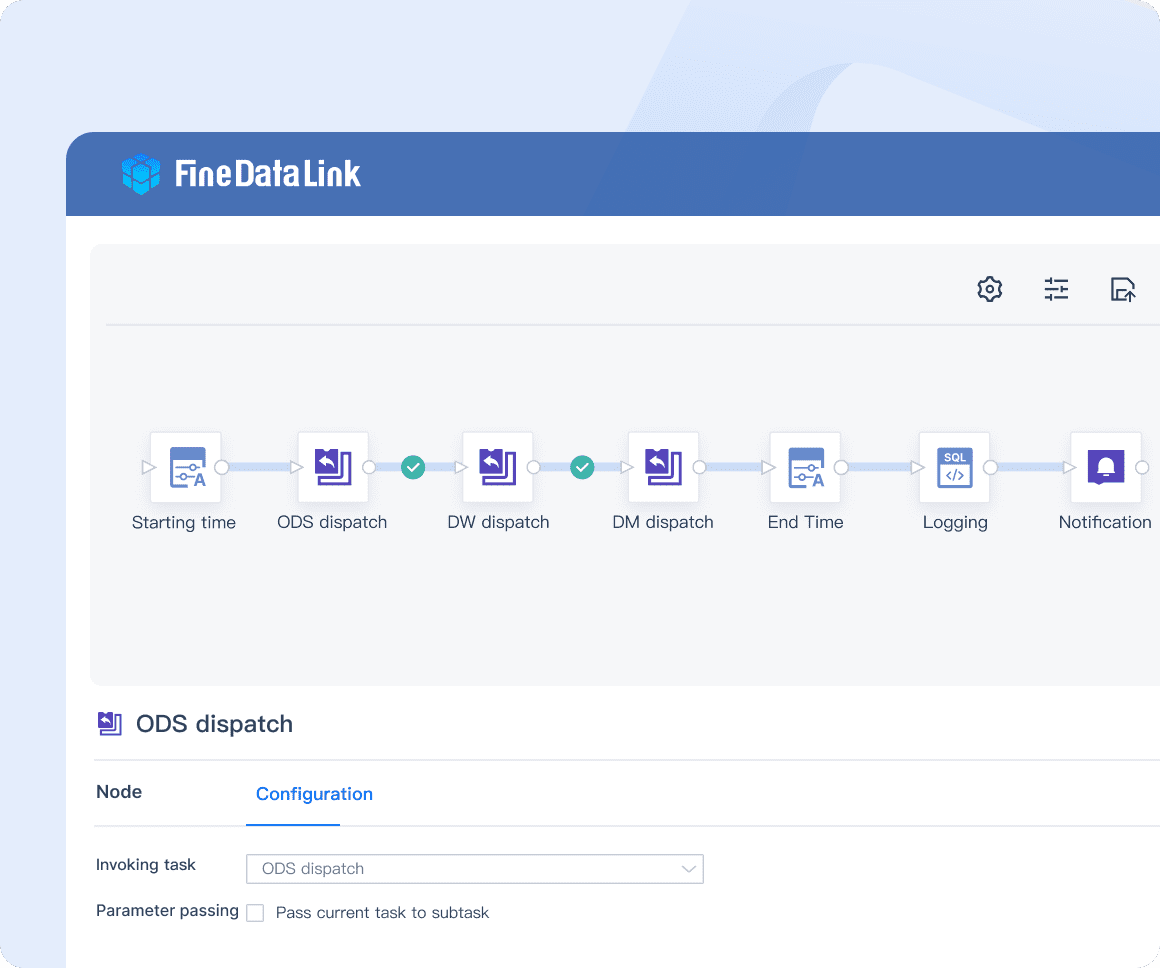

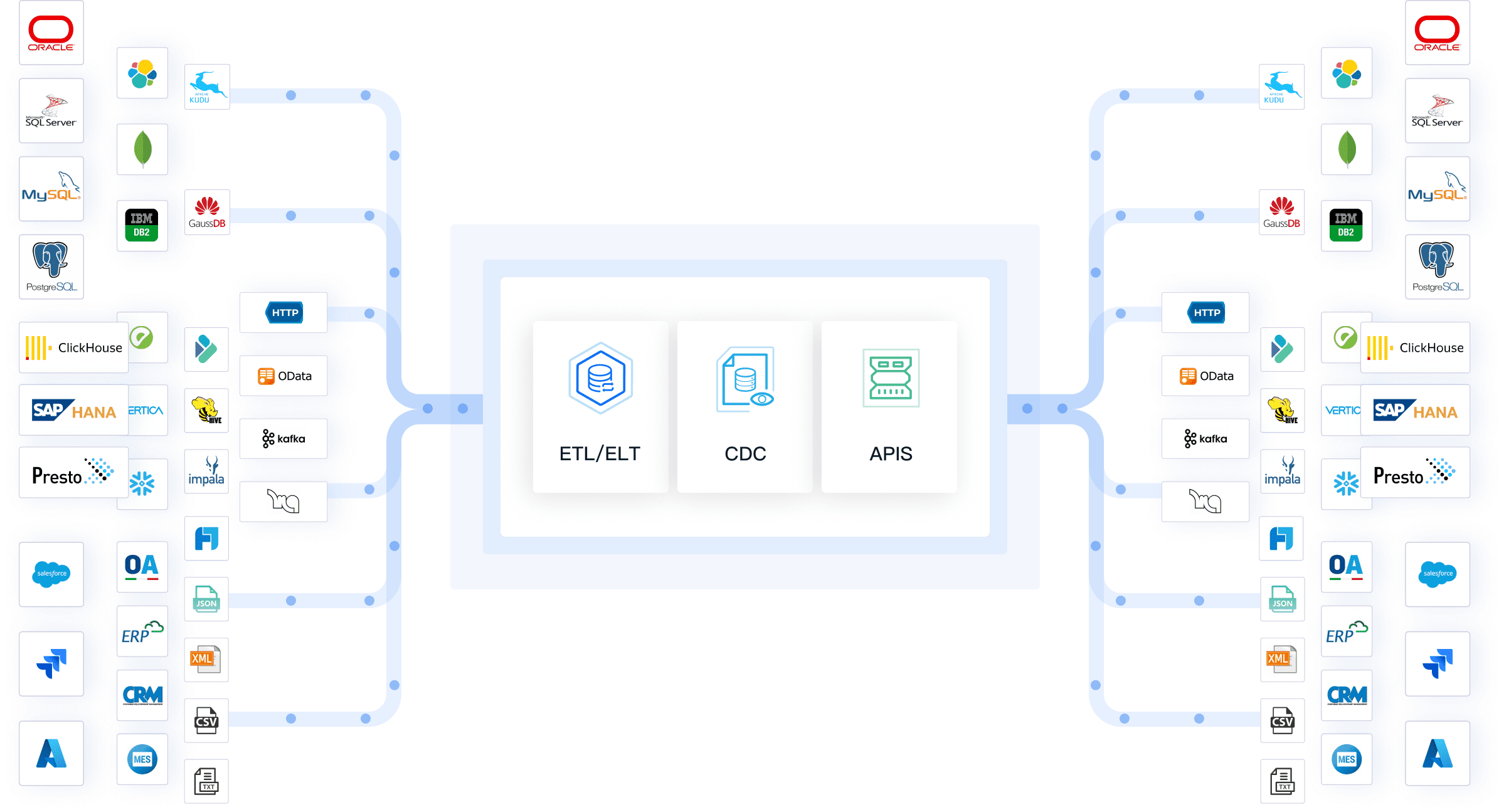

Data integration platforms like FineDataLink play a vital role in the mortgage lending process. These platforms help lenders manage and analyze large volumes of factual data from multiple sources. By streamlining data collection and synchronization, they ensure that lenders have access to accurate and up-to-date information.

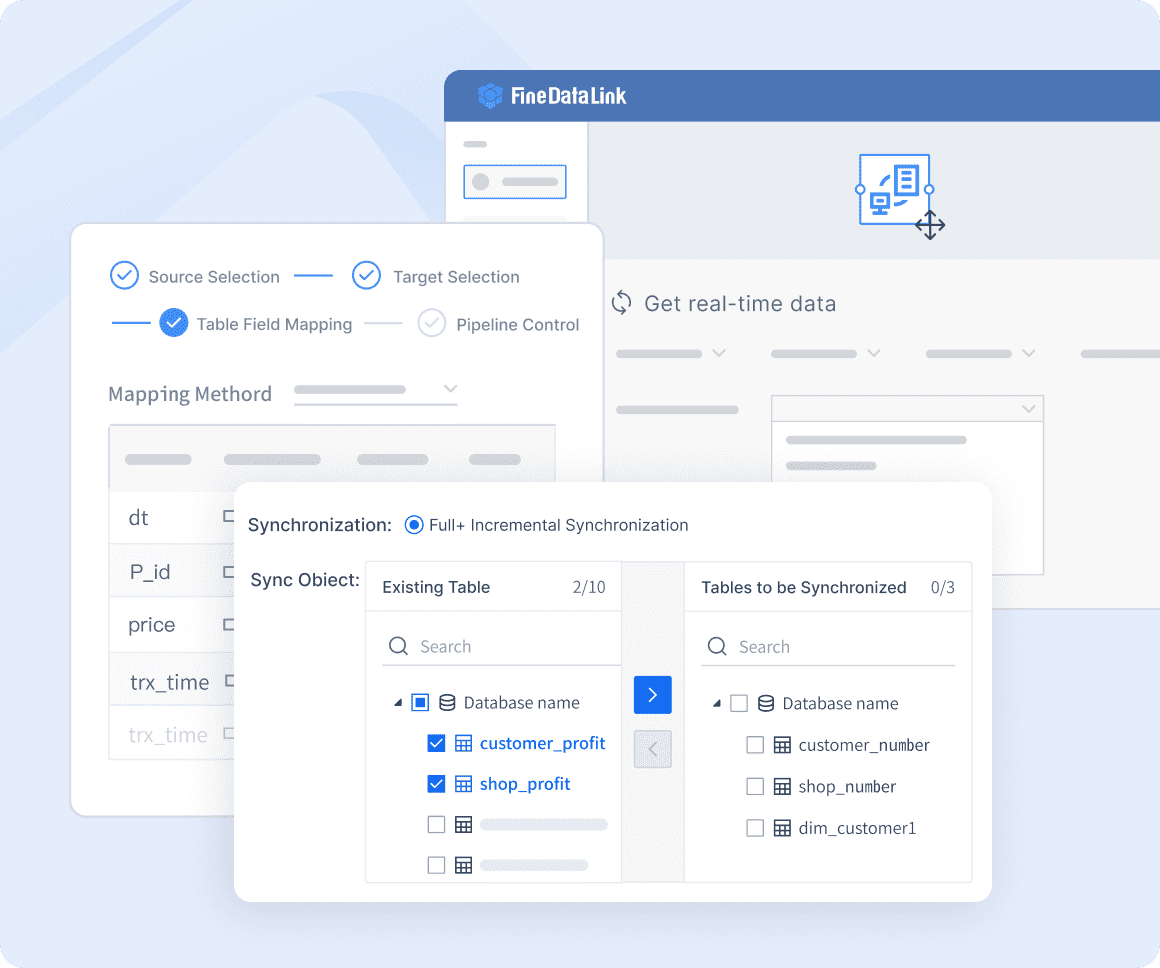

FineDataLink simplifies the integration of data from various systems, such as credit bureaus, payroll providers, and public records. Its real-time synchronization feature ensures that lenders receive the most current data without delays. For example, when verifying your employment or income, FineDataLink can pull information directly from payroll systems. This eliminates the need for manual checks and reduces the chances of errors.

The platform also enhances efficiency through its low-code interface. With drag-and-drop functionality, lenders can quickly set up data pipelines and automate repetitive tasks. This saves time and allows them to focus on evaluating your application. FineDataLink’s ability to handle diverse data formats, such as CSV, XML, and JSON, ensures seamless integration across different systems.

Another key advantage of FineDataLink is its support for advanced ETL (Extract, Transform, Load) processes. These processes clean and organize factual data before it reaches the lender. For instance, FineDataLink can identify and correct inconsistencies in your credit report or property records. This ensures that the data used in your mortgage application is both accurate and reliable.

FineDataLink also provides APIs that enable seamless communication between systems. These APIs allow lenders to access factual data in real time, improving decision-making speed. For you, this means a faster and smoother mortgage approval process.

By using FineDataLink, lenders can reduce risks and improve compliance with regulations. Accurate and well-integrated data helps them meet strict underwriting standards. For borrowers, this translates to fairer evaluations and better loan terms.

Tip: Platforms like FineDataLink not only enhance data accuracy but also make the mortgage process more transparent and efficient. This benefits both lenders and borrowers.

FineDataLink’s ability to integrate and transform data makes it an essential tool in modern mortgage lending. Its features ensure that factual data remains accurate, timely, and accessible throughout the process.

How Lenders Use Factual Data

Assessing Borrower Creditworthiness

Lenders rely on factual data to evaluate your financial reliability. They use this information to determine if you can repay the loan. One of the primary tools they use is your credit report. This document provides a detailed history of your financial behavior, including payment records, outstanding debts, and credit inquiries. By analyzing this data, lenders can assess your creditworthiness and decide whether to approve your application.

Factual Data Corp, a consumer credit reporting agency, plays a key role in this process. It compiles credit-related information from the three major credit bureaus—Equifax, TransUnion, and Experian—into a single, comprehensive report. This merged report gives lenders a complete view of your financial obligations. With this data, they can identify patterns in your credit history, such as consistent on-time payments or frequent late payments. These insights help lenders make informed decisions about your application.

The accuracy of this data is critical. Even small errors in your credit report can affect your chances of approval. Regularly reviewing your credit report and disputing inaccuracies ensures that lenders see an accurate representation of your financial health.

Determining Loan Terms and Interest Rates

Factual data also influences the terms of your loan. Lenders use your credit score, derived from your credit report, to determine the interest rate and repayment terms. A higher credit score often leads to lower interest rates, saving you money over the life of the loan. Conversely, a lower score may result in higher rates or stricter repayment conditions.

Lenders analyze specific factors within your credit report to set these terms. For example, they consider your debt-to-income ratio, which compares your monthly debt payments to your income. A lower ratio indicates better financial stability, which can lead to more favorable loan terms. They also review your payment history to assess your reliability in meeting financial obligations.

By understanding how your credit data impacts loan terms, you can take steps to improve your financial profile. Paying bills on time, reducing outstanding debts, and avoiding unnecessary credit inquiries can boost your credit score. These actions not only increase your chances of approval but also help you secure better loan conditions.

Ensuring Compliance and Risk Mitigation

Lenders must comply with strict regulations when processing mortgage applications. Factual data helps them meet these requirements while minimizing risks. For instance, they use credit reports to ensure that loans adhere to underwriting standards set by regulatory bodies. This reduces the likelihood of approving high-risk loans that could lead to financial losses.

Data integration platforms like FineDataLink enhance this process by providing accurate and up-to-date information. These platforms streamline data collection and synchronization, ensuring that lenders have access to reliable data. For example, FineDataLink can identify inconsistencies in credit reports or employment records, helping lenders avoid errors. This not only improves compliance but also protects you from potential issues during the application process.

By leveraging factual data, lenders can mitigate risks and maintain transparency. For you, this means a smoother mortgage experience with fewer delays and complications.

Tip: Understanding how lenders use factual data empowers you to take control of your financial profile. Regularly monitor your credit report and address inaccuracies to improve your chances of securing favorable loan terms.

The Impact of Factual Data on Credit Scores

How Factual Data Influences Credit Score Calculations

Factual data plays a crucial role in determining your credit score. Credit scoring models analyze specific aspects of your financial behavior to calculate your score. These aspects provide lenders with a clear picture of your creditworthiness.

The table below outlines the key components of factual data used in credit score calculations:

| Aspect of Factual Data | Description | | --- | --- | | Total amount owed | The total debt across all accounts. | | Types of credit used | Different categories of credit accounts. | | Number of inquiries | The count of credit inquiries made. | | New credit requested or given | Recent applications for credit. | | Length of credit history | The duration of credit accounts. | | Payment history | Record of payments made on time or late. |

Each of these factors impacts your credit score differently. For example, payment history carries significant weight. Consistently paying bills on time improves your score, while late payments lower it. Similarly, the total amount owed affects your debt-to-income ratio, which lenders use to assess your financial stability.

Understanding how factual data influences your credit score empowers you to make better financial decisions. By managing your credit responsibly, you can improve your score and increase your chances of securing favorable loan terms.

Common Errors in Factual Data and Their Effects

Errors in factual data can harm your credit score. These mistakes often occur in credit reports and may include:

- Unauthorized hard inquiries on your credit report.

- Incorrect account balances or payment histories.

- Outdated or inaccurate personal information.

Unauthorized hard inquiries can reduce your credit score by 5 to 10 points. These inquiries remain on your credit report for two years, though their impact diminishes after 12 months. The Fair Credit Reporting Act (FCRA) allows you to dispute errors, ensuring your credit report reflects accurate information.

Mistakes in factual data can lead to loan denials or unfavorable terms. Regularly reviewing your credit report helps you identify and correct these errors. Taking action promptly protects your credit score and financial health.

Tools for Monitoring and Correcting Credit Data

Monitoring your credit data is essential for maintaining a healthy credit score. Several tools and strategies can help you stay on top of your credit report:

- Credit Monitoring Services: These services alert you to changes in your credit report, such as new inquiries or account updates.

- Annual Credit Report Access: You can request a free credit report annually from each of the three major credit bureaus—Equifax, Experian, and TransUnion.

- Dispute Resolution Platforms: Many credit bureaus offer online tools for disputing errors in your credit report.

- Data Integration Platforms: Solutions like FineDataLink streamline the process of verifying and correcting factual data. These platforms ensure your credit report remains accurate and up-to-date.

By using these tools, you can monitor your credit data effectively and address issues before they impact your score. Proactive management of factual data not only protects your credit score but also improves your chances of securing better loan terms.

Tip: Set reminders to check your credit report regularly. Identifying and resolving errors early can save you time and money in the long run.

Factual Data and the Mortgage Approval Process

How Factual Data Shapes Approval Decisions

Factual data serves as the backbone of mortgage approval decisions. Lenders rely on this verified information to evaluate your financial stability and determine if you qualify for a loan. Your credit report plays a central role in this process. It provides a detailed history of your financial behavior, including payment patterns, outstanding debts, and credit inquiries. Lenders analyze this data to assess your ability to repay the loan.

Employment and income verification also influence approval decisions. Lenders use this data to confirm your job stability and earnings. They want to ensure you have a steady income to meet monthly mortgage payments. Property appraisals and public records further shape decisions by confirming the value and legal status of the property you wish to purchase.

When lenders integrate all these pieces of factual data, they create a comprehensive profile of your financial health. This profile helps them decide whether to approve your application and under what terms. Accurate and up-to-date data increases your chances of approval and ensures a smoother process.

Tip: Regularly review your credit report to ensure it reflects accurate information. This proactive step can help you avoid surprises during the approval process.

Benefits of Accurate Factual Data for Borrowers

Accurate factual data offers several advantages for you as a borrower. First, it improves your chances of loan approval. When lenders see reliable data, they feel confident in your ability to repay the loan. This confidence can lead to faster approvals and fewer delays.

Second, accurate data helps you secure better loan terms. A strong credit report with a high credit score often results in lower interest rates and more favorable repayment conditions. This can save you thousands of dollars over the life of the loan.

Third, accurate data reduces stress. Errors in your credit report or employment records can cause unnecessary complications. By ensuring your data is correct, you can avoid these issues and focus on finding the right mortgage for your needs.

Note: Tools like FineDataLink can help ensure your factual data remains accurate and up-to-date, making the mortgage process more efficient.

Risks of Inaccurate or Incomplete Factual Data

Inaccurate or incomplete factual data can create significant challenges during the mortgage approval process. Errors in your credit report, such as incorrect account balances or unauthorized inquiries, can lower your credit score. This may lead to loan denials or less favorable terms, such as higher interest rates.

Incomplete employment or income data can also cause problems. If lenders cannot verify your earnings, they may question your ability to repay the loan. Similarly, inaccuracies in property appraisals or public records can delay the process or even result in application rejection.

These risks highlight the importance of monitoring your factual data. Regularly checking your credit report and verifying other financial information can help you identify and correct errors before they impact your mortgage application.

Alert: Inaccurate data not only affects your approval chances but can also cost you money in the form of higher interest rates or additional fees. Take action to ensure your data is accurate.

Managing Factual Data for Better Mortgage Outcomes

Regularly Reviewing and Correcting Credit Reports

Regularly reviewing your credit reports is essential for maintaining accurate financial records. Errors in your credit report can lower your credit score and affect your chances of securing favorable loan terms. By monitoring your reports, you can identify and correct inaccuracies before they cause problems.

Start by checking your personal information, such as your name, birth date, and Social Security Number. Mistakes in these details can lead to identity theft or misattributed accounts. Keep an eye on old or inactive credit accounts, as these are common targets for fraud.

To stay consistent, pull one of your free credit reports every four months. Rotate among the three major credit bureaus—Equifax, Experian, and TransUnion. Set reminders on your calendar to ensure you don’t miss these checks. If you find errors, dispute them immediately. Credit bureaus are required to investigate and correct inaccuracies, ensuring your report reflects factual data.

Tip: Regular monitoring not only protects your credit score but also helps you stay informed about your financial health.

Building a Strong Credit Profile

A strong credit profile increases your chances of loan approval and helps you secure better terms. Lenders evaluate your credit history to assess your financial reliability. By taking proactive steps, you can improve your creditworthiness and present a positive financial picture.

Focus on paying your bills on time. Payment history is one of the most significant factors in credit score calculations. Reduce outstanding debts to lower your debt-to-income ratio, which lenders use to measure your financial stability. Avoid opening unnecessary credit accounts, as too many inquiries can negatively impact your score.

Maintaining a mix of credit types, such as credit cards and installment loans, can also strengthen your profile. This demonstrates your ability to manage different forms of credit responsibly. Over time, these habits will build a solid credit history, making you a more attractive candidate for mortgage approval.

Note: A strong credit profile not only improves your loan approval chances but also helps you negotiate better interest rates and repayment terms.

Leveraging FineDataLink for Data Accuracy and Integration

FineDataLink offers a powerful solution for managing factual data in the mortgage process. This platform simplifies data integration, ensuring lenders have access to accurate and up-to-date information. For borrowers, this means a smoother and faster approval process.

FineDataLink’s real-time synchronization feature ensures that your credit, employment, and property data remain current. By automating data collection and verification, the platform reduces errors and eliminates the need for manual checks. For example, FineDataLink can pull employment data directly from payroll systems, ensuring accuracy and saving time.

The platform’s low-code interface allows lenders to set up data pipelines quickly. This streamlines the mortgage process and ensures compliance with regulations. FineDataLink also supports advanced ETL processes, which clean and organize data before it reaches lenders. This ensures that the factual data used in your application is reliable and error-free.

Tip: Leveraging tools like FineDataLink enhances data accuracy, making the mortgage process more transparent and efficient for both lenders and borrowers.

Collaborating with Lenders to Resolve Data Issues

Resolving data issues with lenders requires effective communication and a proactive approach. You play a key role in ensuring your financial information is accurate and complete. By working closely with your lender, you can address discrepancies and improve your chances of a smooth mortgage process.

One of the most common challenges borrowers face is managing the extensive documentation required during the mortgage process. Lenders often request multiple forms of verification, such as income statements, tax returns, and credit reports. This paper-heavy process can feel overwhelming. Organizing your documents in advance and keeping digital copies can help you stay prepared.

Timely reviews are another hurdle. Loan processors must review your data quickly while maintaining transparency. Delays can occur if your information is incomplete or inconsistent. To avoid this, double-check your records before submitting them. Ensure your employment details, income figures, and credit history match the lender’s requirements.

Proper data consolidation is essential for informed lending decisions. Lenders rely on accurate and unified data to assess your financial stability. Discrepancies in your records can lead to confusion or delays. Platforms like FineDataLink can simplify this process by integrating and synchronizing data from multiple sources. This ensures your lender has access to accurate and up-to-date information.

| Challenge | Description | | --- | --- | | Unified Data Management | Borrowers struggle with the paper-heavy process requiring extensive documentation and reviews. | | Timely Reviews | Loan processors face difficulties in completing reviews quickly while maintaining transparency. | | Data Consolidation | Proper management and consolidation of data are essential for making informed lending decisions. |

To collaborate effectively with your lender, follow these steps:

- Communicate Clearly: Keep your lender informed about any changes in your financial situation. Prompt updates help them adjust their evaluations.

- Stay Organized: Create a checklist of required documents and track your submissions. This reduces the risk of missing important details.

- Use Technology: Leverage tools like FineDataLink to streamline data sharing and verification. These platforms enhance accuracy and save time.

- Ask Questions: If you notice discrepancies, don’t hesitate to ask for clarification. Understanding the issue helps you resolve it faster.

Tip: Building a strong relationship with your lender can make the process less stressful. Open communication and timely responses show your commitment to resolving issues.

By addressing data issues promptly and working closely with your lender, you can ensure a smoother mortgage experience. Accurate and well-managed data not only improves your approval chances but also helps you secure better loan terms.

Factual data plays a vital role in mortgage lending by enabling lenders to assess your creditworthiness and make informed decisions. It directly impacts your credit score and approval chances, ensuring fair evaluations. You can proactively manage this data by understanding credit inquiry grace periods, using soft inquiries, and maintaining low credit utilization. Tools like FineDataLink enhance accuracy and streamline the process. Over time, leveraging factual data builds a robust credit profile, empowers you with insights, and ensures better mortgage outcomes.

| Benefit Description | Impact on Mortgage Lending | | --- | --- | | Assesses Borrower’s Creditworthiness | Enables lenders to make informed decisions based on comprehensive data. | | Building a Robust Credit Profile despite Inquiries | Encourages borrowers to maintain diverse credit habits for better scores. | | Holistic View by Lenders on Creditworthiness | Lenders evaluate overall credit history, not just isolated inquiries. | | Empowerment through Innovative Insights | Helps borrowers develop resilience in their credit scores over time. |

Tip: Regularly monitor your credit data and use advanced tools to ensure accuracy. This proactive approach saves time and improves your mortgage experience.

FAQ

Factual data refers to verified information about your credit, income, employment, and property. Lenders use this data to assess your financial stability and determine your eligibility for a mortgage. It ensures decisions are based on facts, not assumptions.

Factual data directly impacts your approval chances. Accurate data helps lenders evaluate your creditworthiness and financial health. Errors or incomplete information can lead to delays, higher interest rates, or even loan denial. Regularly reviewing your data ensures it reflects your true financial situation.

Lenders verify your employment to confirm your income stability. This step ensures you can meet monthly mortgage payments. They may contact your employer, use automated systems, or rely on third-party services to gather accurate and up-to-date information.

Yes, you can dispute errors by contacting the credit bureau that issued the report. Provide supporting documents, such as payment receipts, to prove inaccuracies. The bureau must investigate and correct any verified mistakes, ensuring your credit report reflects accurate data.

FineDataLink simplifies data integration for lenders. It collects and synchronizes factual data from multiple sources in real time. This ensures accurate and up-to-date information, reducing errors and speeding up the mortgage approval process for you.

Pay bills on time, reduce outstanding debts, and avoid unnecessary credit inquiries. Regularly review your credit report for errors. Maintaining a mix of credit types and keeping your credit utilization low also helps improve your score over time.

Outdated data can misrepresent your financial situation. Lenders may delay or deny your application due to inaccuracies. Regularly updating your credit, employment, and income information ensures lenders have the most current and reliable data for their evaluations.

Appraisals determine the market value of the property you want to buy. Lenders use this data to ensure the loan amount aligns with the property’s worth. Accurate appraisals protect both you and the lender from financial risks.

Continue Reading About Factual Data

Customer Data Integration: A Comprehensive Guide

Master customer data integration to enhance business operations by combining data from multiple sources for a comprehensive customer view.

Howard

Sep 07, 2024

Data Pipeline Automation: Strategies for Success

Understand definition and key components of data pipeline automation. Explore the essential strategies for successful data pipeline automation.

Howard

Jul 18, 2024

Data Pipelines vs ETL Pipelines Explained

Understand the key differences between data pipelines and ETL pipelines. Learn how 'data pipeline vs ETL' impacts data movement, transformation, and analysis.

Howard

Dec 13, 2024