Financial analysis can be initiated by discussing key financial metrics, outlining the purpose of the analysis, and presenting an overview of the financial statements. For instance, one might start by explaining that financial analysis is essential for understanding a company's performance, making informed decisions, and identifying areas for improvement. Key metrics such as revenue, expenses, profitability, and cash flow are typically examined to gain insights into the financial health of a business.

一、INTRODUCTION TO FINANCIAL ANALYSIS

Financial analysis is a critical tool used by businesses, investors, and analysts to evaluate a company's financial performance and make informed decisions. It involves the examination of financial statements, including the balance sheet, income statement, and cash flow statement, to assess the company's financial health and performance. This process helps in identifying trends, comparing financial data over time, and benchmarking against industry standards. By analyzing financial metrics such as revenue, expenses, profitability, and liquidity, stakeholders can gain a comprehensive understanding of the company's operational efficiency and financial stability.

The purpose of financial analysis extends beyond merely assessing past performance. It also plays a crucial role in strategic planning, investment decision-making, and risk management. For instance, investors rely on financial analysis to determine the viability of investing in a company, while managers use it to identify areas for cost reduction and revenue enhancement. In this context, financial analysis serves as a foundation for developing strategies that drive sustainable growth and profitability.

二、KEY FINANCIAL METRICS

Understanding and analyzing key financial metrics is fundamental to financial analysis. These metrics provide insights into various aspects of a company's operations and financial health. Revenue is one of the most important metrics, indicating the total income generated from sales or services. It serves as a primary indicator of business performance and market demand. Analyzing revenue trends over time helps in understanding the company's growth trajectory and market position.

Expenses, on the other hand, represent the costs incurred in running the business. These include operating expenses, cost of goods sold (COGS), and other financial obligations. By examining expenses in detail, businesses can identify cost-saving opportunities and improve operational efficiency. Profitability metrics, such as gross profit margin, operating profit margin, and net profit margin, provide insights into how well a company is converting revenue into profit. These metrics are crucial for assessing the company's ability to generate returns for shareholders.

Liquidity metrics, such as current ratio and quick ratio, assess the company's ability to meet short-term obligations. These ratios are important for understanding the company's financial stability and risk of insolvency. Additionally, solvency metrics like debt-to-equity ratio help in evaluating the company's long-term financial health and leverage. By analyzing these key metrics, stakeholders can make informed decisions and develop strategies to enhance the company's financial performance.

三、ANALYSIS OF FINANCIAL STATEMENTS

The analysis of financial statements is a core component of financial analysis. The balance sheet provides a snapshot of the company's financial position at a specific point in time. It includes assets, liabilities, and shareholders' equity, offering insights into the company's liquidity, solvency, and capital structure. By comparing balance sheets over multiple periods, analysts can identify trends and changes in the company's financial position.

The income statement, also known as the profit and loss statement, summarizes the company's revenues, expenses, and profits over a specific period. It helps in understanding the company's operational efficiency and profitability. Analyzing the income statement involves examining revenue sources, cost structures, and profit margins. This analysis is crucial for identifying areas of improvement and developing strategies to enhance profitability.

The cash flow statement provides information about the company's cash inflows and outflows. It is divided into three sections: operating activities, investing activities, and financing activities. This statement is essential for assessing the company's liquidity and cash management practices. By analyzing the cash flow statement, stakeholders can understand how the company generates and utilizes cash, which is vital for maintaining financial stability and supporting growth initiatives.

四、RATIO ANALYSIS

Ratio analysis is a powerful technique used in financial analysis to evaluate a company's performance and compare it with industry standards. Financial ratios are calculated using data from financial statements and provide insights into various aspects of the company's operations. These ratios are categorized into liquidity ratios, profitability ratios, solvency ratios, and efficiency ratios, among others.

Liquidity ratios, such as the current ratio and quick ratio, measure the company's ability to meet short-term obligations. These ratios are important for assessing the company's financial stability and risk of insolvency. A higher liquidity ratio indicates a stronger ability to cover short-term liabilities, which is crucial for maintaining operational continuity.

Profitability ratios, such as the gross profit margin, operating profit margin, and net profit margin, evaluate the company's ability to generate profits from its operations. These ratios are essential for understanding the company's operational efficiency and overall profitability. By comparing profitability ratios with industry benchmarks, stakeholders can assess the company's competitive position and identify areas for improvement.

Solvency ratios, such as the debt-to-equity ratio and interest coverage ratio, assess the company's long-term financial health and leverage. These ratios are important for evaluating the company's ability to meet long-term obligations and sustain growth. A lower solvency ratio indicates a lower level of debt relative to equity, which is favorable for maintaining financial stability.

Efficiency ratios, such as the inventory turnover ratio and accounts receivable turnover ratio, measure how effectively the company is utilizing its assets. These ratios provide insights into the company's operational efficiency and asset management practices. By improving efficiency ratios, businesses can enhance their overall performance and profitability.

五、TREND ANALYSIS

Trend analysis involves examining financial data over multiple periods to identify patterns and trends. This technique is useful for understanding the company's performance over time and predicting future outcomes. By analyzing trends in revenue, expenses, profitability, and other key metrics, stakeholders can gain insights into the company's growth trajectory and market position.

Revenue trend analysis helps in understanding the company's sales performance and market demand. By examining revenue trends, businesses can identify seasonal patterns, growth opportunities, and potential challenges. This analysis is crucial for developing strategies to drive sales growth and enhance market share.

Expense trend analysis involves examining changes in the company's cost structures over time. This analysis helps in identifying areas for cost reduction and improving operational efficiency. By understanding expense trends, businesses can develop strategies to optimize their cost structures and enhance profitability.

Profitability trend analysis focuses on examining changes in the company's profit margins and overall profitability. This analysis is essential for assessing the company's ability to generate returns for shareholders and sustain growth. By analyzing profitability trends, stakeholders can identify factors affecting profitability and develop strategies to enhance financial performance.

Liquidity trend analysis involves examining changes in the company's liquidity ratios over time. This analysis helps in understanding the company's financial stability and risk of insolvency. By analyzing liquidity trends, businesses can develop strategies to improve cash management practices and maintain financial stability.

六、BENCHMARKING

Benchmarking is a critical aspect of financial analysis that involves comparing a company's performance with industry standards and best practices. This process helps in identifying areas where the company is performing well and areas that need improvement. By benchmarking against industry standards, businesses can set performance targets and develop strategies to achieve them.

Revenue benchmarking involves comparing the company's revenue with industry averages and top performers. This comparison helps in understanding the company's market position and growth potential. By identifying gaps in revenue performance, businesses can develop strategies to enhance sales and market share.

Expense benchmarking involves comparing the company's cost structures with industry standards. This comparison helps in identifying areas for cost reduction and improving operational efficiency. By understanding how the company's expenses compare with industry benchmarks, businesses can develop strategies to optimize their cost structures and enhance profitability.

Profitability benchmarking focuses on comparing the company's profit margins and overall profitability with industry standards. This comparison is essential for assessing the company's competitive position and identifying areas for improvement. By benchmarking profitability, businesses can develop strategies to enhance their financial performance and generate higher returns for shareholders.

Liquidity benchmarking involves comparing the company's liquidity ratios with industry standards. This comparison helps in understanding the company's financial stability and risk of insolvency. By benchmarking liquidity, businesses can develop strategies to improve cash management practices and maintain financial stability.

七、RISK ASSESSMENT

Risk assessment is a crucial component of financial analysis that involves identifying and evaluating potential risks that could impact the company's financial performance. This process helps in developing strategies to mitigate risks and ensure financial stability. By conducting a comprehensive risk assessment, businesses can identify potential threats and develop contingency plans to address them.

Financial risk assessment involves evaluating the company's exposure to financial risks, such as credit risk, liquidity risk, and market risk. This assessment helps in understanding the potential impact of these risks on the company's financial performance and developing strategies to mitigate them. By identifying financial risks, businesses can implement risk management practices to ensure financial stability.

Operational risk assessment focuses on evaluating the risks associated with the company's operational processes and systems. This assessment helps in identifying potential disruptions and developing strategies to mitigate them. By understanding operational risks, businesses can implement measures to enhance operational efficiency and minimize disruptions.

Strategic risk assessment involves evaluating the risks associated with the company's strategic decisions and initiatives. This assessment helps in understanding the potential impact of strategic risks on the company's long-term performance and developing strategies to mitigate them. By identifying strategic risks, businesses can develop contingency plans to address potential challenges and ensure sustainable growth.

Compliance risk assessment focuses on evaluating the risks associated with regulatory and legal compliance. This assessment helps in understanding the potential impact of compliance risks on the company's financial performance and developing strategies to mitigate them. By identifying compliance risks, businesses can implement measures to ensure regulatory compliance and avoid legal penalties.

八、USING TECHNOLOGY FOR FINANCIAL ANALYSIS

Leveraging technology is essential for enhancing the accuracy and efficiency of financial analysis. Advanced tools and software, such as FineBI, play a crucial role in streamlining the financial analysis process. FineBI is a business intelligence tool that offers powerful data visualization and analysis capabilities, enabling businesses to gain insights from their financial data quickly and accurately.

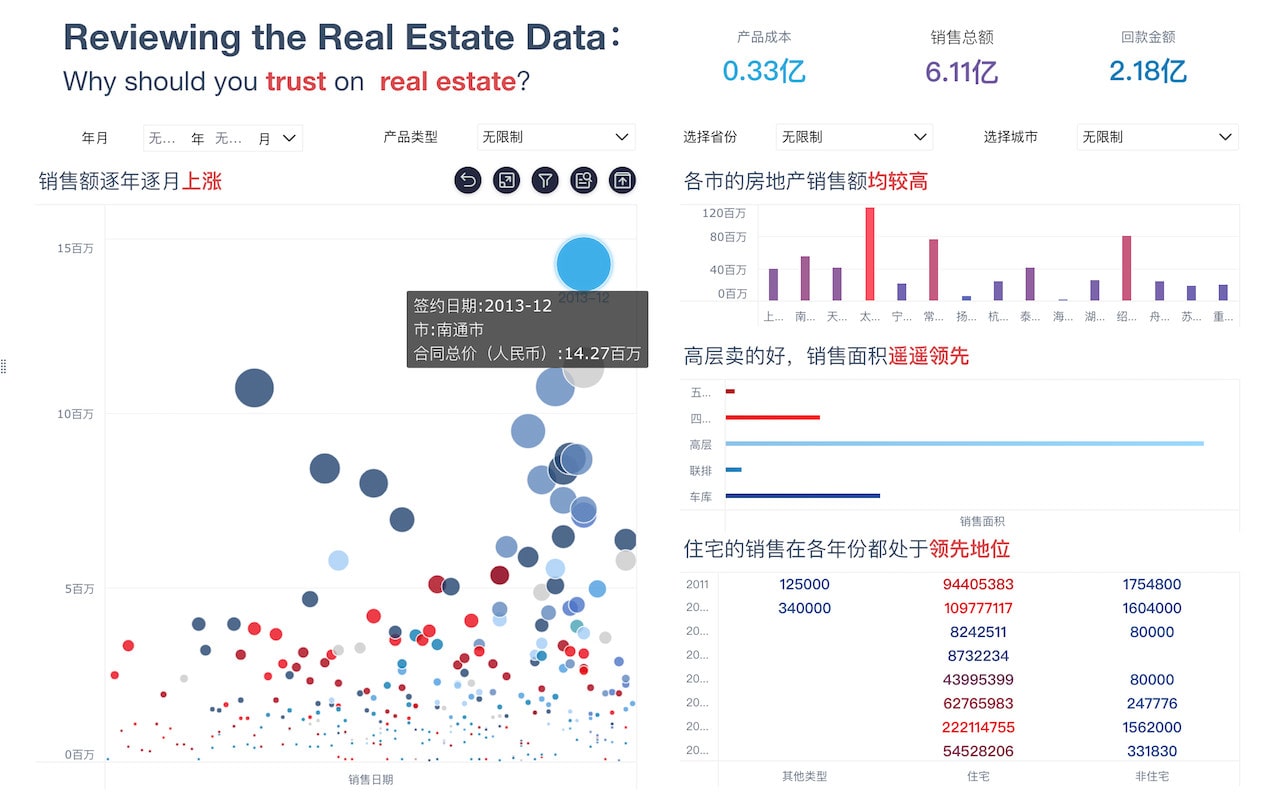

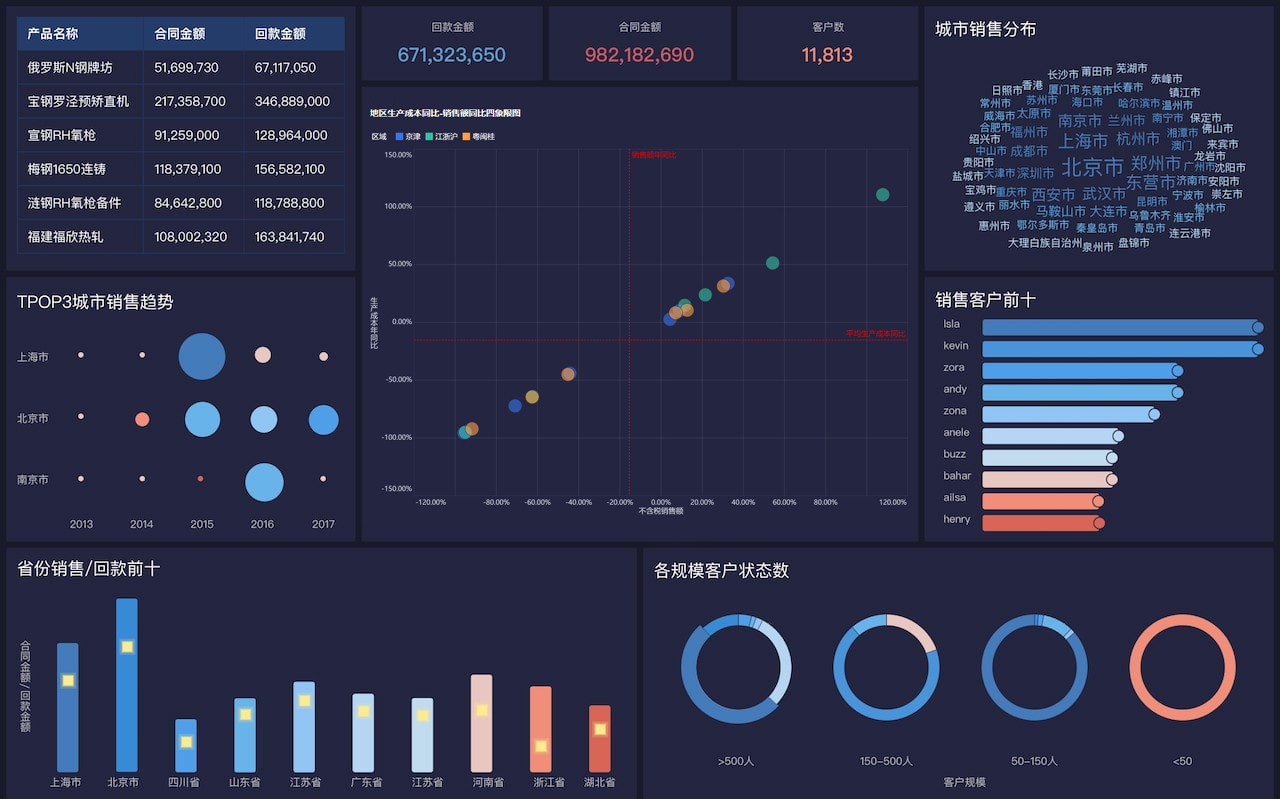

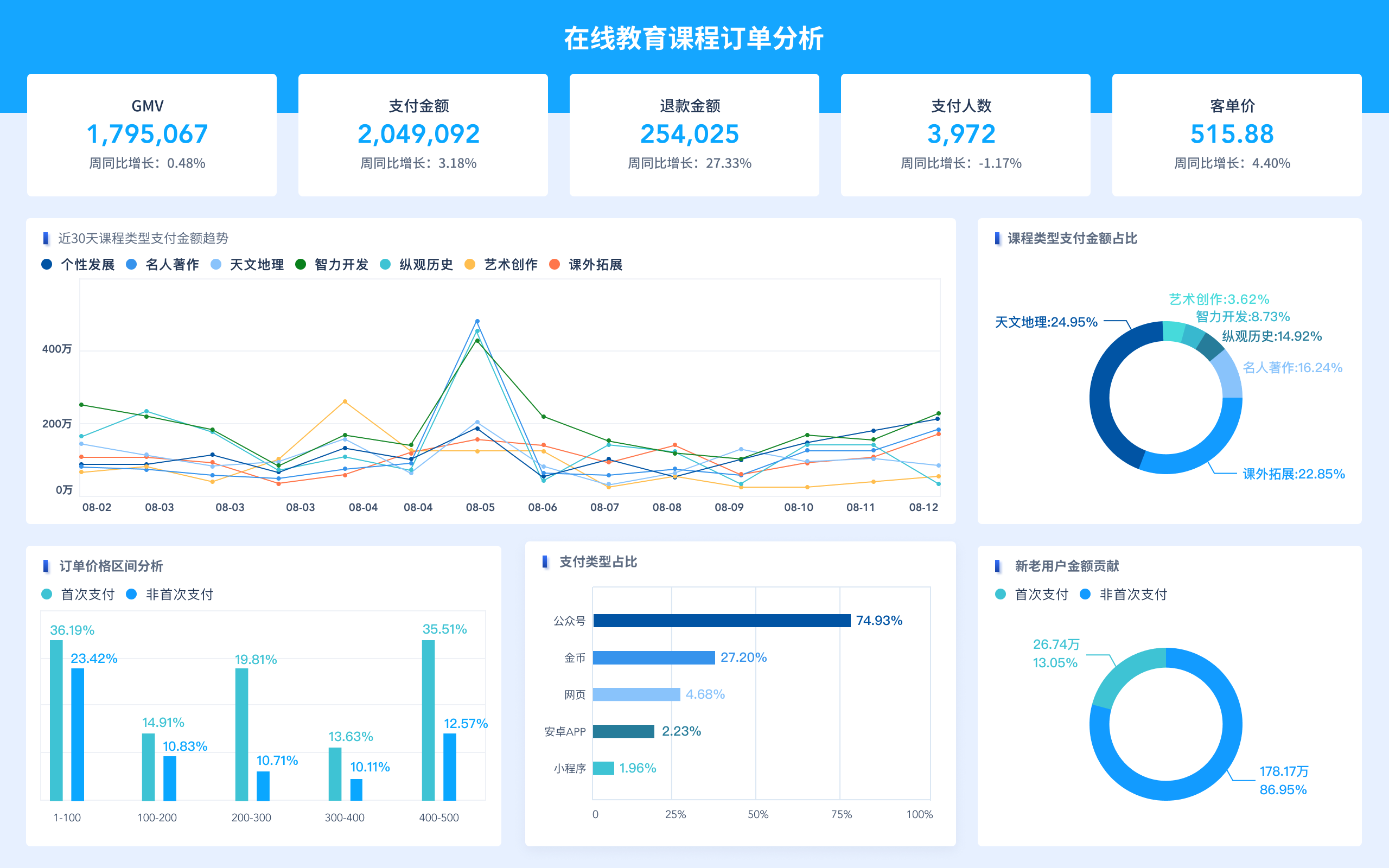

FineBI provides a user-friendly interface and advanced features for data integration, visualization, and reporting. By using FineBI, businesses can integrate financial data from multiple sources, create interactive dashboards, and generate detailed reports. This enhances the accuracy and efficiency of financial analysis, enabling stakeholders to make informed decisions based on real-time data.

Data visualization is a key feature of FineBI that helps in presenting financial data in a visually appealing and easy-to-understand format. By using charts, graphs, and other visual elements, businesses can effectively communicate financial insights to stakeholders. This enhances the overall impact of financial analysis and supports data-driven decision-making.

FineBI also offers advanced analytical capabilities, such as predictive analytics and trend analysis. By leveraging these features, businesses can gain deeper insights into their financial performance and develop strategies to enhance profitability and growth. Predictive analytics, in particular, helps in forecasting future financial outcomes and identifying potential risks and opportunities.

Automation is another key advantage of using FineBI for financial analysis. By automating data integration, analysis, and reporting processes, businesses can save time and reduce the risk of errors. This enhances the overall efficiency of financial analysis and enables stakeholders to focus on strategic decision-making.

FineBI官网: https://s.fanruan.com/f459r;

By leveraging advanced tools like FineBI, businesses can enhance the accuracy and efficiency of their financial analysis processes, gain deeper insights into their financial performance, and make informed decisions to drive sustainable growth and profitability.

相关问答FAQs:

财务分析开头怎么说英语?

在进行财务分析时,开头部分的表达非常重要,因为它不仅为读者提供了背景信息,还设定了分析的基调。以下是一些常见的开场白和表达方式,帮助你在进行财务分析时自信地进行英语表述。

1. What is financial analysis and why is it important?

Financial analysis refers to the evaluation of a company's financial information to understand its performance and make informed business decisions. It involves examining financial statements, ratios, and trends to assess the company's profitability, liquidity, and solvency. The importance of financial analysis lies in its ability to provide stakeholders, including investors, management, and creditors, with insights into the company's financial health and operational efficiency. This analysis helps in identifying strengths and weaknesses, forecasting future performance, and guiding strategic planning.

2. How do you start a financial analysis report?

When starting a financial analysis report, it’s essential to provide a clear introduction that outlines the purpose of the analysis. Begin by stating the company being analyzed, the time period covered, and the specific financial statements used. For example, "This financial analysis focuses on XYZ Corporation's performance over the fiscal year 2022, utilizing the income statement, balance sheet, and cash flow statement to evaluate its financial stability and growth potential." This approach establishes context and prepares the reader for the detailed analysis that follows.

3. What key components should be included in the introduction of a financial analysis?

An effective introduction to a financial analysis should include several key components:

- Company Overview: Briefly describe the company’s business model, industry, and market position.

- Purpose of Analysis: Clearly state the objectives of the analysis, such as evaluating profitability, assessing financial health, or making investment recommendations.

- Scope of Analysis: Define the time frame and specific financial statements that will be analyzed.

- Methodology: Mention any specific ratios or analytical methods that will be employed in the analysis.

By incorporating these elements, the introduction becomes a comprehensive overview that sets the stage for a detailed exploration of the financial data.

在撰写财务分析的开头部分时,使用这些表达方式和结构可以帮助你更有效地传达信息,让读者对分析内容有清晰的理解。

本文内容通过AI工具匹配关键字智能整合而成,仅供参考,帆软不对内容的真实、准确或完整作任何形式的承诺。具体产品功能请以帆软官方帮助文档为准,或联系您的对接销售进行咨询。如有其他问题,您可以通过联系blog@fanruan.com进行反馈,帆软收到您的反馈后将及时答复和处理。