Credit Card Machine Data Mining

Credit card machine data mining, also known as credit card terminal data analysis or POS data mining, is the process of extracting valuable information from the data generated by credit card transactions. This involves analyzing transaction details, customer behavior patterns, and sales trends to gain insights that can help businesses make informed decisions. Customer segmentation, fraud detection, and sales optimization are some of the key applications. For instance, by identifying customer segments based on purchase behavior, businesses can tailor their marketing efforts more effectively, offering personalized promotions that increase customer loyalty and drive sales.

I、UNDERSTANDING CREDIT CARD MACHINE DATA MINING

Credit card machine data mining involves the systematic extraction and analysis of data generated by transactions processed through credit card terminals. These terminals capture a wealth of information, including transaction amounts, dates, times, and locations, as well as details about the goods or services purchased. The goal of data mining in this context is to uncover patterns and insights that can inform business strategies and improve operational efficiency.

Data mining techniques such as clustering, classification, and association rule mining are commonly used. Clustering groups similar transactions together, which can help identify patterns in customer behavior. Classification involves assigning transactions to predefined categories, such as fraudulent or non-fraudulent, to enhance fraud detection. Association rule mining identifies relationships between different items purchased together, enabling businesses to optimize product placements and promotions.

II、APPLICATIONS OF CREDIT CARD MACHINE DATA MINING

Credit card machine data mining has a wide range of applications across various industries.

Fraud Detection: One of the most critical applications is in detecting fraudulent transactions. By analyzing transaction patterns and identifying anomalies, businesses can quickly flag suspicious activities and take preventive measures. Machine learning algorithms can be trained to recognize fraud patterns, significantly reducing the risk of financial loss.

Customer Segmentation: Businesses can use data mining to segment their customers based on purchasing behavior, demographics, and transaction history. This segmentation allows for more targeted marketing strategies, personalized promotions, and improved customer service. For example, a retail store might identify a segment of frequent buyers who prefer luxury items and offer them exclusive deals.

Sales Optimization: Analyzing sales data helps businesses understand which products are performing well and which are not. This insight can guide inventory management, pricing strategies, and promotional campaigns. For instance, a restaurant could analyze transaction data to determine the most popular dishes and adjust their menu accordingly.

Market Basket Analysis: This technique involves examining the combinations of products that customers frequently purchase together. By understanding these associations, businesses can optimize product placements and cross-selling strategies. A supermarket might discover that customers who buy bread often purchase milk as well, leading to strategic product placement.

III、TECHNIQUES USED IN CREDIT CARD MACHINE DATA MINING

Several techniques are employed in credit card machine data mining to extract valuable insights.

Clustering: This technique groups similar data points together based on specific criteria. In the context of credit card data, clustering can be used to identify groups of customers with similar purchasing behaviors, enabling more targeted marketing efforts.

Classification: Classification involves assigning data points to predefined categories. For example, transactions can be classified as either normal or fraudulent. Machine learning models, such as decision trees and neural networks, are commonly used for classification tasks.

Association Rule Mining: This technique identifies relationships between different items in a dataset. For example, it can reveal that customers who purchase a particular product are also likely to buy another specific product. This information can be used to optimize product placements and cross-selling strategies.

Anomaly Detection: Anomaly detection involves identifying data points that deviate significantly from the norm. In credit card data mining, this technique is crucial for detecting fraudulent transactions. By recognizing unusual patterns, businesses can take immediate action to prevent fraud.

Predictive Analytics: Predictive analytics uses historical data to make predictions about future events. For instance, businesses can predict future sales trends based on past transaction data, allowing for better inventory management and sales forecasting.

IV、BENEFITS OF CREDIT CARD MACHINE DATA MINING

The benefits of credit card machine data mining are numerous and impactful for businesses of all sizes.

Enhanced Fraud Detection: By identifying fraudulent transactions in real-time, businesses can mitigate financial losses and protect their customers' sensitive information. Machine learning models can continuously improve their accuracy, making fraud detection more effective over time.

Improved Customer Insights: Data mining provides a deeper understanding of customer preferences and behaviors. This insight enables businesses to tailor their offerings, enhance customer experiences, and build stronger relationships with their clientele.

Optimized Operations: Analyzing transaction data helps businesses streamline their operations, from inventory management to sales strategies. By understanding which products are in high demand, businesses can ensure they are adequately stocked, reducing the risk of stockouts or overstocking.

Increased Revenue: Targeted marketing campaigns and personalized promotions driven by data insights can lead to increased sales and revenue. Businesses can identify opportunities for upselling and cross-selling, maximizing their profitability.

Competitive Advantage: Leveraging data mining techniques gives businesses a competitive edge by enabling them to make data-driven decisions. This agility allows them to respond quickly to market changes and stay ahead of their competitors.

V、CHALLENGES IN CREDIT CARD MACHINE DATA MINING

Despite its benefits, credit card machine data mining also presents several challenges.

Data Privacy and Security: Handling sensitive customer data requires stringent security measures to protect against breaches and ensure compliance with regulations such as GDPR and CCPA. Businesses must invest in robust cybersecurity infrastructure and adopt best practices for data protection.

Data Quality: The accuracy of data mining results depends on the quality of the data being analyzed. Inaccurate or incomplete data can lead to misleading insights and poor decision-making. Businesses must implement data cleansing processes to ensure data integrity.

Complexity of Data: Credit card transaction data can be highly complex, with numerous variables and intricate relationships. Analyzing such data requires advanced analytical skills and sophisticated tools, which can be resource-intensive.

Scalability: As businesses grow, the volume of transaction data increases exponentially. Ensuring that data mining processes can scale to handle large datasets without compromising performance is a significant challenge.

Interpreting Results: Extracting insights from data is only one part of the equation; interpreting those insights and translating them into actionable strategies is equally important. Businesses need skilled analysts who can bridge the gap between data and decision-making.

VI、FUTURE TRENDS IN CREDIT CARD MACHINE DATA MINING

The field of credit card machine data mining is continuously evolving, with several emerging trends shaping its future.

AI and Machine Learning: Advances in artificial intelligence and machine learning are revolutionizing data mining. These technologies enable more accurate predictions, real-time fraud detection, and automated decision-making, enhancing the overall effectiveness of data mining efforts.

Real-Time Analytics: The demand for real-time insights is growing, driven by the need for immediate action in response to market changes and potential threats. Real-time analytics tools are becoming increasingly sophisticated, allowing businesses to analyze transaction data as it is generated.

Integration with IoT: The Internet of Things (IoT) is expanding the sources of data available for analysis. Credit card machines integrated with IoT devices can provide additional context, such as location data and customer behavior in physical stores, enriching the insights derived from data mining.

Blockchain Technology: Blockchain offers a secure and transparent way to record transactions, enhancing the reliability of data used in mining processes. This technology can also help in verifying the authenticity of transactions, further reducing the risk of fraud.

Enhanced Customer Personalization: As data mining techniques become more advanced, businesses will be able to offer even more personalized experiences to their customers. Predictive models will enable hyper-targeted marketing, improving customer satisfaction and loyalty.

VII、IMPLEMENTING CREDIT CARD MACHINE DATA MINING IN YOUR BUSINESS

To implement credit card machine data mining effectively, businesses should follow a structured approach.

Define Objectives: Clearly outline the goals of the data mining initiative, whether it's fraud detection, customer segmentation, or sales optimization. Having specific objectives will guide the data mining process and ensure it aligns with business needs.

Collect and Prepare Data: Gather transaction data from credit card machines and other relevant sources. Ensure the data is clean, accurate, and in a format suitable for analysis. Data preprocessing steps such as normalization and transformation may be necessary.

Choose the Right Tools: Select data mining tools and software that meet the requirements of the project. There are various tools available, ranging from open-source options like KNIME and RapidMiner to commercial solutions like SAS and IBM SPSS.

Build and Train Models: Develop data mining models using techniques such as clustering, classification, and association rule mining. Train the models on historical transaction data to ensure they can accurately identify patterns and make predictions.

Validate and Evaluate: Validate the performance of the models using techniques like cross-validation and evaluate their accuracy, precision, and recall. Fine-tune the models as needed to improve their performance.

Deploy and Monitor: Implement the data mining models in the business environment and monitor their performance over time. Continuously update the models with new data to maintain their accuracy and relevance.

Interpret and Act on Insights: Analyze the insights generated by the data mining models and translate them into actionable strategies. For example, if the models identify a segment of high-value customers, design marketing campaigns tailored to their preferences.

Ensure Compliance: Adhere to data privacy regulations and industry standards when handling customer data. Implement robust security measures to protect sensitive information and maintain customer trust.

By following these steps, businesses can harness the power of credit card machine data mining to gain a competitive edge, enhance customer experiences, and drive growth.

相关问答FAQs:

刷卡机数据挖掘在英文中可以翻译为“Card Reader Data Mining”。这个术语用于描述通过分析和处理刷卡机生成的数据,以提取有价值的信息和洞察力的过程。这种数据挖掘技术通常应用于金融、零售、市场营销等领域,帮助企业更好地理解客户行为、优化运营效率和制定策略。

FAQs

1. 什么是刷卡机数据挖掘?

刷卡机数据挖掘是指利用数据分析技术,从刷卡机生成的交易数据中提取、分析和解释信息的过程。通过对这些数据的深入分析,企业可以获得客户行为的洞察,例如消费习惯、支付方式偏好以及高峰消费时间等。这些信息能够帮助企业优化库存管理、提升客户服务质量,并制定更有效的市场营销策略。

2. 刷卡机数据挖掘的应用场景有哪些?

刷卡机数据挖掘在多个领域都有广泛的应用。首先,在零售行业,商家可以分析客户的购买行为,识别热销商品以及季节性销售趋势,以便更好地进行库存管理。其次,在金融服务领域,银行和支付机构利用数据挖掘技术,分析客户的信用卡使用模式,识别潜在的欺诈行为。此外,餐饮行业也可以通过分析刷卡数据,了解客户偏好,制定个性化的促销活动,从而提升客户满意度和忠诚度。

3. 如何进行刷卡机数据挖掘?

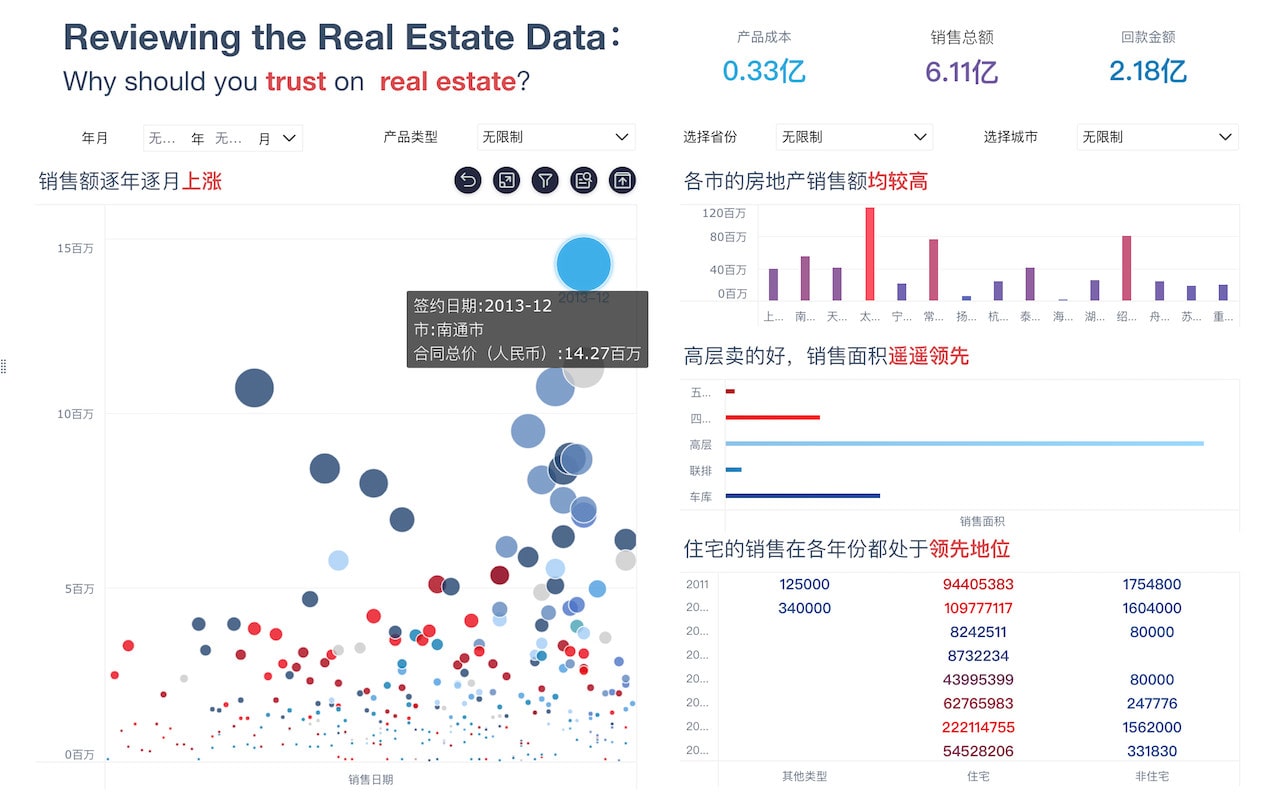

进行刷卡机数据挖掘通常需要几个步骤。首先,数据收集是关键,企业需要确保从刷卡机和相关系统中获取准确和完整的数据。接下来,数据清洗和预处理是必要的步骤,以消除错误和重复数据。之后,应用各种数据分析技术,如聚类分析、关联规则挖掘和预测建模,来提取有价值的信息。最后,企业需要将分析结果可视化,以便决策者能够直观地理解数据背后的意义,从而制定相应的业务策略。

通过以上的探讨,可以看出刷卡机数据挖掘在现代商业中扮演着越来越重要的角色,为企业带来了许多数据驱动的决策机会。

本文内容通过AI工具匹配关键字智能整合而成,仅供参考,帆软不对内容的真实、准确或完整作任何形式的承诺。具体产品功能请以帆软官方帮助文档为准,或联系您的对接销售进行咨询。如有其他问题,您可以通过联系blog@fanruan.com进行反馈,帆软收到您的反馈后将及时答复和处理。