You can transform your working capital management with an AP dashboard. Many finance teams still rely on manual processes, which leads to missed discounts and duplicate payments. Take a look at how most teams manage accounts payable:

| Method of Monitoring | Percentage |

|---|---|

| Excel spreadsheets | 66% |

| Manually key invoices | 68% |

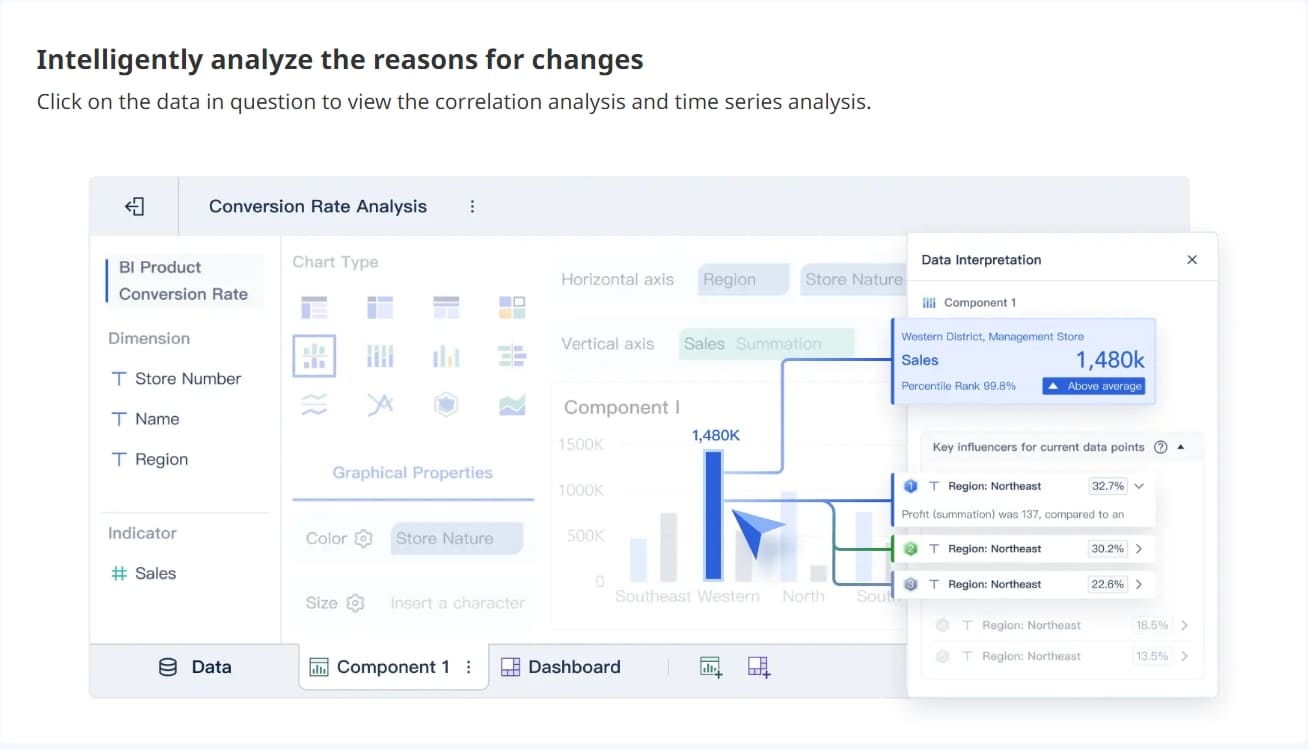

Digital transformation and real-time data help you gain better financial control. FineBI connects to your ERP and generates dashboard indicators automatically, so you avoid manual summaries and errors.

The Value of an AP Dashboard in Financial Management

Overcoming Manual Processes and Data Silos

You may find that relying on Excel for invoice checking creates many challenges for your finance team. Manual processes often lead to missed discounts, duplicate payments, and lost invoices. These issues can slow down your accounts payable workflow and increase costs. Common inefficiencies include:

- Lost or incomplete invoices that delay payments

- Duplicate invoices and payments that waste resources

- Manual approval routing that creates bottlenecks

- Human errors in data entry

- Delays in payment cycles

- Lack of scalability when invoice volumes grow

- Security risks and compliance issues

When your financial data is scattered across different systems, you face data silos. This fragmentation makes it hard to get a clear view of your accounts payable. An AP dashboard solves these problems by integrating all your financial information into one place. With tools like FanRuan and FineBI, you can connect your ERP, automate data collection, and eliminate manual errors.

Digital transformation in accounts payable shifts your process from manual to automated workflows. This change increases business agility and helps you respond quickly to new challenges.

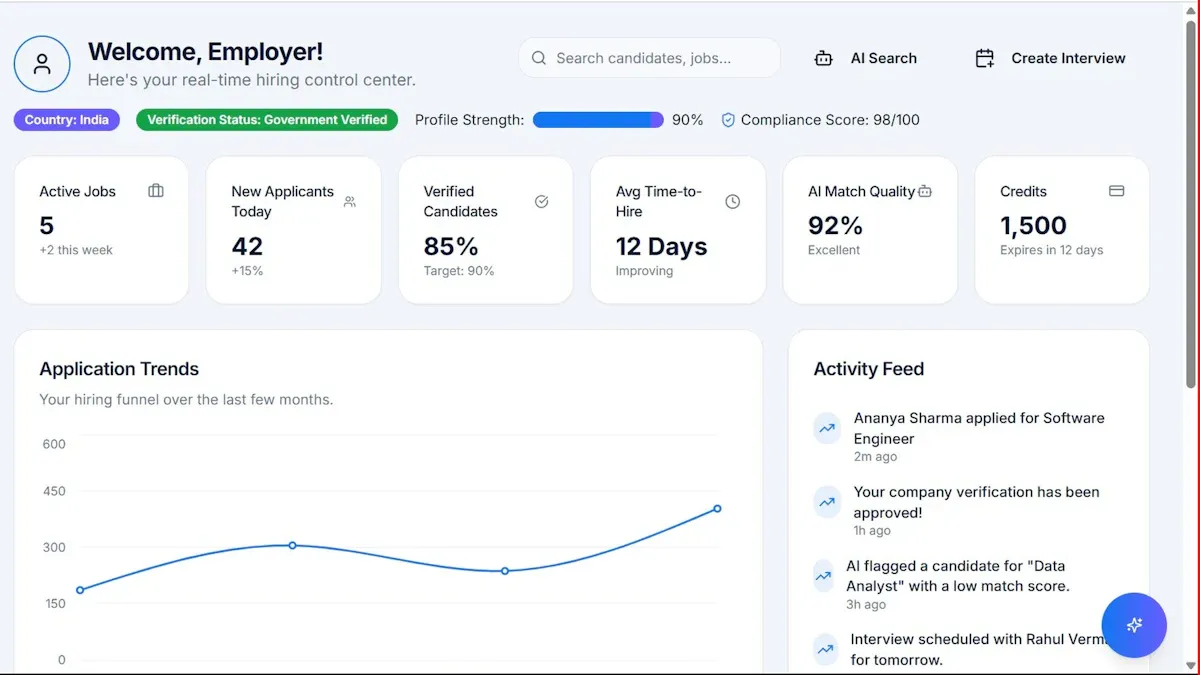

Enhancing Visibility and Control with Real-Time Data

An AP dashboard gives you real-time visibility into your invoices and payments. You can monitor expenditures, track invoice statuses, and manage budgets more effectively. Real-time data helps you:

- Prioritize tasks and prevent payment delays

- Gain better control over spending

- Encourage accountability with performance metrics

You no longer need to wait for monthly reports or search through spreadsheets. The dashboard updates instantly, so you always have the latest financial information at your fingertips.

Supporting Better Decision-Making

A modern accounts payable dashboard supports better decision-making by providing clear, interactive insights. You can track key metrics, forecast cash flow, and optimize working capital. The table below shows how dashboards help you make smarter choices:

| Benefit Description | Purpose |

|---|---|

| Visual, interactive insights into invoices and payments | Track KPIs and optimize workflows |

| Real-time data for AP performance | Enable accurate forecasting and budgeting |

| Proactive, data-driven decisions | Align AP operations with financial goals |

With an AP dashboard, you can move from reactive to proactive financial management. You gain the tools to improve profitability and support your organization’s growth.

Key Metrics for Accounts Payable Dashboards

Tracking the right metrics on your accounts payable dashboard is essential for optimizing working capital and improving financial performance. When you monitor these indicators, you gain a clear view of your outstanding invoices, payments, and vendor relationships. Experts recommend including Days Payable Outstanding (DPO) and Discount Capture Rate as core metrics in any mature AP dashboard. FineBI connects to your ERP system in real time and automatically generates these key performance indicators, so you never have to rely on manual summaries.

Here is a table of important metrics you should include:

| Metric | Description |

|---|---|

| Total Invoices Processed | Shows the volume of invoices your AP team handles. |

| Average Time To Process Invoice | Measures how long it takes to process each invoice from start to finish. |

| Days Payable Outstanding (DPO) | Tracks the average number of days you take to pay suppliers. |

| Cost Per Invoice | Calculates the average cost to process a single invoice. |

DPO and Discount Capture Rate

DPO is a critical metric for working capital optimization. It tells you how many days, on average, your company takes to pay its suppliers. A higher DPO means you keep cash longer, which can help your business grow. However, you must balance this with maintaining good supplier relationships and a strong credit profile. The table below explains why DPO matters:

| Aspect | Explanation |

|---|---|

| Cash Flow Management | A higher DPO lets you retain cash longer for reinvestment. |

| Supplier Relationship | High DPO can strain supplier trust if payments are too slow. |

| Creditworthiness | Investors and creditors use DPO to judge your reliability. |

| Industry Norms | DPO varies by sector; manufacturing often has longer DPO than tech. |

| Working Capital Efficiency | Increasing DPO boosts liquidity but requires careful management to avoid supplier issues. |

Discount Capture Rate is another essential metric. It measures how often you take advantage of early payment discounts offered by suppliers. Monitoring this rate helps you spot cost-saving opportunities and ensures you maximize available discounts. When you track this metric, you:

- Identify ways to save money on payments.

- Compare discounts captured to those offered, so you do not miss savings.

- Optimize cash flow and reduce expenses.

FineBI automates the calculation and visualization of both DPO and Discount Capture Rate. You can see these metrics update in real time, helping you make informed decisions quickly.

Invoice Status and Duplicate Payment Prevention

Keeping track of invoice status is vital for managing outstanding invoices and preventing errors. Real-time tracking lets you see which invoices are pending, approved, or paid. This improves cash flow management and helps you avoid late payments. You also build better relationships with vendors by ensuring timely payments.

Duplicate payments are a common issue in accounts payable. About 1.29% of all invoices processed are duplicates. This can lead to unnecessary costs and confusion. An accounts payable dashboard with automated checks and real-time alerts helps you spot potential duplicates before you process payments. FineBI provides these features, so you can protect your business from costly mistakes.

Benefits of real-time invoice status tracking include:

- Improved cash flow management by analyzing outstanding invoices and payments.

- Better vendor relationships through timely payments.

- Strategic decision making with up-to-date insights.

Cash Flow Projections and Vendor Performance

Cash flow projections are crucial for proactive capital planning. Automated accounts payable systems like FineBI give you real-time access to data on invoices and payments. This allows you to forecast cash flow with precision and plan for future needs. You can address financial challenges before they become problems.

Vendor performance metrics play a key role in strengthening supplier relationships. When you review vendor performance metrics regularly, you ensure transparency and open communication. You can identify issues early and work with suppliers to resolve them. This approach leads to better collaboration and continuous improvement.

By using FineBI, you can automate the tracking of outstanding invoices, payments, and vendor performance metrics. The dashboard gives you a complete view of your financial data, helping you optimize working capital and drive better financial results for your organization.

Customization Strategies for AP Dashboards

Selecting Metrics for Your Business Needs

You need to customize your dashboard to match your business goals and finance team requirements. Start by choosing metrics that align with your objectives, such as improving profit margin or achieving better cash flow. Experts recommend these steps for effective customization:

- Align metrics with your business objectives, like maximizing profit margin or enhancing financial control.

- Assess your AP processes to find the most important stages for your finance operations.

- Benchmark against industry standards, including DPO and Discount Capture Rate, to enhance performance.

- Involve stakeholders from finance and operations to ensure all needs are met.

- Keep your dashboard manageable by focusing on a few critical KPIs.

This approach helps you avoid the common pain point of missing discounts or making duplicate payments when using Excel.

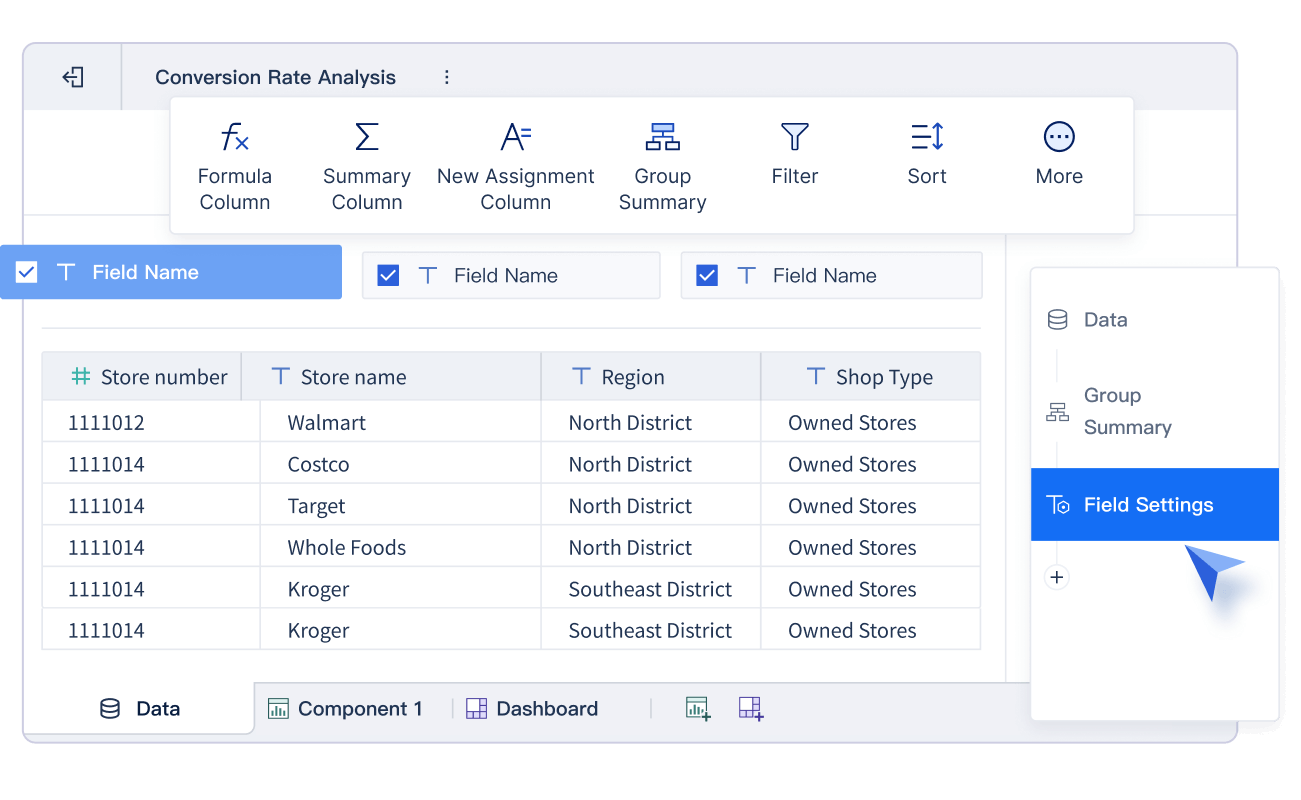

Data Integration with FineBI and FanRuan

You can achieve accurate financial reporting by integrating data from multiple sources. FineBI and FanRuan make this process seamless. The table below shows how different data sources contribute to dashboard accuracy:

| Data Source Type | Contribution to Accuracy |

|---|---|

| ERP Systems | Real-time data updates and fewer manual errors |

| Accounting Software | Consistent financial reporting |

| CRM Systems | Comprehensive insights for profit margin analysis |

| Bank Feeds | Up-to-date transaction data for better cash flow |

| Payroll Systems | Accurate employee financial data |

| External Market Data | Current trends for profit margin improvement |

FineBI’s self-service, drag-and-drop customization lets you connect these sources easily. You can automate the calculation of DPO and Discount Capture Rate, ensuring your AP dashboard always reflects real-time insights. This integration supports data-driven decisions and helps you improve your profit margin.

Real-Time Alerts and Role-Based Views

Real-time insights are essential for preventing errors and fraud in finance. FineBI provides real-time alerts that notify you of duplicate invoices or unusual payment patterns. These alerts help you maintain financial integrity and protect your profit margin.

Role-based views allow each user to see only the information relevant to their job. Executives, finance managers, and operations leaders can focus on the metrics that matter most to them. This customization increases user engagement and ensures your dashboard drives better decisions across your organization.

Tip: Customization with FineBI means you get real-time data updates, tailored dashboards, and improved profit margin—all with less manual effort.

Financial Dashboards for Continuous Improvement

Monitoring Trends and Anomalies

You can use financial dashboards to drive continuous improvement in your accounts payable process. These dashboards give you real-time data access, which helps you make timely decisions and accurate forecasts. When you automate repetitive tasks, you reduce errors and speed up invoice approvals. This leads to higher productivity for your finance team.

A well-designed dashboard lets you monitor key metrics and spot trends or anomalies quickly. You can track important indicators such as Days Payable Outstanding (DPO), Discount Capture Rate, and total payable balances. FineBI connects to your ERP system in real time, so you always see the latest data without manual summaries. This helps you avoid missing discounts or making duplicate payments, which are common pain points for finance departments using Excel.

Here is a table showing how financial dashboards support ongoing improvement:

| Feature | Benefit |

|---|---|

| Real-time data access | Enables accurate forecasting and timely decisions |

| Automation of tasks | Reduces errors and speeds up approvals |

| Monitoring metrics | Ensures timely payments and healthy cash flow |

| Identifying bottlenecks | Improves processing efficiency and resource allocation |

| Actionable data | Provides tighter control over spending and cash flow |

Dashboards also help you detect anomalies, such as duplicate invoices or unusually large payments. Early detection of these issues reduces risk and improves compliance. You can respond quickly to potential threats and keep your financial operations running smoothly.

Enabling Collaboration and Governance

Financial dashboards make it easier for your finance team to work together. When everyone sees the same real-time data, you can prioritize focus areas and make better decisions. As Khurram Chohan, CFO of TogetherCFO, says:

"Having a clear financial dashboard is the key to making better business decisions and being able to act faster."

Dashboards consolidate performance data into a single view. This transparency fosters a culture of collaboration, accountability, and trust across your organization. You can also use dashboards to support governance and compliance. Real-time insights into invoice status and key metrics help you manage risks and ensure everyone follows financial policies.

With FineBI, you gain role-based access and automated alerts. This means each team member sees only the information they need, which protects sensitive data and supports compliance. By using financial dashboards, you improve cash flow, build better vendor relationships, and drive continuous improvement in your finance operations.

Customizing your AP dashboard brings measurable benefits for working capital optimization. You gain improved cash flow visibility, better supplier relationships, and cost-effective operations. See the table below for a quick summary:

| Benefit | Description |

|---|---|

| Improved cash flow visibility | Clear view of all outstanding payables |

| Enhanced supplier relationship | Better control over cash flow |

| Tracking critical metrics | Spot discrepancies and prioritize payments |

| Avoiding late fees | Timely payment management |

| Cost-effective operations | More efficient processes |

In short, clinging to Excel for invoice verification is a recipe for duplicate payments and missed discounts. Modern finance teams are shifting to professional AP Dashboards to monitor essential KPIs like DPO and Discount Capture Rate in real-time.

By choosing FineBI, you can seamlessly link your ERP data and replace manual reporting with automated analytics. This transition with FanRuan not only boosts accuracy and speed but also ensures robust financial compliance.

Ready to eliminate manual errors and optimize your cash flow? Click the banner below to start your FREE trial of FineBI and experience the power of automated AP management!

Continue Reading About dashboard

What Does the Motive Dashboard Do?

Draft Dashboard Review - Is It the Ultimate DFS Tool?

Mastering Client Dashboards: A Complete Guide to Transform Data into Actionable Business Insights

FAQ

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Profit and Loss Dashboard Made Easy for Beginners

Build a profit and loss dashboard from scratch with easy steps. Automate updates, track key metrics, and gain real-time financial insights for your business.

Lewis

Dec 25, 2025

What Makes an AR Dashboard Essential for Modern Finance Team

An AR Dashboard centralizes receivables, automates collections, and delivers real-time insights for finance teams to boost cash flow and efficiency.

Lewis

Dec 25, 2025

Top 12 Marketing Analytics Dashboard Templates for Smarter Campaigns

Compare top marketing analytics dashboard templates for 2025 to track campaigns, unify data, and boost ROI with real-time, actionable insights.

Lewis

Dec 24, 2025