You need an AR Dashboard to keep your finance team ahead. Many teams struggle with late payments, slow accounts receivable processes, and disorganized ledgers. These issues often arise from fragmented tools and manual work. See how these challenges impact your daily operations:

| Challenge | Impact | Solution |

|---|---|---|

| Late Payments | Cash flow issues | Automatic reminders |

| Inaccurate Invoices | Financial loss, damaged reputation | Automated invoicing |

| Slow AR Processes | Payment delays | Process automation |

| Disorganized Ledgers | Compliance risks | Streamlined records |

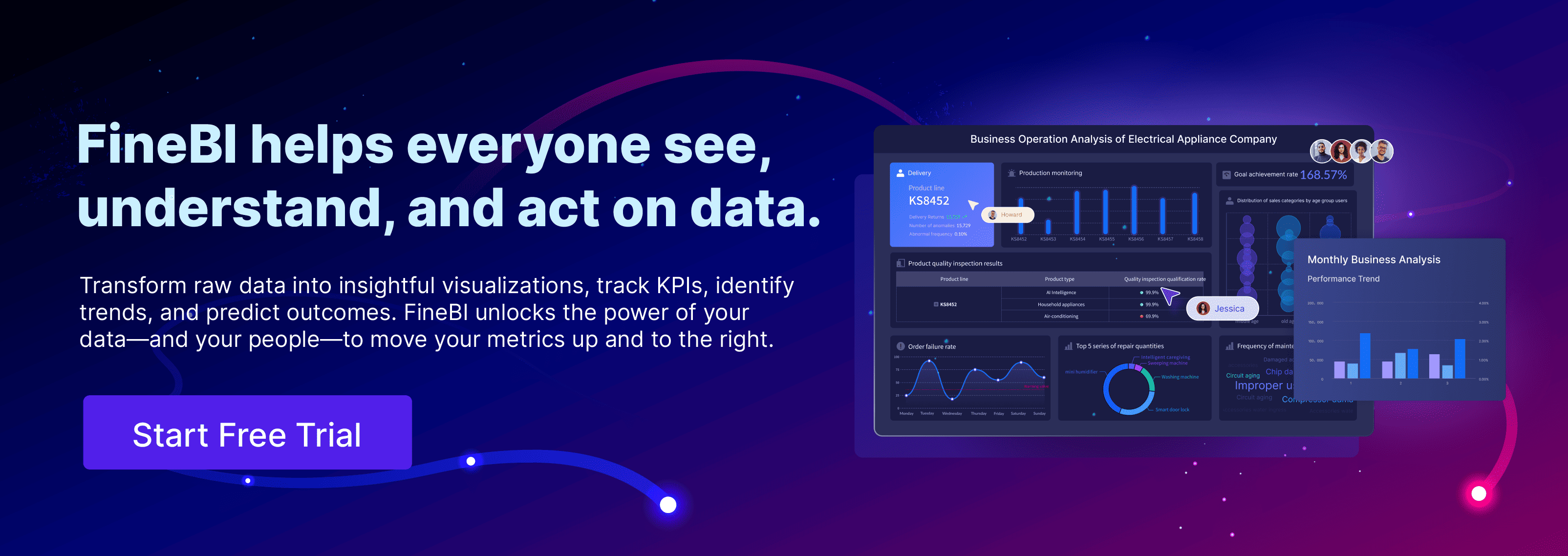

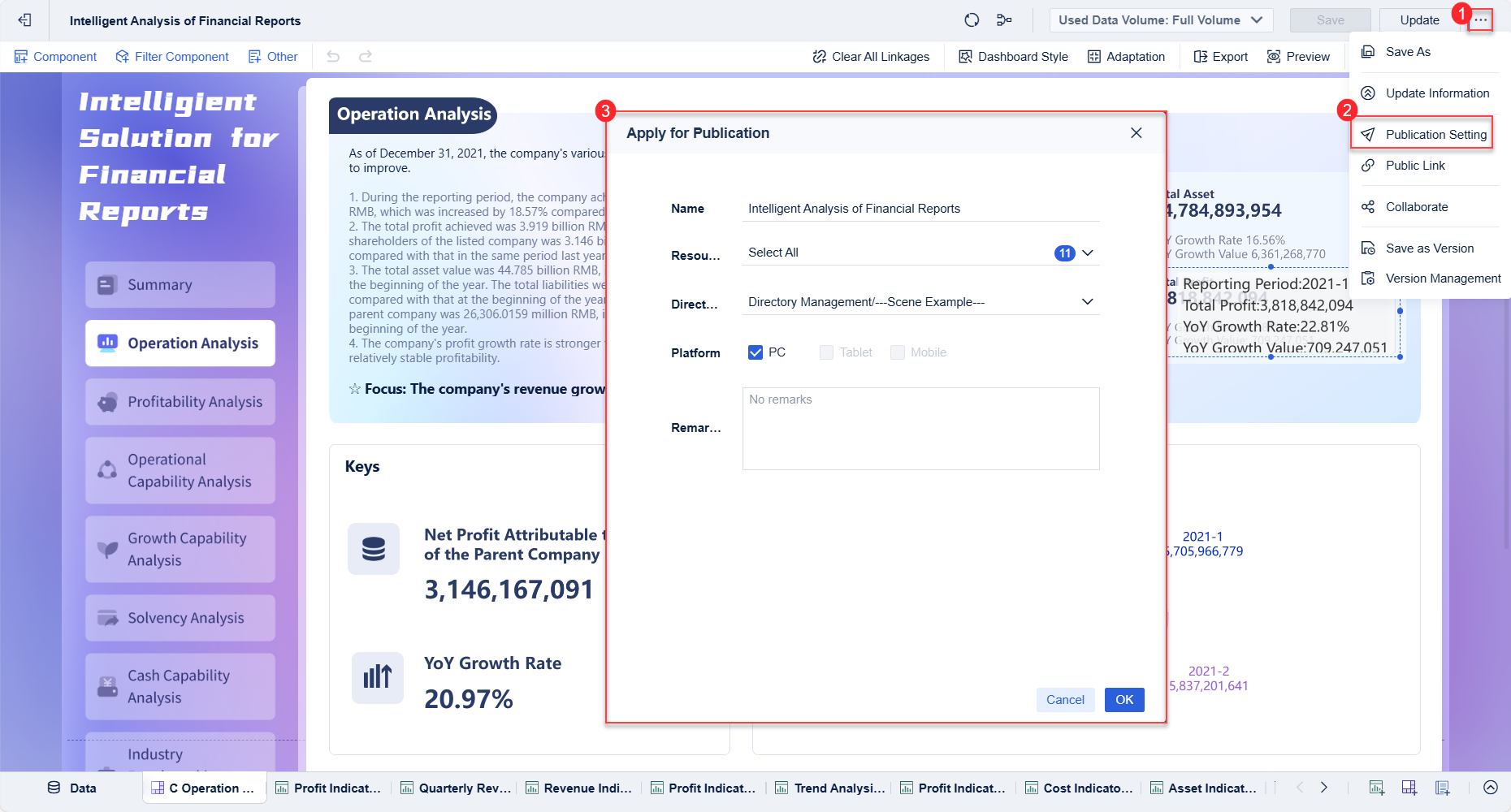

Modern dashboards powered by FineBI and FanRuan give you real-time insights and help you track every customer, organize data, and make better financial decisions.

What Is an AR Dashboard

Definition and Purpose

An ar dashboard, also known as an accounts receivable dashboard, is a digital tool that helps you track and manage money owed to your business. You can use it to see which customers have unpaid invoices, how much they owe, and how long payments have been outstanding. This dashboard gives you a clear view of your accounts receivable process, making it easier to spot trends and take action.

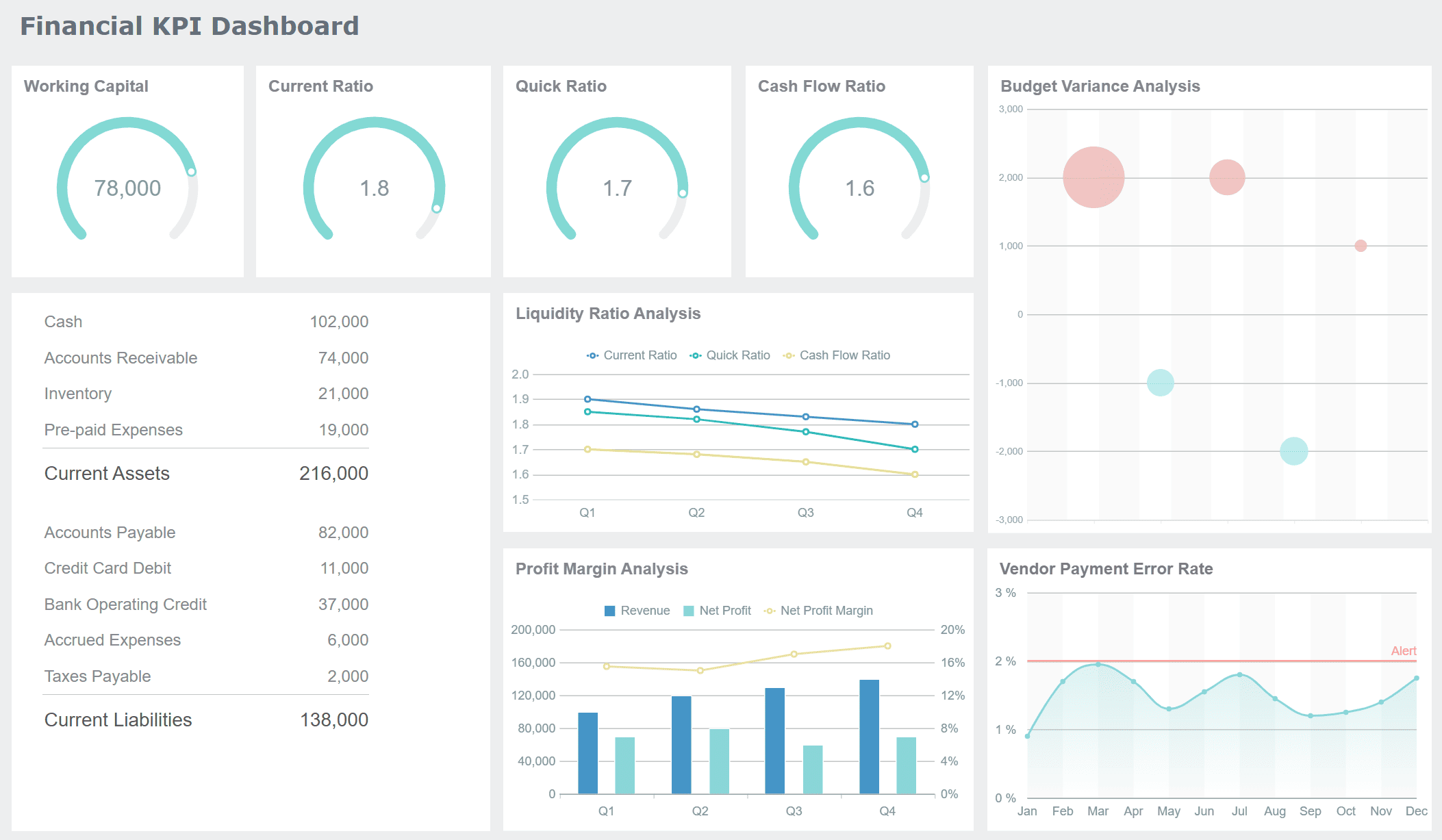

The main purpose of an ar dashboard is to improve how you handle accounts receivable. You get real-time data, which means you always know your current cash flow and can make better decisions. You can also monitor key performance indicators (KPIs) like Days Sales Outstanding (DSO) and collection effectiveness. Here is a quick overview of why finance teams use these dashboards:

| Purpose | Description |

|---|---|

| Improve cash flow management | Identify slow-paying customers and focus on collections. |

| Enhance productivity | Align your team with easy-to-understand data. |

| Provide real-time data | Get timely insights for better budget and sales monitoring. |

| Insights into AR performance | Track KPIs and trends to measure progress toward your goals. |

Modern solutions like FanRuan and FineBI make it simple to build and use an ar dashboard. These platforms let you automate critical metrics, speed up payment cycles, and reduce the risk of bad debt. You also gain financial transparency, which is key for any growing business.

How AR Dashboards Centralize Accounts Receivable Data

You might wonder how an accounts receivable dashboard brings all your data together. Traditional methods often leave you with scattered spreadsheets and manual updates. An ar dashboard changes this by acting as a single source of truth for your accounts receivable data.

- You can see all outstanding invoices, payments, and customer details in one place.

- The dashboard updates in real time, so you always have the latest information.

- You get a visual snapshot of cash flow, DSO, and collections performance.

- Integrated platforms like FineBI and FanRuan connect to your existing systems, eliminating inefficiencies and making your workflow smoother.

With a centralized dashboard, you no longer waste time searching for information or double-checking numbers. Instead, you focus on what matters—collecting payments and keeping your business healthy.

AR Dashboard Key Features

Modern finance teams rely on an ar dashboard to manage accounts receivable with speed and accuracy. You need a solution that brings together all your outstanding receivables, automates collections, and connects seamlessly with your existing systems. Let’s explore the key features that make an accounts receivable dashboard essential for your financial operations.

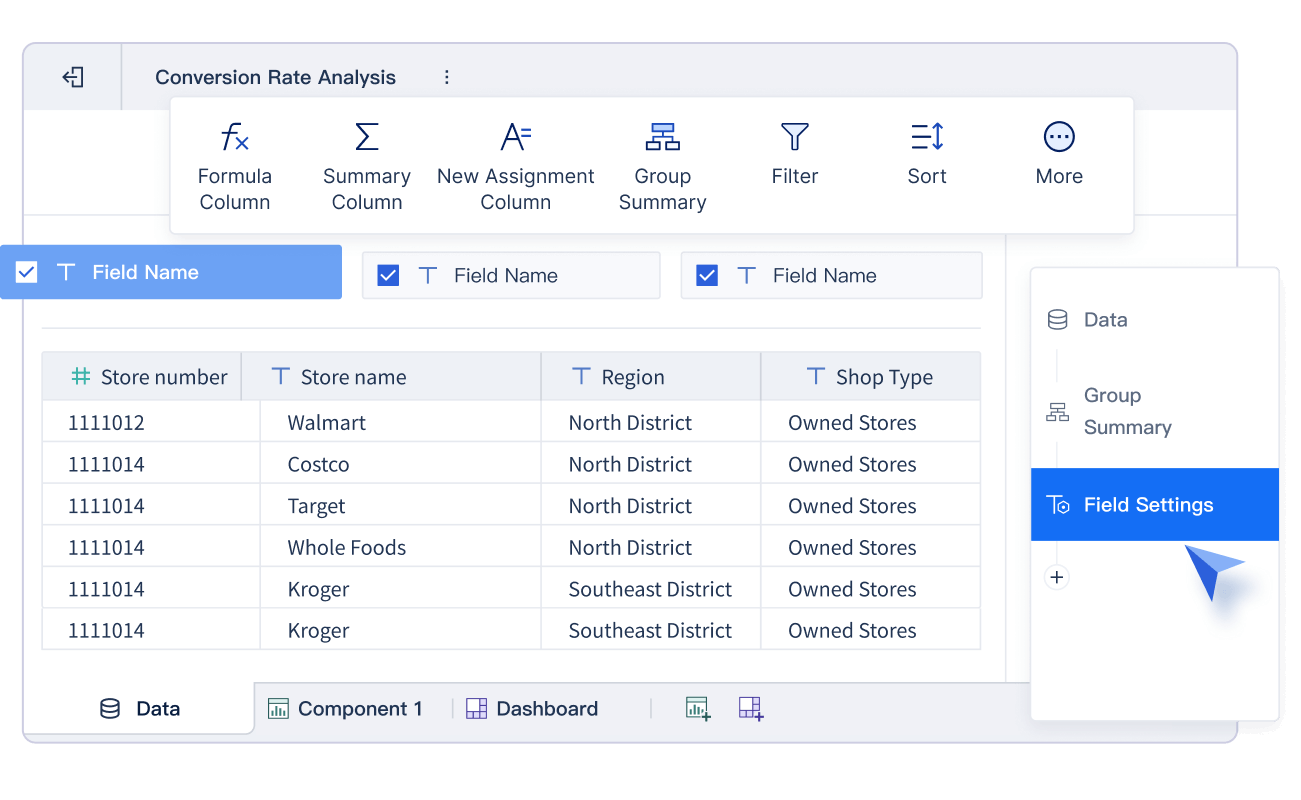

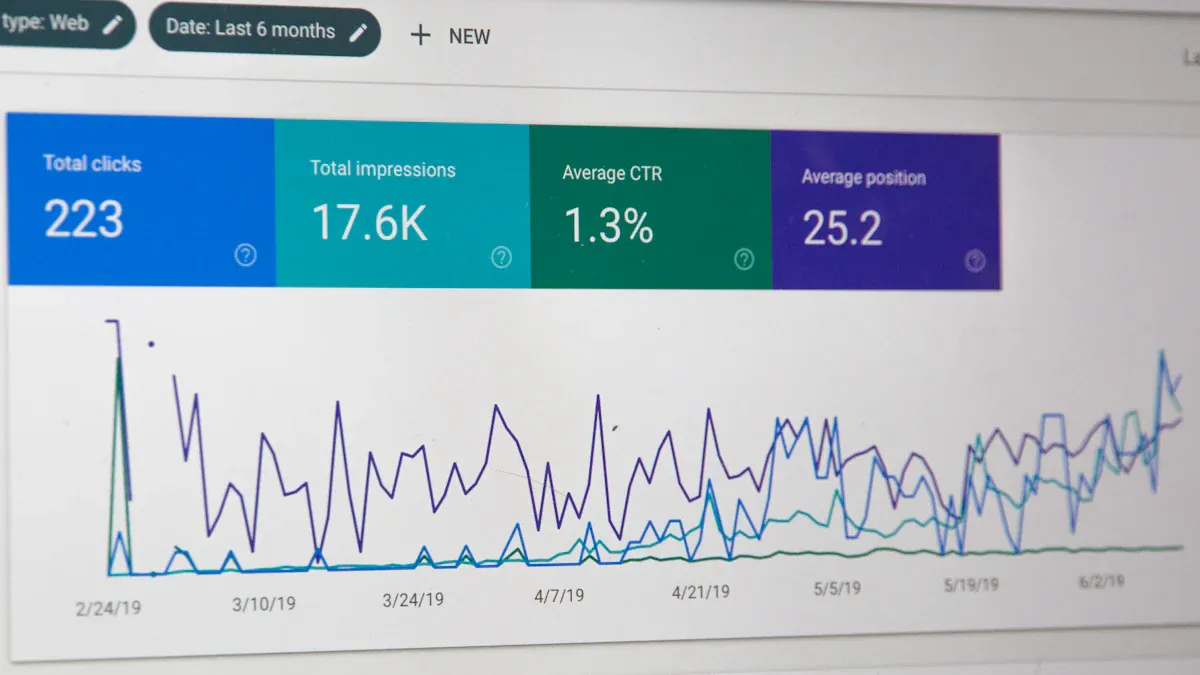

Real-Time Data and Visualization

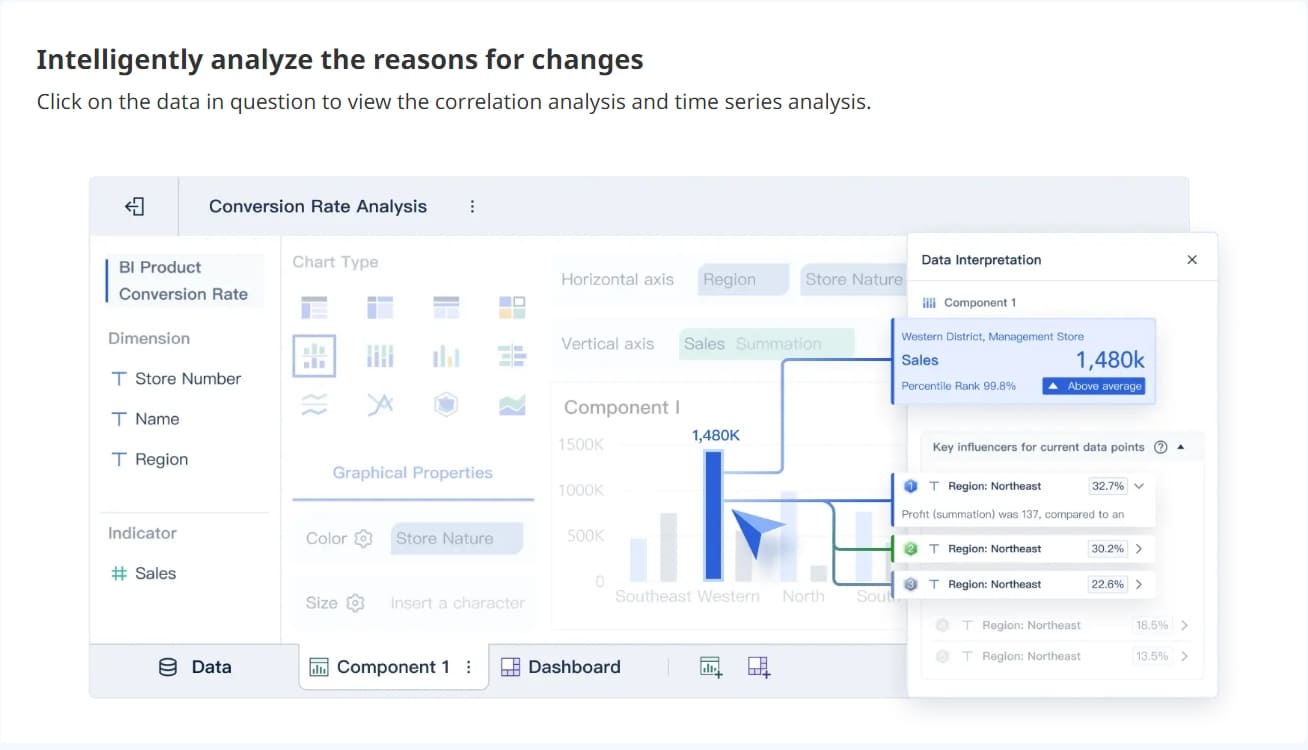

You want to see your accounts receivable status at a glance. An ar dashboard provides real-time data, so you always know which invoices are outstanding and which customers need attention. FineBI makes this possible by connecting directly to your ERP and financial systems. You no longer have to wait for manual updates or spend hours consolidating spreadsheets.

Tip: Real-time dashboards help you spot trends and act quickly. You can track KPIs like Days Sales Outstanding (DSO), monitor cash flow, and analyze payment patterns—all in one place.

Here’s a quick look at the most essential features you get with a modern ar dashboard:

| Feature | Description |

|---|---|

| Real-Time Monitoring | Live tracking of invoices and payments. |

| Aging Analysis | Segmentation of accounts based on overdue duration. |

| Payment Trend Analysis | Identifying customer payment behaviors. |

| Collection Performance Metrics | Evaluating collection effectiveness. |

| Cash Flow Forecasting | Predicting future cash inflows. |

| Integration with ERP Software | Seamless connectivity with various platforms. |

FineBI’s visualization tools let you create interactive charts and tables. You can filter by customer, region, or invoice status. This helps you focus on the most important accounts and make informed financial decisions.

Automated Alerts and Collections

You need to act fast when payments are late. An accounts receivable dashboard powered by FineBI automates alerts and collections, so you never miss a critical deadline. The system sends reminders to customers, escalates issues to the right team members, and even predicts which invoices might become overdue.

- Automated dunning campaigns adjust based on invoice status and customer history.

- Personalized communication templates keep your outreach professional.

- Escalation paths involve stakeholders when needed.

- Exception handling flags unusual cases for review.

- Payment prediction models analyze past behavior to forecast risks.

- Risk scoring highlights accounts likely to pay late.

- Customer payment portals give 24/7 access to invoices and payment options.

- Dispute management workflows resolve issues quickly.

- Flexible payment plans and methods accommodate customer needs.

- Real-time dashboards track DSO and collection effectiveness.

With FineBI, you automate repetitive tasks and focus your team’s energy on high-value activities. You reduce manual errors, speed up payment cycles, and minimize bad debt risks.

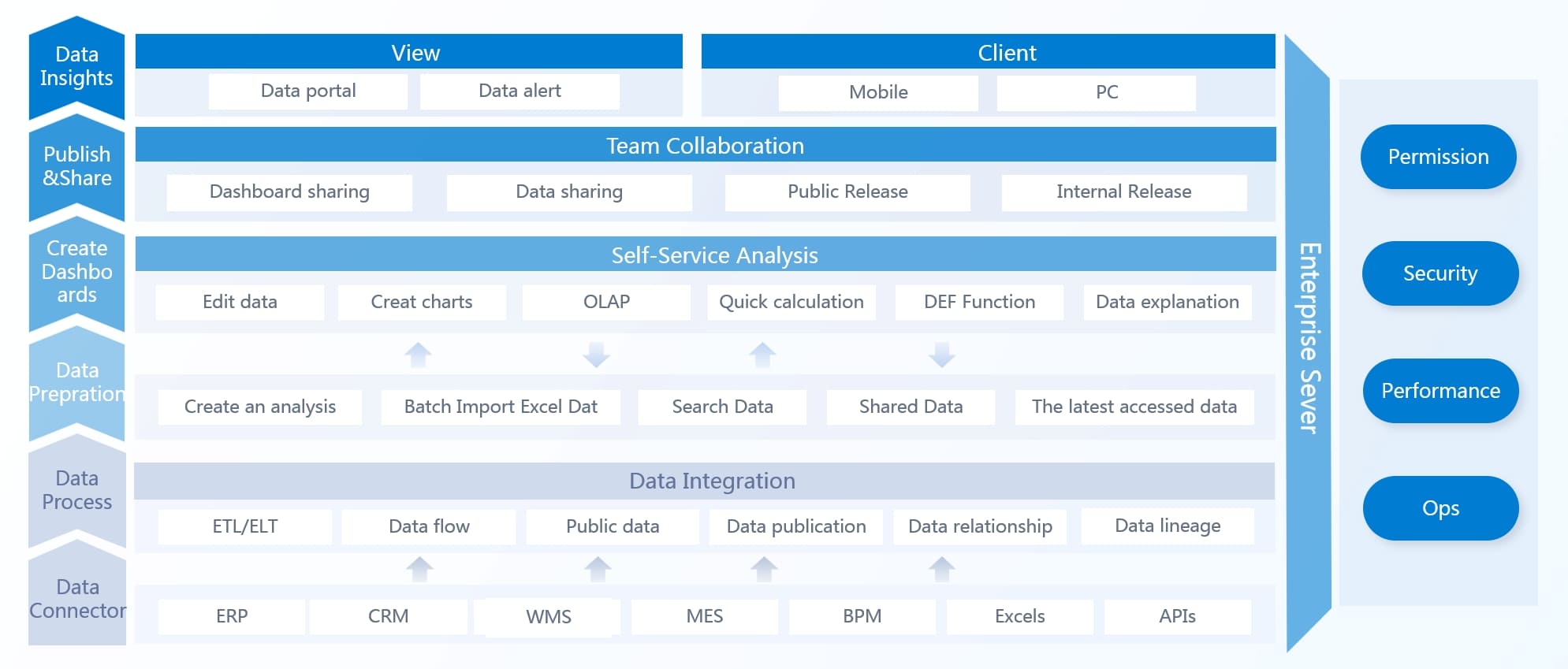

Integration with FineBI and Other Systems

You want your ar dashboard to work with all your business systems. FineBI excels at integrating data from ERP, CRM, and other financial platforms. This means you get a single source of truth for all your accounts receivable data.

| Feature | Benefit |

|---|---|

| Advanced data processing | Cleanse and standardize data from multiple sources for better analysis. |

| Real-time insights | Get immediate updates for timely decision-making. |

| AI-enhanced features | Personalize dashboards and improve user engagement. |

| Data sharing capabilities | Collaborate easily with your team. |

| Low-code data development | Prepare data without needing technical skills. |

| Memory computing | Process large datasets quickly for fast dashboard performance. |

FineBI’s integration eliminates manual data consolidation. You connect once and see all your outstanding receivables, customer details, and financial data in one dashboard. This streamlines your workflow and ensures financial transparency.

Note: Industry trends show that teams using advanced ar dashboards see a 25-40% reduction in DSO within 90 days, 90% accuracy in cash flow predictions, and fewer write-offs due to early risk identification.

When you use FineBI and FanRuan, you empower your finance team to automate critical metrics, accelerate collections, and keep your accounts receivable process running smoothly.

Benefits for Finance Teams

Improved Cash Flow and Efficiency

You want your finance team to work smarter, not harder. An accounts receivable dashboard gives you a clear view of all outstanding receivables and payment activity. This visibility helps you optimize cash flow management and keep your business running smoothly. When you use a modern solution like FineBI, you can:

- Identify slow-paying customers quickly and focus your collection efforts where they matter most.

- Track key performance indicators such as Days Sales Outstanding (DSO) and collection effectiveness.

- Automate reminders and follow-ups, which speeds up timely collections and reduces manual work.

- Compare your process efficiency against industry benchmarks to find areas for improvement.

A recent McKinsey study found that companies focusing on team performance are over four times more likely to outperform their peers. As your finance team matures, your AR dashboard evolves from a simple reporting tool to a performance management platform. You gain the ability to measure, analyze, and improve every part of your accounts receivable process.

Tip: Real-time data lets you spot issues before they become problems. You can act fast to correct errors and keep your cash flow healthy.

Enhanced Decision-Making with Accounts Receivable Insights

You need accurate financial data to make smart decisions. An accounts receivable dashboard powered by FineBI gives you instant access to the information you need. You can see which customers owe you money, how long invoices have been outstanding, and which accounts might need special attention.

- Real-time monitoring allows you to detect errors immediately and fix them before submitting reports.

- Dashboards provide instant insights into compliance status, helping you track reporting deadlines and identify risks.

- You can use these insights to adjust payment terms, improve collection strategies, and reduce the risk of bad debt.

When you have access to real-time accounts receivable insights, you make proactive decisions that align with both regulatory demands and your business goals. You also ensure that your financial health remains strong.

Note: FineBI’s dashboards help you visualize KPIs and trends, making it easier to communicate results with your team and leadership.

Real-World Impact: BOE and SAMOA

Companies like BOE and SAMOA have transformed their financial operations with AR dashboards from FanRuan. BOE reduced inventory costs by 5% and increased operational efficiency by 50% after implementing FineBI. The company now uses KPI dashboards to monitor performance and benchmark across factories. SAMOA unified its reporting and automated performance calculations, which improved decision-making and eliminated data silos. These examples show how a modern dashboard can drive measurable improvements in cash flow, efficiency, and transparency.

Team Collaboration and Data Security

You want your team to work together seamlessly while keeping sensitive information safe. An accounts receivable dashboard centralizes all your financial data, making it easy for everyone to access the same information. FineBI supports secure data sharing and role-based permissions, so you control who can view or edit each report.

- Team members can collaborate on dashboards, share insights, and validate data together.

- Real-time updates ensure everyone works with the latest information.

- Data security features protect sensitive customer and financial details from unauthorized access.

With FineBI and FanRuan, you build a culture of collaboration and trust. Your team spends less time searching for information and more time focusing on strategic tasks. You also meet compliance requirements and reduce the risk of data breaches.

Callout: Centralized dashboards not only improve teamwork but also ensure that your financial data stays secure and compliant.

By adopting a modern accounts receivable dashboard, you empower your finance team to automate critical metrics, accelerate payment cycles, minimize bad debt risks, and maintain financial transparency. You gain the tools you need to support your company’s growth and long-term success.

Essential Accounts Receivable Metrics

Modern finance teams need more than static Excel spreadsheets to manage accounts receivable. When you rely on manual tracking, you risk missing overdue payments and making reconciliation errors. These gaps can hurt your cash flow and make it hard to get accurate financial data for informed decisions. With a dashboard powered by FineBI and FanRuan, you gain a visual workspace of key ar performance metrics and automate the most important ar metrics for your business.

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) measures how quickly your customers pay their invoices. Tracking DSO in your accounts receivable dashboard helps you optimize receivables and maintain financial health. You can:

- Monitor DSO to spot trends and understand customer payment behaviors.

- Run weekly DSO reports to catch changes early.

- Compare DSO across customer segments to find areas needing attention.

- Set up automatic email alerts for DSO reports, so you never miss a review.

- Collaborate with your Credit and Sales teams to align payment terms.

- Proofread your invoicing process to reduce errors.

FineBI makes it easy to automate these steps, giving you real-time data and analytics that support your financial goals.

Aging Analysis and Collection Effectiveness

Aging analysis shows how long invoices have been outstanding. This metric helps you prioritize collections and improve your cash flow. Your accounts receivable dashboard can:

- Identify overdue invoices by reviewing aging categories.

- Prioritize collections based on overdue amounts and periods.

- Assess credit policies to see what works best.

- Forecast incoming payments to improve cash flow.

- Communicate with customers about overdue invoices.

- Evaluate customer relationships to manage credit extension.

- Support financial reporting by integrating the AR Aging Report.

With FineBI, you automate aging analysis and collection effectiveness, reducing manual work and minimizing bad debt risks.

KPI Tracking in Accounts Receivable Dashboard

Tracking kpi in your accounts receivable dashboard helps you measure performance and reach your financial objectives. FineBI’s customized dashboards let you visualize and track essential metrics:

| Feature | Benefit |

|---|---|

| Overdue Invoice Tracking | Identifies customers who are late on payments, helping you prioritize collections. |

| Aging Analysis | Shows how long invoices have been overdue, allowing for better collection strategies. |

| Payment History Tracking | Monitors customer payment behavior over time, informing credit control measures. |

| Automated Late Fee Application | Applies late fees automatically, encouraging faster payments and improving cash flow. |

You get a single, real-time view of all outstanding accounts receivable and financial data. This approach supports your financial health and ensures you always have accurate financial data for informed decisions.

Tip: FineBI’s analytics and visualization tools give you a visual workspace of key ar performance metrics, making it easy to share insights and drive results across your team.

Use Cases and Success Stories

FanRuan Customer Success with FineBI

You can see the real impact of AR dashboards by looking at how companies use FineBI from FanRuan. For example, BOE, a global leader in the IoT and display industry, faced challenges with fragmented data and inconsistent metrics. After adopting FineBI, BOE built a unified data warehouse and standardized its metrics. This change led to a 5% reduction in inventory costs and a 50% boost in operational efficiency. The company now tracks every outstanding invoice and monitors kpi dashboards for real-time performance.

SAMOA, a top distributor in the retail sector, also transformed its finance operations with FineBI. The company unified its reporting, automated performance calculations, and eliminated data silos. Now, SAMOA’s finance team can focus on collecting outstanding payments and making informed decisions. These examples show how you can use AR dashboards to improve cash flow, reduce manual work, and enhance data accuracy.

FineBI gives you extensive customization options. You can modify layouts, select different data views, and set personalized alerts. Real-time updates and error-checking mechanisms ensure that your data stays reliable and trustworthy.

Tip: When you use a modern AR dashboard, you empower your team to automate critical metrics, accelerate payment cycles, and minimize bad debt risks.

Practical Applications in Finance Operations

You can apply AR dashboards in many areas of finance. For instance, you can prioritize collections, offer targeted discounts for early payments, and minimize bad debt. Many organizations use dashboards to track key metrics like Days Sales Outstanding (DSO), Collection Effectiveness Index (CEI), and dispute rates. Here is a table showing some important metrics you can monitor:

| Metric | Description | Target Range |

|---|---|---|

| Days Sales Outstanding (DSO) | Average collection period for credit sales | Varies by industry |

| Collection Effectiveness Index | Percentage of collectible receivables actually collected in period | 95%+ for most B2B |

| Dispute Rate | Disputed invoices ÷ total invoices × 100 | 2-8% depending on industry |

You can also use AR dashboards to improve customer service. For example, Staples introduced a self-service portal where customers can access invoices and make payments. This improved the customer experience and reduced the workload for support teams.

Modern AR dashboards powered by FineBI and FanRuan help you automate alerts, integrate with ERP systems, and provide real-time insights. You gain financial transparency and can collaborate with your team more effectively. By using these tools, you ensure your finance operations stay efficient and your business remains competitive.

Modern AR dashboards transform how you manage accounts receivable. With solutions like FanRuan and FineBI, you automate key metrics, speed up payment cycles, and reduce bad debt risks. You gain financial transparency and better team collaboration. To get started, you should:

- Audit your AR process to find bottlenecks.

- Update credit and invoicing policies.

- Use automation tools for greater efficiency.

Tip: Assess your current AR workflow and see how a modern dashboard can help your finance team grow.

Ready to optimize your receivables and boost liquidity? Click the banner below to start your FREE trial of FineBI and transform your AR management today!

Continue Reading About dashboard

How an AP Dashboard Optimizes Your Working Capital

Dashboard Anywhere Made Easy for Chrysler Employees

Mastering Client Dashboards: A Complete Guide to Transform Data into Actionable Business Insights

FAQ

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Profit and Loss Dashboard Made Easy for Beginners

Build a profit and loss dashboard from scratch with easy steps. Automate updates, track key metrics, and gain real-time financial insights for your business.

Lewis

Dec 25, 2025

How an AP Dashboard Optimizes Your Working Capital

Customizing your AP dashboard boosts working capital by improving cash flow, reducing errors, and providing real-time financial insights.

Lewis

Dec 24, 2025

Top 12 Marketing Analytics Dashboard Templates for Smarter Campaigns

Compare top marketing analytics dashboard templates for 2025 to track campaigns, unify data, and boost ROI with real-time, actionable insights.

Lewis

Dec 24, 2025