Sean, Industry Editor

Aug 31, 2024

Financial data management refers to the process of collecting, organizing, and maintaining your financial information so you can use it accurately and efficiently. Today, you face a rapidly changing business world where digital transformation shapes how you handle finances. With advanced technologies like automation and real-time analytics, you can speed up processes, reduce manual errors, and make better decisions. Effective management helps you stay compliant, supports smarter choices, and drives business growth.

Financial data management is the practice of organizing, storing, and maintaining your financial information so you can use it effectively. You use financial data management to ensure that your records are accurate, secure, and accessible when you need them. This process helps you make sense of large amounts of financial information, which is essential for running your business smoothly.

The main purpose of financial data management is to help you make better decisions, stay compliant with regulations, and protect sensitive information. When you manage your financial data well, you can respond quickly to changes in the market and keep your business on track. You also reduce the risk of errors and make it easier to share information across different teams.

You can see the primary objectives of financial data management in the table below:

| Objective | Description |

|---|---|

| Enhance Decision-Making | Effective data management aids in making informed financial decisions. |

| Ensure Regulatory Compliance | Helps organizations meet legal and regulatory standards. |

| Improve Operational Efficiency | Streamlines processes and reduces operational costs. |

| Safeguard Sensitive Information | Protects critical financial data from unauthorized access and breaches. |

Financial data management supports your business by improving the quality and reliability of your financial information. It gives you the tools to analyze trends, forecast outcomes, and plan for the future. You can also meet legal requirements more easily and avoid costly mistakes.

You need to follow several key processes to achieve effective financial data management. Each step ensures that your financial data remains accurate, secure, and useful for your business needs.

You also need to establish strong data governance and security measures. These practices protect your financial data from unauthorized access and ensure that only the right people can view or change sensitive information.

Financial data management workflows often include budgeting, accounts payable and receivable, financial reporting, and audit compliance. You use these workflows to keep your financial operations consistent and efficient. For example, budgeting helps you estimate future needs, while financial reporting gives you a clear picture of your company’s status.

By following these key processes, you create a reliable system for managing your financial data. This system supports your business goals and helps you respond to challenges with confidence.

You face strict regulations when handling financial information. Financial data management helps you meet these requirements and avoid costly mistakes. Regulations such as the Sarbanes-Oxley Act (SOX), International Financial Reporting Standards (IFRS), and Generally Accepted Accounting Principles (GAAP) set clear standards for how you must manage and report your financial data. The table below outlines these key regulations:

| Regulation | Description |

|---|---|

| Sarbanes-Oxley Act (SOX) | Mandates strict internal controls and procedures for financial reporting to prevent fraud. |

| International Financial Reporting Standards (IFRS) | Global accounting standards ensuring consistency and comparability in financial statements. |

| Generally Accepted Accounting Principles (GAAP) | Standard framework of guidelines for financial accounting in the U.S. ensuring accurate financial statements. |

By following these standards, you ensure your financial records are accurate and reliable. Financial data management also protects your business from penalties and legal issues. When you manage your data well, you:

Note: Failing to protect data from tampering or unauthorized access is a violation of financial data security regulations. Noncompliance can lead to significant fines and damage your reputation.

You also benefit from improved cybersecurity. Good financial data management practices help you prevent legal issues, minimize the chance of a security incident, and keep your business running smoothly. Accurate data supports clear financial reporting, which builds trust with stakeholders and regulators.

Financial data management gives you the tools to make better decisions. When you organize and analyze your financial data, you gain insights that drive business growth. Many organizations have seen a 20% increase in revenue by using data-backed insights to guide their strategies. Accurate forecasting helps you allocate resources wisely and reduce risks.

You save time by automating processes, which allows you to focus on strategic discussions. Real-time data insights let you adapt quickly to market changes. You can compare your business performance against industry benchmarks and identify areas for improvement.

Financial leaders use financial data management to inform business growth strategies in several ways:

You can see how these components work together in the table below:

| Component | Description |

|---|---|

| Financial Strategy | A roadmap aligning capital structure, revenue targets, and risk profile with long-term objectives. |

| Data Management | Ensures data integrity and effective reporting for informed decision-making. |

| Real-time Dashboards | Provides insights into key performance indicators, enabling quick pivots in strategy. |

| Forecasting and Analysis | Helps in adapting strategies based on market shifts and performance metrics. |

| Weekly Variance Reviews | Allows leaders to make timely adjustments to prevent small issues from escalating. |

When you use financial data management effectively, you boost efficiency, support growth, and align your analytics with your strategic goals. You turn financial data into a powerful asset that guides your business toward long-term success.

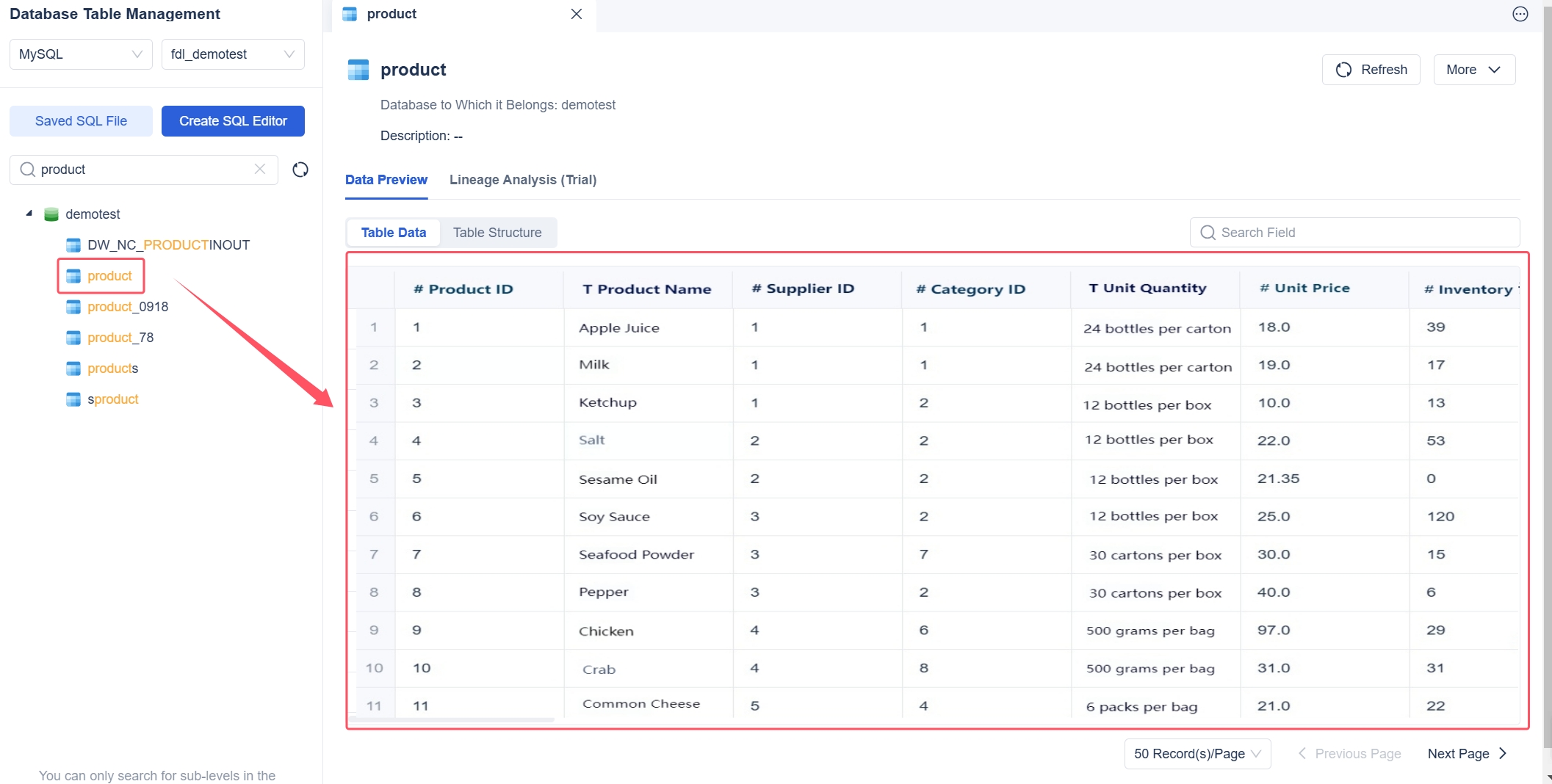

You need strong data collection and storage practices to support financial data management. When you gather financial information from invoices, receipts, and digital records, you create a foundation for accurate reporting. Secure storage protects your financial data from unauthorized access and loss. Poor storage practices can lead to serious risks:

You can avoid these risks by using reliable systems and regular backups. Good storage practices help you maintain trust and keep your financial operations running smoothly.

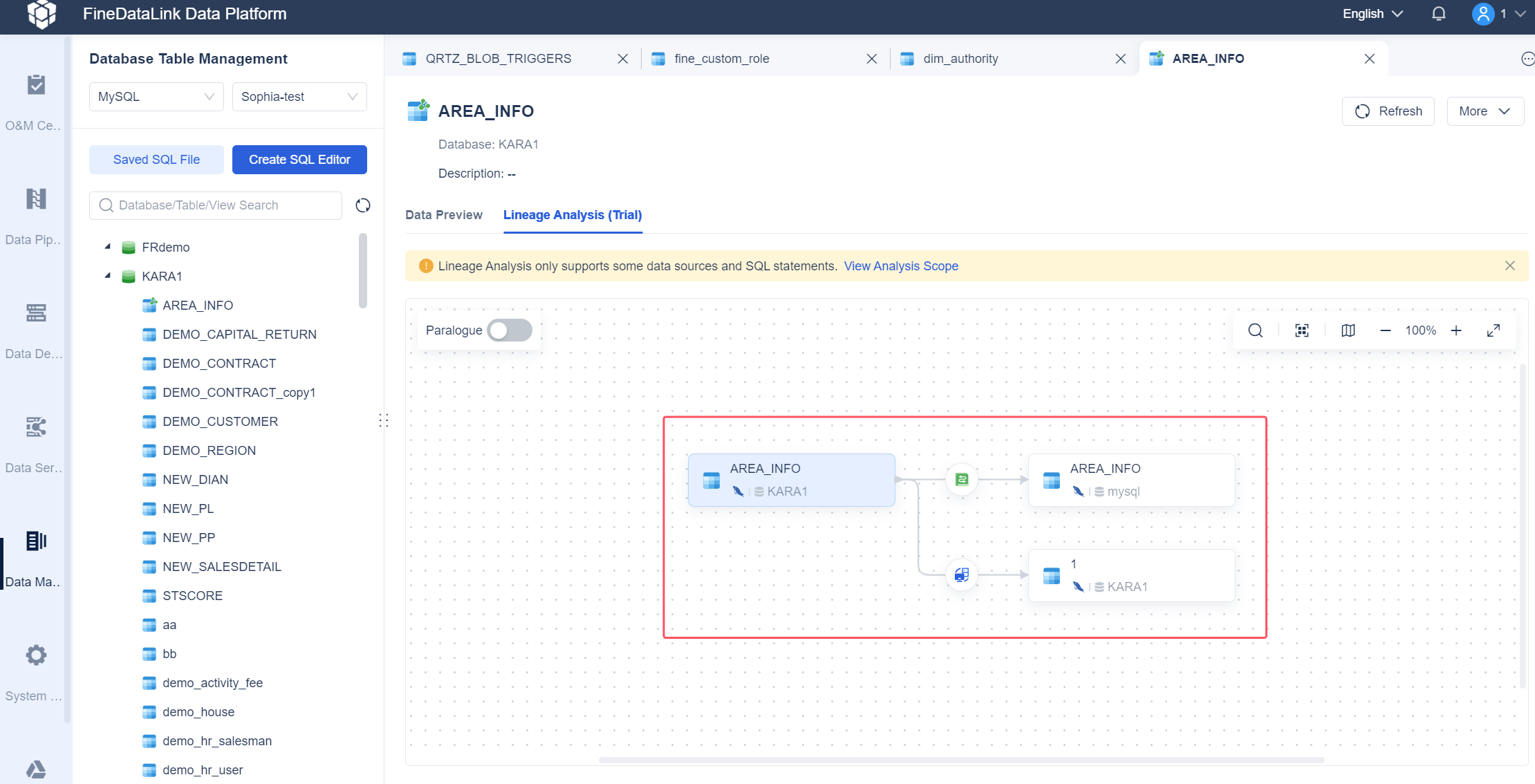

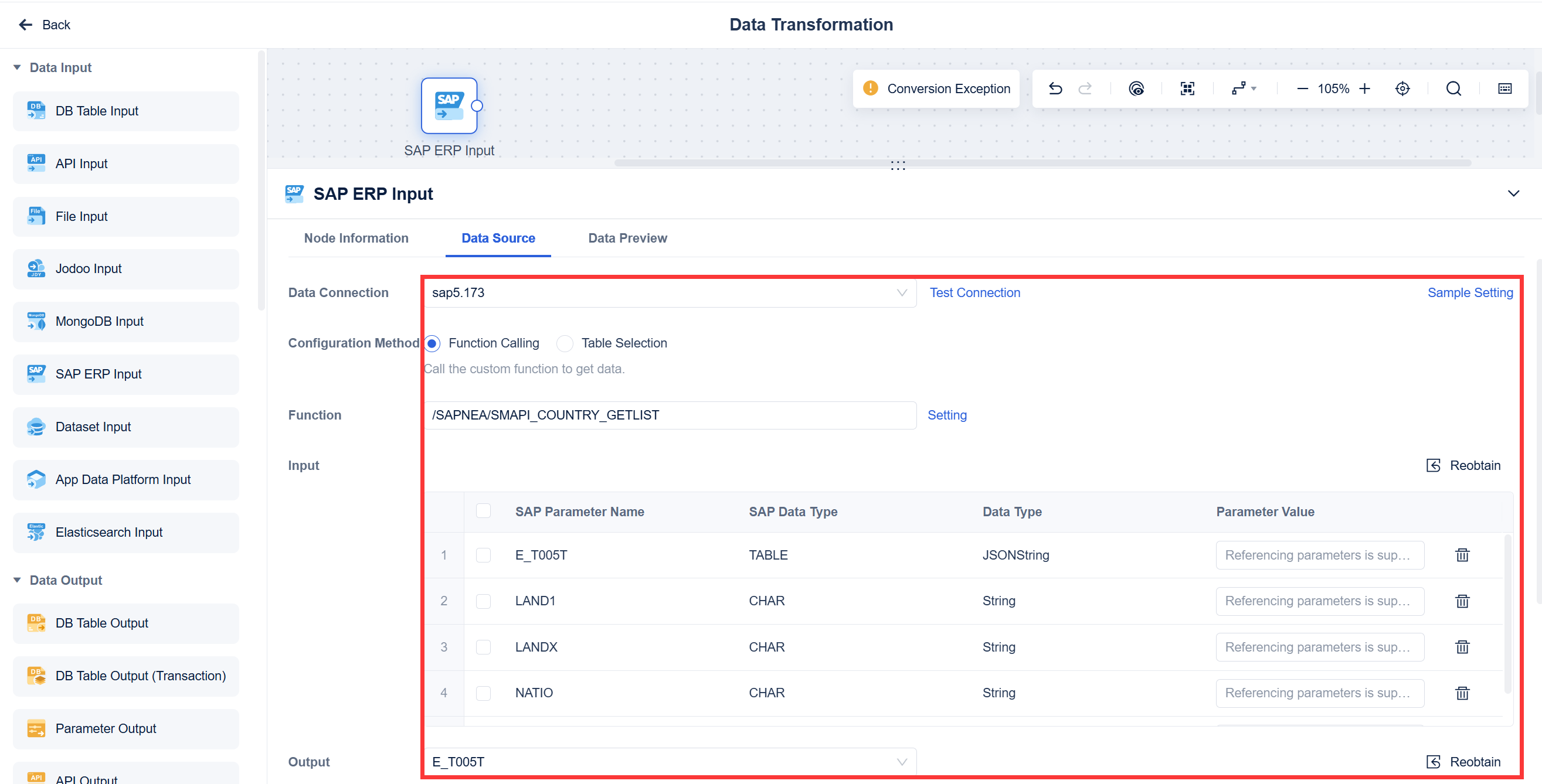

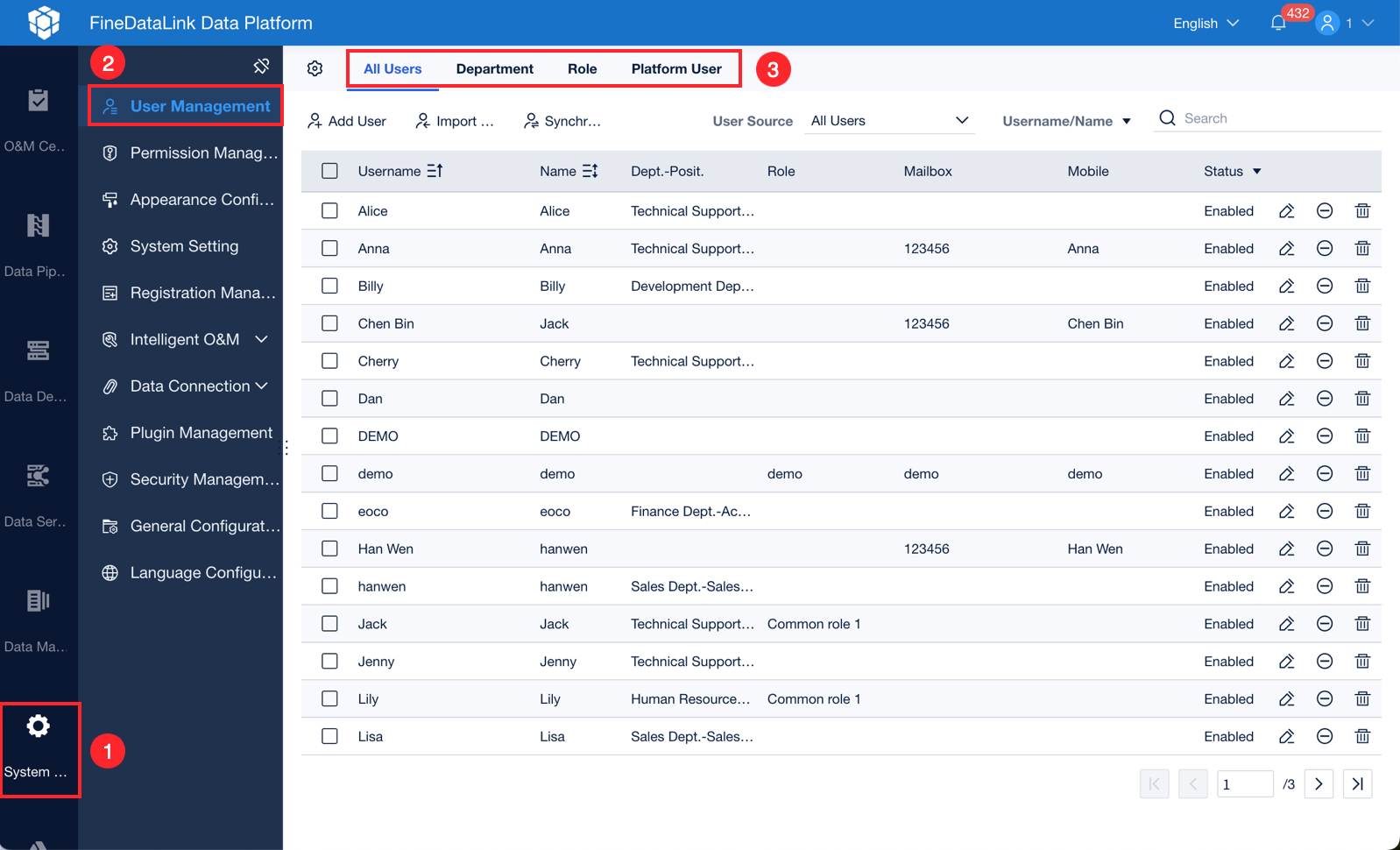

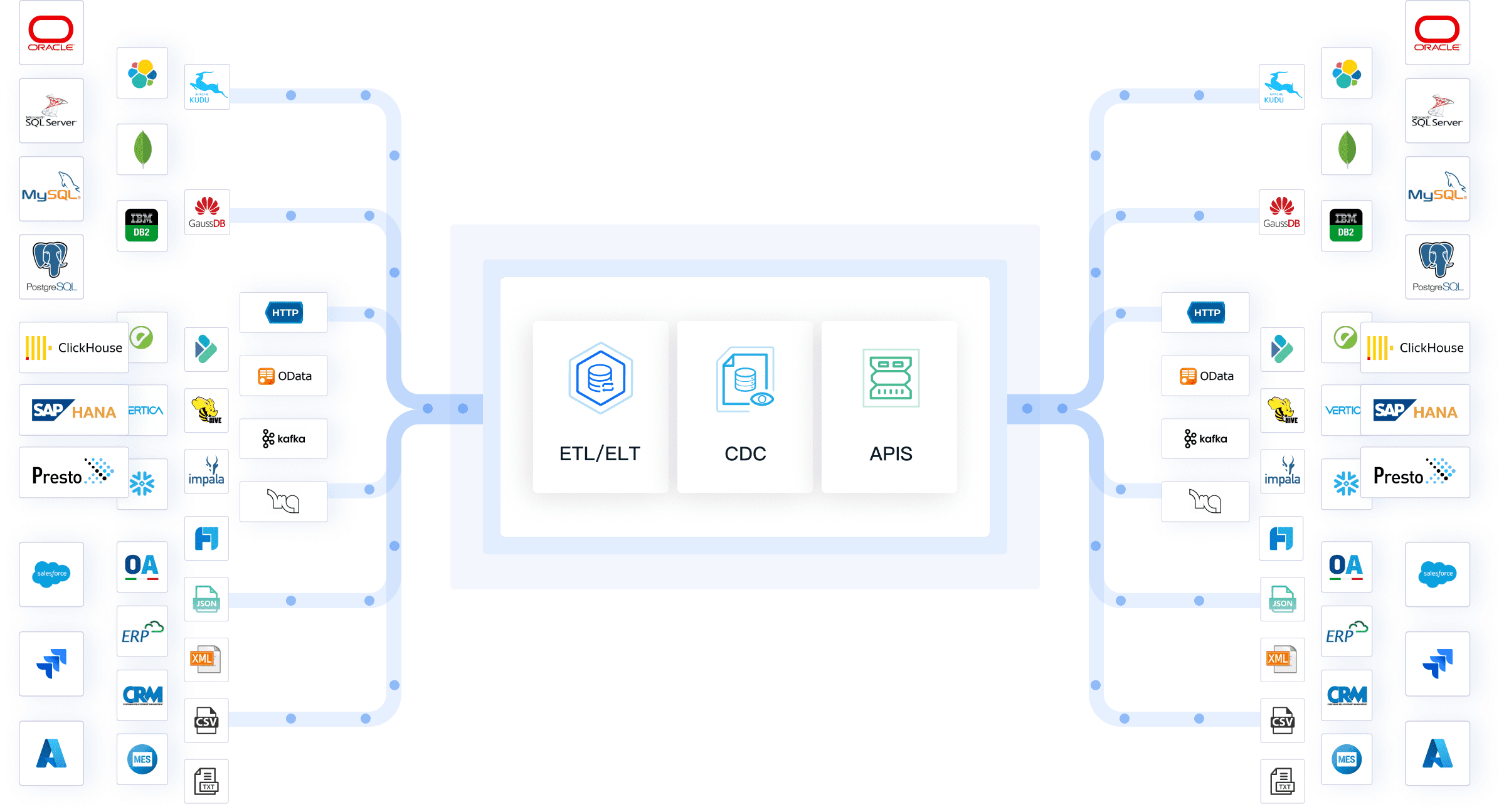

Integration tools play a key role in financial data management. FineDataLink is a leading example of a data integration platform. You can use FineDataLink to connect and harmonize data from multiple sources. The platform offers a low-code interface, real-time synchronization, and advanced ETL/ELT capabilities. These features help you overcome common challenges such as data silos, manual processes, and scalability issues. The table below shows how FineDataLink supports seamless financial data management:

| Feature | Description |

|---|---|

| Data Integration | FineDataLink connects and harmonizes data from multiple sources. |

| Consistency and Reliability | Ensures data from different sources is consistent and reliable. |

| Automation | Automates data synchronization for up-to-date BI reports and dashboards. |

| Data Transformation | Transforms data during integration for accurate analysis. |

You can streamline your financial workflows and improve reporting accuracy with these integration tools.

Real-time data processing and ETL (Extract, Transform, Load) are essential for financial data management. You benefit from automated data validation, which helps you meet compliance standards and avoid penalties. Real-time integration lets you analyze current financial information, improving the accuracy of your reports. Automated ETL processes deliver quick insights, allowing you to respond to market changes. ETL and ELT processes also integrate data from multiple sources, providing a single source of truth for reporting and risk management. Financial institutions use these methods to assess credit and market risk efficiently. Cloud-based ELT architectures enable fast data access and transformation, supporting near real-time financial reporting and analytics.

You face unique challenges when managing financial data as a small business. Limited resources and manual processes can make it difficult to keep your financial records accurate and up to date. The table below highlights some common obstacles:

| Challenge | Explanation |

|---|---|

| Lack of Working Capital | You may struggle to secure enough funds due to limited credit history. |

| Poor Cash Flow Management | Insufficient cash flow can delay payments and disrupt operations. |

| Manual Tasks | Relying on manual processes increases the risk of errors in your financial data. |

To overcome these challenges, you can use cost-effective solutions designed for small businesses. Many free or affordable tools help you automate tasks and improve accuracy:

By adopting these tools, you can streamline your financial data management and focus on growing your business.

Large organizations require robust financial data management strategies to handle vast amounts of information. You need to ensure data quality, compliance, and performance at scale. The table below outlines key strategies:

| Strategy | Description |

|---|---|

| Data Governance | Manages large data volumes and enforces compliance policies. |

| Data Architecture | Supports high performance for processing massive financial information. |

| Orchestration Tools | Automates and monitors complex data workflows. |

To implement effective financial data management, follow these best practices:

These steps help you maintain control over your financial data and support informed decision-making at every level.

You gain more accurate financial reporting when you use strong financial data management. Centralizing your data reduces reconciliation time and ensures everyone in your organization accesses the same information. Automation in data management minimizes human error in repetitive tasks, so your finance team can focus on analysis instead of fixing mistakes. When you comply with regulations and prioritize data security, you build trust with stakeholders. Regular backups and addressing data bias help keep your financial reporting reliable and consistent.

Automation brings measurable benefits to your financial data management processes.

Automation tools also flag anomalies before they become bigger problems. By minimizing manual input, you enhance data accuracy and can address discrepancies quickly. This approach supports compliance and helps you respond to financial changes in real time.

Founder Securities shows how effective financial data management transforms business operations. The company used advanced data integration and business intelligence tools to empower over 2,000 employees. Staff could access and analyze data independently, which improved operational efficiency and decision-making. During a major merger, the company migrated 50,000 user accounts smoothly by using real-time data monitoring and automated workflows. This approach reduced manual errors, improved reporting, and ensured compliance with regulations.

You can follow best practices to achieve similar results.

| Best Practice | Description |

|---|---|

| Effective Reporting Strategies | Use clear reports and visual aids tailored to your audience. |

| Utilizing Key Performance Metrics | Focus on KPIs like ROI and EBIT to guide your strategy. |

| Ensuring Data Quality | Validate and update data regularly to avoid errors. |

| Data Management Technologies | Use advanced platforms like FineDataLink for efficient integration and automation. |

By adopting these steps and leveraging solutions such as FineDataLink, you can streamline your financial data management, improve reporting, and support business growth.

Financial data management plays a vital role in modern business. You improve operational efficiency, reduce costs, and gain real-time insights by investing in integrated solutions. FineDataLink helps you connect data sources, automate workflows, and support business growth. The table below shows the long-term outcomes of integrated financial data management:

| Outcome | Description |

|---|---|

| Enhanced Operational Efficiency | Automated processes improve accuracy and productivity. |

| Cost Reduction | Fewer errors and less manual work save money over time. |

| Customization and Scalability | Systems adapt to your business needs and growth. |

| Improved Data Accuracy | Centralized management ensures reliable information. |

| Real-time Insights | Up-to-date data supports informed decisions. |

| Better Decision-Making | Optimized resource allocation drives sustainable growth. |

You streamline operations, reduce errors, and enhance reporting accuracy. Prioritize financial data management and explore advanced tools to support better decision-making.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

You use financial data management to organize, store, and protect your financial information. This process helps you make better decisions, stay compliant with laws, and keep your data safe from unauthorized access.

Automation speeds up your financial data management tasks. You reduce manual errors, save time, and get real-time updates. Automated systems help you focus on analysis instead of routine data entry.

You may face data silos, manual processes, and security risks. Inconsistent data and lack of integration tools can also slow you down. Using the right platform helps you overcome these challenges.

You can use affordable tools to automate tasks and keep your records accurate. Regular backups and secure storage protect your data. Clear workflows and simple software make financial data management easier for small teams.

You choose FineDataLink to connect data from many sources. The platform offers real-time synchronization, low-code operation, and advanced ETL features. These tools help you streamline financial data management and improve reporting accuracy.