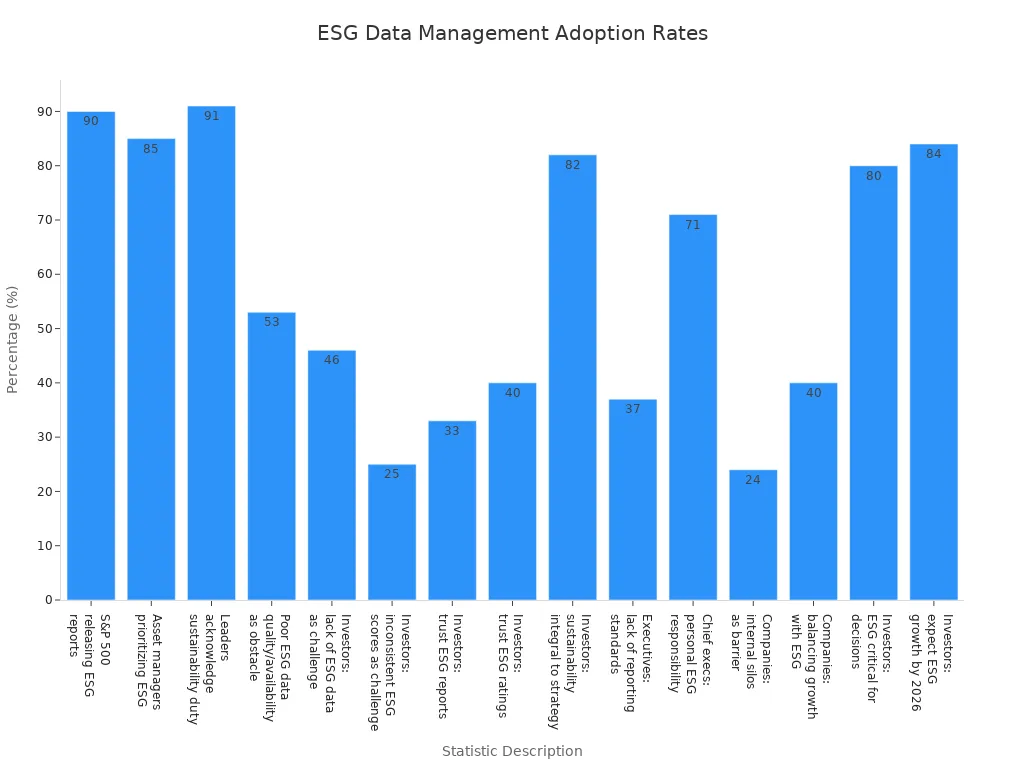

ESG data management involves collecting, organizing, and analyzing environmental, social, and governance information to guide responsible business practices. Companies now see ESG as essential for long-term sustainability and brand reputation. A recent chart shows that 90% of S&P 500 companies release ESG reports, while 85% of asset managers prioritize ESG considerations.

Business leaders recognize that strong ESG data management supports compliance, attracts investment, and drives sustainable growth. Platforms like FanRuan and FineReport help organizations streamline ESG processes and improve data quality.

Key Takeaways

- ESG data management means collecting and organizing environmental, social, and governance information to help companies act responsibly and meet regulations.

- Good ESG data management improves compliance, builds trust with investors, and supports sustainable business growth.

- Many companies face challenges like poor data quality, scattered data sources, and complex regulations that make ESG reporting hard.

- Technology platforms like FanRuan and FineReport help centralize ESG data, automate validation, and provide real-time reporting to improve accuracy and efficiency.

- Strong governance, continuous improvement, and advanced tools enable companies to create reliable ESG data systems that drive transparency and long-term success.

ESG Data Management Overview

What Is ESG Data Management

ESG data management refers to the systematic process organizations use to handle environmental, social, and governance data. Leading industry bodies describe this process as a series of structured steps that ensure the reliability and usefulness of ESG data for decision-making and reporting. The process includes:

- Collecting ESG data from both internal departments and external sources.

- Standardizing data formats for consistency.

- Validating data to confirm accuracy and completeness.

- Integrating information from various systems to create a unified ESG dataset.

- Compiling data into reports that meet regulatory frameworks such as GRI and TCFD.

- Analyzing ESG data to measure performance and identify trends.

- Engaging stakeholders, including investors and regulators, to address their concerns.

- Ensuring compliance with ESG regulations and standards.

- Managing risks related to ESG issues.

- Using ESG insights for strategic planning.

- Continuously improving ESG data management practices for greater transparency and accountability.

ESG data management requires robust IT infrastructure and strong data governance. Organizations must focus on user-centered approaches to align with best practices and industry standards.

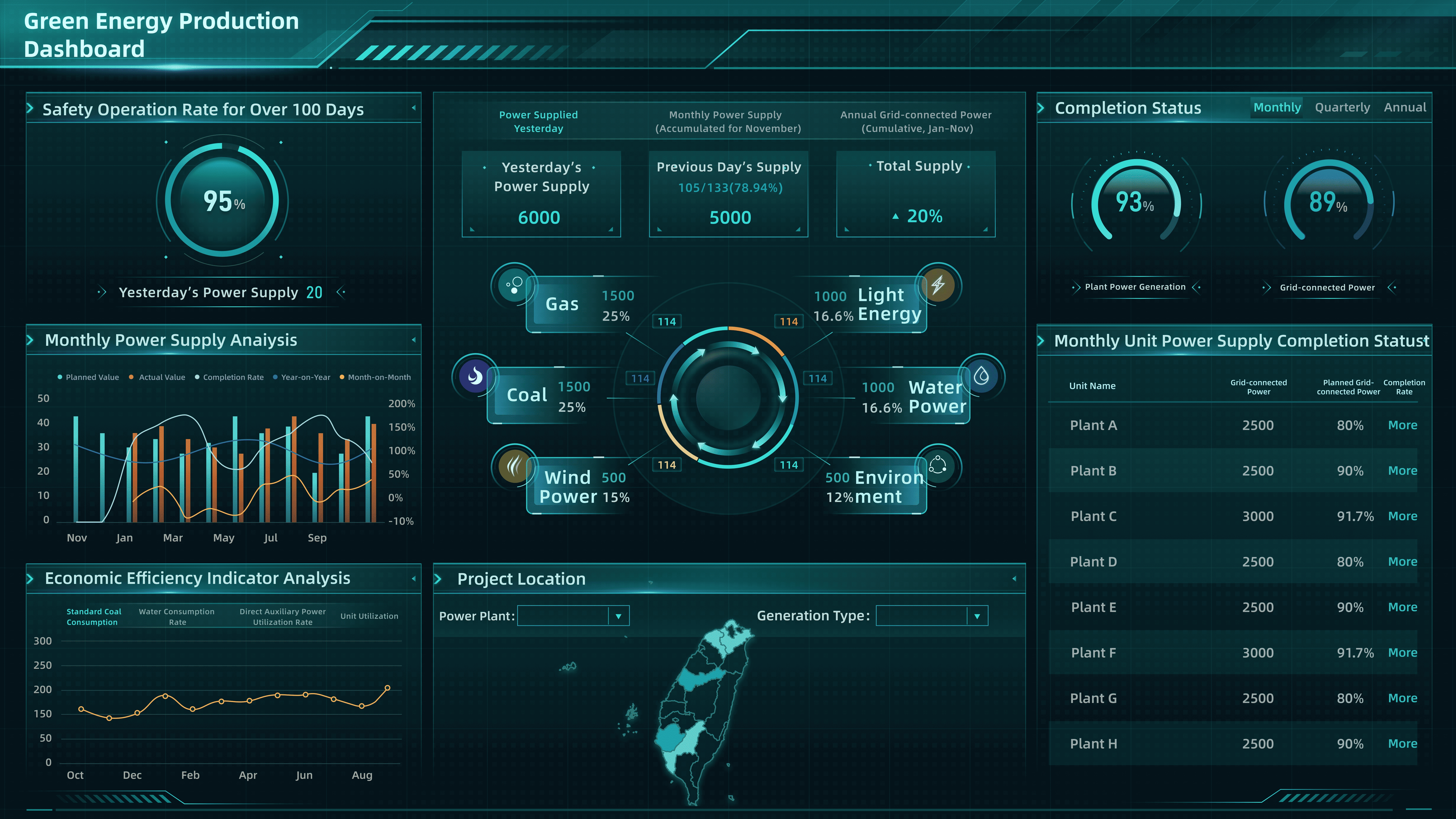

Below is a Green energy production dashboard.

ESG Data Types

Organizations collect several types of ESG data to support sustainability and compliance goals. These data types fall into three main categories:

| ESG Data Category | Examples of Metrics and Reports |

|---|---|

| Environmental | Energy usage, greenhouse gas emissions, water consumption, waste management, GHG inventories, environmental impact assessments |

| Social | Labor practices, human rights policies, community engagement, diversity and inclusion, employee health and safety |

| Governance | Board composition, executive compensation, anti-corruption policies, governance structures, regulatory compliance |

ESG data can be quantitative, such as emissions figures, or qualitative, like a company’s commitment to sustainability. Organizations often gather ESG data through collaboration among sustainability, finance, HR, and legal teams. Environmental data may come from operations or facilities, social data from HR systems, and governance data from board and compliance functions. Many companies use ESG data management platforms to centralize ESG data collection and ensure high data quality.

Tip: Regularly updating ESG data and using advanced analytics help organizations maintain accurate and actionable insights for sustainability reporting and ESG reporting.

Why ESG Data Management Matters

Effective ESG data management plays a critical role in modern business. Companies rely on ESG data to identify risks, uncover opportunities, and support sustainable product development. Accurate ESG data enables organizations to meet regulatory requirements, improve stakeholder trust, and enhance their reputation.

Key benefits of ESG data management include:

- Improved compliance with global ESG standards and frameworks.

- Enhanced ability to benchmark ESG performance against peers.

- Streamlined reporting ESG data for investors, regulators, and customers.

- Better risk management and strategic planning for long-term sustainability.

- Increased transparency and accountability through robust data governance.

Platforms like FineReport supports ESG data management by integrating data from multiple sources, automating ESG data collection, and providing advanced analytics for real-time insights. These tools help organizations break down data silos, improve data governance, and ensure that ESG data supports both compliance and corporate sustainability goals.

Organizations that invest in strong ESG data management gain a competitive edge in sustainability, attract responsible investment, and build lasting value for stakeholders.

ESG Data Management Challenges

Data Quality Issues

Organizations face significant challenges in maintaining high-quality esg data. Diverse datasets and scattered sources across departments often lead to inconsistency and incompleteness. Many companies struggle with inaccurate or unreliable esg data, which undermines reporting accuracy and compliance. Common issues include missing information, lack of standardization, and weak data governance frameworks. These problems make external assurance and auditing difficult. Incomplete or inaccurate esg reporting can result in market inefficiencies and poor valuations. Internally, unreliable esg data hinders effective management decisions.

Strong internal controls and robust data governance help companies address these challenges. Information owners, disclosure owners, and validators play key roles in ensuring data quality before external reporting. Platforms like FineReport support esg data collection, validation, and remediation strategies, helping organizations build trustworthy disclosures and meet stakeholder demands for transparency.

Common data quality issues in esg data management:

- Data inconsistency

- Incompleteness

- Inaccuracy

- Scattered data sources

- Lack of standardization and governance

Data Integration and Silos

Integrating esg data from multiple sources presents another major challenge. Companies must manage growing volumes of esg data while ensuring reliability and consistency. Data silos hinder collaboration and prevent a holistic view of organizational esg performance. Silos cause redundant or inconsistent data, complicating measurement and analysis. Manual, disconnected esg data collection increases errors and inefficiencies. According to a recent study, 41% of executives identify inadequate data as a barrier to esg progress.

Consequences of esg data silos:

- Hindered cross-department collaboration

- Incomplete or inaccurate esg insights

- Impaired decision-making

- Increased errors and inefficiencies

FineReport helps organizations break down silos by orchestrating esg data integration. These platforms automate esg data collection, harmonize methodologies, and support real-time analytics. Establishing a culture of data governance with clear policies, standardized metrics, and regular audits ensures data integrity and supports esg-aligned decisions.

Regulatory and Standards Complexity

Global esg regulations and standards continue to evolve, adding complexity to esg data management. Companies must comply with frameworks such as IFRS Sustainability Disclosure Standards, SASB, SFDR, CSRD, and GRI. Frequent regulatory changes require continuous monitoring and updates to materiality assessments. Organizations must adopt flexible data governance strategies to handle diverse and sometimes conflicting requirements.

| Framework / Standard | Description | Geographic Scope |

|---|---|---|

| IFRS S1 & S2 | Sustainability-related financial disclosures | Global |

| SASB | Industry-specific ESG disclosure standards | Global |

| SFDR | Transparency for sustainable investments | EU |

| CSRD | ESG risk and opportunity disclosures | EU |

| GRI | International sustainability reporting | Global |

Advanced technology and real-time esg risk monitoring help companies anticipate regulatory shifts and align esg efforts with business objectives.

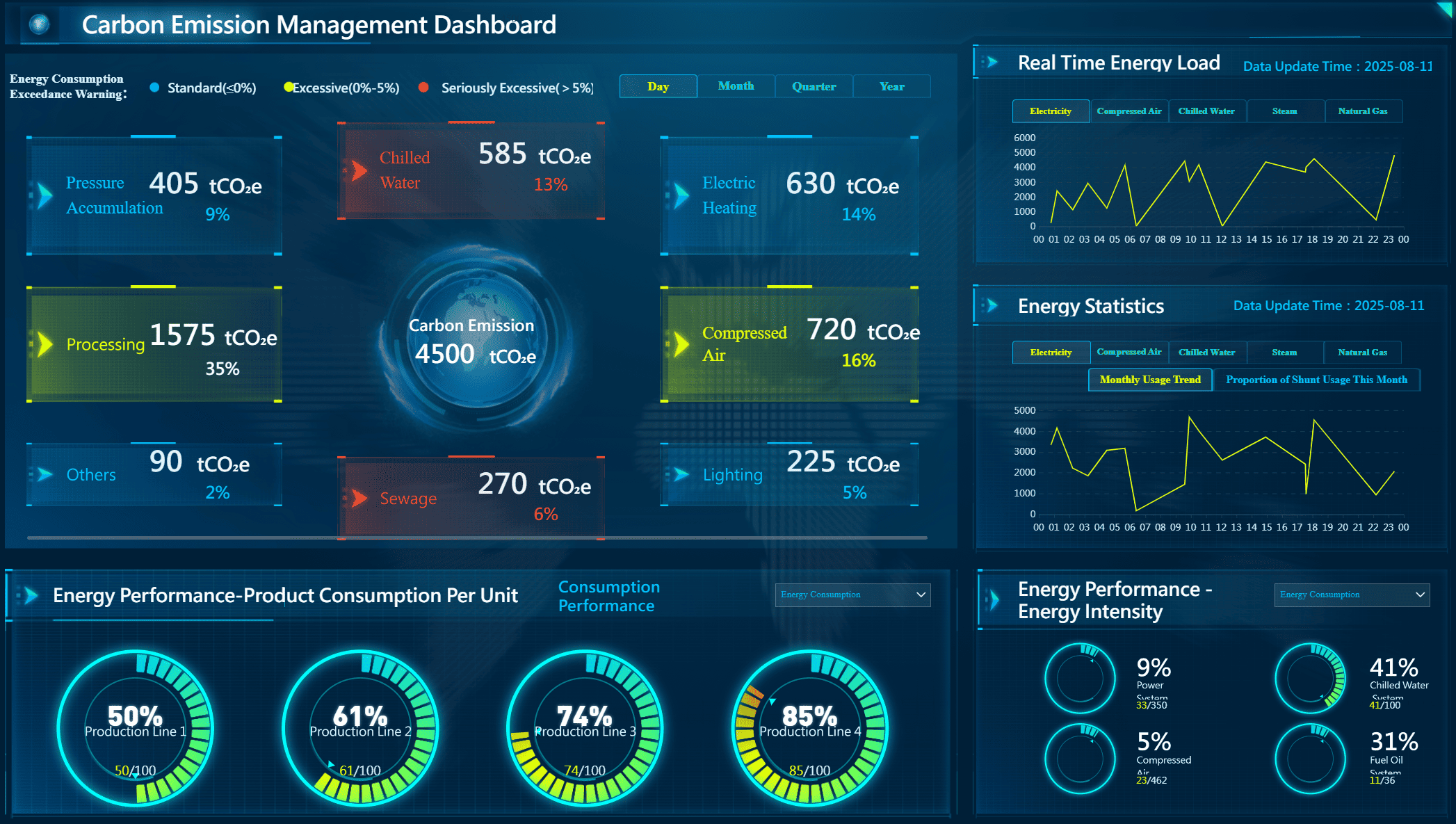

Below is a carbon emission management dashboard.

Solutions for ESG Data Management

Technology Platforms: FanRuan and FineReport

Modern organizations rely on advanced technology platforms to manage ESG data efficiently. FanRuan and FineReport stand out as leading solutions for ESG data management. These platforms help companies collect, organize, and analyze ESG data from multiple sources. FanRuan offers a robust data integration platform, FineDataLink, which centralizes ESG data and reduces fragmentation. FineReport provides a flexible reporting and dashboard tool that supports real-time ESG reporting and analytics.

FineReport enables organizations to:

- Centralize ESG data from various departments and external sources.

- Automate data validation to ensure accuracy and completeness.

- Integrate ESG data with existing IT and financial systems using APIs.

- Support compliance with evolving ESG frameworks and regulations.

- Facilitate collaboration across teams for better data accessibility.

For example, a manufacturing company can use FineReport to collect environmental data from production lines, social data from HR systems, and governance data from compliance teams. The platform then compiles this information into standardized ESG reports for stakeholders and regulators. This approach streamlines sustainability reporting and improves the quality of reporting ESG data.

Below is a Power Management Dashboard.

Data Integration and Automation

Data integration technology plays a vital role in ESG data management. Companies often face challenges with fragmented ESG data stored in different systems. FineDataLink addresses this by centralizing ESG data sources into a single platform. This reduces manual effort and speeds up reporting ESG data.

Key benefits of data integration and automation include:

- Centralizing ESG data from multiple sources, which reduces fragmentation.

- Automating data validation to minimize errors and duplication.

- Aligning ESG data with existing IT and financial reporting systems through APIs.

- Supporting compliance with global ESG frameworks by ensuring compatibility.

- Facilitating collaboration across departments for improved data accessibility.

- Generating real-time insights that enhance transparency and investor confidence.

Companies like Nutresa have seen practical benefits from automation. They report more frequent, detailed, and reliable ESG reporting, increased operational visibility, and stronger sustainability leadership. Automation tools, such as those found in FineReport, streamline ESG data analysis and support compliance and decision-making.

| Tool Name | Key Features and Strengths | ESG Data Management Effectiveness |

|---|---|---|

| FineDataLink | Real-time data synchronization, ETL/ELT, API integration, visual interface, 100+ data source support | Centralizes ESG data, automates validation, supports real-time reporting, enhances collaboration and compliance |

| FineReport | Drag-and-drop report designer, multi-source data integration, automated report generation, mobile access, dashboards | Simplifies ESG reporting, enables real-time analytics, supports regulatory compliance, improves data quality and usability |

| Workiva | Unified ESG and financial reporting, real-time collaboration, custom dashboards | Scalable for large enterprises, integrates ESG with financial reporting, supports complex reporting needs |

| Diligent | Integrated data management, live ESG tracking, automated reporting | Strong governance focus, real-time insights, supports strategic decision-making |

Real-Time Reporting and Analytics

Real-time reporting and analytics have become essential for effective ESG data management. FineReport empowers organizations to monitor ESG performance with up-to-date dashboards and automated reports. Real-time ESG reporting provides accurate, timely, and verifiable data that aligns with evolving disclosure standards. This transparency builds trust with investors and consumers.

Benefits of real-time ESG reporting and analytics include:

- Accurate and timely ESG data collection for transparent reporting.

- Early identification of risks and inefficiencies, enabling immediate corrective actions.

- Enhanced stakeholder communication and engagement.

- Support for long-term sustainability strategies and accountability.

- Improved risk management and operational efficiency.

Organizations use analytics platforms like FineReport to automate ESG data collection from internal and external sources. These platforms validate data accuracy and compile ESG data centrally. This enables comprehensive analysis, benchmarking, and identification of areas for improvement. Reporting tools generate standardized ESG reports that support both internal decision-making and external communication.

Real-time ESG analytics help companies set benchmarks, track progress, and create roadmaps for sustainable development. By leveraging technology, organizations can make informed decisions that align with their sustainability goals and build stakeholder trust.

ESG data management supports compliance, risk management, and business value. Companies use esg data to meet regulations and improve transparency. Strong esg data practices help organizations identify risks and measure progress in esg initiatives. FineReport provides tools for collecting, analyzing, and reporting esg data. These platforms enable teams to manage esg data efficiently and support sustainability goals. Adopting best practices and advanced technology helps organizations achieve reliable esg data and drive esg performance.

Continue Reading about ESG data management

How Data Management Consultants Boost Operational Efficiency

FAQ

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Supply Chain Visibility Tools for 2025

Compare the top 10 supply chain visibility tools for 2025 to enhance real-time tracking, integration, and predictive analytics for efficient operations.

Lewis

Oct 29, 2025

Carbon Emission Management Explained and Why It Matters

Carbon emission management involves tracking and reducing greenhouse gases to meet regulations, cut costs, and protect the environment.

Lewis

Oct 12, 2025

What is Green Manufacturing and Its Key Principles

Green manufacturing uses eco-friendly processes to boost energy efficiency, reduce waste, and promote sustainable materials in production.

Lewis

Oct 10, 2025