You see deferred revenue when a company gets money first but has not given goods or services yet. This makes a deferred revenue liability on the balance sheet. Reporting deferred revenue the right way helps you show a true financial picture. You only count revenue when you earn it, which follows GAAP rules. FineReport from FanRuan helps you track these numbers and keeps your financial statements easy to understand.

You might hear about deferred revenue when a business gets paid before giving a product or service. This happens if a customer pays early, but the company has not earned the money yet. In accounting, this is called unearned revenue. It is listed as a liability on the balance sheet because the company still owes the customer something.

Deferred revenue means you got money for goods or services you have not given yet. For example, if you sell a magazine subscription for a year and get paid at the start, you cannot count all the money as revenue right away. You must wait until you send each magazine issue. This rule follows accounting standards like GAAP and IFRS. These rules say you should only count revenue when you earn it.

Here are some common times you see deferred revenue:

You can see deferred revenue in many types of businesses. It helps you keep track of money you got but have not earned yet.

Deferred revenue is important for managing money in a business. When you record it the right way, you show a true picture of your company’s finances. You do not make your income look bigger than it is. You also follow the rules from accounting standards.

If you run a subscription business, deferred revenue helps you tell the difference between cash you got and revenue you earned. This makes your financial reports more correct. Investors and managers can trust your numbers. They can make better choices for your company’s future.

Here are some reasons deferred revenue is important:

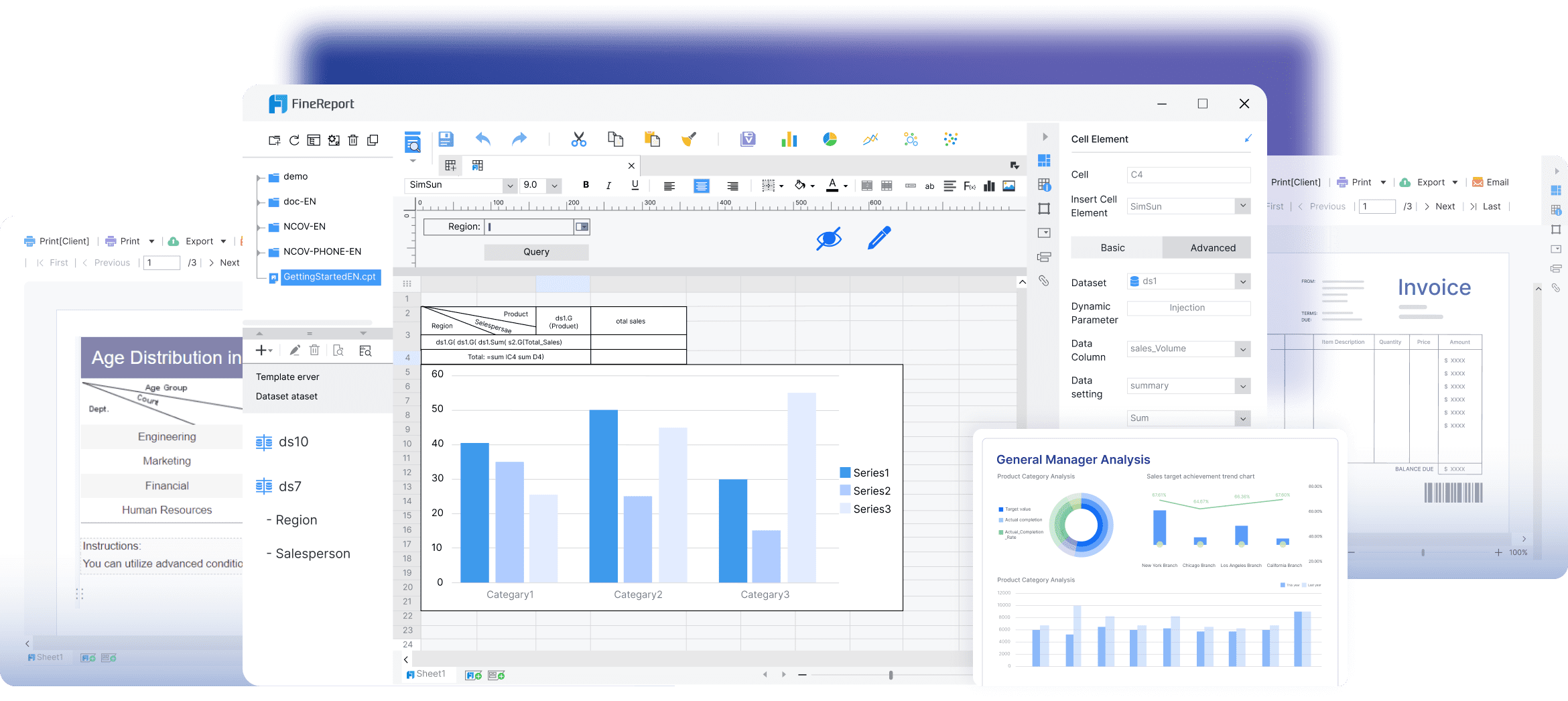

When you use a reporting tool like FineReport from FanRuan, you can track deferred revenue easily. FineReport helps you organize your data, make reports automatically, and follow accounting rules. You can see your deferred revenue quickly and know how much you still owe your customers. This makes your work easier and your reports more trustworthy.

Deferred revenue is a liability because you got paid first. You have not given the product or service yet. This means you still owe your customer something. The money is not yours until you finish your promise. When you get paid early, you must show this on your balance sheet as a liability. This keeps your financial statements fair and follows the rules.

Deferred revenue stops your business from showing money you have not earned. You only move the money to revenue after you give the product or service. This helps you not show too much profit and keeps your records simple.

FineReport helps you track deferred revenue with automatic reports. You can see what you owe and when to count revenue. The software links to your accounting system and updates your balance sheet right away.

Deferred revenue happens in many types of businesses. Here are some examples:

SaaS companies use software to handle deferred revenue. Here is how they do it:

Financial tools like FineReport help track and count deferred revenue. You do not need hard spreadsheets. The software works with your accounting system and follows rules like ASC 606 and IFRS 15.

| Feature | Description |

|---|---|

| Automation | FineReport tracks and counts deferred revenue for you. |

| Compliance | The software makes sure you follow the rules. |

| Integration | FineReport connects to your main ledger for correct reports. |

You can use FineReport to make reports for each contract or customer. This helps you see what you owe and plan your money. You follow the rules and make fewer mistakes.

You can figure out deferred revenue with a simple math formula. This tells you how much money you got but have not earned yet. The formula is:

Here’s what the parts mean:

Follow these steps to put deferred revenue in your accounting records:

Tip: FineReport can help you do this faster. FineReport can do the math for you, update your records, and make easy-to-read reports. You can always see how much deferred revenue you have. This helps you not make mistakes and saves you time.

Let’s look at an example to see how deferred revenue works.

Imagine your company sells a yearly subscription to a data platform. A customer pays $36,000 at the start of the year. You give the service over 12 months.

Here is a table to show how it works:

| Month | Revenue Recognized | Deferred Revenue Remaining |

|---|---|---|

| 1 | $3,000 | $33,000 |

| 2 | $3,000 | $30,000 |

| 3 | $3,000 | $27,000 |

| ... | ... | ... |

| 12 | $3,000 | $0 |

FineReport can help you keep track of this. FineReport connects to your accounting system, does the monthly math, and makes charts. You can see your deferred revenue, how much revenue you earn each month, and changes over time. This helps your finance team stay neat and make smart choices.

Note: FineReport makes deferred revenue easier by doing the work for you. You get correct and current reports with just a few clicks.

When you work with deferred revenue, you must record it right. This keeps your financial statements correct. It also helps you follow the rules for revenue recognition.

If you get paid before giving goods or services, you make a deferred revenue journal entry. You add to your cash and also add to your deferred revenue liability. Here is what it looks like:

| Action | Account | Amount |

|---|---|---|

| Debit | Cash | $1,200 |

| Credit | Deferred Revenue | $1,200 |

This shows you got cash but still owe the customer something. You do not count this as revenue yet.

Tip: FineReport can help you do this automatically. You can use templates for deferred revenue journal entry. Every time you get paid early, your records update fast.

When you give your goods or services, you start to recognize revenue. Each time you finish part of your promise, you move some money from deferred revenue to earned revenue. For example, if you give $100 of service each month, your entry looks like this:

| Action | Account | Amount |

|---|---|---|

| Debit | Deferred Revenue | $100 |

| Credit | Revenue | $100 |

You keep doing this until you finish everything. This way, your revenue matches what you have delivered. It keeps your income statement and balance sheet right.

FineReport lets you track every step of revenue recognition. The software updates your financial statements for you. You always know how much deferred revenue is left and how much you have earned.

Note: Using FineReport helps you make correct deferred revenue journal entries. It keeps your financial statements current. You make fewer mistakes and save time, so your accounting is easier.

Here are some ways to make sure you recognize deferred revenue the right way:

| Strategy | Description |

|---|---|

| Robust Accounting Systems | Use software like FineReport to automate revenue recognition and reduce errors. |

| Clear Agreements | Make sure contracts explain when to recognize revenue. |

| Regular Reviews | Check your records often to keep everything accurate. |

By following these steps and using good tools, you can handle deferred revenue well.

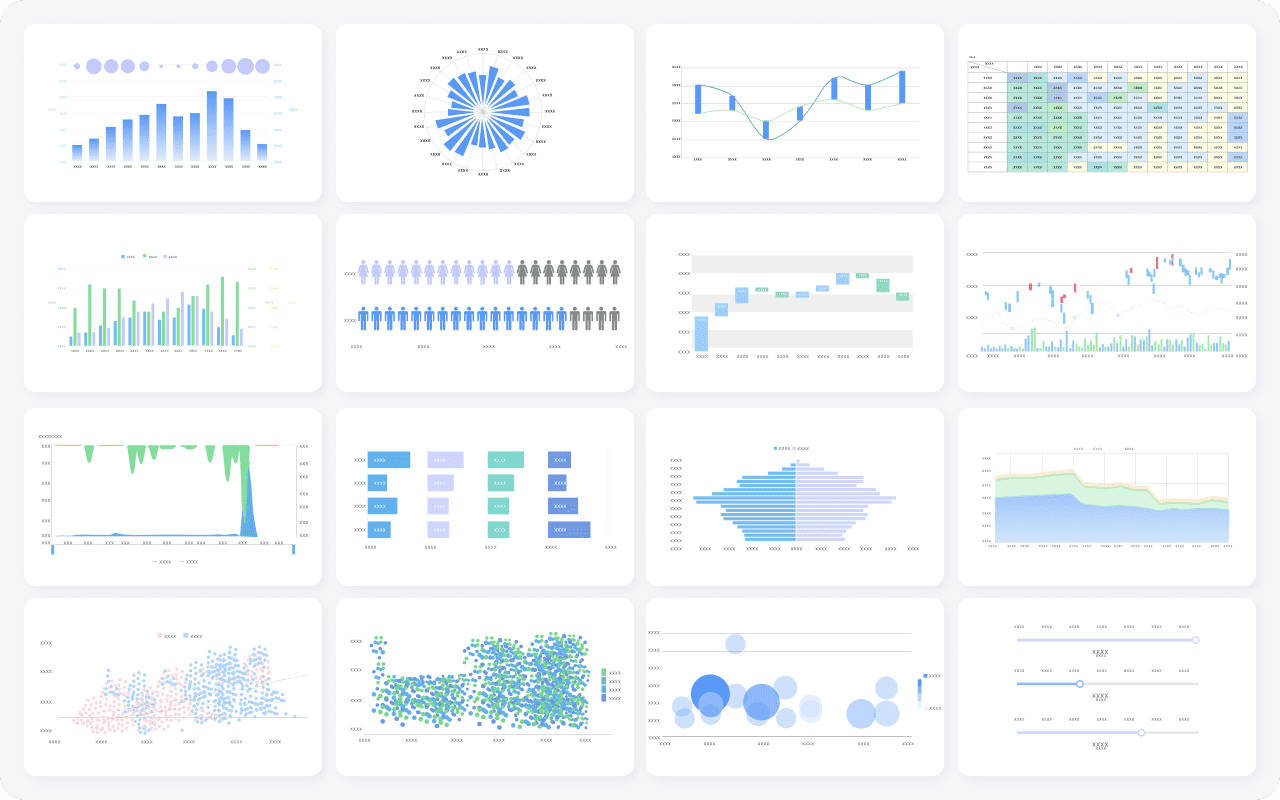

You might see both deferred revenue and accounts receivable on reports. They are not the same thing. Deferred revenue means you got paid before giving goods or services. This means you must give something later. You list deferred revenue as a liability because you owe your customer.

Accounts receivable is different. You give goods or services first, then wait for payment. This means someone owes you money. You list accounts receivable as an asset because you will get cash soon.

Here is a simple table to show the differences:

| Term | Definition | Classification | Timing |

|---|---|---|---|

| Deferred Revenue | Money received for goods/services not yet delivered | Liability | Cash first, service later |

| Accounts Receivable | Money owed for goods/services already delivered | Asset | Service first, cash later |

You can remember it like this: Deferred revenue means you need to deliver something. Accounts receivable means someone needs to pay you.

FineReport helps you track both items. You can see what you owe and what you expect to get. This keeps your financial statements clear and current.

Let’s look at an example. Imagine you have a software company. In January, a customer pays $60,000 for a 12-month license. You record this as deferred revenue. Each month, you give the service and count part of the revenue. Your obligation goes down each month.

Now think about a consulting job. You finish the work in March and send a $20,000 bill. You record this as accounts receivable. You already did the work, so you expect payment soon. This amount is an asset on your financial statements.

Here is a table to compare both:

| Aspect | Deferred Revenue | Accounts Receivable |

|---|---|---|

| Definition | Money received before service delivered | Money owed after service delivered |

| Financial Statement | Liability | Asset |

| Obligation | You owe the customer | Customer owes you |

| Example | $60,000 upfront for 12-month license | $20,000 invoice after project |

FineReport helps you manage these details. You can track what you owe and what you should get paid. The software updates your reports for you, so you always know your real financial position.

Tip: Keeping your financial statements correct helps you make smart business choices and builds trust with your team and investors.

You now know deferred revenue helps you see your company’s real finances. Cash you get is not always earned revenue.

Deferred revenue is a liability and can change your financial ratios.

FineReport and other tools help you track and report automatically. This lowers mistakes and saves you time.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

Deferred revenue shows money you got but have not earned. It helps keep your financial records right. You also follow the rules for accounting.

FineReport helps you track deferred revenue by itself. You can make reports and update your records fast. You also see your money situation right away.

You move deferred revenue when you give goods or services. Each time you finish part of your promise, you count that part as revenue.

Deferred revenue means you got paid for something in the future. A deposit is money you hold and might give back later. They are not the same thing.