You need a simple way to judge real estate investments. FFO gives you a better measure than net income. FFO changes for depreciation and takes out gains from property sales. This helps you see a clearer picture of cash flow. The calculation often uses net earnings, depreciation, and deferred tax expenses. It does not count one-time sales. Modern data tools and platforms, like those from FanRuan, help you check these numbers fast. They also help you manage risks with confidence.

With FineReport, you can automate FFO tracking, visualize trends, and make data-driven decisions—all in one intuitive platform. (click to engage)

You might hear FFO a lot when you study real estate. FFO means funds from operations. This number shows how much money a REIT makes from its main business. You do not have to use net income alone, which can be confusing for real estate companies.

FUNDS FROM OPERATIONS is net income, but it leaves out gains or losses from debt changes and property sales. It adds back depreciation and amortization. It also makes changes for partnerships and joint ventures.

This meaning comes from the National Association of Real Estate Investment Trusts (NAREIT). FFO helps you see a REIT’s real earnings. Net income has many things that do not show the real cash flow. FFO takes these out so you can see what matters.

To figure out FFO, you start with net income. Then you add back depreciation and amortization. These are not cash expenses. You also take out gains from property sales and other one-time things. This way, you see the money a REIT makes from its main business.

Here is a simple table to help you see what goes into FFO:

| Component | Included/Excluded | Description |

|---|---|---|

| Depreciation and Amortization | Included | Added back to net earnings as a non-cash expense. |

| Losses on Sales of Assets | Included | Added back to net earnings; considered non-recurring. |

| Gains on Sales of Assets | Excluded | Subtracted from net earnings; considered non-recurring. |

| Interest Income | Excluded | Subtracted from net earnings; considered non-recurring. |

You can see that FFO looks at the main business. It takes out things that do not happen often or do not change cash flow. This makes FFO a good tool for investors.

You may wonder why FFO is so important in real estate. Many investors and analysts use FFO because it shows a better view of a REIT’s performance. Net income can be hard to understand. It has depreciation, which does not always show the real value of a property. FFO solves this problem.

Here are some reasons to use FFO:

You can also see the main good things about FFO in this table:

| Advantage of FFO | Explanation |

|---|---|

| Cash-generating capacity | FFO shows how well a REIT can make cash. |

| Adjusts for distortions | FFO takes out depreciation and one-time gains or losses. |

| Reflects asset appreciation | FFO shows the real value of real estate, not just accounting numbers. |

| Supports income stability | FFO helps you check if a company can keep paying dividends. |

You can use FFO to compare REITs, see if they can pay dividends, and check if they are growing. FFO helps you make better choices. You do not have to worry about tricks or one-time things. You get a clear look at the business.

When you use FFO, you focus on the real money a REIT makes. This helps you avoid mistakes and find better investments. Funds from operations is a key tool for anyone who wants to do well in real estate investing.

You need a simple formula to figure out ffo. The usual ffo formula helps you see how well real estate investment trusts do. You can use ffo per share to compare companies. The National Association of Real Estate Investment Trusts gives these formulas:

| Formula Type | Formula |

|---|---|

| Basic ffo per share | ffo available to common shareholders / weighted average number of common shares |

| Diluted ffo per share | (ffo available to common shareholders + adjustments) / (weighted average number of common shares + potential common shares) |

Ffo shows how much cash flow comes from the main business. This formula helps you check if a company can pay a dividend and grow. You can also compare ffo and net income to see which is better for showing how a company is doing.

You can follow easy steps to figure out funds from operations. These steps help you get the right cash flow number. Here is what you do:

You need to watch for common mistakes. Some people put expenses in the wrong place or forget lease amortization. Others miss non-recurring items or use different definitions. Always check if you are using the right numbers for affo and ffo vs. adjusted ffo.

Tip: Always use the same ffo definition. This makes it easier to compare cash flow and performance between companies.

You can use ffo to see if a REIT has good cash flow and can pay steady dividends. You also learn how the company handles its assets. If you want more details, you can look at affo to learn more about cash flow.

You want to know if a REIT is doing well. FFO helps you see the real story. Many investors use funds from operations to check how much money comes from the main business. Net income can hide the real cash flow, but FFO does not. FFO adds back things like depreciation and takes out gains from selling properties. This makes it easier to see how the business is really doing.

Analysts use FFO to compare different REITs. They look at how much cash each company makes. This helps you find which REITs have strong business models. FFO works better than net income for checking how a REIT is doing. It shows more about how a company reacts to good earnings news. Models that use FFO tell you more about stock price changes after earnings come out.

The analysis shows that using Funds From Operations (FFO) explains more changes in stock returns around earnings announcements than using Net Income (NI). Also, FFO does a better job showing positive earnings surprises in REITs, making it a strong way to measure performance.

You can see how FFO growth links to total returns. When FFO goes up, returns often go up too. Here is a simple table to show this:

| Year | FFO Growth | Total Return Projection |

|---|---|---|

| 2025 | 3% | 10% |

| 2026 | ~6% | 10% |

“We think more real estate will be bought and sold soon. This will give REITs more chances to grow, so growth should speed up in 2026.”

Most REITs report higher FFO each year. This shows FFO is important for tracking growth. Sometimes, FFO drops a little, like by 1.1%, but most REITs still show gains. You can use FFO to compare companies and see which ones have steady cash flow and strong business results.

You want to know if a REIT can keep paying you. FFO helps you check if dividends are safe. REITs must pay out at least 90% of their taxable income as dividends. FFO shows how much cash is there for these payments. It leaves out non-cash expenses, so you see the real money a company can use.

A strong ffo-to-dividend ratio means the REIT has enough cash to keep paying you. If FFO is high, the company can keep or even raise its dividend. You can use FFO to compare how well different REITs can pay dividends. This helps you pick companies that can keep rewarding you.

AFFO, or adjusted funds from operations, goes even further. It takes out regular capital expenses and straight-line rent changes. You can use AFFO to see if a REIT can keep paying dividends for a long time.

You may see some REITs have high dividend payout ratios, sometimes over 100%. This happens because net income can be lower than cash flow. FFO gives you a better way to measure income and if dividends are safe. You see the real cash ready for payouts.

You can trust FFO as a key way to check if dividends are safe. It helps you avoid surprises and pick REITs that can keep paying you. You get a better idea of income and long-term safety.

You may wonder how funds from operations compare to net income. Net income has many things that do not show real cash. Depreciation and one-time gains or losses can change net income a lot. This can make net income look too high or too low. FFO helps you see the money a REIT makes again and again. It shows the real cash flow from the main business.

Net income is not always good for looking at REITs. It has depreciation, which is not real cash spent. This does not show the real profit from real estate. FFO is better because it takes out these non-cash costs and shows the real cash made from the business.

You can learn more by looking at adjusted funds from operations and cash flow. AFFO makes FFO better by taking away money spent to keep properties in good shape. It also counts leasing commissions, tenant improvements, and changes in rent over time. This helps you see the real cash left to give out.

Here is a simple table to help you compare FFO, AFFO, and cash flow:

| Metric | Description |

|---|---|

| FFO | Changes REIT net income for real estate depreciation and gains or losses from selling property. |

| AFFO | Goes further than FFO by taking out money for repairs, leasing commissions, tenant improvements, and rent changes. It shows a better picture of cash flow and if dividends can be paid. |

AFFO gives a better look at how much cash a REIT makes and if it can keep paying dividends. It leaves out things that do not happen often and counts money spent on the property. You can use AFFO to compare REITs and see which ones are better and can grow. Many investors use AFFO to check if a REIT can keep paying money to owners and stay strong for a long time.

Tip: When you compare REITs, look at both FFO and AFFO. This helps you find which companies have the best cash flow and safest dividends.

You can use funds from operations to see how well a REIT is doing. FFO takes out things like depreciation that are not paid in cash. This helps you see the real money from the main business. Many people also look at adjusted funds from operations, called AFFO. AFFO removes money spent on fixing and keeping up properties. This lets you know if a REIT can care for its buildings and pay regular dividends.

When you compare REITs, look at both FFO and AFFO. This helps you decide if a company can keep paying you and take care of its assets. FFO per share lets you compare companies of any size. You can use these numbers to find strong REITs with steady money coming in.

FanRuan’s data tools, like FineReport, FineBI, and FineDataLink, help you study FFO and other important numbers. These tools put all your data in one place, show easy-to-read charts, and help you make smart choices. FineReport can make your work faster and help you spot patterns easily.

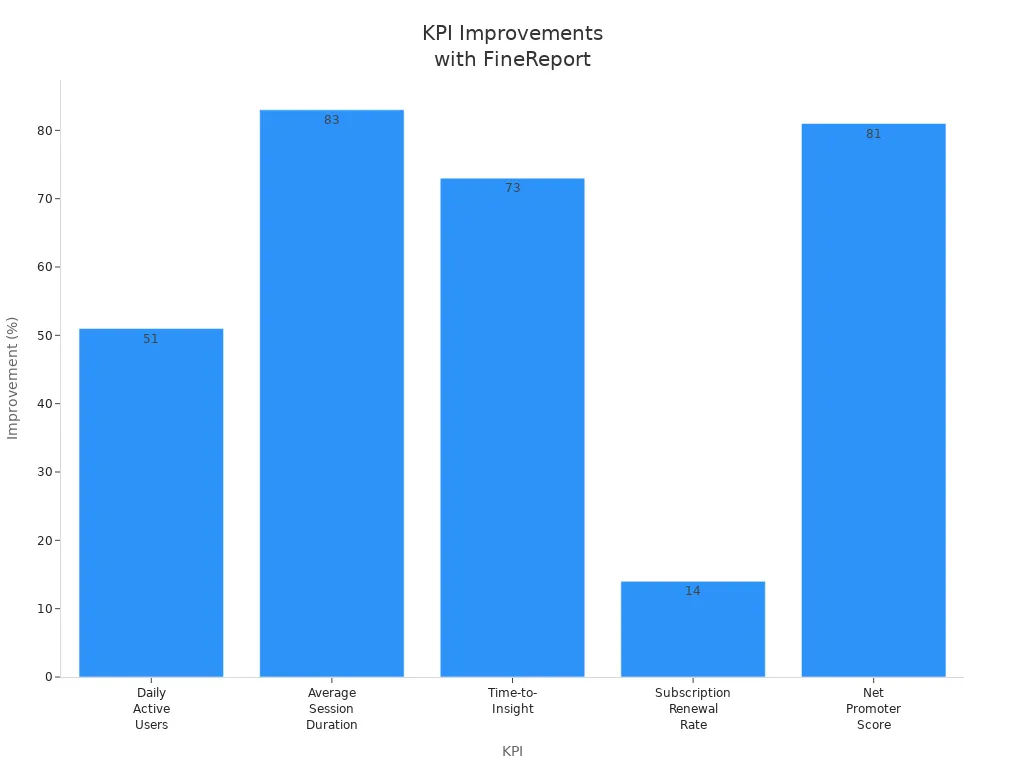

| KPI | Improvement |

|---|---|

| Daily Active Users | 51% increase |

| Average Session Duration | 83% rise |

| Time-to-Insight | 73% reduction |

| Subscription Renewal Rate | 14% increase |

| Net Promoter Score | 81% rise |

You should use FFO to check a REIT’s cash flow and income. This helps you know if the company can keep paying dividends. Here are some good tips:

FanRuan’s tools make this easier. FineReport and FineBI let you watch FFO, AFFO, and other numbers as they change. FineDataLink helps you bring together data from many places, so you always have the newest information. Founder Securities used FineBI to make their data study and choices better. They got answers faster and managed risks better. You can use these tools to make smarter choices and lower your risk.

Tip: Always look at the trend in FFO and AFFO, not just one year. This helps you find strong REITs with safe dividends and steady money coming in.

You should learn about ffo to make good choices. This number shows the real cash a REIT makes. It helps you know if a REIT is healthy. Tools like FanRuan show easy charts and give you trusted numbers. You can use these tools to check if the data is good. They also help you lower your risks.

| Benefit | Impact |

|---|---|

| Data quality tools | Help you make correct choices |

| Integration platforms | Make it easier to handle money data |

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

FFO stands for Funds From Operations. You use it to measure how much money a real estate investment trust (REIT) makes from its main business. FFO helps you see the real cash flow.

Net income includes many non-cash items. FFO adds back depreciation and removes one-time gains. You get a clearer view of a REIT’s real earnings with FFO.

You should check FFO because it shows if a REIT can pay steady dividends. FFO helps you compare different REITs and pick the best ones for your investment.

Yes! FFO helps you see if a REIT has enough cash to keep paying dividends. If FFO stays strong or grows, you can expect safer and more reliable payouts.

You can use tools like FineReport, FineBI, and FineDataLink from FanRuan. These tools let you track FFO, compare REITs, and make smart choices with easy charts and real-time data.