You rely on the financial management process to keep your money organized and your goals within reach. Financial management means handling your resources so you can make smart choices every day in Malaysia. This process helps you track income, manage expenses, and measure progress. The importance of financial management stands out when you need to stay stable and grow. Tools like FineReport from FanRuan bring new ways to handle financial data, making tasks easier and more accurate. Effective financial management gives you the confidence to plan ahead and respond to changes in Malaysia.

You use the financial management process to guide how you handle money and resources. This process includes planning, organizing, controlling, and monitoring your financial activities. When you follow a clear financial management cycle, you set goals, create budgets, track spending, and review results. Each step helps you make better choices and avoid mistakes.

The financial management process covers more than just tracking income and expenses. It also involves risk assessment, investment evaluation, and performance measurement. For example, researchers built a model using financial indicators like solvency and profitability to predict risks and improve decisions. This shows that the process supports not only daily operations but also long-term planning and risk management.

You need a reliable financial management process because it helps you reach your goals and stay prepared for changes. When you use this process, you gain control over your finances and reduce risks. Empirical studies show that performance measurement systems, which are part of financial management, boost your ability to adapt, innovate, and learn. These systems also improve satisfaction and stock market returns.

You face a fast-changing world where markets can be unpredictable. For example, studies of telecom stocks in India found high volatility and no long-term stability. This means you must use active risk management and keep reviewing your financial plans in Malaysia.

Strategic financial planning and budgeting skills have the strongest positive effects on both financial and organizational performance. When you build these skills, you set your business up for success in Malaysia.

The financial management process gives you a roadmap. It helps you make smart decisions, measure progress, and adjust quickly. By following each step in the financial management cycle, you build a strong foundation for growth and stability.

You start the financial management cycle with financial planning. This step helps you set clear goals for your money and resources. You look at your current financial situation, predict future needs, and decide how to reach your targets. Financial planning connects your financial targets with your daily operations. For example, you might map out how cost drivers affect your gross profit in Malaysia. This approach lets you trace results back to specific decisions and find ways to improve.

Strategic financial planning makes sure your goals match your company’s vision in Malaysia. It also supports smart resource allocation and ongoing performance checks. Research shows that when you use structured financial planning, you can link financial outcomes to operational choices. This helps you spot problems early and make better decisions. Many organizations now include environmental, social, and governance (ESG) factors in their planning. This change supports long-term growth and builds trust with investors in Malaysia.

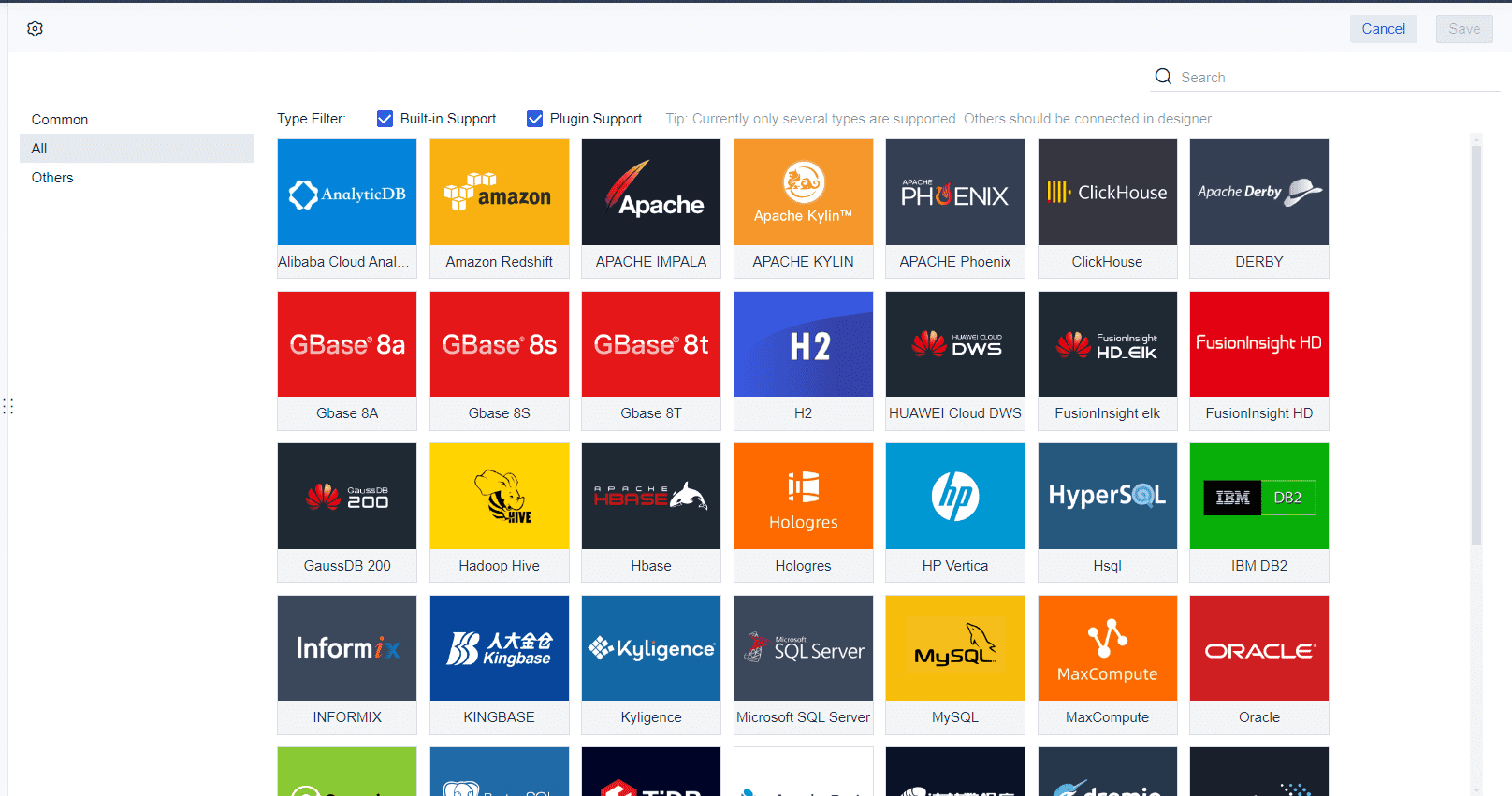

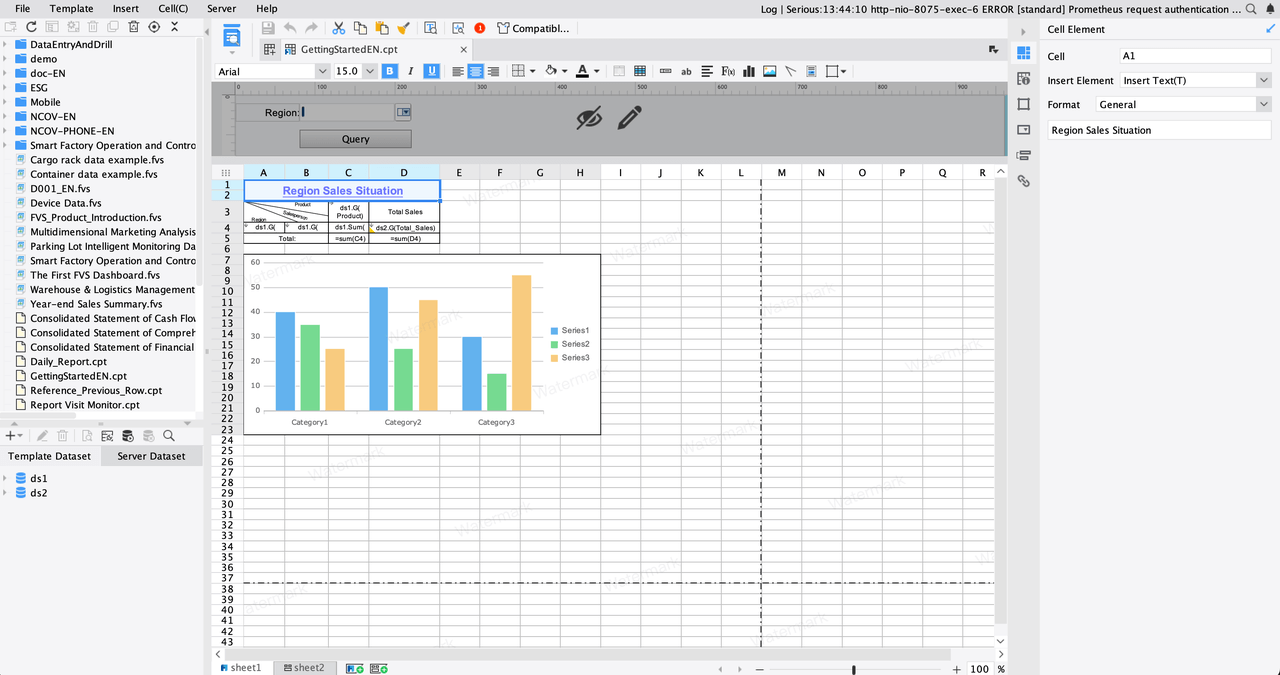

FineReport from FanRuan gives you tools to make financial planning easier. You can pull data from many sources, create dynamic reports, and visualize your plans. With these features, you can see the big picture and adjust your strategies quickly.

Budgeting is the next key step. You use a budget to set spending limits and track your income. This process helps you control costs, avoid debt, and save for the future. Budgeting and financial planning work together to keep your finances in Malaysia on track.

You can measure how well your budget works by comparing what you planned with what actually happened. For example:

| Metric | Forecasted Value | Actual Value | Variance | Variance % |

|---|---|---|---|---|

| Units Produced | 1,000 | 1,100 | +100 | +10% |

| Production Time Per Unit | 0.25 hours | 0.20 hours | -0.05 | -2% |

| Utility Cost Per Hour | $40 | $53.64 | +$13.64 | +34% |

| Total Utility Cost | $100,000 | $118,000 | +$18,000 | +18% |

This table shows how you can use variance analysis to spot problems and fix them fast.

FineReport helps you automate budgeting. You can collect data, generate reports, and share results with your team. The platform makes it easy to update your budget and keep everyone in Malaysia informed.

Resource allocation means deciding how to use your financial resources for the best results. You want to put your cash, time, and people where they will have the most impact. You can use financial ratios, project timelines, and resource use rates to measure how well you allocate resources. When you use your resources wisely, you boost productivity and cut costs.

Real-world examples show that smart resource allocation leads to better returns. One global bank increased its sales conversion rates by 50% by changing how it used its resources. Another company grew its revenue by 18% without raising its budget, just by shifting funds to the right areas.

FineReport supports resource allocation by giving you real-time data and clear dashboards. You can track how you use your financial resources and adjust your plans as needed. The platform’s data integration features help you see all your resources in one place, making it easier to make informed choices.

Monitoring and evaluation are the final steps in the financial management process. You need to check your progress and see if you are meeting your goals. Monitoring helps you stay on track and spot problems early. Evaluation lets you measure your results and learn from your actions.

A strong monitoring and evaluation system gives you timely, reliable information. You can see what works, what needs to change, and how to use your resources better. This process is key to good financial management.

FineReport makes monitoring and evaluation simple. You can set up dashboards to track key metrics, automate report generation, and share insights with your team. The platform’s real-time data and visualization tools help you make quick, evidence-based decisions.

Tip: Use FineReport’s automated reporting and dashboard features to keep your financial management cycle running smoothly. You will save time, reduce errors, and always have the latest data at your fingertips.

You need strong financial health to keep your business in Malaysia stable and ready for growth. Financial health means you can pay your bills, handle emergencies, and invest in new opportunities. You measure financial health by looking at several key metrics. These include liquidity, cash flow, profitability, and financial stability. When you track these numbers, you see how well your business in Malaysia performs and where you can improve.

Here is a table that shows how different financial metrics support business performance in Malaysia:

| Financial Metric | Description | Role in Business Performance |

|---|---|---|

| Profitability Ratios | Show how well you turn sales into profit | Support growth and highlight efficiency |

| Liquidity Ratios | Measure your ability to pay short-term debts | Reflect financial stability and flexibility |

| Cash Flow Metrics | Track how much cash you generate and keep | Show if you can fund new projects |

| Debt-to-Equity Ratio | Compare your debt to your own investment | Help manage risk and financial stability |

| Return on Assets (ROA) | Show how well you use assets to make profit | Prove asset efficiency |

| Revenue Growth | Track how much your sales increase each year | Signal business expansion |

| Net Cash Available | Show how much cash you have after investments | Reflect financial fitness |

You should always look at these metrics together. No single number tells the whole story. When you keep a close eye on liquidity and cash flow, you protect your financial stability and set the stage for long-term success.

Effective financial management gives you the tools to make smart choices. You use current, unbiased data to guide your financial decision-making. When you rely on evidence and clear analysis, you avoid mistakes that come from guessing or acting on emotion. Research shows that when you work with others and use real data, your decisions improve. You can gather input from your team, review key performance indicators, and use financial reports to see the full picture.

Financial literacy also plays a big role. When you understand concepts like cash flow, liquidity, and profitability, you feel more confident making decisions. You can spot risks early and act before problems grow. This approach leads to better results and helps your business in Malaysia stay strong.

Tip: Build a habit of reviewing your financial data often. Use dashboards and reports to keep your information up to date. This practice supports effective financial management and better outcomes in Malaysia.

You create value when you use your resources wisely and improve how your business in Malaysia runs. Efficient financial management helps you cut costs, boost cash flow, and increase profitability. Technology makes this easier. For example, automated tools can speed up invoice processing, track spending, and give you instant updates on your cash position. When you use budgeting and forecasting tools, you control spending and plan for the future.

You also gain more control over risk. Automated systems help you spot fraud, manage compliance, and keep your financial data safe. With better visibility into your cash and operations, you can make changes quickly and take advantage of new opportunities. Over time, these practices lead to higher value for your business in Malaysia and support sustainable growth.

Using solutions like FineReport, you can automate reporting, visualize key metrics, and integrate data from many sources. This makes effective financial management easier and more reliable, helping you reach your goals faster in Malaysia.

You face many challenges when managing your finances. One of the biggest issues is poor data quality. If your data is not accurate or complete, you risk making bad decisions. Many organizations struggle with manual data entry, which often leads to errors and delays. Siloed systems make it hard to get a full picture of your financial situation. When departments do not share information, you cannot see how money moves across your business in Malaysia.

You may also find it difficult to track cash flow and monitor liquidity. Without real-time data, you might miss signs of trouble. Compliance requirements add another layer of complexity. If you do not keep up with changing rules, you risk fines and loss of trust. Many companies depend on a few experts to extract data from different systems, which slows down analysis and reporting. As your business in Malaysia grows, your software must scale to handle more data and users.

Statistical analysis helps you spot trends and forecast future scenarios. This approach supports better risk assessment, budgeting, and performance tracking. Still, without integrated, up-to-date data, you may struggle to keep your financial management process efficient.

You can overcome these challenges by following proven best practices:

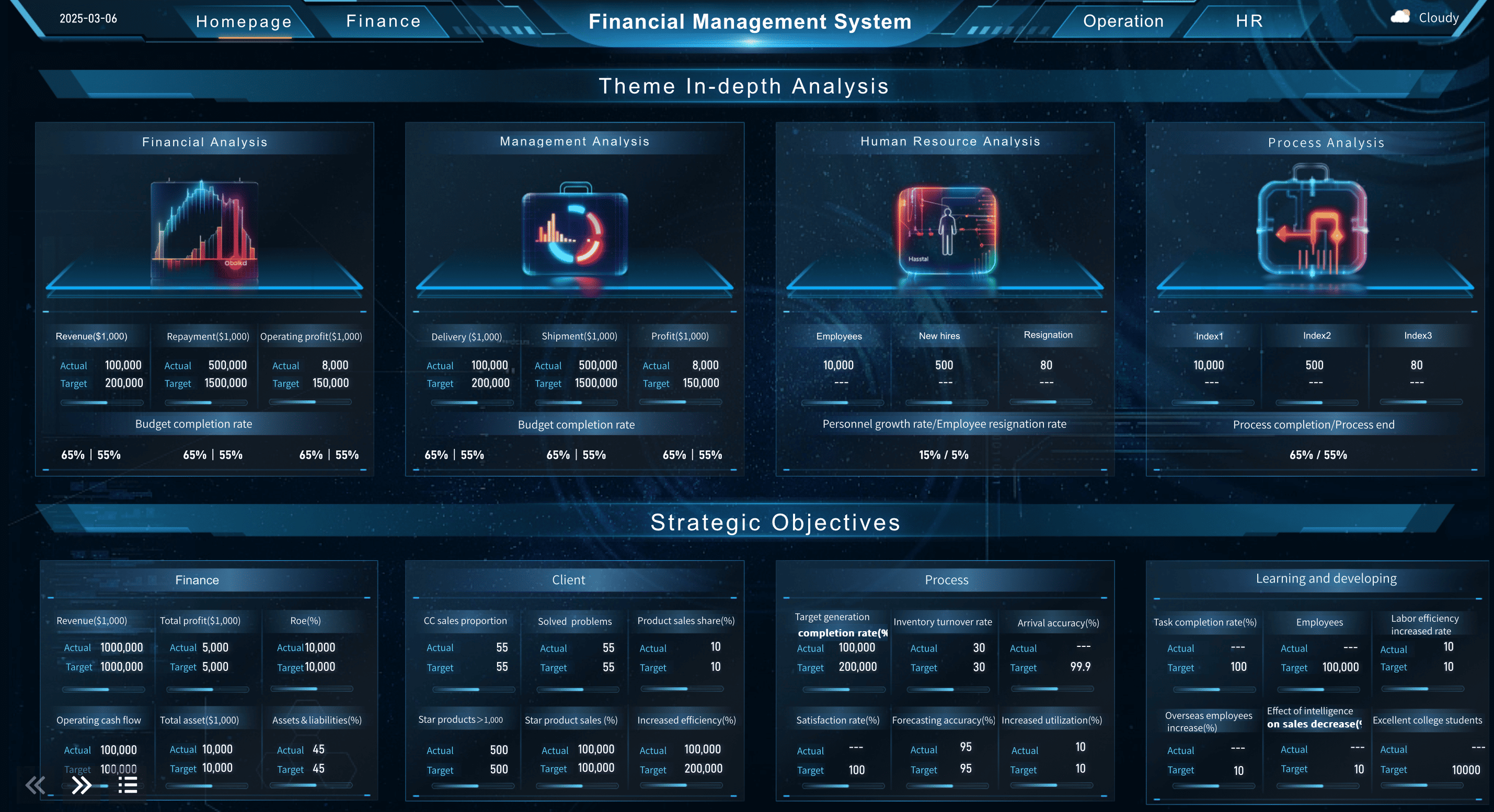

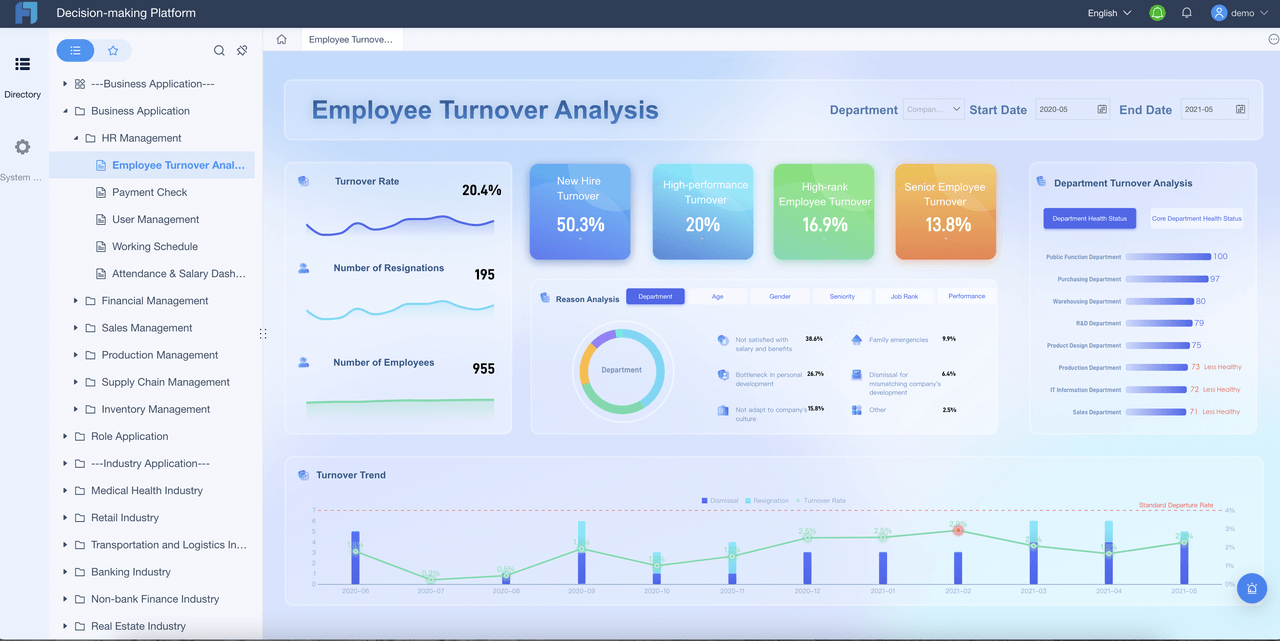

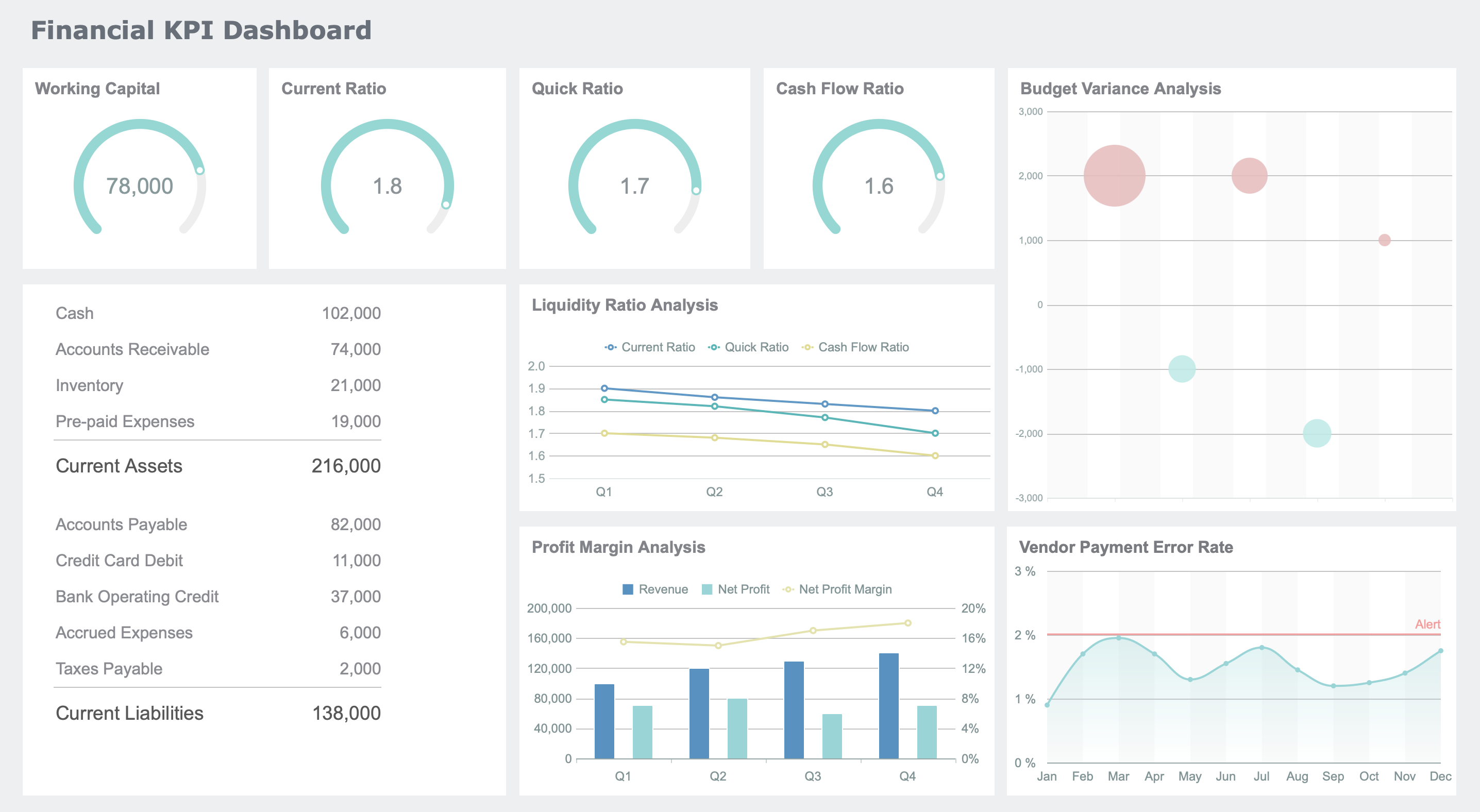

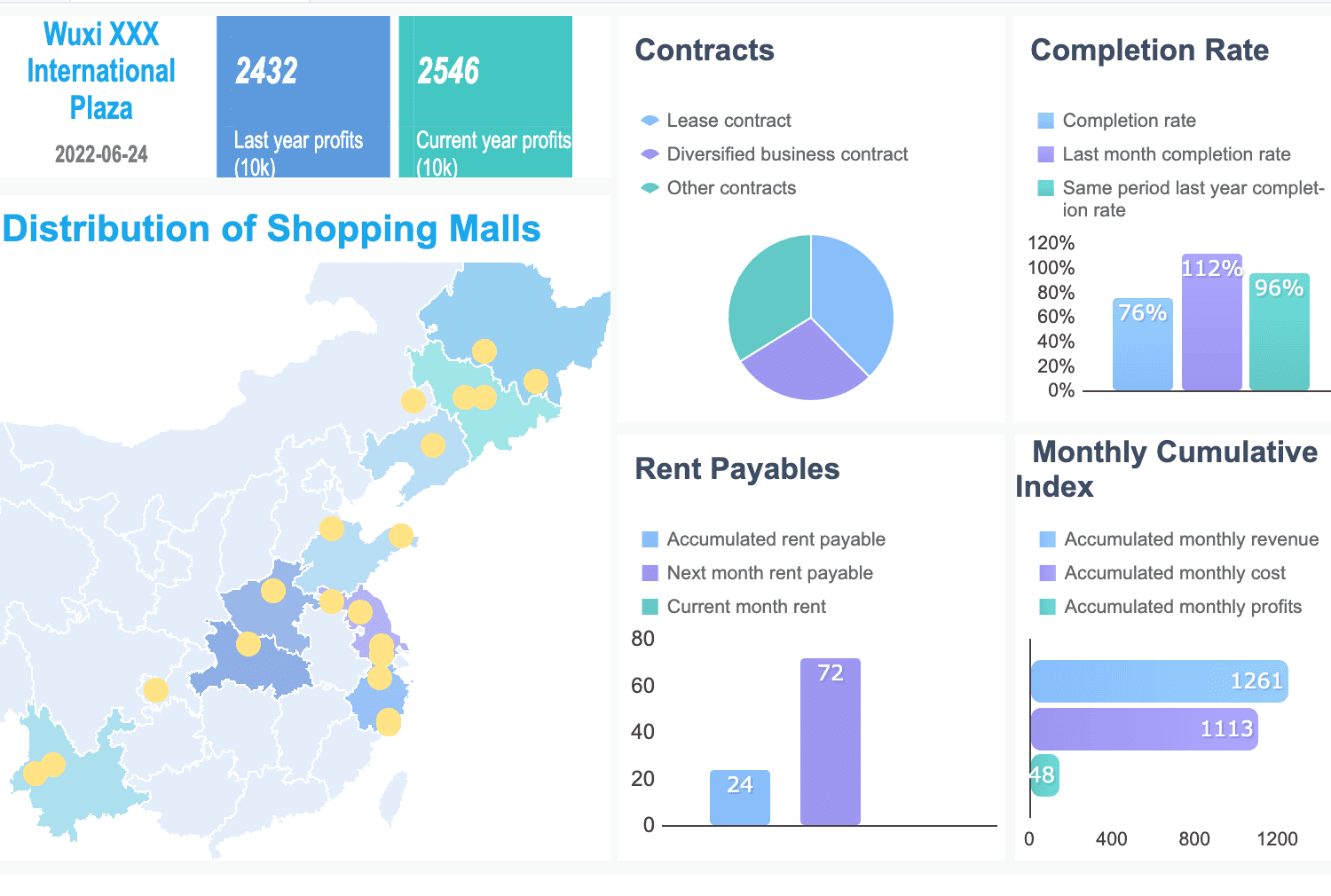

A Financial KPI Dashboard gives you a quick view of your key metrics. You can track revenue, expenses, and liquidity in real time. FineReport lets you build dashboards that update automatically. This helps you spot trends and act fast.

With a Financial Performance Dashboard, you can compare actual results to your goals. You see where you meet targets and where you fall short. FineReport makes it easy to visualize financial performance and share insights with your team.

Financial Index Analysis helps you dig deeper into your data. You can analyze ratios, trends, and other indicators to understand your business health in Malaysia. FineReport supports multi-dimensional analysis, so you can make better decisions and improve performance.

Tip: Automate your reporting and use dashboards to keep your financial data accurate and up to date. This approach saves time and supports smarter decision-making.

You gain a strong advantage when you understand and apply the financial management process. This knowledge helps you protect your cash, improve your financial health, and reach your goals. Digital tools like FineReport from FanRuan make it easier to track your financial data and make smart choices. Start using best practices and technology now to build a stable future.

Click the banner below to experience FineReport for free and empower your enterprise to convert data into productivity!

Location Data Management: Key Techniques and Tools

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

What is a data management platform in 2025

A data management platform in 2025 centralizes, organizes, and activates business data, enabling smarter decisions and real-time insights across industries.

Howard

Dec 22, 2025

Top 10 Database Management Tools for 2025

See the top 10 database management tools for 2025, comparing features, security, and scalability to help you choose the right solution for your business.

Howard

Dec 17, 2025

Best Data Lake Vendors For Enterprise Needs

Compare top data lake vendors for enterprise needs. See which platforms offer the best scalability, integration, and security for your business.

Howard

Dec 07, 2025