Sean, Industry Editor

Oct 21, 2025

A bank reconciliation statement lets you compare your company’s records with the bank’s records. This helps you check if your financial records are correct and find any mistakes fast. Using a bank reconciliation statement keeps your business safe from errors and makes things clearer. About 30% of companies find mistakes in their records because they do not check often. You can use digital tools like FanRuan to keep your records right and make your reports more accurate.

With FineBI, you can automate reconciliation workflows, catch discrepancies in real time, and generate clear, audit-ready reports with ease.(click to engage)

Bank reconciliation means checking your company’s records with the bank statement. You look at each transaction to see if both records are the same. This helps you find any differences between your books and the bank’s records. You might notice mistakes, missing items, or timing problems.

A bank reconciliation statement shows how you match your records with the bank’s. It has some important parts:

You will see these parts in every bank reconciliation. Some businesses use different ways to do bank reconciliation. For example, you might do a quick check for a small account. You might do a careful review for a busy business.

You should do a bank reconciliation often. Many experts say to do it every month. If your business has lots of transactions, you might do it every week. This habit helps you find mistakes early and keeps your cash flow strong.

Bank reconciliation is important because it keeps your business safe. When you check your records with the bank statement, you make sure your numbers are correct. This helps you keep good financial records and avoid big mistakes.

Many things can cause differences between your records and the bank’s. Some common reasons are:

If you do not check for these problems, you might miss something important. Doing reconciliation often helps you find fraud, spot mistakes, and fix them before they get worse.

Different industries use bank reconciliation in special ways. Here is a table that shows how some sectors use reconciliation:

| Sector | Key Reconciliation Practices | Purpose/Goal |

|---|---|---|

| Retail | Cash flow and inventory management | Accurate sales and supplier payments |

| Manufacturing | Cost and inventory reconciliation | Correct costing and stock levels |

| Financial Institutions | Regulatory compliance and fraud detection | Accurate client accounts and legal compliance |

| Healthcare Providers | Insurance claim and patient billing reconciliation | Match claims and payments |

| Nonprofit Organizations | Donor fund and grant tracking | Transparency and expense reporting |

| E-commerce | Sales and payment gateway reconciliation | Match sales with deposits and refunds |

| Hospitality Industry | Daily revenue and expense management | Verify revenue and control expenses |

| Technology Companies | Subscription and project cost reconciliation | Accurate revenue and cost tracking |

| Construction Firms | Job costing and vendor payment reconciliation | Track profitability and equipment use |

| Real Estate Companies | Rental income and property expense reconciliation | Match income with agreements and expenses |

FineReport helps you streamline your bank reconciliation process, reduce manual errors, and deliver fast, compliant, and accurate financial reports. (click to engage)

Bank reconciliation is not just for accountants. It is a smart habit for anyone who wants to run a business well. When you use a bank reconciliation statement, you trust your numbers and make better choices.

Your bank reconciliation might not match your records every time. Timing issues are a big reason for these differences. When you write a check, the money leaves your account after the bank clears it. Sometimes, you put money in the bank, but it does not show up right away. These delays can make your records and the bank statement look different.

Some timing issues happen often:

Small businesses deal with these timing problems a lot. They may not track every transaction date closely. If you record a payment in one month and the bank processes it next month, you will see a difference. Not tracking dates well can cause errors in reconciliation. You need to match your records with the bank statement to keep things accurate and find mistakes easily.

Note: Timing differences are normal in bank reconciliation. Checking your records often helps you find differences early and keeps your records current.

Mistakes and fraud can also make your bank reconciliation different. You might enter the wrong data or miss a transaction. Sometimes, you may see transactions on your bank statement that you did not make. These can be signs of fraud or just simple mistakes.

The most common errors found during reconciliation are:

Businesses lose about 5% of their yearly revenue to fraud. Financial statement fraud can cause a median loss of $954,000. Doing bank reconciliation often helps you stop fraud and find problems fast. By checking your records regularly, you can find differences, fix mistakes, and keep your business safe.

You can make a bank reconciliation statement by following easy steps. This helps you check your records with the bank statement and find any problems. Here is a simple way to do it:

Tip: Doing this every month helps you keep your records current and makes them more accurate.

Here is an example for a mid-sized company. This table shows how you can organize your reconciliation:

| Description | Amount |

|---|---|

| Opening Balance | $100,000 |

| Total Sales Received | $120,000 |

| Invoiced Debtors from Previous | $40,000 |

| Total Payments | $80,000 |

| Monthly Salaries | $30,000 |

| Difference Between Books and Bank | $40,000 |

Start with your opening balance. Add your sales and any money owed from before. Take away payments and salaries. The difference shows what you need to check. If your records and the bank statement do not match, you need to find out why.

Note: You may see different types of bank reconciliation depending on your business. Some companies do a quick check, while others use detailed reports for each account.

When you make a bank reconciliation statement, you might face some common problems. These can slow you down or make it hard to find mistakes. Here are some main issues:

Alert: If you do not check for these problems, you might miss mistakes or even unauthorised transactions.

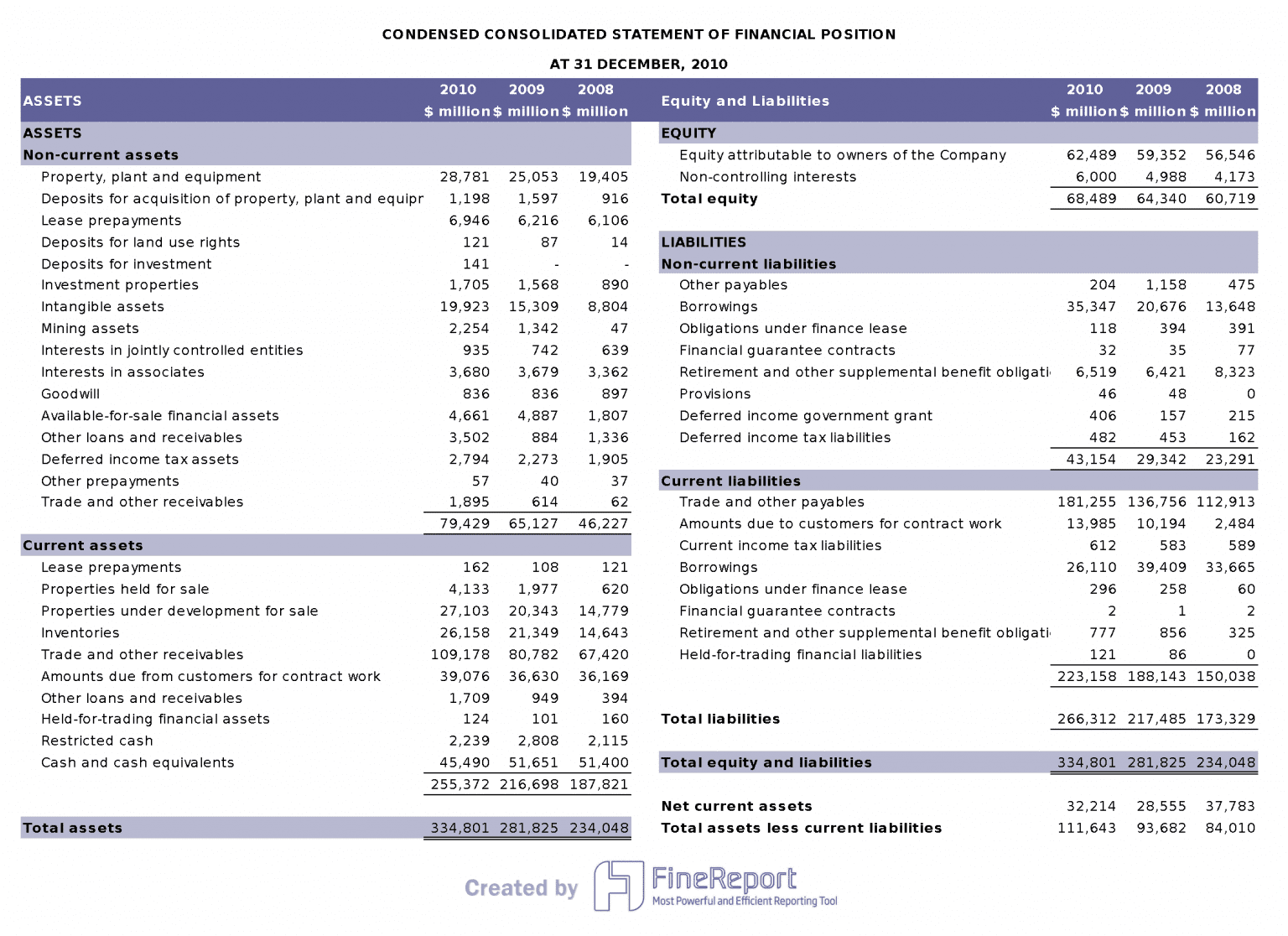

You can make reconciliation much easier with digital tools. FanRuan has FineReport, which helps you automate and speed up the process. FineReport lets you collect data from many places and update your records right away. You can use its templates to enter data quickly and avoid manual mistakes. The platform also makes clear reports, so you can find differences fast.

With FineReport, you can finish your monthly close with less stress. The software checks for mistakes, matches transactions, and helps you keep your records correct. You save time and lower the chance of errors. Many businesses use FineReport to make their records better and make reconciliation part of their daily work.

Tip: Automating your bank reconciliation with FanRuan tools gives you more time to grow your business.

When you do manual bank reconciliation, you match transactions by hand. You look at your bank statement and check each entry with your records. Some people use spreadsheets or paper to do this. This takes a lot of time if you have many transactions. You can make mistakes by typing wrong numbers or missing entries. Manual reconciliation often causes errors and delays.

Here is a table that shows the main differences between manual and automated reconciliation:

| Category | Manual Reconciliation | Automated Reconciliation |

|---|---|---|

| How It Works | You match transactions one by one using spreadsheets or paper. | Transactions are matched automatically with rules, AI, and software. |

| Time & Efficiency | It is slow and hard, especially with lots of transactions. | It is fast and easy; it works well with many transactions. |

| Accuracy | People can make mistakes or miss entries. | Rules help lower mistakes and show mismatches. |

| Scalability | It is hard to do more as you get more transactions. | It works well for many accounts, currencies, and systems. |

| Visibility | You do not see results right away; delays happen often. | Dashboards show matches and problems right away. |

| Audit & Compliance | There are no clear records; changes are hard to track. | All matches and changes are saved with time stamps. |

| Team Effort | People work a lot and can get tired or make mistakes. | Teams spend less time and focus on special cases. |

| Setup & Learning | It is easy to start but gets harder over time. | You need training and setup, but it helps a lot later. |

Manual reconciliation can have error rates up to 45%. You might spend 5 to 8 hours each week checking records. Month-end close can take 7 days longer. These problems make it hard to keep your bank reconciliation statement correct.

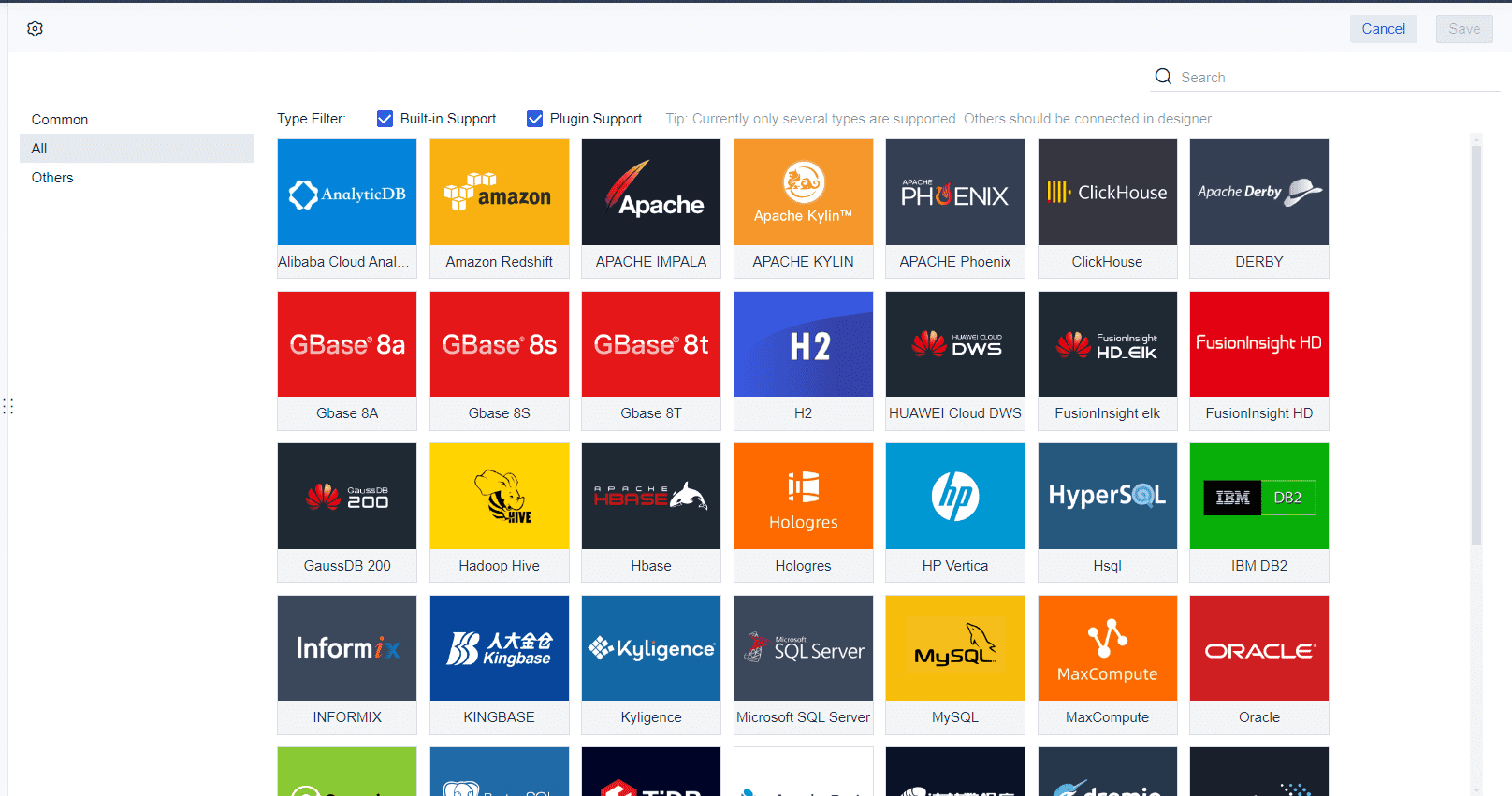

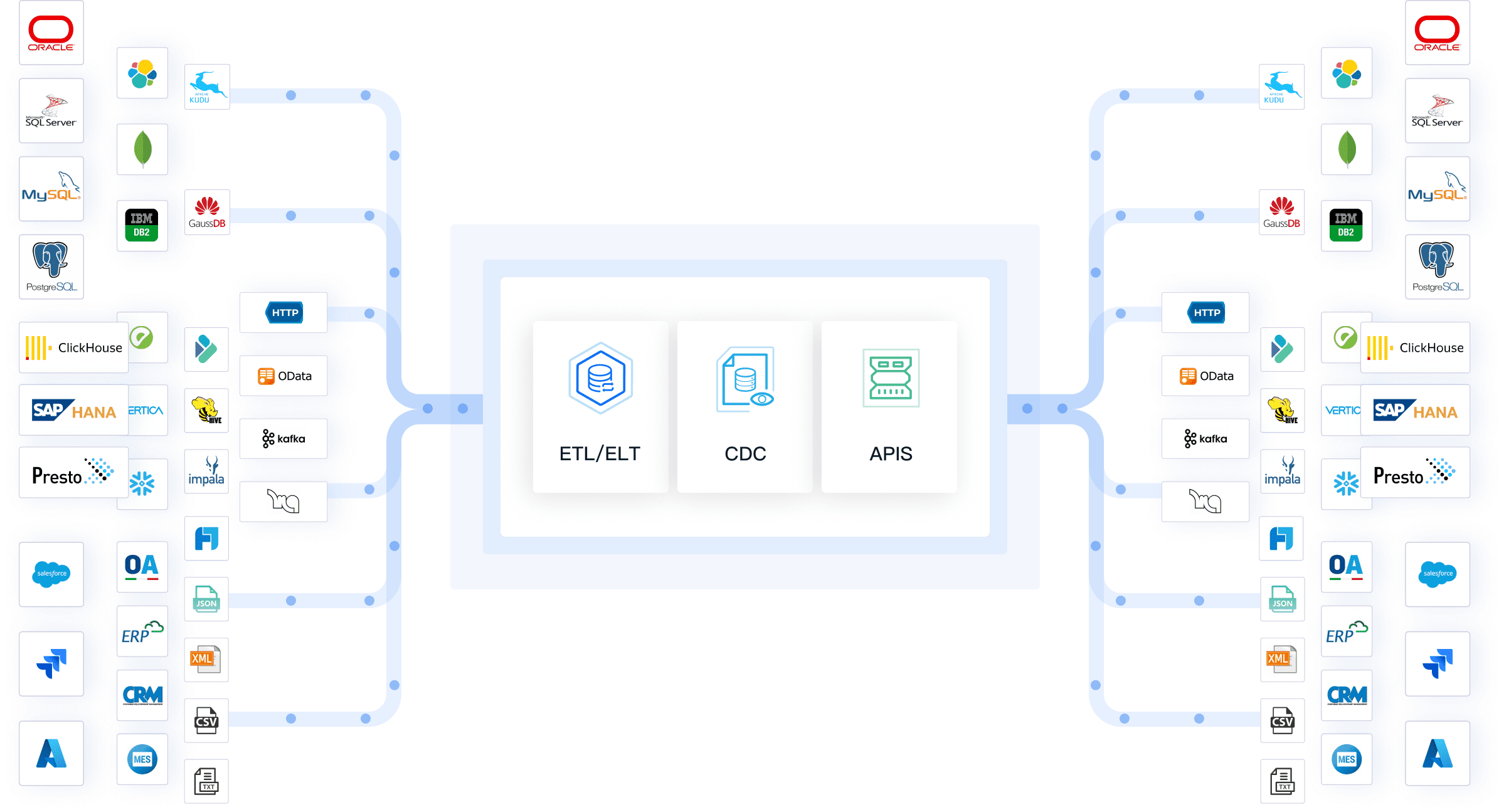

Automated bank reconciliation uses software to match transactions for you. FanRuan has FineDataLink and FineReport to help you do this. You can connect your bank statement and business records directly. The system matches transactions with rules and AI. You see dashboards that show matches and problems right away. This makes reconciliation much faster and easier.

FanRuan lets you use data from many places. You do not need to move files by hand. FineDataLink updates data in real time and works with over 100 sources. FineReport makes clear reports and tracks every change. You get safe records and can see everything. Your team spends less time on manual work and more time fixing real problems.

Tip: Automated bank reconciliation helps you keep records right, saves time, and helps you worry less.

You can keep your bank reconciliation strong by using good habits. Doing reconciliation often helps you find problems early. Most experts say you should do this every month. If your business has lots of transactions, do it every week or day. Using automation makes the process faster and cuts down on mistakes. Software can help match transactions and make reports. This saves time and makes your records more correct.

Here are some best practices for bank reconciliation:

Tip: Keeping good records helps you pass audits and makes your business more open.

Mistakes can happen during reconciliation, but you can stop them with the right steps. Missing or unrecorded transactions cause many problems. Duplicate entries can make your cash balance look too high. Data entry errors, like typing the wrong number, can cause mismatches. Timing differences can make your records and the bank statement not match. Unauthorized transactions can cause losses if you do not find them.

You can use this table to see common mistakes and how to avoid them:

| Mistake Type | Description | How to Avoid |

|---|---|---|

| Missing or Unrecorded Transactions | Transactions not in your records | Update records often and use automated tools |

| Duplicate Transactions | Double entries make your balance too high | Check transactions and use reconciliation software |

| Data Entry Errors | Typing mistakes or wrong numbers | Use AI tools and review your work |

| Timing Differences | Delays in clearing transactions | Track items and use technology |

| Unauthorized Transactions | Fraud or errors not found | Reconcile accounts often and set controls |

Training helps your team make fewer mistakes. You should teach your team why bank reconciliation is important and how to do it right. Good training makes sure your staff keeps records correct and follows the right steps.

Note: Doing reconciliation often and giving good training helps you avoid mistakes and keep your records right.

If you check your bank accounts often, you keep your business safe. This habit helps you keep your records right and find problems early. Digital tools like FanRuan’s FineReport and FineDataLink make things quicker and simpler. Here are some long-term benefits:

| Benefit | Impact |

|---|---|

| Accurate Financial Reporting | Fewer mistakes and less chance of fraud |

| Improved Cash Flow Management | Better control and fewer business problems |

| Enhanced Decision-Making | Smarter choices with good data |

| Compliance with Regulations | Less risk of fines and legal trouble |

Lots of people use technology for money tasks now. You can do this too and make your business better by using smart tools and good habits.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

A bank reconciliation statement lets you check your business records with your bank statement. You use it to find errors, missing items, or timing problems. This helps keep your financial records correct.

You should do bank reconciliation every month. If your business has lots of transactions, you can do it every week. Checking often helps you find mistakes early.

You can use software like FanRuan’s FineReport and FineDataLink. These tools match transactions, make reports, and update records for you. Automation saves time and lowers errors.

Differences happen because of timing problems, typing mistakes, or missing items. Sometimes, the bank handles payments or deposits later than you record them.

Yes! Bank reconciliation helps you find unauthorized transactions fast. You can fix problems before they get worse. This keeps your business safe.