Sean, Industry Editor

Oct 21, 2025

You see additional paid in capital on a company’s balance sheet. This happens when investors pay more for stock than its par value. Here are definitions from trusted financial sources:

| Source | Definition |

|---|---|

| Becker | Additional paid-in capital is money given above par or stated value. It can also come from other types of deals. |

| AccountingTools | Additional paid-in capital is money from investors for stock that is more than the par value. Par value is usually set very low. |

Investors see additional paid in capital as a sign of trust. They believe in the company’s future.

Knowing about APIC helps you study a company’s financial health. It helps you make smarter choices.

You can find additional paid in capital, or APIC, on a company’s balance sheet. This means investors pay more for shares than the par value. When a company sells new shares, it sets a par value. Par value is usually very small. If you buy a share with a 5, the extra $4 is APIC. This amount is listed in the shareholders’ equity section.

APIC is an important part of paid-in capital. Paid-in capital includes both par value and the extra money investors pay. Look at the table below to see the difference:

| Aspect | Additional Paid-In Capital | Contributed Capital |

|---|---|---|

| Definition | Money paid by shareholders above par value | Total cash and assets given by shareholders |

| Components | Only the amount over par value | Includes par value and additional paid-in capital |

You might hear contributed capital in excess of par. This means the same as additional paid in capital. It is the money paid above par value for shares.

The main parts of additional paid in capital are:

APIC shows that investors trust the company. Paying more than par value means they believe in its future.

APIC is important for a company’s finances. High APIC means investors have faith in the company. They pay extra for shares. This gives the company more money for growth and new projects.

Here are reasons why APIC matters for investors and business leaders:

Here is how additional paid in capital is different from other paid-in capital:

When a company sells shares, APIC becomes very important. The extra money from APIC helps the company grow. This affects how much money the company can raise by selling shares.

Tip: Companies with strong APIC get top investors. They use this money to grow and compete.

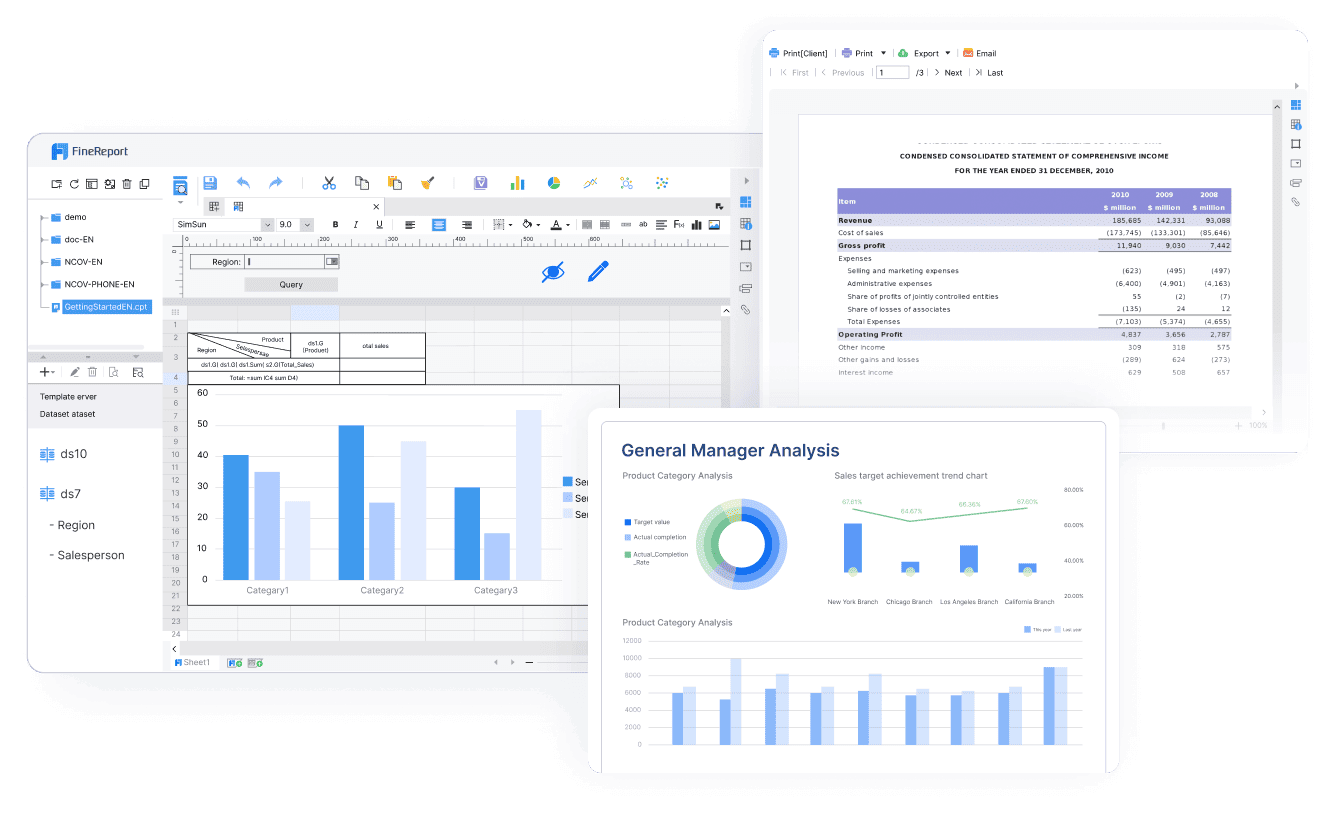

Modern financial tools, like those from FanRuan, help you study APIC better. With FineReport, you can look at financial performance using different ratios. This helps you compare and find trends. For example, you can use return on net assets to see how APIC changes company value. FanRuan’s tools make APIC easier to see and understand, so you can make smarter choices.

FineReport turns complex equity data like APIC into clear visuals and actionable insights—helping finance teams make faster, smarter decisions.(click the above demo to engage)

To figure out additional paid in capital, you need two numbers. Par value is a small amount set by the company for each share. It is usually just a few cents. Issue price is what you pay to buy the share from the company. If you pay more than par value, the extra money is additional paid in capital. If you pay only par value, there is no extra paid in capital.

Note: Par value is not the same as market value. Par value is a number the company picks. Issue price is what you pay when new shares are sold.

There is an easy formula to find additional paid in capital:

This formula shows how much extra money the company gets from selling shares for more than par value. For example:

Let’s look at an example step by step:

You can use tools like FanRuan’s FineReport to do these calculations for you. FineReport lets you type in the number of shares, par value, and issue price. It then finds additional paid in capital and puts it in your financial reports. This saves time and helps you avoid mistakes.

Tip: Using FineReport makes it simple to keep track of additional paid in capital and other important numbers. You get clear and correct data to help you make good choices.

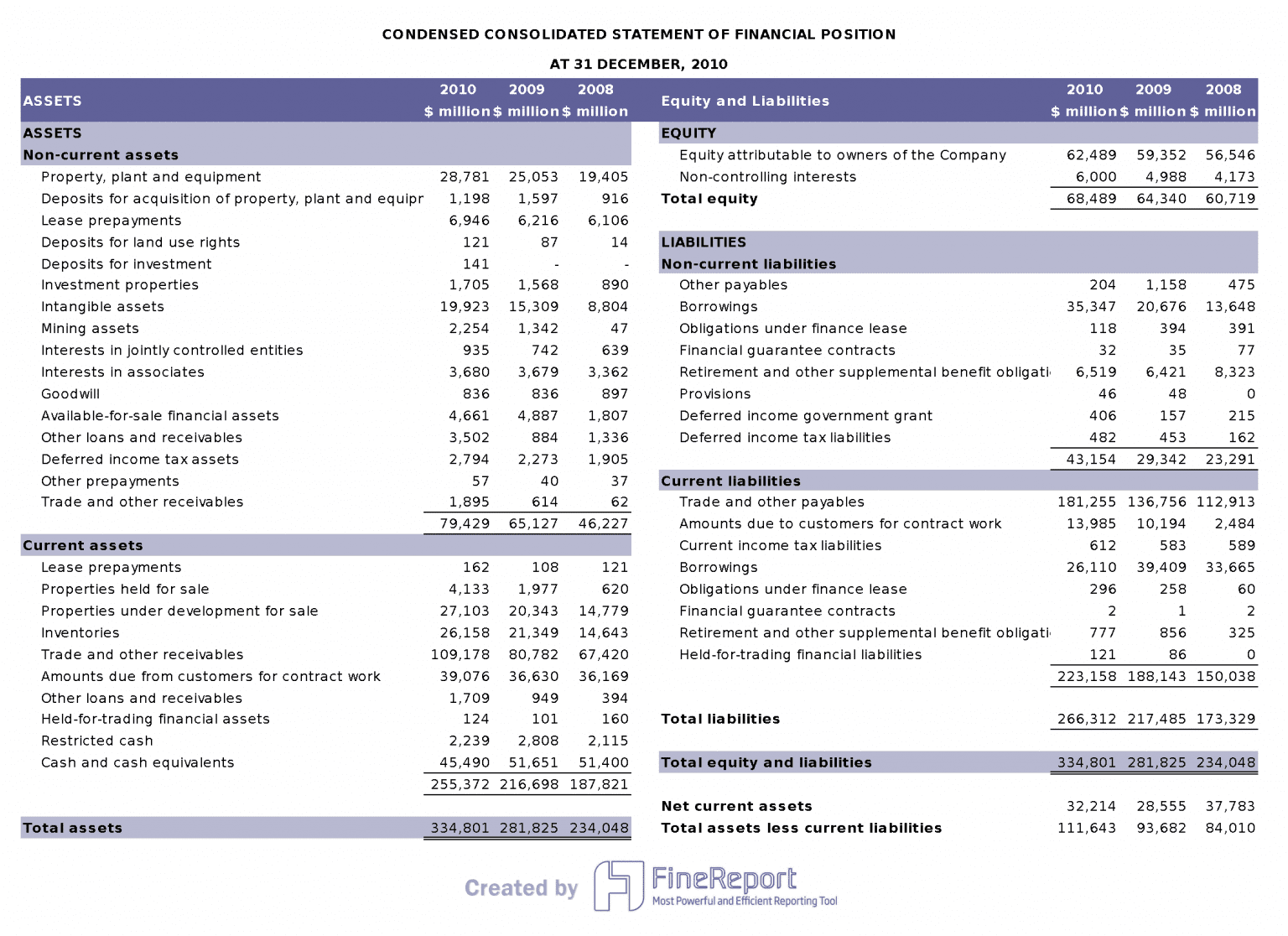

You can see additional paid in capital on the balance sheet. It is in the shareholders’ equity section. Companies put it after common stock and preferred stock. This amount shows money paid above par value for shares. Accountants sometimes call it capital in excess of par value. You might also hear capital surplus, which means the same thing.

Paid-in capital has par value and extra money investors pay. The balance sheet splits these amounts for you. You can see how much is from par value and how much is capital in excess of par value. This helps you know how much trust investors have in the company.

Here is a table that shows how equity accounts look on the balance sheet:

| Equity Account | Description |

|---|---|

| Common Stock | Par value of shares given to common shareholders |

| Preferred Stock | Par value of shares with set dividends |

| Additional Paid-in Capital | Money paid above par value, also called capital in excess of par value or capital surplus |

FanRuan’s FineReport helps you see these numbers easily. You can use dashboards to track paid-in capital and capital in excess of par value. FineReport connects to big databases and lets you make custom reports fast.

FineReport gives finance teams a clear, visual view of capital structure—making it easier to monitor changes and support smarter planning. (click the above demo to engage)

Additional paid in capital makes shareholders’ equity go up. When investors pay more than par value, the extra money goes into capital in excess of par value. This gives the company more equity and more money to grow.

Paid-in capital is a big part of equity. It works with accounts like common stock and preferred stock. When you add par value, capital in excess of par value, and other equity accounts, you get total equity for shareholders.

You can use tools to study paid-in capital and capital in excess of par value. FanRuan’s FineReport gives financial managers many features:

| Feature | FineReport |

|---|---|

| Reporting Automation | Yes |

| Customizable Dashboards | Yes |

| Data Source Connectors | Works with all big databases |

| Analytical Views | Yes |

| Cash Flow Monitoring | Yes |

| Budgeting and Forecasting | Yes |

| Ease of Use | Easy report/dashboard making |

| Integration | Open APIs for changes |

| Data Visualization Styles | Many controls for data input and checking |

FineReport turns paid-in capital data into easy charts and tables. You can find trends in capital in excess of par value and make smart choices. With these tools, you can see how additional paid in capital helps company growth and financial health.

Tip: Use dashboards to watch paid-in capital and capital in excess of par value over time. This helps you see how investor trust changes.

Paid-in capital helps you check a company’s financial health. If paid-in capital is high, the company has strong equity. This makes the company safer and stronger in many ways:

When you look at additional paid in capital, you see how much investors trust the company. This trust can help the company get loans and better credit.

Tip: Companies with strong paid-in capital can handle problems with more confidence and stay steady.

Paid-in capital does more than protect a company. It also helps the company grow bigger. When a company gets money from additional paid in capital, it can use this money for many projects. Here are some ways companies use paid-in capital:

| Use of Capital | Description |

|---|---|

| Research and Development | Pays for new products and ideas |

| Expansion | Opens new places or goes into new markets |

| Operations | Helps with daily business needs |

| Strategic Initiatives | Invests in technology or new services |

Founder Securities is a good example. This company used business intelligence tools from FanRuan to watch and study its paid-in capital. With better data, Founder Securities made better choices and finished a big merger. The company moved 50,000 user accounts without problems and kept its business safe. Paid-in capital gave them what they needed to handle this big change and keep growing.

If you use tools like FanRuan, you can track paid-in capital and additional paid in capital easily. This helps you make smart choices for your company’s future.

You now know that additional paid in capital is money paid over par value. This extra money makes your company’s equity bigger. It also shows that investors trust your company a lot.

| Benefit | Impact |

|---|---|

| Financial flexibility | Helps your company grow and stay strong |

| Investor confidence | Brings in more people who want to invest |

| Better decisions | Looking at data helps you find new ideas |

Using tools like FanRuan lets you study APIC, make better reports, and choose what is best for your business.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

Paid-in capital is all the money you pay for company shares. Additional paid in capital is just the extra money over par value.

No, additional paid in capital does not go down. You add it when new shares are sold. It only changes if the company buys back shares or changes its equity.

APIC does not change how dividends work. Dividends depend on company profits and what the board decides, not on APIC.

You see APIC in the shareholders’ equity part of the balance sheet. It is listed after common stock and preferred stock.