DuPont analysis is a framework used to break down a company's return on equity (ROE) into its component parts, providing a more detailed understanding of its financial performance. This method allows decision-makers to see how operating efficiency, asset turnover, and financial leverage each affect overall results. Unlike traditional methods that focus only on aggregate figures, DuPont analysis gives a clearer picture of what drives return on equity. FineBI by FanRuan enables users to perform advanced analyses like DuPont analysis with ease, helping organizations pinpoint strengths and areas for improvement.

The DuPont method stands as a foundational approach in financial analysis. It originated in 1919 when Donaldson Brown, an executive at DuPont Corporation, introduced a new way to evaluate company performance. He broke down return on equity into three main components: profit margin, asset turnover, and financial leverage. This approach allowed managers to see exactly which factors influenced profitability. The DuPont analysis quickly became popular because it provided a clear, cause-and-effect view of financial results.

Over time, the DuPont method evolved. In the 1920s, ratio analysis became more common, helping analysts compare companies of different sizes. The DuPont model shifted financial analysis from simple bookkeeping to a tool for strategic insight. Today, the method remains a key part of business education and financial analysis. It helps companies identify strengths and weaknesses in their operations.

The 3-step DuPont analysis breaks down ROE into three ratios:

This structure gives managers a detailed look at what drives return on equity. For deeper insight, some analysts use a five-step version, which separates operating activities from financing activities. This helps companies see the effect of interest expenses and other factors on net income.

Tip: The DuPont analysis is especially useful for benchmarking performance and teaching financial concepts. It remains relevant even as new financial metrics and models appear.

ROE, or return on equity, measures how well a company uses its shareholders' equity to generate profits. It answers a simple question: How much net income does a company produce for every dollar of equity invested by shareholders? The basic ROE calculation uses this formula:

ROE = Net Income / Shareholders' Equity

Net income is the profit after all expenses and taxes. Shareholders' equity includes the money invested by owners and retained earnings. This ratio shows the profit generated for each unit of equity. Companies and investors use ROE to compare financial performance across different firms and industries.

The DuPont analysis takes the ROE calculation further. By breaking ROE into net profit margin, asset turnover, and financial leverage, the DuPont method reveals the underlying drivers of profitability. This helps managers and analysts understand if strong ROE comes from high profit margins, efficient use of assets, or greater use of debt.

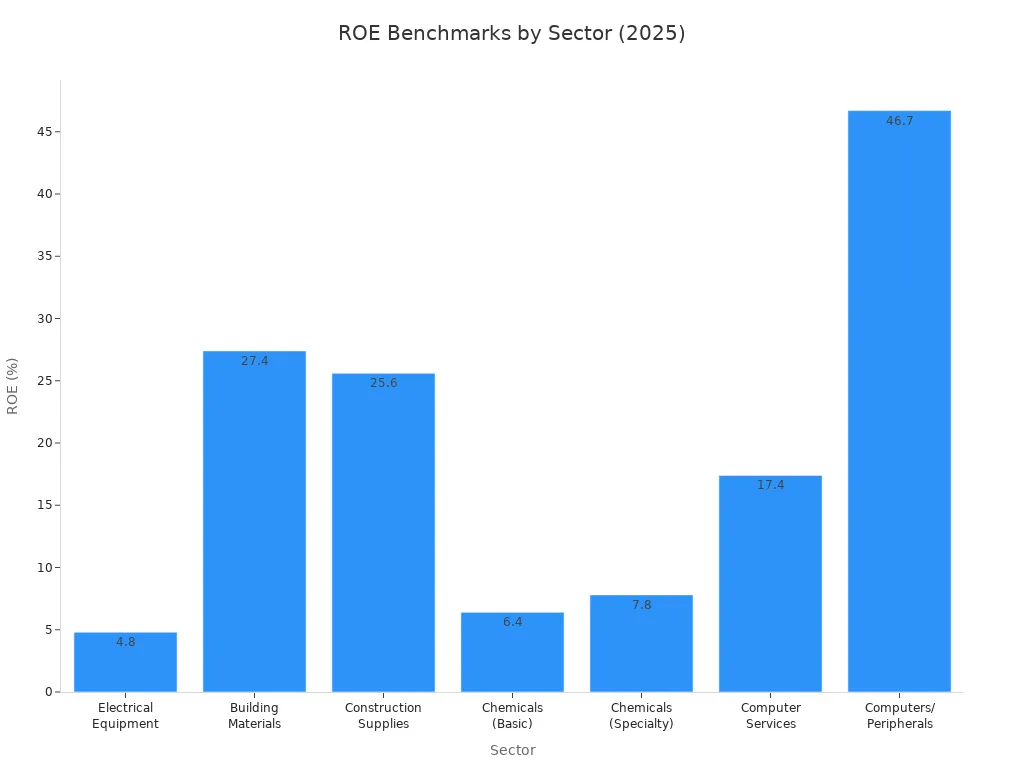

Industry benchmarks for ROE can vary widely. For example, in 2025, manufacturing sectors like Building Materials and Construction Supplies showed ROE values above 25%. Technology sectors such as Computer Services had ROE near 17.4%. These benchmarks help companies compare their own performance to industry standards.

| Sector | ROE (%) |

|---|---|

| Electrical Equipment | 4.8 |

| Building Materials | 27.4 |

| Construction Supplies | 25.6 |

| Chemicals (Basic) | 6.4 |

| Chemicals (Specialty) | 7.8 |

| Computer Services | 17.4 |

| Computers/Peripherals | 46.7 |

The DuPont method, especially the 3-step DuPont analysis, remains a powerful tool for understanding what drives return. By using this approach, companies can pinpoint areas for improvement and make better strategic decisions.

DuPont analysis breaks down ROE into three essential drivers. Each component reveals a different aspect of a company's financial performance. By examining these elements, companies can identify whether operational efficiency, asset utilization, or capital structure most influences their financial profitability.

Net profit margin measures how much profit a company keeps from its total revenue after covering all expenses, including taxes and interest. The formula for net profit margin is:

Net Profit Margin = (Net Profit / Total Revenue) × 100

A high profit margin shows strong cost control and operational efficiency. Companies with high profit margins generate more profit from each dollar of sales, which directly boosts ROE in the DuPont analysis. For example, Google once reported a net profit margin of 29%, which contributed to a robust ROE. In contrast, a low profit margin signals that expenses consume a large portion of revenue, reducing profitability and weakening the impact on ROE.

Net profit margins vary by industry. An average margin across industries is about 7.71%. Margins of 5% are considered low profit margin, 10% healthy, and 20% high profit margin. For instance, Amazon's net profit margin stands at around 3.36% due to high operating costs. Grocery stores often show low profit margin because of thin markups, while software companies may achieve high profit margin thanks to lower variable costs.

Net profit margin plays a critical role in the DuPont ratio. It highlights how well a company turns sales into profit, making it a key indicator of financial profitability. Companies should compare net profit margins within the same industry to draw meaningful conclusions.

Note: A higher net profit margin not only increases ROE but also signals better financial profitability and resilience during economic downturns.

Asset turnover evaluates how efficiently a company uses its assets to generate revenue. The formula is:

Asset Turnover = Revenue / Total Assets

A high asset turnover means the company generates more sales per dollar of assets. This efficiency boosts ROE in the DuPont analysis. Retail and service industries often display high asset turnover because they rely less on heavy equipment and more on rapid inventory movement. For example, a retail chain with high asset turnover can quickly convert inventory into sales, increasing profitability and ROE.

On the other hand, a low asset turnover suggests that assets are underutilized. Manufacturing and utility companies often have low asset turnover due to significant investments in equipment and infrastructure. This can drag down ROE unless the company compensates with high profit margin or effective cost management.

| Industry Type | Average Asset Turnover Ratio | Characteristics and Impact on ROE |

|---|---|---|

| Retail | Around 2.0 or higher | High asset turnover, efficient asset use, boosts ROE |

| Service | High (similar to retail) | Efficient asset utilization, supports higher ROE |

| Manufacturing | Lower than retail | Capital-intensive, lower turnover, may reduce ROE |

| Utilities | Low | Very capital-intensive, low turnover, can depress ROE |

Companies can improve asset turnover by optimizing inventory, selling underperforming assets, or streamlining operations. In the DuPont ratio, asset turnover works together with net profit margin and financial leverage to determine overall profitability.

Tip: Benchmark asset turnover within the same industry for accurate analysis, as capital intensity varies widely.

Financial leverage, also known as the equity multiplier, measures how much a company relies on debt compared to equity. The formula is:

Equity Multiplier = Total Assets / Shareholders’ Equity

A high equity multiplier indicates that a company uses more debt to finance its assets. This can amplify ROE in the DuPont analysis if the company earns more from its assets than it pays in interest. For example, a company with a high equity multiplier and high asset turnover can achieve strong profitability, even if its net profit margin is moderate.

However, high financial leverage also increases risk. If profits fall, the company may struggle to cover interest payments, leading to financial distress. A low equity multiplier means the company relies more on equity and less on debt, which reduces risk but may limit ROE growth.

A low equity multiplier signals a conservative approach, with less risk but potentially lower ROE. Companies must balance the benefits and risks of leverage to achieve sustainable financial profitability.

Note: The DuPont ratio uses the equity multiplier to show how capital structure choices affect both risk and profitability.

| Component | Insight Provided |

|---|---|

| Net Profit Margin | Measures profitability and cost control, showing how effectively sales convert into profits. |

| Asset Turnover | Indicates operational efficiency by showing how well assets generate revenue. |

| Equity Multiplier | Reflects financial leverage, indicating the extent of debt use and associated financial risk. |

By analyzing these three core components, the DuPont analysis gives companies a clear view of what drives ROE. This approach helps managers and investors identify whether improvements in profitability, asset efficiency, or capital structure will most effectively enhance shareholder returns.

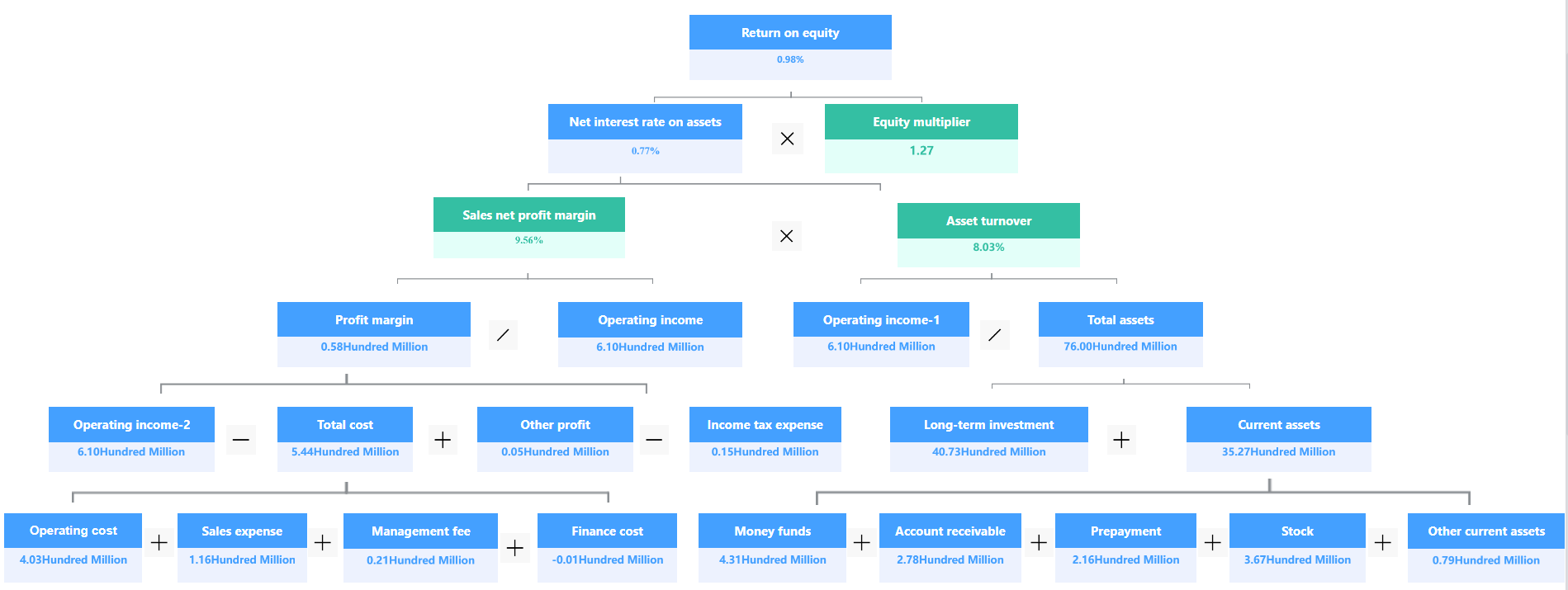

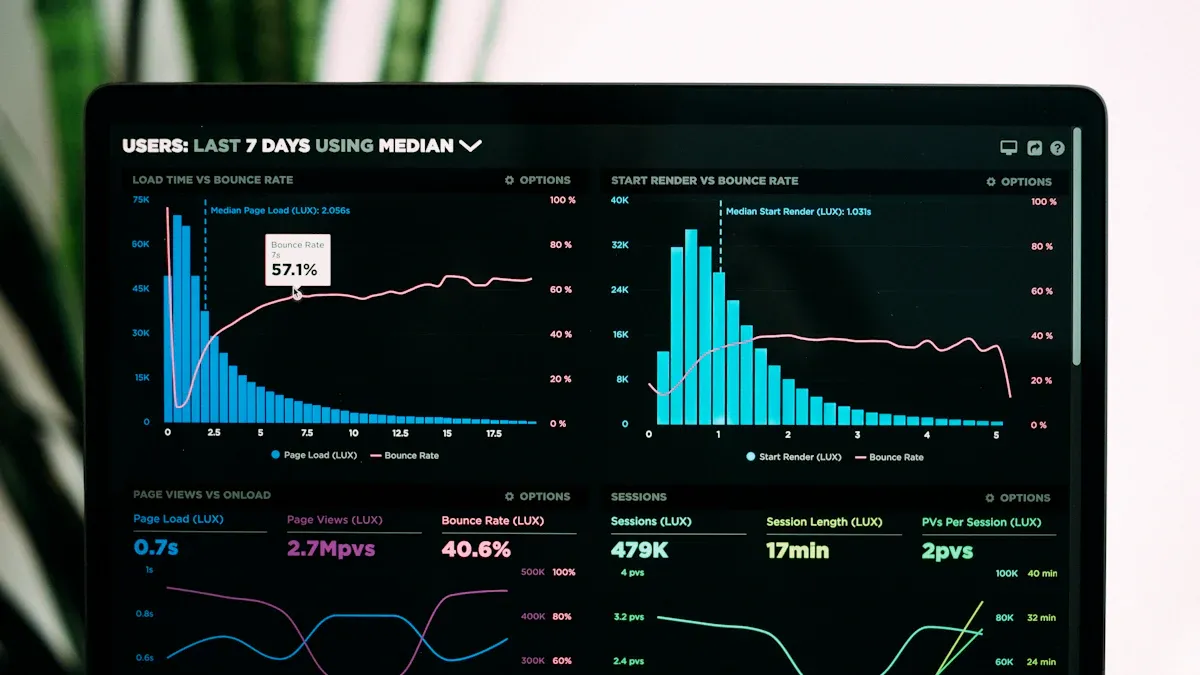

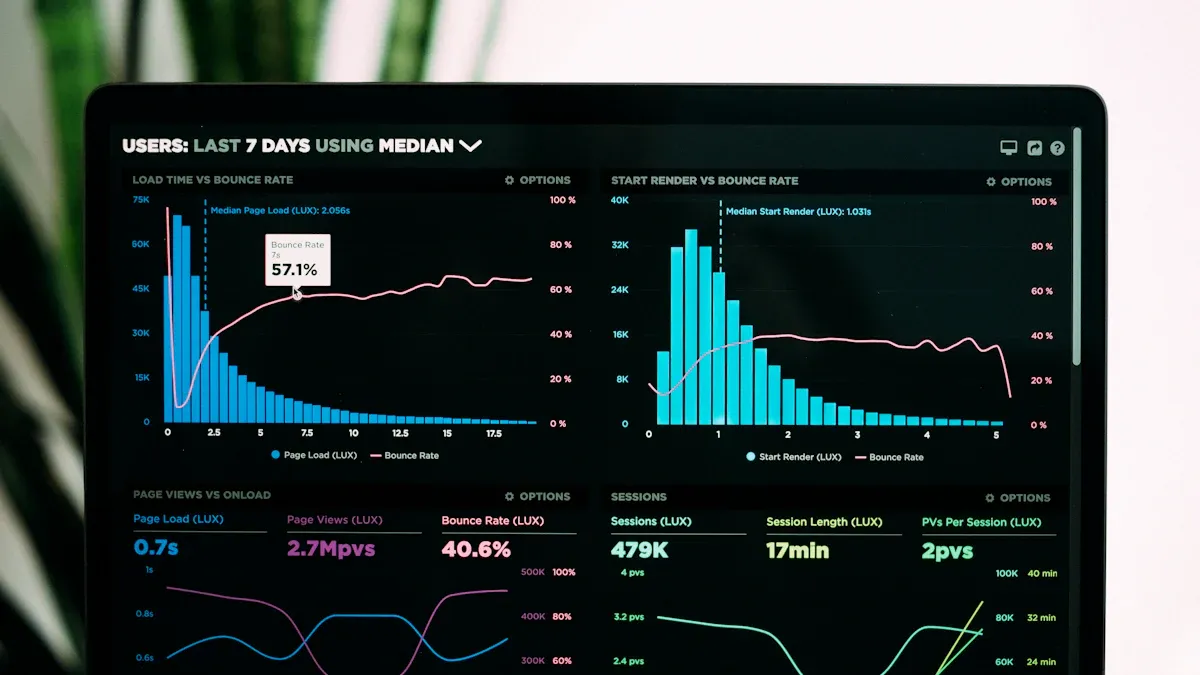

The best way to achieve effective DuPont analysis is to visualize the data. Compared with densely packed tables, visual charts can clearly show key indicators such as return on equity, asset turnover, equity multiplier and their composition, so as to conduct evaluation and analysis.

It is recommended to use a self-service data analysis BI tool, FineBI. It allows users to automatically prepare data, process data, visualize data, and build storytelling dashboards through a process, and then use data analysis to evaluate the business status, discover business problems, and guide decision-making.

As a self-service data analysis software, FineBI is characterized by its simple operation and quick start. Even business personnel who do not understand SQL or code can complete data processing and produce visual charts and data analysis reports through drag-and-drop operations.

First, import the data into FineBI and clean it to organize the required data. FineBI can capture data from various data sources for analysis. In addition to supporting commonly used databases such as Oracle, SQLServer, MySQL, it also supports multi-dimensional databases such as SAP BW, HANA, Essbase, etc. FineBI also supports importing Excel data and importing data from R language scripts. Therefore, it can basically connect to various data sources, open up and integrate them.

If the required information is in multiple tables, you can merge the required information in FineBI's self-service information collection, which is very convenient.

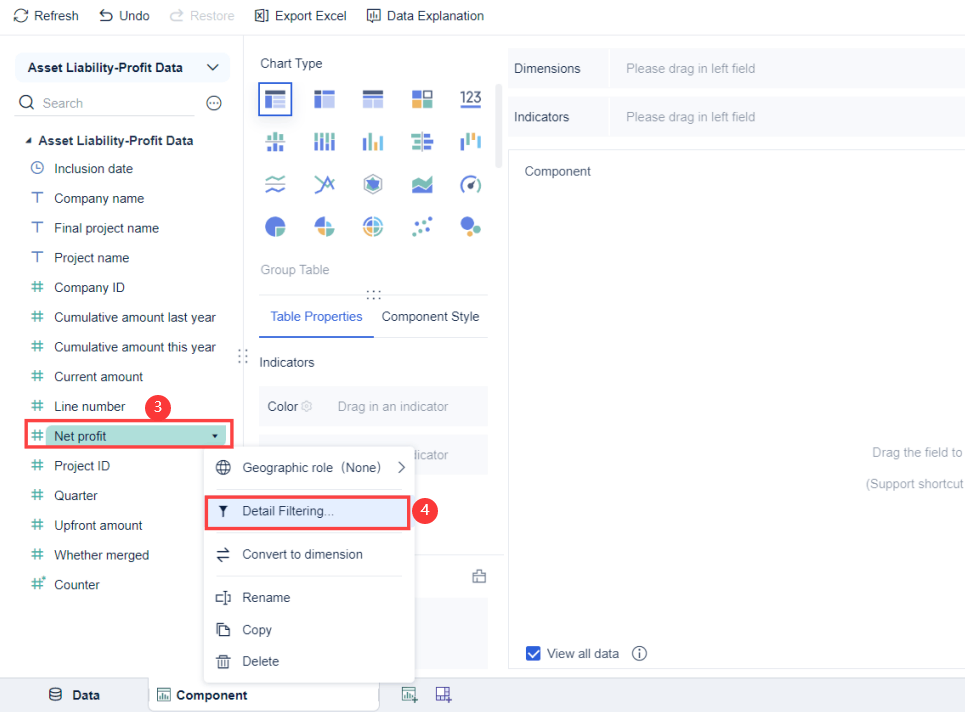

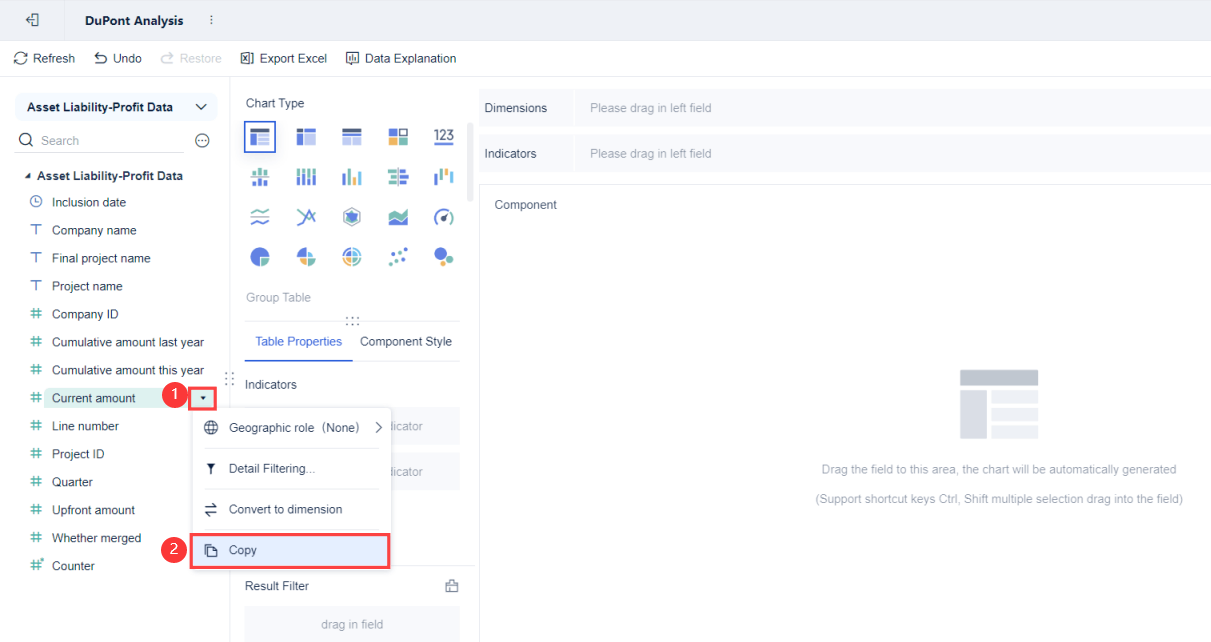

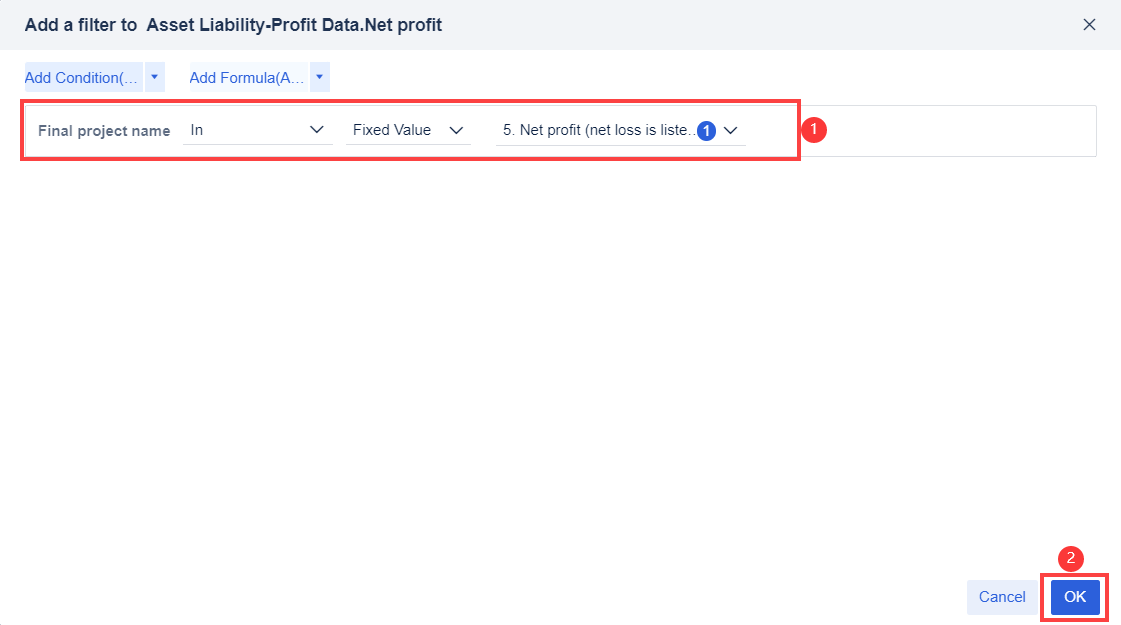

Select the current amount indicator, click the drop-down, select "Copy", name it "Net Profit" and select "Detail Filter".

Select the detailed filter condition as "Final Account Name" belonging to "Net Profit", and click "OK". In this way, we can easily filter out the required net profit value.

Use the above filtering components to filter out the "sales revenue" indicator.

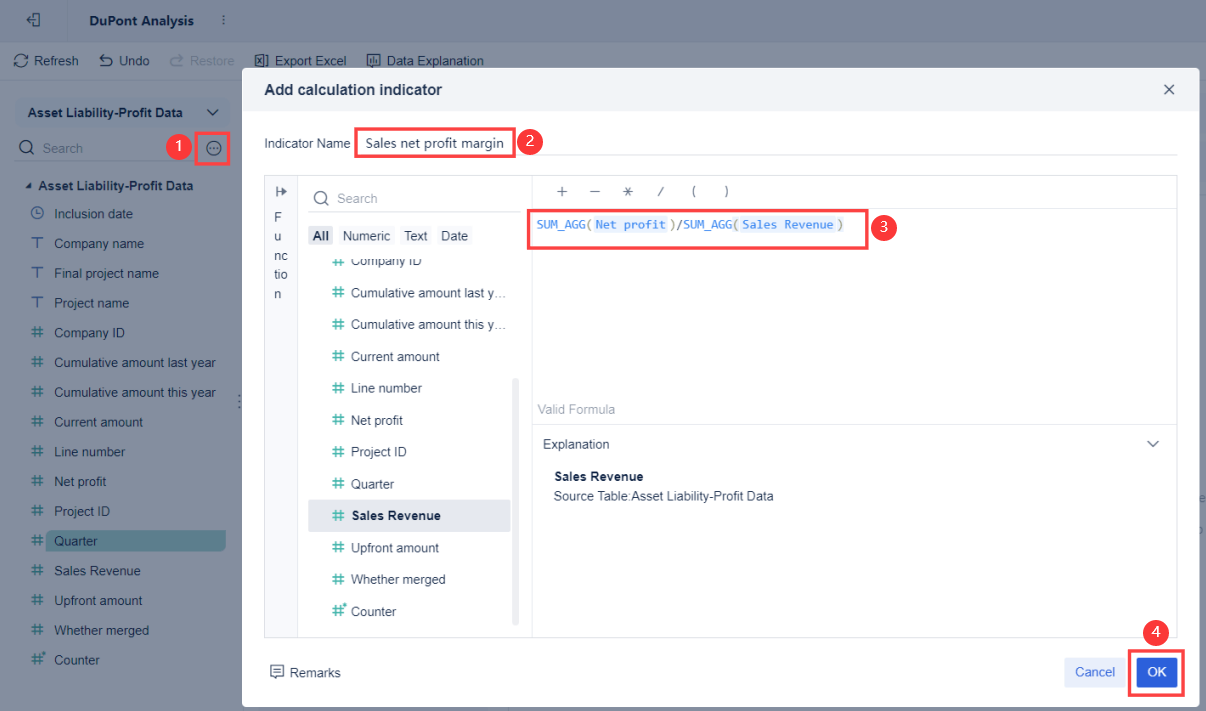

The formula for net profit margin is: net profit margin = net profit / sales revenue.

Add a new "Calculation Field", name it "Net Profit Margin of Sales", enter the formula: SUM_AGG(Net Profit)/SUM_AGG(Sales Revenue) , click "OK", and you will get the "Net Profit Margin of Sales".

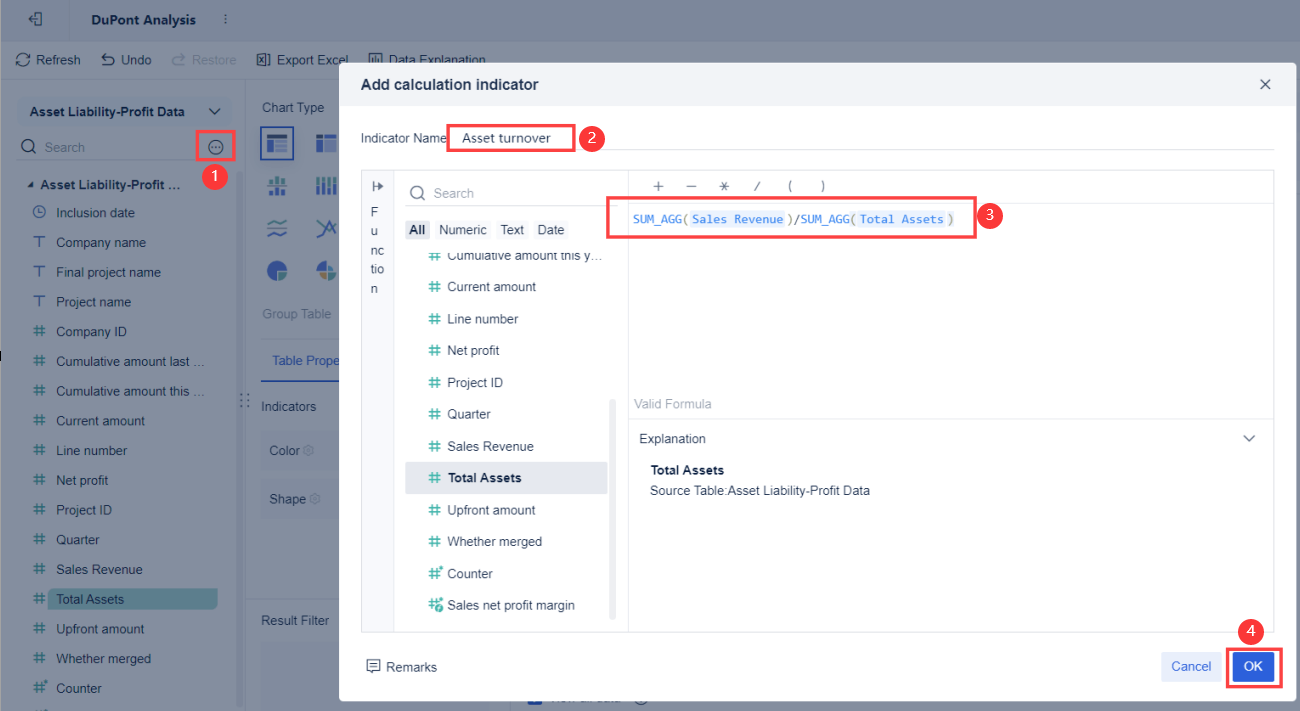

Next, let's calculate the asset turnover rate. After filtering the components to get the desired "sales revenue" and "total assets" as described above, you can use the formula in FineBI to get the "asset turnover rate" in one go.

Add a calculation field, name it and enter the formula: SUM_AGG(Sales Revenue)/SUM_AGG(Total Assets) , then click "OK".

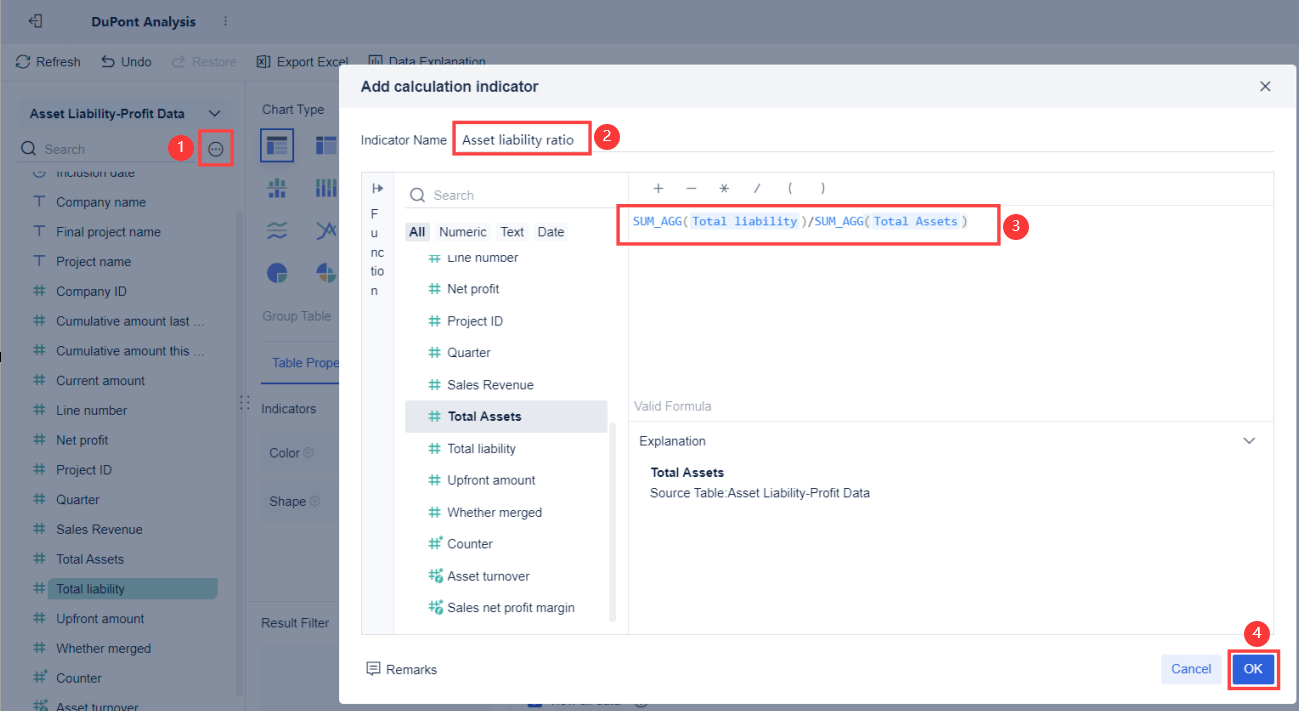

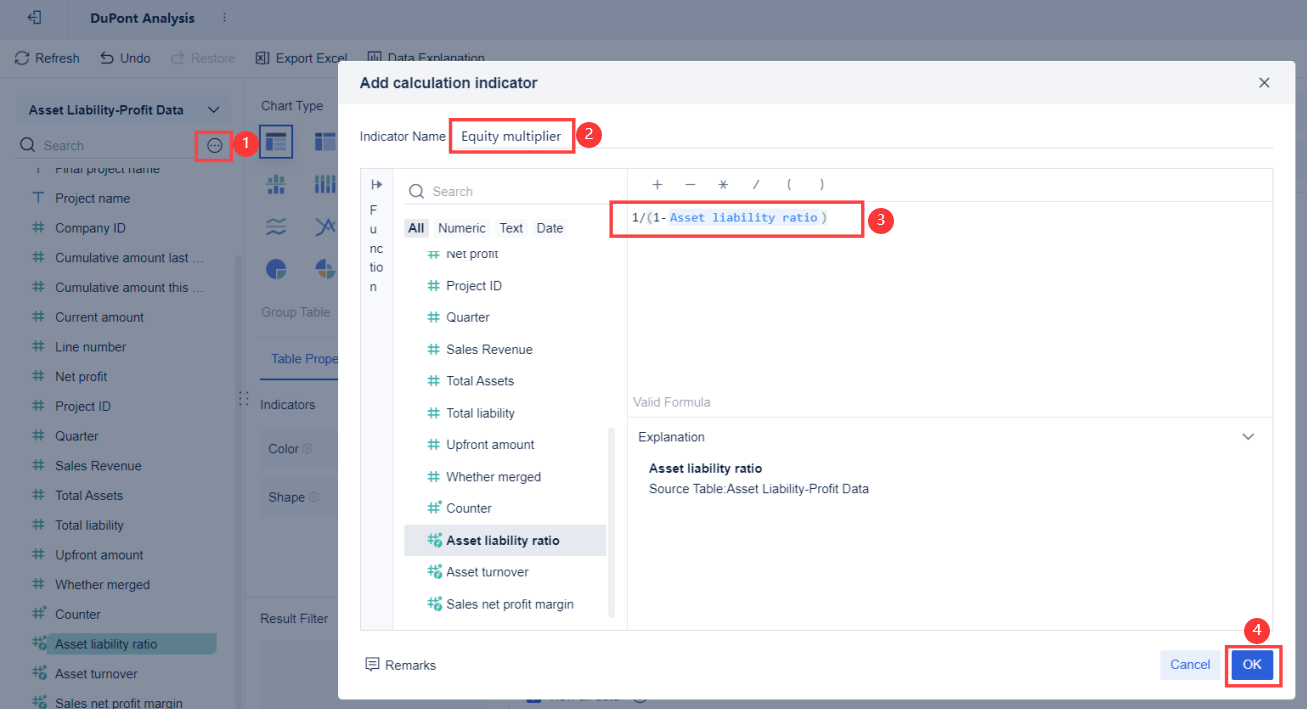

First calculate the debt-to-asset ratio. According to the above method, we can obtain the desired two indicators of "total liabilities" and "total assets" through filtering components, and obtain the "liability-to-asset ratio" through the formula.

Then, add a calculation field, name it and enter the formula: 1/(1-liability-to-asset ratio) , click "OK" to get the "equity multiplier".

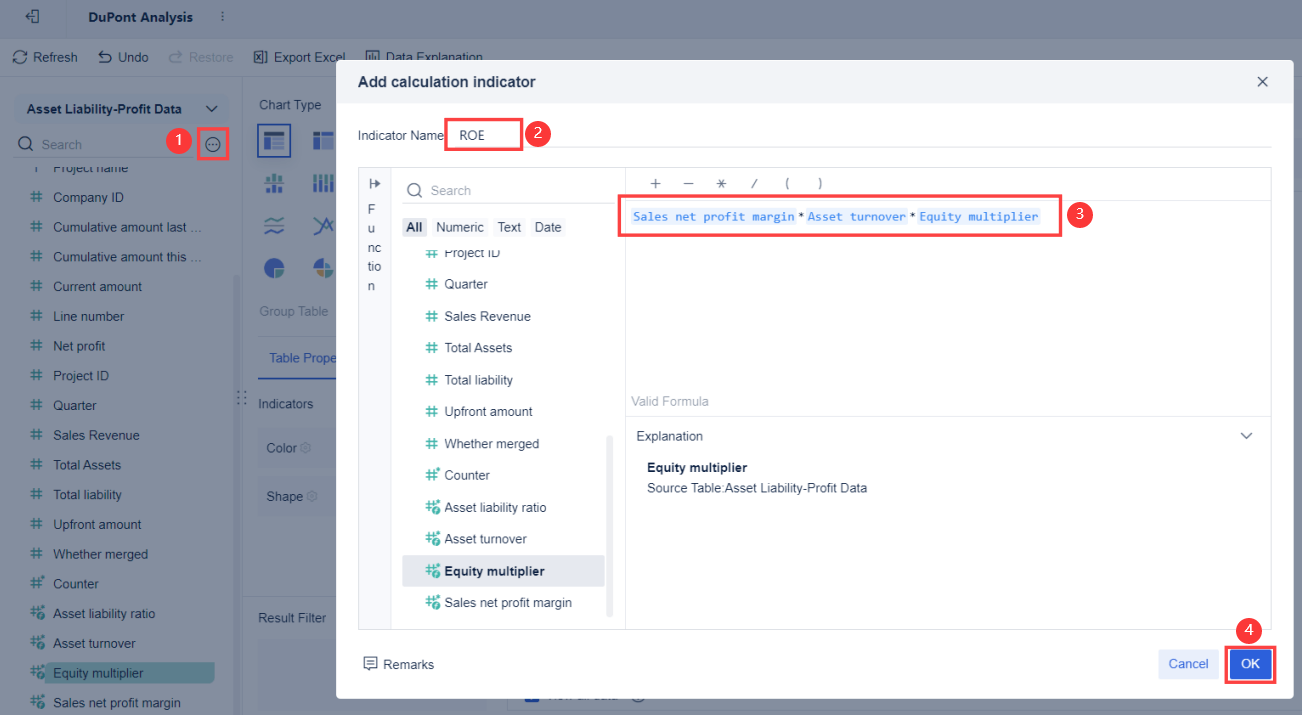

Add a calculated field in FineBI , name it and enter the formula: net profit margin * asset turnover rate * equity multiplier , and click "OK".

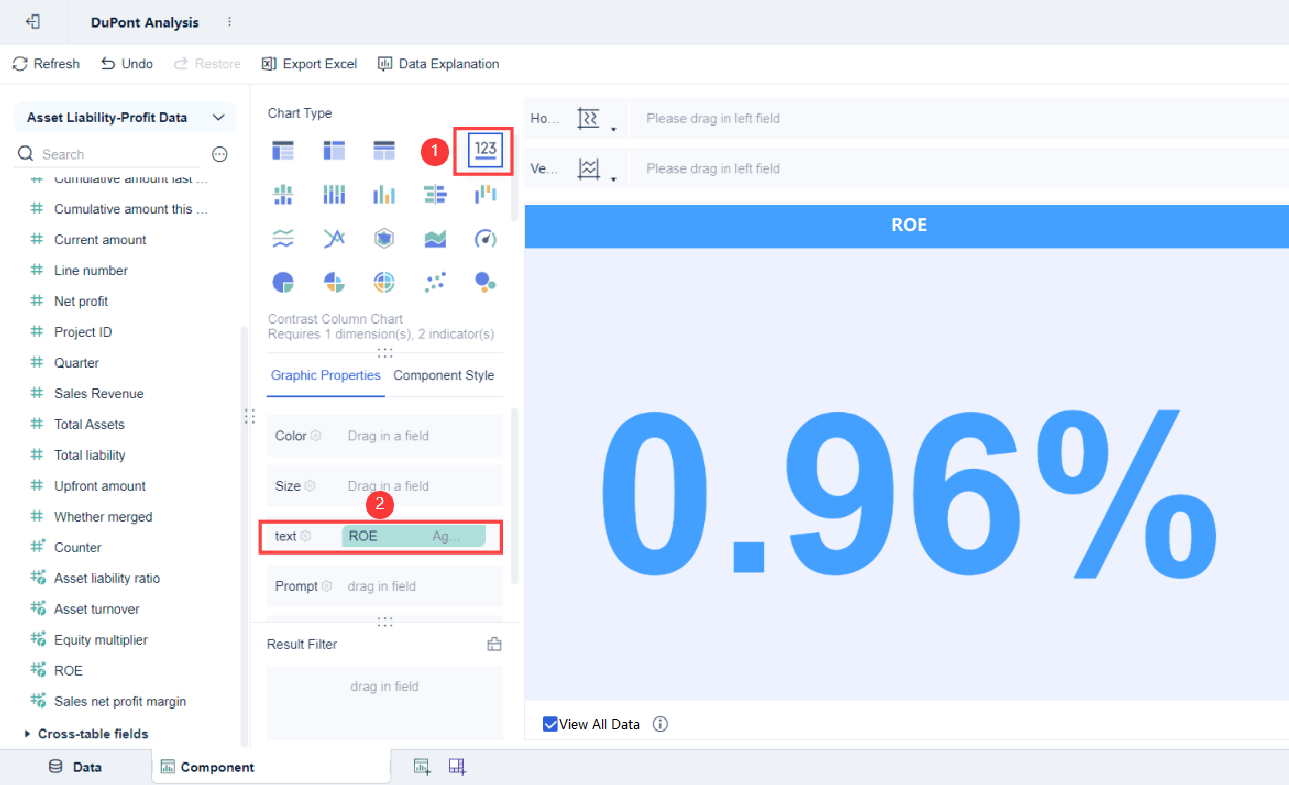

Select the "Indicator Card", drag "Net Asset Return" into the text box, and set the format as shown in the figure below. The other indicators can be done in the same way.

And here’s the final result of the DuPont analysis~

If you’d like to learn more detailed steps for creating a DuPont analysis, please refer to the help documentation: Dupont Analysis

FineBI automates these steps by letting users select the right data fields, apply the dupont analysis formula, and view results instantly. This saves time and reduces errors compared to manual calculations.

FineBI transforms the way organizations use Dupont for financial analysis. The platform automates data integration, so teams always work with up-to-date information. Real-time analytics allow users to monitor changes in key ratios as soon as new data arrives.

Finance teams benefit from FineBI’s ready-made templates for dupont analysis. These templates guide users through each step, from data selection to visualization. Analysts can quickly compare results across years or business units. FineBI frees analysts from manual data processing, allowing them to focus on insights and communication.

The platform’s visualization options, such as pyramid charts, enhance understanding of complex financial relationships. Managers can share dashboards securely, ensuring that decision-makers access the right information at the right time. FineBI’s approach makes dupont analysis accessible, efficient, and actionable for any finance team.

DuPont analysis helps organizations evaluate a company’s earning power and understand what drives profitability. Many finance teams use this method to link financial returns to business strategies and operational management. The analysis allows professionals to monitor profit and margin ratios, which supports efforts to optimize business unit profitability.

Common use cases include:

Large organizations often use DuPont analysis to break down return on equity into profit margin, asset turnover, and financial leverage. This breakdown helps identify strengths and weaknesses in profitability, operational efficiency, and capital structure risk. Companies can benchmark these components against industry standards and track performance trends over time. By simulating changes in each driver, leaders can forecast outcomes and make informed strategic decisions. DuPont analysis enables teams to evaluate a company’s overall financial condition and prioritize areas for improvement.

Tip: DuPont analysis provides a comprehensive analysis that supports sustainable growth and helps organizations align their strategies with financial goals.

While DuPont analysis offers valuable insights, it has several limitations. The method depends on accounting data from financial statements, which may be inaccurate or subject to manipulation. The accuracy of the results relies on the quality of these inputs. Without proper industry or historical benchmarks, it becomes difficult to assess whether the calculated ratios are favorable.

Other limitations include:

For example, a multinational company’s ROE may vary between regions due to different market conditions. During a recession, a construction company’s ROE might drop and later recover, but DuPont analysis only shows a static snapshot. To evaluate a company accurately, finance teams should supplement DuPont analysis with other tools and qualitative assessments. This approach ensures a more complete understanding of the company’s financial health.

DuPont analysis breaks down return on equity into profit margin, asset turnover, and financial leverage. This approach helps organizations pinpoint what drives profitability and where to improve.

FineBI enables teams to visualize and monitor these metrics, supporting strategic planning and data-driven decisions. Explore FineBI to unlock deeper insights and strengthen financial management.

What is Pareto Chart and How Does it Work

How to Do Retention Analysis for Business Success

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

What is Ecommerce Analytics and Why Does It Matter

Ecommerce analytics helps online stores track data, optimize sales, and enhance customer experience for better growth and profitability.

Lewis

Jan 04, 2026

What is Ad-Hoc Analysis and Why is it Important

Ad-hoc analysis lets you answer unique business questions instantly, offering flexible, real-time insights that drive smarter, faster decisions.

Lewis

Sep 16, 2025

What Is a Data Model and Why Does It Matter

A data model defines how data is structured and connected, making information easier to manage, analyze, and use for smarter business decisions.

Lewis

Aug 04, 2025