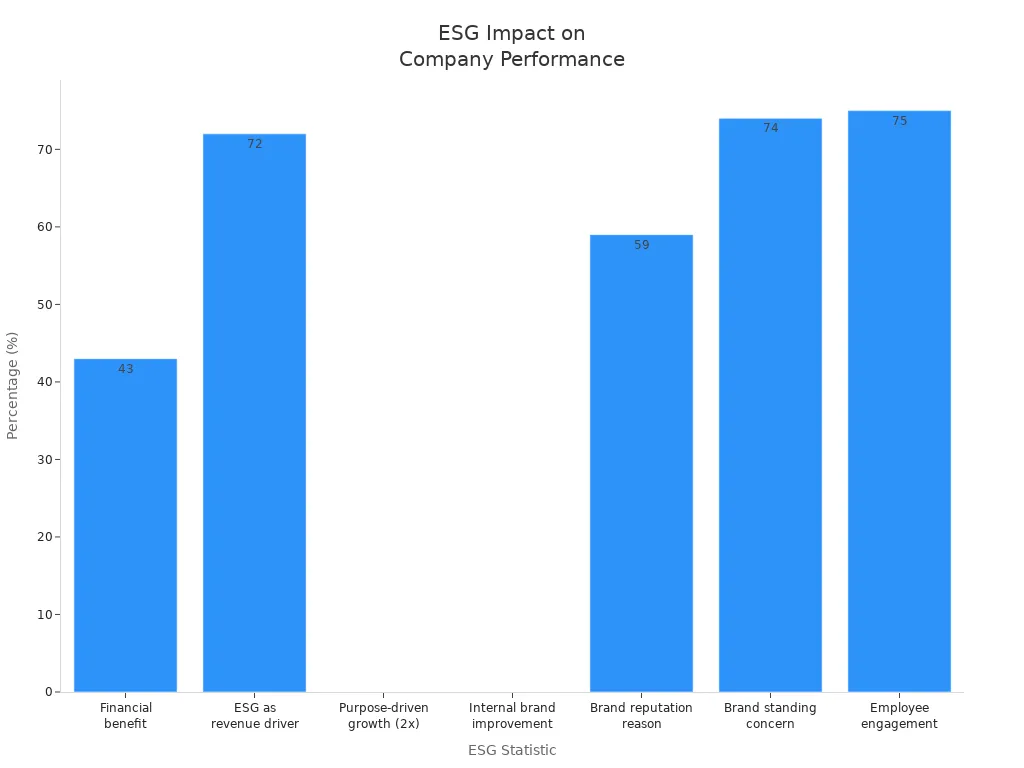

ESG risk management means you integrate environmental, social, and governance factors into your decision-making. You protect your business from risks that could harm financial performance or reputation. Companies lose millions when ESG issues go unchecked. The numbers speak for themselves—74% of executives worry poor ESG performance will damage brand standing, and purpose-driven brands grow twice as fast as profit-focused ones.

You need to understand ESG risk management as a process that helps you identify, assess, and address risks related to environmental, social, and governance factors. This approach goes beyond traditional financial risk management. It focuses on how your company’s actions impact the world and how those impacts can create risks for your business.

ESG risk management covers three main pillars. Each pillar brings unique challenges and opportunities for your organization. The table below shows the core components according to leading industry frameworks:

| Pillar | Description | Key Risk Categories |

|---|---|---|

| Environmental | Examines your impact on the natural world, including climate change and pollution. | Transition Risks, Physical Risks |

| Social | Addresses relationships with employees, customers, and communities, focusing on diversity and ethics. | Labor Standards, Data Privacy |

| Governance | Focuses on leadership, internal controls, and shareholder rights, emphasizing transparency and ethics. | Board Composition, Executive Compensation |

You use ESG risk management to recognize risks early. You evaluate how these risks could affect your operations, reputation, and financial standing. You then implement strategies to reduce or eliminate those risks. This process supports sustainability and long-term value for your business.

ESG risk management helps you protect your reputation, maintain stakeholder trust, and improve financial performance.

You face growing pressure from regulators, investors, and customers to manage ESG risks effectively. Regulatory bodies now require companies to adopt robust governance frameworks, collect accurate data, and integrate ESG considerations into business strategy. You must also conduct double materiality assessments, which means you consider both financial and non-financial impacts.

Here is a summary of regulatory requirements:

| Evidence Description | Key Points |

|---|---|

| Governance Frameworks | You must implement strong governance to comply with ESG regulations. |

| Data Collection Processes | You need effective data collection for ESG reporting. |

| Assurance Measures | You must obtain assurance for ESG disclosures to ensure accuracy. |

| Double Materiality Assessments | You must consider both financial and non-financial impacts. |

| Integration into Business Strategy | ESG must be part of your overall business strategy. |

You see ESG risk management as essential for several reasons:

In finance and manufacturing, ESG risks are especially relevant. You may encounter climate risk exposure, fair lending practices, and ethical conduct requirements. Manufacturing businesses face risks from waste, emissions, worker safety, and financial transparency. You must address these risks to remain competitive and compliant.

When you manage ESG risks well, you gain real business benefits:

Investors and stakeholders look at your ESG risk management practices closely. Transparency in ESG reporting builds trust and credibility. Accurate reporting enables investors to make informed decisions. Strong ESG performance signals stability and readiness for future challenges. Poor ESG records can damage your reputation and reduce your appeal to buyers.

You see new regulations, such as mandatory climate reporting, making ESG risk management even more important. Companies with robust ESG practices position themselves for long-term success and investment attraction.

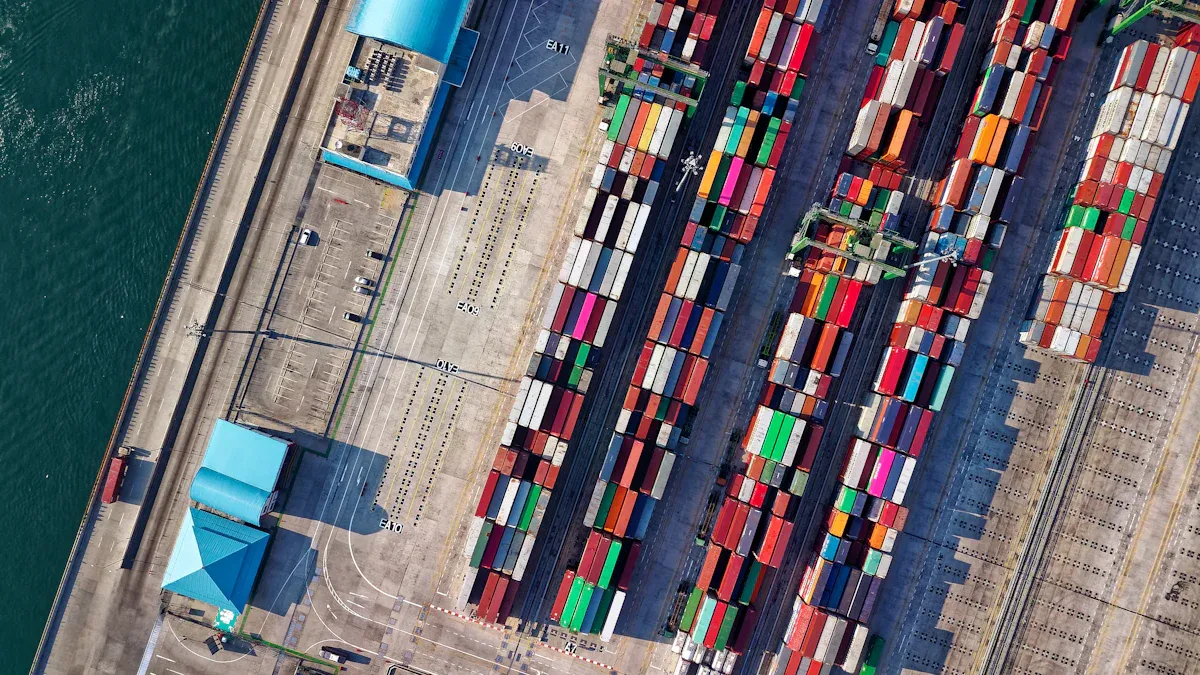

You face environmental risks that can threaten your business operations and reputation. ESG risk management helps you identify and address these risks before they escalate. Common environmental risks include carbon emissions, water usage, waste management, and ecosystem damage. You must also consider supply chain resiliency and human rights issues.

Companies in finance and manufacturing encounter these risks daily. For example, the EU Green Deal requires a 55% reduction in emissions by 2030. The SEC Climate Disclosure mandates transparent reporting of emissions and climate risks. General Electric faced over a billion dollars in costs due to PCB pollution. BP paid 54 billion dollars after the Gulf of Mexico oil rig explosion. Northwest Southern’s toxic derailment in Ohio exceeded a billion dollars in costs.

You must manage these risks to avoid regulatory penalties, compliance costs, and supply chain disruptions. Extreme weather events can delay production and reduce revenue. Negative brand perception can lower market share and stock price. FineReport enables you to consolidate and visualize ESG risk data, making it easier to track material ESG risks and respond quickly.

Social risks focus on how your company treats employees, communities, and consumers. ESG risk management requires you to monitor employment standards, human rights, and societal benefits. You must ensure fair pay, safe working conditions, and equal opportunities.

Social risks include labor rights violations, health hazards, and community impacts. For instance, Cambodian sugar plantations created jobs but led to land appropriation and water pollution. Mining lithium in Chile supports electrification but raises concerns about indigenous rights. Your reputation depends on ethical practices and social responsibility. Firms that ignore social risks may lose trust and face negative perceptions. FineReport helps you visualize social risk data, supporting better decision-making and stakeholder engagement.

Governance risks relate to leadership, transparency, and ethical conduct. ESG risk management requires you to address shareholder rights, board diversity, executive compensation, and anti-corruption measures.

Governance failures can result in financial penalties and reputational damage. Boeing experienced a 32% drop in share price due to safety governance failures. High-profile scandals, such as FTX, show how poor governance leads to legal and financial consequences. You must build strong governance frameworks to maintain consumer trust and avoid costly mistakes. FineReport supports governance risk management by consolidating data and providing clear visualizations for board and executive oversight.

You start effective ESG risk management by identifying the risks that matter most to your organization. This process requires you to look beyond financial data and consider how environmental, social, and governance factors could impact your business. You need a structured approach to uncover potential threats and opportunities.

Follow these practical steps to identify ESG risks:

You can strengthen your ESG risk management by involving key stakeholders and using proven methodologies. In finance and manufacturing, you often see best practices such as board engagement, robust data management, and cross-functional collaboration. These practices ensure you integrate ESG considerations into every part of your business.

| Best Practices for ESG Risk Identification | Description |

|---|---|

| Board Engagement | Involves active participation of the board in ESG initiatives to ensure alignment with company strategy. |

| Data Management | Focuses on robust processes for collecting and reporting ESG data to meet compliance and stakeholder expectations. |

| Cross-Functional Collaboration | Encourages collaboration across departments to integrate ESG considerations into all aspects of the business. |

You should also prioritize metrics that support auditable ESG disclosures and engage experienced vendors for guidance and tools. This approach helps you build a strong foundation for ESG risk management.

Once you identify ESG risks, you need to assess their potential impact and likelihood. ESG risk assessment helps you understand which risks require immediate attention and which ones you can manage over time. You use clear criteria to evaluate each risk and determine your next steps.

Key criteria for ESG risk assessment include:

| Criteria | Description |

|---|---|

| Total Exposure | Evaluation of exposure to each material ESG issue at the subindustry level. |

| Manageable Risk | Identification of risks that can be managed through dedicated ESG programs and policies. |

| Unmanageable Risk | Recognition of risks that are inherently unmanageable for certain companies due to industry-specific challenges. |

| Managed Risk | Assessment of controllable risks based on company policies, programs, and performance measures. |

| Management Gap | Identification of unmanaged risks that impact the company's management score. |

| Unmanaged Risk | Calculation of ESG Risk Ratings by aggregating unmanaged risks for each material ESG issue. |

You can use ESG frameworks and industry benchmarks to compare your performance with peers. ESG benchmarking measures your organization’s performance against industry standards. This process helps you identify strengths, spot areas for improvement, and make better decisions. Materiality matrices can also help you prioritize ESG issues based on stakeholder impact and business relevance.

ESG risk assessments allow you to detect risks before they escalate and uncover potential blind spots by comparing your ESG performance to industry standards.

After you complete ESG risk assessments, you need to manage and monitor these risks effectively. FineReport provides a comprehensive platform to support your ESG risk management strategy. You can use its data entry forms to collect ESG data from multiple sources, ensuring accuracy and consistency. FineReport’s dashboards allow you to visualize ESG risks in real time, making it easier to track progress and identify trends.

FineReport’s decision-making platform brings all your ESG risk management activities together. You can manage user permissions, automate report generation, and integrate ESG data from various systems. This centralized approach supports proactive risk management and helps you respond quickly to emerging issues.

In the finance industry, you can use FineReport to monitor credit risk, regulatory compliance, and asset quality. The platform consolidates data from different departments, giving you a holistic view of ESG risks. In manufacturing, FineReport helps you track environmental performance, worker safety, and supply chain risks. You can create custom dashboards to monitor emissions, waste, and resource usage, supporting your ESG into risk management efforts.

FineReport’s integration capabilities allow you to connect with external data sources and industry benchmarks. You can automate ESG reporting, streamline workflows, and ensure your disclosures meet regulatory requirements. By leveraging FineReport, you strengthen your ESG frameworks and improve your risk management strategies.

Integrating ESG considerations into your risk management process positions your business for long-term success and resilience.

You can achieve stronger financial performance by integrating ESG risk management into your business strategy. Companies that prioritize ESG often outperform their peers. Sustainable funds have outperformed traditional funds over a ten-year period, with 58.8% showing better results. You also see improved risk management, as 54% of companies now include ESG in their risk inventory reporting. This approach helps you identify and address risks early, protecting business continuity and supporting long-term growth.

| Benefit | Evidence |

|---|---|

| Improved risk management | 54% of companies include ESG in risk inventory reporting, enhancing their ability to manage risks. |

| Enhanced portfolio performance | 58.8% of sustainable funds outperformed traditional peers over a 10-year period. |

| Strengthened regulatory compliance | ESG investing helps businesses prepare for regulatory changes and avoid penalties. |

| Attracting and retaining talent | Companies focusing on employee welfare are more likely to attract and retain top talent. |

FineReport's reporting and analytics tools help you visualize ESG data, track performance, and make informed decisions. This leads to better resource allocation and supports sustainable business growth.

You face increasing regulatory demands related to ESG risks. Regulations such as the CSRD in the EU and the SEC’s climate disclosure rule in the U.S. require rigorous risk assessments and transparent ESG reporting. ESG risk management enables you to meet these requirements and reduce the risk of non-compliance. You can avoid operational disruptions from issues like environmental violations or government investigations.

| Compliance Challenge | Description |

|---|---|

| Environmental compliance violations | Improper waste disposal, greenwashing, or misreporting of sustainability metrics. |

| Social impacts | Forced labor in the supply chain or community displacement that can damage reputation and result in penalties. |

| Governance lapses | Failures in transparency, conflicts of interest, or cybersecurity breaches that undermine trust. |

You build stakeholder trust by communicating your ESG efforts and challenges regularly. Transparent ESG reporting and disclosure increase credibility. Investors and customers want assurance that your business follows sustainable practices and upholds corporate social responsibility. When you engage stakeholders and address their concerns, you strengthen relationships and support business continuity.

FineReport supports your ESG disclosure process, ensuring accurate and timely reporting. This transparency enhances stakeholder confidence and positions your business as a sustainable business leader.

You encounter several obstacles when you implement ESG risk management in your business. Many businesses struggle to address climate change, supply chain issues, and fraud concerns. Effective governance and monitoring also present significant challenges. The table below highlights the most common challenges you may face:

| Challenge Type | Description |

|---|---|

| Climate Change | ESG risks related to climate issues are a significant concern for companies. |

| Supply Chain Issues | Ongoing global supply chain concerns pose challenges in risk management. |

| Fraud Concerns | Companies face risks related to fraud that complicate ESG management. |

| Governance and Monitoring | Effective governance and monitoring are essential yet challenging aspects. |

You may find it difficult to assess and monitor ESG risks. Many businesses struggle to collect and analyze data on key ESG issues. This lack of assessment and monitoring can hinder your ability to track performance and improve reporting. You need reliable systems to manage ESG risk management effectively.

You can overcome these challenges by adopting proven strategies. Start by implementing ESG risk monitoring processes. Establish a framework that allows you to detect and evaluate risks continuously. Align your operations with ESG standards. Revise your internal policies and invest in technology that supports sustainability.

You should conduct third-party and supply chain ESG due diligence. Assess and monitor the ESG practices of your partners to ensure compliance and sustainability. Leverage predictive analytics to forecast potential risks before they occur. This proactive approach helps you stay ahead of emerging threats.

FineReport supports your ESG risk management journey. You gain access to robust support, training, and integration services. FineReport helps you consolidate ESG data, automate reporting, and visualize risks in real time. You can streamline workflows and ensure your disclosures meet regulatory requirements. With FineReport, you build a resilient business that adapts to ESG challenges and achieves long-term success.

You strengthen your business by making ESG risk management a core part of your strategy. When you embed ESG into long-term planning, you support compliance, protect your reputation, and drive sustainable growth.

Start by appointing ESG officers, setting measurable goals, and conducting regular audits. FineReport can help you take the first step toward effective ESG risk management and build a resilient future.

How to Do Retention Analysis for Business Success

What is Pareto Chart and How Does it Work

How DuPont Analysis Helps You Understand Your Business

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

9 Best Supply Chain Tools for Smarter Management in 2026

Find the best supply chain tools for 2025 to boost efficiency, gain real-time insights, and achieve smarter management for your business.

Lewis

Dec 18, 2025

Top 10 Supply Chain Tracking Software for 2026

Compare the top supply chain tracking software for 2026 to boost visibility, automate workflows, and leverage AI analytics for smarter decisions.

Lewis

Dec 18, 2025

Top 10 Supply Chain Management Software for Small Businesses

See the top 10 supply chain management software comparison for small businesses in 2026. Compare features, pricing, and scalability to find your best fit.

Lewis

Dec 18, 2025