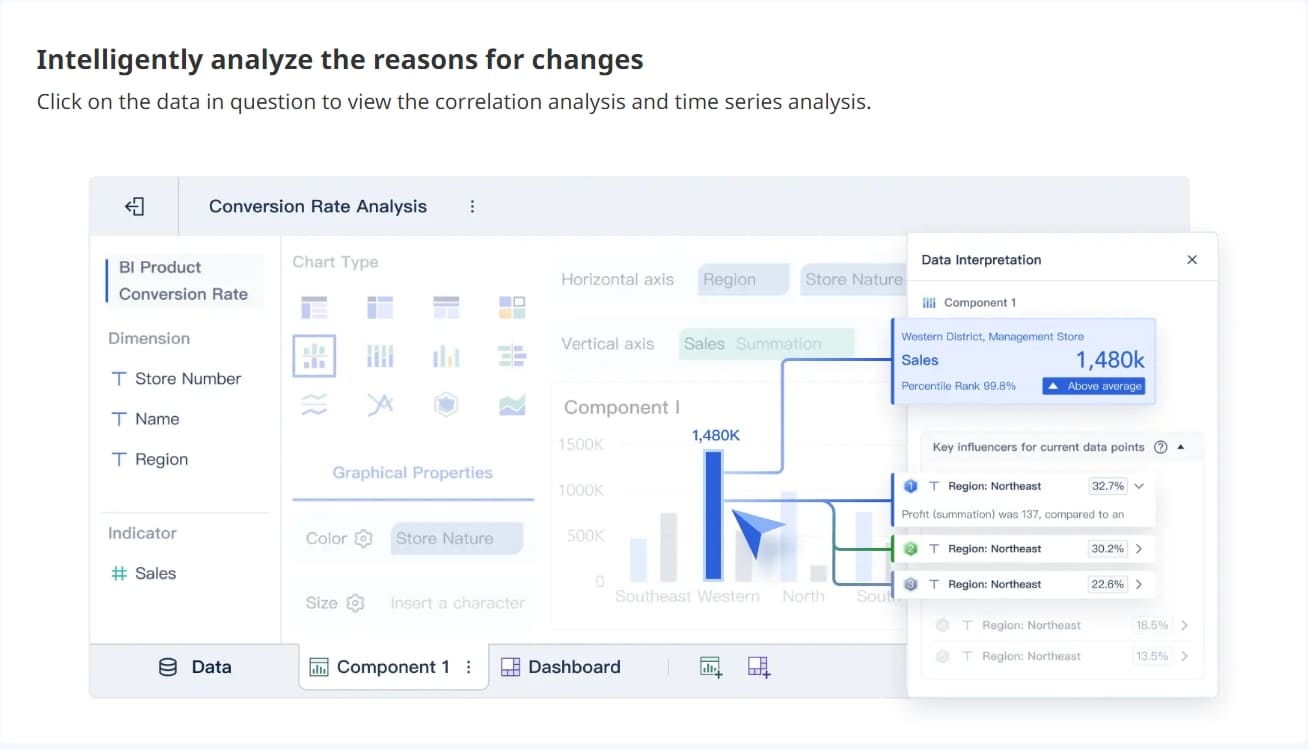

Book value per share tells you how much equity each share has if a company sells everything it owns. You can use this number to see if a stock costs too much or too little. Many investors use book value per share to find out what a company is really worth, especially in fields like manufacturing and banking. FineBI from FanRuan lets you link your financial data, make easy-to-read charts, and get updates right away. This helps you make better choices when you invest.

FineBI turns raw financial metrics like book value per share into clear, interactive visuals—so you can uncover insights faster and invest with greater confidence. (click the demo to engage)

Book value per share shows you how much each share of a company is worth based on its actual assets. You find this number by taking the company’s total assets, subtracting all its debts, and then dividing the result by the total outstanding shares. This calculation gives you a clear picture of what each share would be worth if the company sold everything it owns and paid off all its bills.

Book value per share is a key metric in financial analysis. It helps you see the real value behind a company’s stock, not just the price you see in the market.

Many financial education materials explain that book value is the amount left after liquidating all assets and repaying liabilities. This number reflects the company’s equity pricing in the market. When you look at book value per share, you get a sense of the company’s true worth.

You might wonder why book value per share is important. This metric helps you decide if a stock is priced fairly. If the market price is much higher than the book value per share, the stock might be overvalued. If the price is lower, it could be undervalued.

Book value per share gives you a solid starting point for judging a company’s financial health. You can use it to compare companies in the same industry or track changes over time. When you use tools like FineBI, you can quickly see these numbers and make smarter investment choices.

You can figure out the value of each share with a simple formula. This formula shows how much equity each share would get if the company sold everything and paid its debts. Here is a table that explains the main parts of the formula:

| Component | Description |

|---|---|

| Total Common Stockholder Equity | The total equity available to common shareholders |

| Number of Common Shares | The total number of common shares outstanding |

| Book Value Per Share (BVPS) | Total Common Stockholder Equity / Number of Common Shares |

This formula helps you check what a company’s shares are really worth. Many investors use it to compare companies in the same business.

Here are the steps to find book value per share for any company:

FineBI by FanRuan makes these steps much easier. You can link your financial data from different places, clean and sort it, and do the math without doing it by hand. FineBI lets you make dashboards that show book value per share right away. You can see updates as soon as new data is added. This helps you make fast and smart choices when you look at stocks.

Book value per share helps you see how healthy a company is. It shows what each share is worth if the company sells everything and pays its debts. If book value per share goes up, the company is growing its net worth. This often means the company is strong and managed well.

When book value per share is higher than the market price, the stock might be undervalued. This number gives you a safe guess of what the company is worth. Many investors use it to find companies that others may miss. Watching book value per share over time shows if a company is getting better or having problems.

Tip: FineBI from FanRuan lets you link your financial data and see book value per share right away. You can make dashboards that update when new numbers come in. This helps you and your team spot changes and decide quickly.

Book value per share is more than just one number. You can use it to compare companies in the same field. Banks and real estate companies have lots of assets. In these areas, book value per share helps you know if a stock is priced fairly.

Big investors use the price-to-book (P/B) ratio to check a stock’s market price against its book value per share. If the P/B ratio is less than 1, the stock may be undervalued. If it is more than 1, the stock may be overpriced. This ratio helps you find good investments where the market does not see the real value.

Book value per share is even more useful with tools like FineBI. You can study and see this number for many companies and different times. FineBI’s dashboards show changes as they happen, so you always know what is going on. This helps you make smart choices using data.

Book value per share and market value are not the same. They tell you different things about a company’s stock. Book value per share shows what each share is worth using the company’s balance sheet. Market value tells you what people will pay for a share right now.

Here is a table that shows the main differences:

| Category | Book Value of Shares | Market Value of Shares |

|---|---|---|

| Meaning | The value in the company’s financial statements. | The value of all shares in the market. |

| Presence in Books | Shown in the company’s balance sheet. | Not shown in any financial statements. |

| Stability of Valuation | Changes only if assets or debts change a lot. | Changes all the time with share prices. |

| Basis of Valuation | Found by subtracting debts and intangible assets from total assets. | Found by multiplying share price by total shares. |

| Target Users | Checked by shareholders and people who want to invest. | Checked by regular investors and traders. |

| Investment Approach | Used for long-term investing. | Used for short-term investing. |

Book value per share gives a steady number from real company data. Market value per share changes often because buyers and sellers set the price.

Use book value per share to see the real worth of a company’s assets. This number helps you know if a stock is priced too high or too low. If you compare the price to book value per share, you can find good deals.

Market value is useful when you want to know what you could sell your shares for today. This value helps you follow trends and see what people think about a company. Traders use market value for quick choices. Long-term investors look more at book value per share.

Tip: Use both numbers to get the full story. Book value per share shows the company’s base. Market value shows what people will pay. Comparing them helps you make smarter choices when you invest.

You may ask how book value changes over time. Many things can make this number go up or down. Some of the main reasons are in the table below:

| Factor | Description |

|---|---|

| Impact of Depreciation | When depreciation is high, assets lose value. This can make book value per share go down. |

| Effect of Inventory Management | If a company has too much inventory, costs can rise. This can hurt the value. |

| Consequences of Changes in Debt | Getting more debt or equity can raise total assets. Paying off debt or buying back shares can lower the value. |

Big company actions can also change book value. Here are some examples:

Watching how book value changes helps you learn about a company’s money story.

Book value per share is useful, but it is not perfect. It only uses numbers from the balance sheet. It does not include things like brand value, patents, or future growth. Sometimes, companies own things that are hard to count, like ideas or inventions. These are not in the calculation.

Book value per share can also change fast if a company writes down assets or gets new debt. This makes it less steady for some businesses, especially those with many things you cannot touch. Always use book value per share with other numbers to see the whole picture.

You have learned that book value per share helps you see if a stock is too cheap or too expensive. You find it by dividing equity by the number of shares. This number is most helpful when you use it with other numbers like ROE and P/B ratio. Many investors check more than one thing to pick good companies. FineBI from FanRuan shows these numbers in easy charts, so you can understand them quickly.

Table: Key Takeaways from Recent Research

| Key Takeaway | Description |

|---|---|

| Measure of Value | BVPS helps you know if a stock costs less or more than its market price. |

| Limitations | BVPS does not always show the real market value, uses old costs, and leaves out things like brand names. |

| Not Isolated | Do not use BVPS alone to make choices; you need to look at other company facts too. |

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

You use book value per share to see if a stock is undervalued or overvalued. This number helps you compare companies and make better investment choices.

Check book value per share every quarter when companies release financial reports. This helps you track changes and spot trends in a company’s financial health.

Yes! FineBI lets you connect your financial data, create dashboards, and see book value per share in real time. You get updates as soon as new data arrives.

No, you should use book value per share with other metrics like earnings per share and return on equity. This gives you a full picture of a company’s value.