You need to know if your business can pay bills now. The cash ratio helps you see this. It compares your cash and cash equivalents to your current debts. This ratio is the strictest way to measure liquidity. It only counts cash and assets you can use right away. A high cash ratio means you can pay debts with cash anytime. Here is how the cash ratio compares to other liquidity ratios:

| Liquidity Ratio | Description | Predictive Value for Solvency |

|---|---|---|

| Cash Ratio | Measures ability to pay current liabilities with cash and equivalents. | Shows your liquidity right now. |

| Current Ratio | Compares current assets to current liabilities. | Gives a wider look at short-term financial strength. |

| Quick Ratio | Leaves out inventory from current assets. | Gives a careful measure of liquidity. |

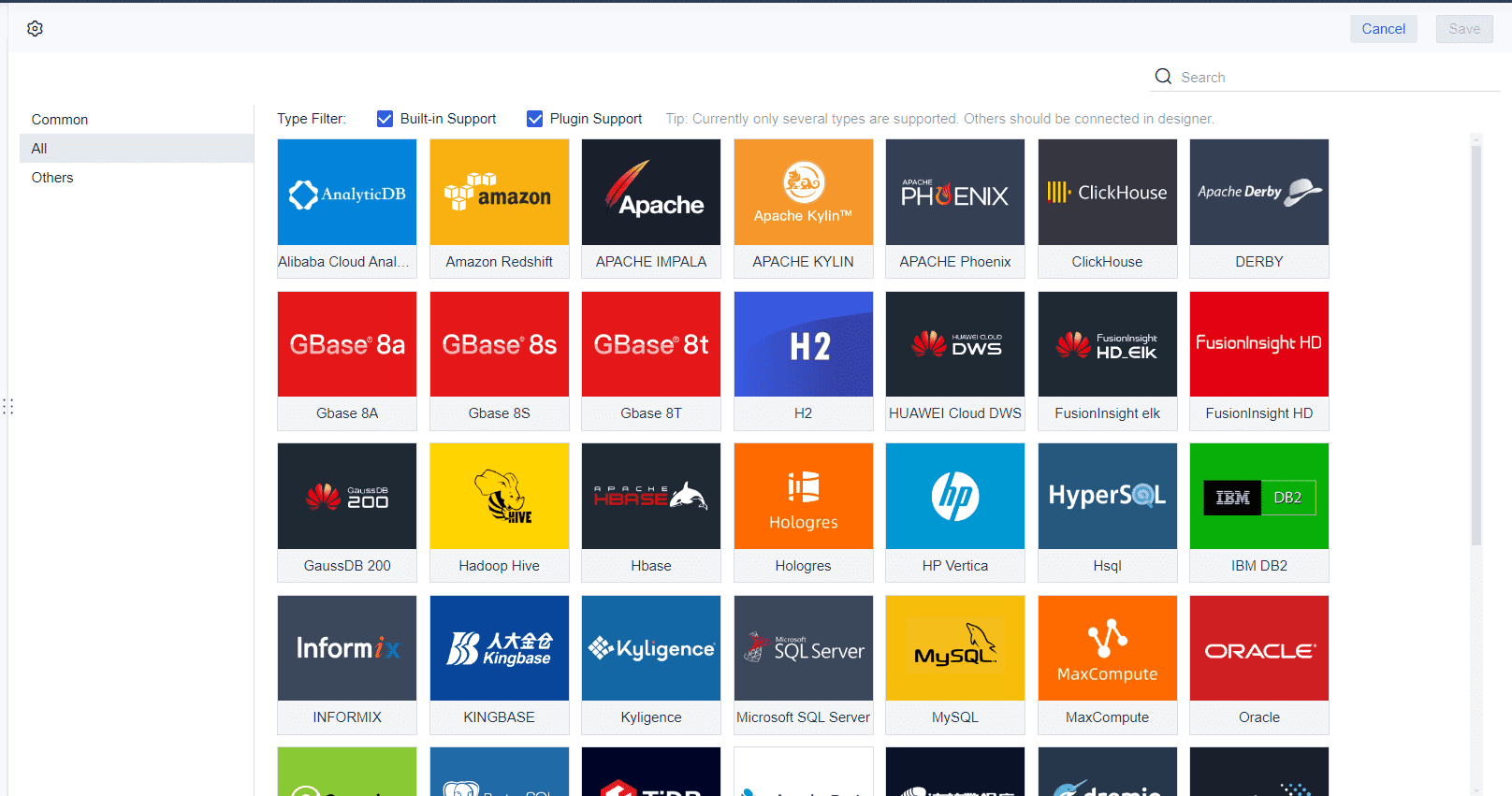

Modern tools like FineReport from FanRuan help you track cash. They make clear reports. This makes it easier to watch your business’s liquidity.

You want to know if your business can pay its short-term debts right away. The cash ratio helps you answer this question. The cash ratio definition is simple: it measures how much cash and cash equivalents you have compared to your current liabilities. This ratio uses only the most liquid assets, so you get a clear picture of your ability to pay bills now.

Here are the main parts of the cash ratio:

| Component | Type |

|---|---|

| Cash & Cash Equivalents | Numerator |

| Short-Term Liabilities | Denominator |

Cash and cash equivalents include things you can turn into cash quickly. These are:

Short-term liabilities are debts you must pay within a year. These include:

The cash ratio gives you a strict test of your liquidity. It does not count inventory or other assets that may take time to sell.

You need to know if you can pay your bills without delay. The cash ratio shows if you have enough cash on hand to cover your short-term debts. This ratio focuses only on the most liquid assets, such as cash and marketable securities. You do not have to worry about selling inventory or waiting for payments from customers.

Financial analysts use the cash ratio because it gives a clear view of your liquidity. It tells you if your business can meet its obligations using only cash and cash equivalents. If your cash ratio is high, you can pay your debts right away. If it is low, you may need to find more cash or delay payments.

Tip: A strong cash ratio can help you feel confident about your business’s financial health. It also reassures lenders and investors that you can handle short-term challenges.

The cash ratio helps you check if your business can pay short-term debts with cash right now. The formula is easy to use:

Cash Ratio = Cash and Cash Equivalents / Current Liabilities

This formula only uses the most liquid assets. You do not count inventory or accounts receivable. You only look at cash and cash equivalents because you can use them right away.

Here is a table that shows what each part means:

| Component | Definition |

|---|---|

| Cash | Money in bills, coins, and checking accounts. |

| Cash equivalents | Investments you can turn into cash fast, like money market instruments. |

| Current liabilities | Debts you must pay in one year, like short-term loans and payables. |

You can find these amounts on your company’s balance sheet. Cash and cash equivalents are at the top of your assets. Current liabilities are listed under the liabilities section.

Follow these steps to figure out your cash ratio:

Let’s see an example:

Imagine your company has:

You use the formula:

Cash Ratio = 186,000 = 1.00

This means you have enough cash and cash equivalents to pay all your current liabilities right now.

💡 Tip: FineReport can help you do this automatically. FineReport connects to your financial data and gets the latest numbers for cash, cash equivalents, and current liabilities. It figures out the cash ratio for you and shows the results in simple dashboards. You can see your liquidity quickly and share reports with your team. This saves you time and helps you make better choices.

You can use FineReport to watch your cash ratio over time. The software helps you spot changes and act fast if your liquidity changes. You do not have to do math by hand or worry about mistakes. FineReport makes cash ratio calculation easy and trustworthy.

With FineReport, finance teams get clear dashboards and real-time alerts—so they can stay on top of liquidity without second-guessing the numbers. (click the demo to engage)

When you look at your cash ratio, you see how much cash you have compared to what you owe soon. This number gives you a strict test of your liquidity. The cash ratio only counts cash and cash equivalents, so it shows if you can pay your short-term debts right away. You do not include inventory or accounts receivable. This makes the cash ratio a conservative measure.

Here is what different cash ratio values can tell you:

The interpretation of the cash ratio helps you understand your financial safety net. Companies with higher cash ratios often perform better during tough economic times. More cash gives you a buffer when business slows down.

You may wonder what number you should aim for. A good cash ratio depends on your industry and business needs. Financial experts say a cash ratio close to 1.0 is ideal for many companies. This means you can cover all your short-term debts with cash and cash equivalents. Ratios between 0.5 and 1.0 are also healthy. They show you have strong cash coverage for your obligations. If your cash ratio drops below 0.5, you may face liquidity risk. If your cash ratio goes above 1.5, you might have too much cash sitting idle.

Different industries have different standards. Here is a table to help you compare:

| Sector | Cash Ratio Characteristics |

|---|---|

| Manufacturing | Usually lower cash ratios due to efficient working capital management. |

| Retail | Often shows lower ratios, with discount stores sometimes as low as 0.276. |

| Technology | Tends to keep higher cash ratios to handle uncertainty and innovation risks. |

You should check your cash ratio regularly. This helps you spot changes in your liquidity and make smart decisions for your business.

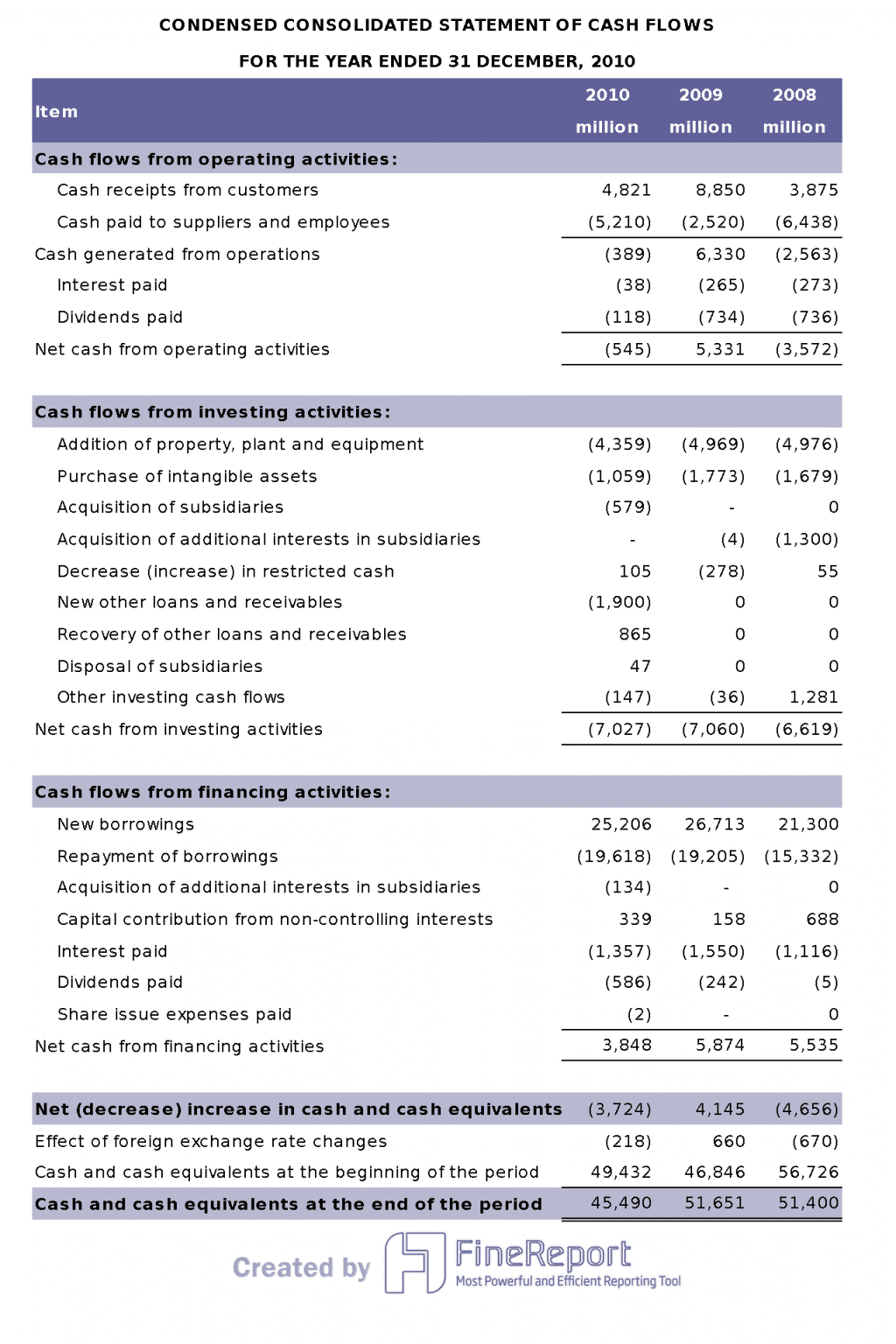

You want to know your company’s cash status anytime. FineReport makes this easy for you. The software links to your financial data. It gathers info from many places. You can see cash, cash equivalents, and current liabilities together. This helps you figure out your cash ratio fast. You can check your liquidity without trouble.

FineReport works with databases, Excel, and cloud services. You do not have to use many different systems. Here is how FineReport helps you handle your financial data:

| Feature | Description |

|---|---|

| Data Integration | Connects to SQL databases, Excel files, and cloud services for complete data accessibility. |

| Data Connectivity | Centralizes data from different systems, giving you a unified view for analysis and reporting. |

You can set up reports that update your cash ratio each day. FineReport builds dashboards that show your cash and debts right now. You can see changes and act fast if your cash ratio shifts. This helps keep your business safe and ready for anything.

Tip: Use FineReport’s dashboards to share your cash ratio with your team. Everyone can see the newest numbers and make smart choices together.

Many companies use FineReport to make financial analysis better. For example, Founder Securities is a top financial company. They used FineReport’s tools to handle lots of data. They watched cash, checked liquidity, and made good choices during a big merger. FineReport helped them move 50,000 user accounts without problems and keep things running.

You can use FineReport to automate your cash ratio reports. This cuts down on manual work and stops mistakes. The software gives you clear charts and current info. This means you always know your cash status and can react quickly to changes in your business.

Knowing how the cash ratio compares to other ratios helps you see more about your business’s health. You can use different ratios to check how fast you can pay debts. Each ratio uses different types of assets in its math. Let’s see how the cash ratio is different from the quick ratio and the current ratio.

The quick ratio gives a wider view of your liquidity than the cash ratio. It counts cash, cash equivalents, short-term investments, and accounts receivable. This means you include money you will get soon, not just what you have now.

Here is a table to help you see the difference:

| Metric | Cash Ratio | Quick Ratio |

|---|---|---|

| Calculation | (cash + cash equivalents) / current liabilities | (current assets - inventory) / current liabilities |

| Interpretation | Measures immediate liquidity without future collections | Provides a broader view of liquidity including receivables |

You might use the quick ratio if your business has lots of receivables you can turn into cash fast. This ratio helps if you work in a field where inventory sells slowly or you wait for customers to pay.

The current ratio is the broadest way to measure short-term financial strength. It counts all current assets, like cash, receivables, inventory, and other things you can turn into cash in a year. This ratio shows if you can pay debts using everything you own that is easy to sell or collect.

Here is a table that shows the main differences:

| Ratio | Definition | Assets Considered |

|---|---|---|

| Cash Ratio | The strictest liquidity measure, comparing cash and cash equivalents to current liabilities. | Only cash and cash equivalents |

| Current Ratio | A liquidity ratio that measures a business’s ability to pay short-term debts. | All short-term assets |

You can use the current ratio to get a big view of your ability to pay bills. The cash ratio is the strictest test, and the quick ratio is in the middle. By looking at all three, you can better understand your company’s cash and liquidity.

Tip: Use these ratios together to find trends and make smart choices about your cash and short-term bills.

You should not use only the cash ratio to judge your company’s health. This ratio just looks at cash and cash equivalents. It does not tell you everything. Many things can change how much cash you have. If you only look at this number, you might miss other key facts.

Here are some reasons to be careful:

You should also know that the right amount of cash depends on your industry. Some businesses need to keep more cash ready. Others can do fine with less. The table below shows why industry differences matter:

| Industry Characteristics | Cash Ratio Interpretation |

|---|---|

| Varies by industry | Appropriate levels differ |

| Low ratios | Indicates less financial flexibility |

If your cash ratio is low, you may not have much room to handle problems. This can be hard if you get a big bill or sales drop. Auditors watch low cash ratios closely, especially in risky areas.

Note: Always use the cash ratio with other checks. Look at other ratios and your company’s full money picture. This helps you avoid mistakes and make better choices about your cash and liquidity.

You now know the cash ratio is a tough way to check liquidity. It tells you how much cash and cash equivalents you have compared to what you owe soon. You find it by dividing cash and cash equivalents by current liabilities. This ratio helps you see money problems early and plan what to do next.

FineReport makes it easier to look at your finances. With real-time data, automation, and clear pictures, you can watch your cash and make better choices. BI tools show you everything, help you get ready for the future, and let you use facts instead of guessing.

| Feature | Benefit |

|---|---|

| Real-time data access | Accurate, up-to-date financial insights |

| Automation | Fewer errors, faster reporting |

| Data visualization | Easier understanding of complex data |

Tip: Try BI tools like FineReport to help you plan your money and stay ahead in business.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

You include cash in hand, checking accounts, money market funds, and short-term investments you can turn into cash quickly. Do not count inventory or accounts receivable.

You should check your cash ratio every month. This helps you spot changes in your liquidity and act before problems grow.

Yes. If your cash ratio is too high, you may not use your cash well. You could invest extra cash to help your business grow.

FineReport connects to your financial data and updates your cash ratio automatically. You see real-time dashboards and reports. This helps you make quick, smart decisions.