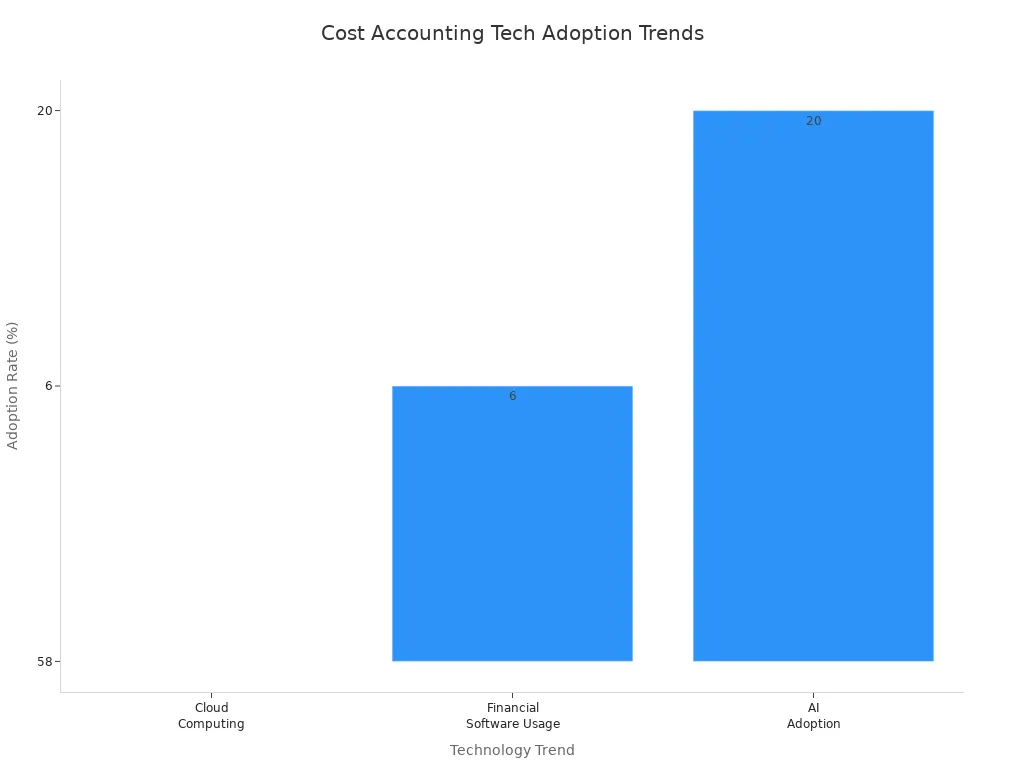

Cost accounting helps you keep track of your business costs. It lets you look at your spending and manage it better. You use cost accounting to make smarter choices and save money. This can help your business earn more profit. Today, businesses use digital tools to keep their numbers right. They also use data integration to stay updated. Many companies now use cloud accounting systems and AI technology. These tools help them work faster and easier, as the chart below shows. Brands like FanRuan help you link and study your financial data. This makes it easier for your business to do well.

Cost accounting helps you keep track of every cost in your business. It shows you where your money goes. This helps you manage your spending better. You can see your expenses clearly. This helps you make smart choices about prices, budgets, and spending.

Cost accounting uses some important rules. These rules help you record and study costs the right way. Here is a table that explains the main rules:

| Principle | Description |

|---|---|

| Cause and Effect | Every cost has a reason. For example, you charge the electricity used by a machine to the product it helps make. |

| Matching | You match costs with the earnings they help create. This ensures you report profits accurately. |

| Consistency | You use the same methods of cost accounting over time. This makes it easier to compare results. |

| Accrual | You record costs when they happen, not when you pay cash. This gives a clearer picture of performance. |

| Materiality | You focus on important costs. Small costs can be ignored to keep records simple. |

| Prudence | You report costs carefully. It is better to show higher costs than lower, so you do not overstate profits. |

Some people think cost control and cost accounting are the same. They are not. Cost accounting helps you find out what you spend and why. Cost control is about keeping costs low. Some people also think financial reporting should guide your choices. But cost accounting gives you more details about your business. You should use this data to make decisions.

Tip: Using smart tools like FineReport helps you manage financial data better, especially when things change fast in the economy. Click the demo to engage.

There are different types of cost accounting. These include job costing, process costing, and activity-based costing. Each type helps you track costs in a way that fits your business. Job costing is good for custom products. Process costing works for businesses that make many of the same item.

You start by collecting data about every cost in your business. You look at direct costs like materials and labor. You also look at indirect costs, such as rent and utilities. Then you assign these costs to products, services, or departments.

Here is how you usually set up a cost accounting system:

If you work in manufacturing, you follow some key steps:

Tip: Using smart tools like FineReport helps you manage supply chain data better. Click the demo to engage.

Cost accounting is different in each industry. In manufacturing, you might use direct allocation or activity-based costing. In retail, you focus on inventory turnover and gross profit margin. In services, you may use multi-dimensional allocation to see costs across projects or clients.

Tip: Keep teaching your staff about cost accounting and new technology. Training helps your team stay up to date and helps your business do better.

Rules can also change your cost accounting system. If you need to meet outside rules or recover all costs, you may need a more detailed system. Following rules helps you keep your financial information correct and builds trust with others.

Cost accounting gives you tools to understand your business better. You can see which products make money and which lose money. You can also see how to improve. By using the right types of cost accounting and keeping your system updated, you help your business succeed.

There are many ways to do cost accounting. Each way helps you track costs for your business. The most used types are standard costing, job costing, process costing, direct costing, target costing, and activity-based costing. You should choose the best method for your products and services.

Here is a table that shows how each method works in different industries:

| Cost Accounting Method | Industry/Application | Example |

|---|---|---|

| Operating Costing Method | Service industries | A bus company calculates cost per kilometre. |

| Unit Costing Method | Manufacturing (identical products) | A pen-making factory determines cost per pen. |

| Multiple Costing Method | Manufacturing (multiple parts/processes) | A car company uses multiple costs for assembly. |

Each cost accounting method has its own use. Job costing is good for custom products. Process costing is best for making lots of the same thing. Activity-based costing helps you see which activities use the most resources.

Tip: Think about what your business needs before you pick a cost accounting method. This helps you get the best cost data.

You can use different ways to do cost accounting in your business. Big companies often use job costing, process costing, activity-based costing, standard costing, and marginal costing. These ways help you understand costs and make better choices.

You can see the differences in this table:

| Costing Method | Application Context | Cost Calculation Method |

|---|---|---|

| Job Order Costing | Used by companies that manufacture customized products or perform specific services. | Costs are calculated for each individual product based on unique customer requirements. |

| Process Costing | Ideal for industries with continuous mass production of homogeneous goods. | Costs are averaged across all units produced during a specific period or run. |

Digital tools make cost accounting easier to do. FanRuan’s FineDataLink lets you connect data from many places. You can bring cost data together and get updates right away. This makes your cost accounting more correct and helps you decide faster.

Note: Using data integration tools like FineDataLink helps you make fewer mistakes and saves time. You get a clear look at your cost and accounting data.

It is important to know about cost accounting if you want your business to grow. Cost accounting helps you control spending and set prices. It helps you plan budgets and make smart choices. You can see where your money goes. You can find problems early and fix them before they get worse.

Cost accounting systems help you watch costs and revenues. You can use cost accounting to test your business ideas. If you want to focus on customer service or make your company better, cost accounting gives you numbers to check your plan. You can study your business and make changes to earn more profit.

A Smart ERP Accounting System is very important for businesses today. It gives you real-time data and analytics. These help you make quick choices and stay competitive.

Cost accounting lets you guess how changes will affect your money. You can use cost accounting as an early warning system. If something starts to go wrong, you see it in your reports. This helps you act fast and stay ahead of others.

In finance, digital change is making companies manage money in new ways. You need real-time insights to make quick choices. FanRuan’s FineReport gives you these insights. FineReport collects data from many places and shows you clear reports. You can see your costs, track spending, and find ways to save money. This makes cost accounting easier and more correct.

Cost accounting gives you many good things. You can use cost accounting to make your business better in many ways:

Here are some clear benefits of cost accounting for your business:

| Benefit | How Cost Accounting Helps You |

|---|---|

| Improved cost management | You track every cost and control spending. |

| Accurate pricing decisions | You set prices that cover costs and boost profits. |

| Enhanced budget planning | You plan budgets with real numbers, not guesses. |

| Performance measurement | You compare actual costs to your goals. |

| Better inventory valuation | You know the true value of your stock. |

| Identify profitable activities | You see which products or services make money. |

Cost accounting turns guessing into smart choices. When you know your true costs, you avoid mistakes in pricing. You can plan your budget with confidence. You measure how well your business does by comparing costs to your goals.

FanRuan’s FineReport makes cost accounting even stronger. You can collect data in real time, automate reports, and see numbers in charts. FineReport helps you study costs across departments and projects. You can share clear reports with managers who do not work in accounting. This helps teamwork and helps everyone see why cost accounting matters.

Today, you need real-time data to stay ahead. FineReport gives you instant access to cost accounting information. You can make choices faster, help customers, and keep your business working well.

In today's competitive world, businesses must use real-time data to stay quick. A Smart ERP Accounting System brings together real-time data, automation, and analytics. This turns accounting into a tool that helps you make faster choices and keeps your business working together.

You can use cost accounting to keep your business strong. You control costs, set smart prices, plan budgets, and measure success. With digital tools like FineReport, you get the most from your cost accounting system. You stay ahead and build a successful future.

You may wonder how cost accounting and financial accounting are not the same. Both help you learn about your business, but they have different jobs. Cost accounting looks at every cost in detail. You use it to watch and control costs inside your company. Financial accounting shows the big picture of your business’s money. You use it to share results with people outside, like banks or investors.

Here is a table that shows the main ways they are different:

| Aspect | Cost Accounting | Financial Accounting |

|---|---|---|

| Objective | Maintain cost records for your organization | Maintain all financial data for your organization |

| Cost Recording | Tracks both past and planned costs | Tracks only past costs |

| Users | Used by managers and staff inside your company | Used by both internal and external parties |

| Stock Valuation | Values stock at cost | Values stock at cost or market value, whichever is lower |

| Reporting Frequency | Reports often, sometimes monthly or weekly | Reports once a year, after the year ends |

| Profit Determination | Finds profit for each product or service | Finds profit for the whole company |

| Purpose | Helps you control and reduce costs | Helps you keep full records for reporting |

Cost accounting gives you detailed reports about costs. You can see where your money goes and find ways to save. Financial accounting gives you summary reports. These reports follow strict rules and help others trust your numbers.

Note: Cost accounting is flexible and does not have strict rules. Financial accounting must follow rules like GAAP or IFRS.

Use cost accounting when you want to control spending, set prices, or plan budgets. This type of accounting helps you see the cost of each product, project, or department. You get detailed information to help you make smart choices every day.

Cost accounting works best for businesses that make things or offer many services. If you run a factory, you need to know the cost of each item you make. You can use cost accounting to find waste, fix problems, and earn more profit. It also helps you plan for the future by showing real-time cost data.

Financial accounting is important when you need to show your business results to others. You use it to make reports for banks, investors, or the government. These reports show your total income, expenses, and profit for the year. Financial accounting helps you prove your business is healthy and honest.

Here is a quick guide:

Cost accounting helps you make choices every day. Financial accounting helps you show your results at the end of the year. Both are important, but you use them for different reasons.

You can use cost accounting to help your business grow strong. It lets you watch your costs and see patterns. You can also plan for the future. Cost accounting gives you more control over spending. It helps you make better choices. Digital tools like FanRuan show you reports right away. You can also see easy-to-read dashboards. Look at the table below to see how cost accounting helps you:

| Metric | Importance |

|---|---|

| Gross Profit Margin | Shows how well you manage costs |

| ROI | Measures the value of your investments |

| Expense Patterns | Helps you find and fix rising costs |

Try using digital tools to make cost accounting quicker and more correct.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

You use cost accounting to track and manage your business costs. This helps you make smart choices, control spending, and increase profits.

Cost accounting shows you the true cost of making products or services. You use this information to set prices that cover costs and earn profits.

Yes! Digital tools like FanRuan’s FineReport and FineDataLink help you collect, organize, and analyze cost data quickly. You get real-time updates and clear reports.

You should use cost accounting if you want to control costs, set better prices, or plan budgets. It works well for manufacturers, retailers, and service providers.

FanRuan’s tools let you connect data from many sources. You see your costs in real time and create easy-to-read reports. This helps you make better business decisions.