What is 'audit dashboard'? An audit dashboard is a digital platform that displays key audit metrics, client data, and workflow status in a single, interactive view. You use it to track audit progress, monitor team tasks, and access client information instantly.

Audit dashboards help you improve workflow efficiency. You gain real-time visibility over your audit portfolio, reduce manual tracking, and save hours each week. Senior managers report greater effectiveness, and directors note that data-driven insights recover overruns and boost profitability. FineReport delivers a leading audit dashboard solution for CPA firms seeking better client management and audit performance.

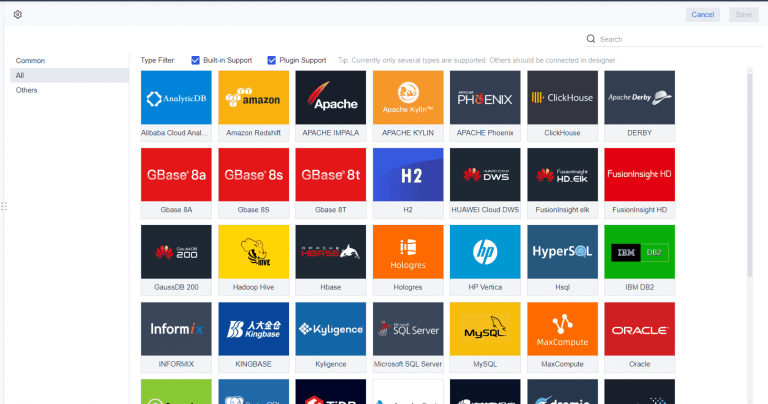

You need a single source of truth for your audit work. Centralized data management in an audit dashboard brings all your information together. FineReport connects to accounting software, ERP systems, CRM platforms, payroll tools, Excel files, and project management systems. You see every client record, financial transaction, and audit status in one place.

Centralized data management eliminates silos. Your team stops wasting time reconciling conflicting numbers. You make decisions based on accurate, unified data.

| Evidence Description | Source Link |

|---|---|

| A central data repository eliminates information silos by pulling data from all your systems into one place. This creates a single source of truth, so your teams can stop arguing over conflicting numbers and start making confident, aligned decisions. | Central Data Repository: The Ultimate 2025 Guide |

| Every disconnected system in your firm carries a hidden cost: lost time, inconsistent data, and missed opportunities. When your tax software doesn’t talk to your billing system, and your document management lives in a separate silo, your team spends more time managing technology than serving clients. The solution lies in breaking down these silos. | Why the power of integrated technology is the future of accounting firms |

| Automated enrichment of CRM data brings that picture into focus, creating a clear, connected view of how your firm engages with clients: who’s engaging with whom, how strong your relationships are, where accounts are overly reliant on a single contact, and where opportunities exist to deepen client relationships to deliver greater value and drive growth. | The One Thing Holding Back Your Firm’s Digital Transformation |

You gain a connected view of your client relationships. You track engagement, spot opportunities, and deliver greater value.

Common data sources integrated into audit dashboards:

You need to know the status of every audit at a glance. Real-time monitoring in your audit dashboard keeps you informed and proactive. FineReport delivers live updates on audit progress, staff efficiency, and client status.

| Feature | Description |

|---|---|

| Real-Time Data | Enables fast, informed decisions using live data, reducing lag in insights. |

| Staff Efficiency | Monitors team performance in real time, identifying strengths and weaknesses. |

| Work Status Tracking | Provides updates on project status for each client, ensuring nothing is missed. |

| Client Transparency | Offers tailored reports and real-time insights to keep clients informed. |

| Automated Reporting | Automates reporting processes, providing real-time updates effortlessly. |

You see audit status instantly. You respond quickly to changes in financial metrics. You access up-to-date dashboard reports for every client.

Smart algorithms in FineReport spot unusual transactions. You detect repeated payments, overpayments, incorrect tax rates, inflated contract amounts, and discount errors. Audit automation replaces manual data entry, leading to faster and more accurate detection of anomalies.

You manage multiple audits and teams. Workflow and task tracking features in your audit dashboard help you stay organized. FineReport automates tasks, standardizes processes, and centralizes deadlines.

| Feature | Description |

|---|---|

| Workflow Management & Automation | Automates tasks and standardizes processes, ensuring smooth operations and reducing errors. |

| Deadline and Task Tracking | Centralizes tracking of due dates and tasks, helping firms stay ahead of deadlines. |

| Team Collaboration Tools | Facilitates collaboration within the workflow, enhancing communication among team members. |

| Client Management | Organizes client information in one dashboard, improving the client experience and efficiency. |

| Time Tracking and Billing | Provides insights into profitability and helps in accurate pricing of services. |

| Reporting | Offers strong reporting capabilities to assess firm performance and identify areas for improvement. |

| Capacity Management | Helps understand team workload and manage resources effectively. |

You maintain automated audit trails for transparency. You assess risks, monitor compliance, and analyze trends in financial data. Collaboration tools in FineReport improve team coordination and client interaction.

Your team completes tasks faster. You reduce idle time and redundant work. You focus on billable tasks and strengthen client collaboration.

| Benefit | Description |

|---|---|

| Real-time visibility | Provides updates on workflow status, allowing teams to see progress and identify bottlenecks. |

| Automated task assignments | Routes work based on expertise and workload, ensuring tasks are assigned efficiently. |

| Enhanced collaboration | Facilitates communication among team members, reducing delays and improving efficiency. |

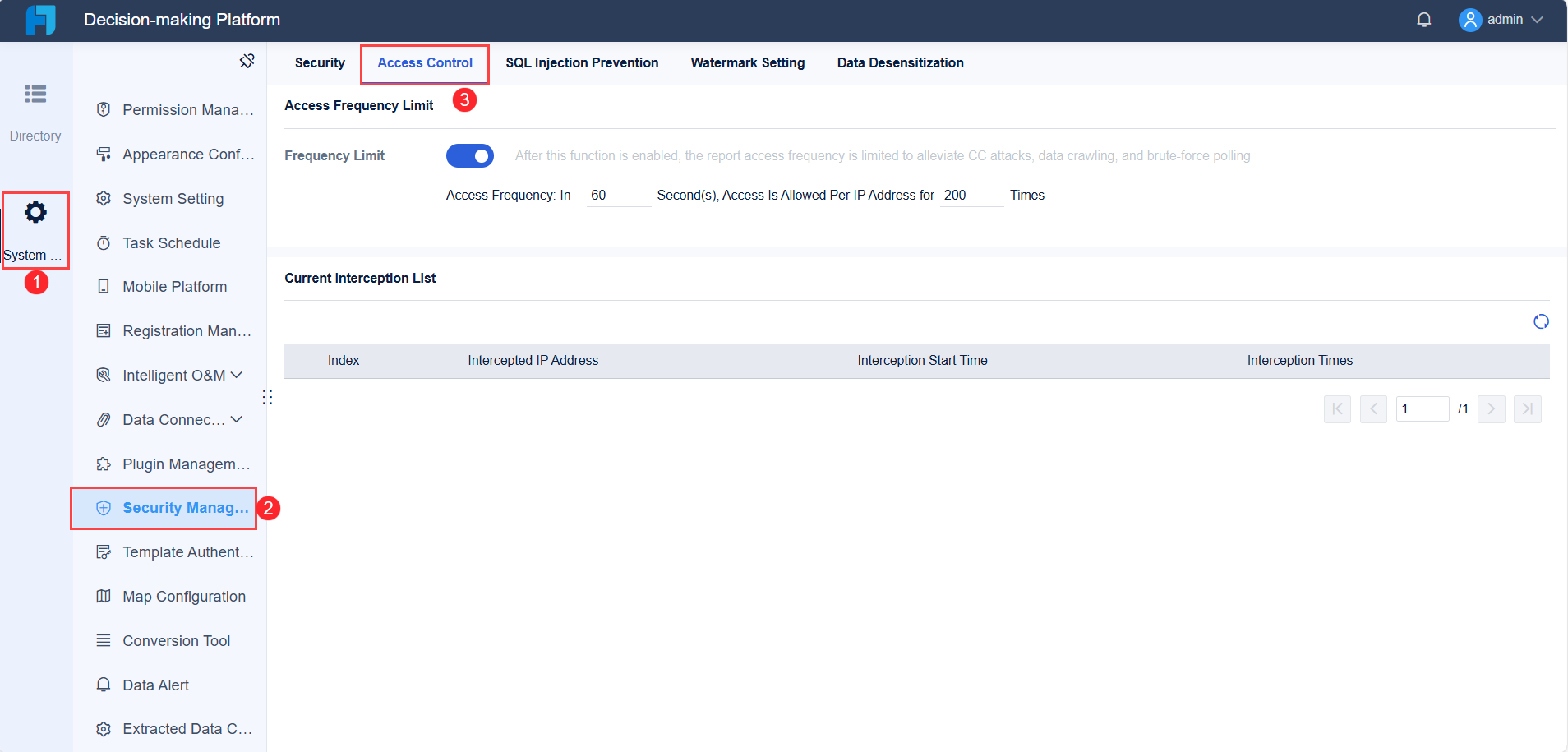

You must protect sensitive client data. User access controls in your audit dashboard ensure security and compliance. FineReport implements role-based permissions, strong authentication, and automated access management.

You comply with data privacy regulations. FineReport supports SOC 2 Type 2 standards, risk management programs, and vendor assessments.

| Compliance Aspect | Description |

|---|---|

| SOC 2 Type 2 | AuditDashboard has consistently obtained SOC 2 Type 2 reports, adhering to rigorous standards since 2016. |

| Risk Management Program | AuditDashboard integrates risk management processes to enhance decision-making and conducts annual assessments. |

| Vendor Management and Assessment | Sub-service organizations undergo thorough security assessments and provide regular audit reports. |

You need seamless integration for effective dashboard reporting. FineReport connects to over 500 data sources, including SQL databases, cloud platforms, and file-based systems. You use drag-and-drop tools to build dashboard reports and automate dashboard reporting.

FineReport’s decision-making platform centralizes dashboard reports, user management, and system operations. You customize dashboards for executives, managers, and audit teams. You access dashboard reports on any device, including mobile phones and tablets.

You automate report scheduling and distribution. You receive dashboard reports by email or app notification. You manage user permissions and data security from a single platform.

FineReport empowers you to create interactive dashboard reports with advanced visualization. You drill down into client data, monitor audit status, and make informed decisions. You streamline audit processes and improve client experience with real-time dashboard reporting.

You want your audit process to run smoothly from start to finish. An audit dashboard gives you a centralized platform that brings together all audit tasks, documents, and communications. This unified approach reduces confusion and keeps everyone on the same page. You no longer need to search through emails or spreadsheets to find the latest updates. Instead, you access a single dashboard that shows the status of every engagement.

A streamlined process means fewer errors and faster completion times. Automation handles repetitive tasks, such as document requests and reminders. You save time on follow-ups and reduce the risk of missing important deadlines. Clients benefit from a more organized and predictable experience. They receive timely updates and clear instructions, which builds trust and satisfaction.

Here is how an audit dashboard streamlines your process:

| Feature | Benefit |

|---|---|

| Centralized Dashboard | Provides a 360-degree view of operations, enhancing visibility and control over engagements. |

| Automation of Manual Processes | Reduces manual effort and errors, speeding up onboarding and document management. |

| Enhanced Client Experience | Offers a unified portal for clients, improving satisfaction and reducing access-related queries. |

| Workflow Efficiency | Integrates with existing tools, eliminating data silos and improving task management. |

| Data-Driven Insights | Leverages analytics for informed decision-making and strategic planning. |

You see measurable improvements in efficiency and quality. Firms report that standardized workflows and automation lead to fewer audit issues and a more structured approach. This results in a better client experience.

| Improvement Type | Description |

|---|---|

| Enhanced Efficiency | Firms reported streamlined audits through standardized workflows and automation. |

| Reduced Audit Issues | Implementation of audit dashboards led to fewer issues during audits, improving overall quality. |

| Structured Approach | A more organized method to audits resulted in a better client experience. |

You need strong communication to deliver successful audits. An audit dashboard supports enhanced collaboration by providing tools for messaging, file sharing, and task management. You and your client can communicate directly within the dashboard, reducing email clutter and keeping all discussions in context.

You use integrated tools like Slack, Microsoft Teams, or Zoom to facilitate conversations and meetings. These platforms allow you to share documents, discuss findings, and resolve issues quickly. Smart notifications ensure that everyone stays informed and can respond promptly.

You create a seamless environment for client collaboration. This approach leads to fewer errors, faster decision-making, and a more positive client relationship.

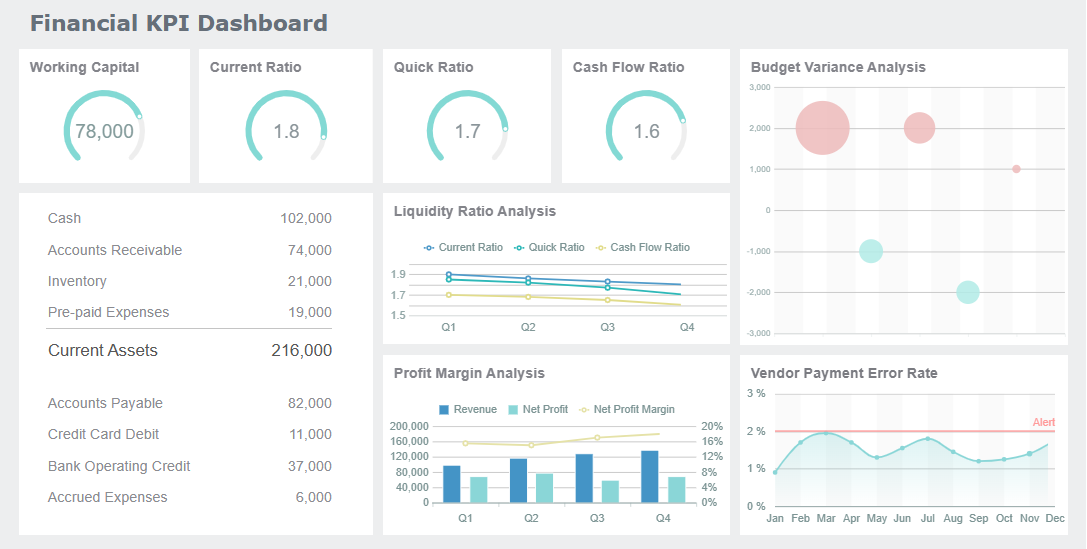

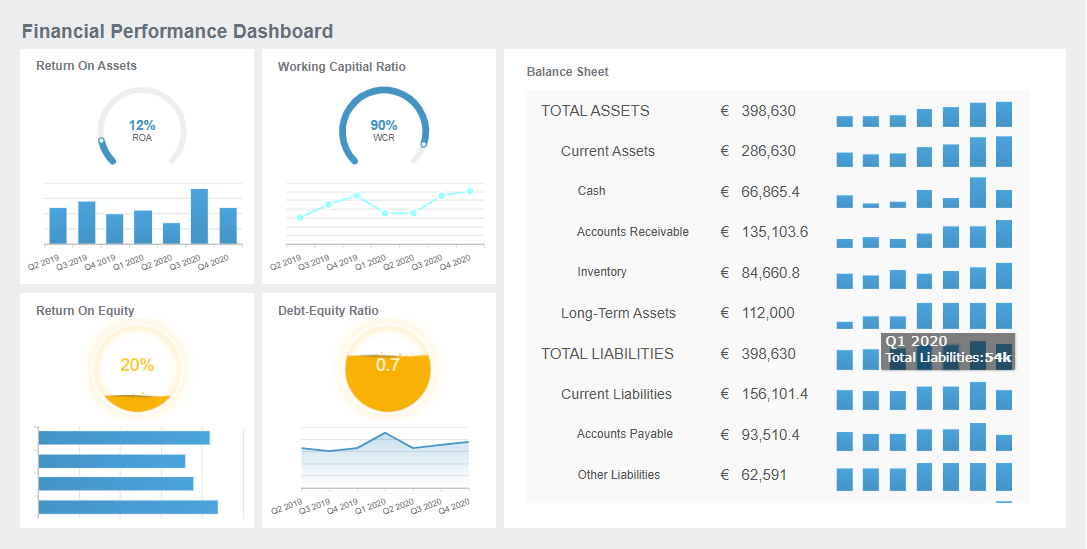

You want your clients to have access to the information they need, when they need it. An audit dashboard provides real-time insights through visual reports and dashboards. Clients can view key performance indicators, track audit progress, and receive instant updates on important metrics.

Real-time data helps clients make informed decisions. Visualizations make it easy to spot trends and outliers. Up-to-date information allows for rapid course correction if issues arise. You improve transparency and build trust by giving clients direct access to their audit data.

| Benefit | Description |

|---|---|

| Faster insights | Visual data representation makes it easier to spot trends and outliers. |

| Improved decision-making | Real-time access to KPIs enables quicker, data-driven decisions. |

| Enhanced visibility | Up-to-date visibility into metrics allows for rapid course correction. |

| Better communication | Visualizations facilitate discussion and understanding of analytics. |

You notice that clients ask fewer questions about audit status. They feel more in control and appreciate the transparency. Managers stay informed with dashboards and progress indicators, which keeps the audit process on track.

You must meet regulatory requirements and maintain accurate records. An audit dashboard helps you manage compliance by organizing documentation, tracking incidents, and communicating important updates. You use the dashboard to store policies, procedures, and training materials, ensuring that everyone follows the correct processes.

The dashboard tracks incidents and investigations, helping you address any issues or violations. You manage third-party risks and monitor internal controls from a single platform. Automated alerts notify you of changes in regulations or upcoming deadlines, reducing the risk of non-compliance.

| Component | Description |

|---|---|

| Incident and investigation tracking | Helps address issues or violations of regulations. |

| Compliance communication | Organizes dissemination of important information, reducing non-compliance risk. |

| Training | Ensures employees are informed about compliance activities related to their roles. |

| Conflicts of interest | Keeps stakeholders aware of potential conflicts that could influence their actions. |

| Third-party risk management | Ensures vendors or suppliers are compliant and reputable. |

| Policies and procedures | Helps adhere to various regulations and standards. |

| Internal controls | Provides oversight and monitoring of operations, ensuring accurate financial reporting. |

| Governance | Involves stakeholders in compliance oversight and communication of changes. |

| Reports and alerts | Notifies of changes in regulations, upcoming deadlines, and other compliance-related information. |

You ensure that all documentation is complete and accessible. This reduces the time spent on audits and improves the quality of your compliance efforts.

FineReport's customer story with Kintetsu World Express shows the impact of a well-implemented audit dashboard. Kintetsu integrated multiple data sources into a real-time dashboard, giving their teams and clients instant access to customer information and logistics data. This improved operational efficiency, streamlined reporting, and enhanced the overall client experience. You can achieve similar results by adopting a modern audit dashboard for your firm.

You handle many tasks each day as a CPA. An audit dashboard helps you manage these tasks with ease. You can monitor ongoing audits, track deadlines, and assign responsibilities to your team. The dashboard gives you a clear overview of all client engagements. You see which audits need attention and which ones are on track. This visibility helps you prioritize work and avoid missed deadlines.

| Common Automated Tasks | Description |

|---|---|

| Continuous Monitoring | Automated tools monitor financial processes and flag non-compliance in real time. |

| Compliance Management | Tools apply the correct accounting treatment automatically and stay updated with regulations. |

| Report Generation | Users can generate standard and custom audit reports quickly, streamlining the audit process. |

| Reducing Manual Labor | Automation minimizes manual tasks, leading to faster and more efficient audits. |

You reduce manual work and focus on high-value activities. The dashboard supports you in delivering consistent results for every client.

You need to create dashboard reports for clients and internal teams. Automation in dashboard reporting saves you time and reduces errors. You schedule reports to run at set intervals, such as daily, weekly, or monthly. The system generates and distributes these reports automatically. You no longer spend hours compiling data or formatting documents. Instead, you review the results and share insights with your team or client.

Automated reporting ensures that everyone receives the latest information. You maintain accuracy and consistency in your audit documentation. This process supports better decision-making and keeps your firm compliant with regulations.

You often work outside the office. Mobile dashboard access lets you view dashboard reports on your phone or tablet. You check audit status, review client data, and approve tasks from anywhere. This flexibility helps you respond quickly to client needs. You stay connected to your team and keep audits moving forward, even when you are on the go.

Mobile access improves your productivity. You never miss important updates or deadlines. Your clients appreciate your responsiveness and attention to detail.

You can see the benefits of these applications in real-world scenarios. FineReport supports daily audit management by integrating data from multiple sources. You use its drag-and-drop tools to build custom dashboard reports. FineReport automates report scheduling and distribution, so you deliver timely insights to every client. The mobile dashboard feature keeps you connected, whether you are in the office or meeting with a client.

Kintetsu World Express improved its operations by using FineReport to create real-time dashboards. The company integrated customer data and logistics information, giving teams and clients instant access to key metrics. This approach led to better decision-making and higher client satisfaction. You can achieve similar results by adopting FineReport for your audit dashboard needs.

You want an audit dashboard that fits your firm’s unique needs and supports excellent client service. Start by evaluating the features that matter most. Look for customizable reporting so you can tailor reports for each audit client. Integration capabilities are essential. The dashboard should connect with your existing systems to streamline data flow and reduce manual entry. Automation features help your team focus on analysis instead of repetitive tasks. Real-time monitoring lets you detect issues quickly and track compliance for every client.

| Criteria | Description |

|---|---|

| Customizable Reporting | Flexibility to create reports that fit unique organizational needs rather than using templates. |

| Integration Capabilities | Ability to connect with existing systems to streamline data flow and reduce manual entry errors. |

| Automation | Reduces manual tasks, enhancing productivity and allowing teams to focus on complex analysis. |

| Real-Time Monitoring | Enables immediate detection of issues and compliance tracking, improving responsiveness. |

You need a clear plan to integrate your audit dashboard. Begin by mapping your current systems and identifying data sources. Work with your IT team to connect the dashboard to accounting, CRM, and project management tools. Test the integration to ensure data flows smoothly. Address common challenges such as understanding your IT environment and closing skill gaps. Many firms face issues like fragmented knowledge of systems and resource shortages. Involve key staff early to reduce these risks.

You must prepare your team for the new audit dashboard. Offer hands-on training that covers both compliance and risk-based approaches. Many firms find that staff excel at compliance but need more training in analytics and technology. Address resistance to change by creating a transformation plan. Support your team with ongoing resources and clear documentation.

| Finding | Description |

|---|---|

| Resistance to Change | 75% of firms have not documented a transformation plan. |

| Methodology Limitations | 30% of firms say their audit methodology does not support transformation. |

| Training Gaps | Staff excel at compliance but lack training in risk-based approaches and data analytics. |

You can make the most of FineReport by following a few best practices. Start with a pilot project for one audit client to test features and workflows. Use FineReport’s drag-and-drop tools to build custom dashboards that match your client service goals. Schedule regular reviews to update your dashboards as your firm grows. Leverage FineReport’s support resources for troubleshooting and ongoing learning. This approach ensures you deliver consistent, high-quality client service and maximize the value of your audit dashboard.

You transform your audit process when you use an audit dashboard like FineReport. By organizing financial data in one place, you reduce manual work and improve efficiency. This approach supports long-term growth and delivers a customer-first client experience. You give each client real-time insights and foster better collaboration. As audit platforms evolve, you will see more AI-driven features that enhance transparency and quality. Explore FineReport to elevate your client experience and stay ahead in the future of audit technology.

Best Dashboard Apps for Business Insights

What is a Call Center Dashboard and Why Does It Matter

What is a Reporting Dashboard and How Does it Work

What is An Interactive Dashboard and How Does It Work

What is a Call Center Metrics Dashboard and How Does It Work

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

What is a White Label Marketing Dashboard and How It Works

A white label marketing dashboard lets agencies present branded, automated reports and real-time insights to clients for improved engagement and retention.

Lewis

Jan 15, 2026

Strategy Dashboard Explained and Why Your Business Needs One

A strategy dashboard visualizes key metrics, tracks goals, and drives better decisions, making it vital for business performance and team alignment.

Lewis

Jan 15, 2026

How to Create a Marketing Metrics Dashboard from Scratch

Create a marketing metrics dashboard from scratch to track KPIs, unify data, and drive better decisions for your marketing team.

Lewis

Jan 15, 2026