A saas dashboard is a visual tool that lets you monitor, analyze, and act on your company’s most important metrics in real time, all from a single interface. For 2026, you need to track these 10 essential SaaS dashboard metrics and KPIs: Monthly Recurring Revenue (MRR), Customer Churn Rate, Customer Lifetime Value (CLV), Customer Acquisition Cost (CAC), Net Promoter Score (NPS), Active Users (DAU/WAU/MAU), Expansion Revenue, Gross Margin, Average Revenue Per User (ARPU), and Lead-to-Customer Conversion Rate.

Tracking these metrics helps you stay competitive as the SaaS industry expects a market volume of $793.10 billion by 2029, with over 80% of companies using AI-enabled apps by 2026.

Modern BI tools like FineBI help you visualize, track, and share these KPIs, making data-driven decisions faster and easier.

A saas dashboard gives you a unified view of your business’s most important metrics and kpis, helping you make faster, smarter decisions.

Saas metrics and kpis measure the health and growth of your business. You track these numbers to understand how your company earns revenue, retains customers, and grows over time. Leading companies in 2026 focus on metrics such as:

These metrics differ from traditional business metrics. Saas metrics focus on ongoing payments and customer retention. Traditional metrics often measure one-time sales. The table below shows the main differences:

| Metric Type | SaaS Metrics | Traditional Metrics |

|---|---|---|

| Revenue Model | Subscription-based | One-time sales |

| Customer Relationship | Ongoing engagement and retention | Transactional |

| Key Metrics | MRR, ARR, Churn Rate | Gross Margin, One-time Revenue |

| Business Impact | Long-term customer value | Immediate sales |

You track saas metrics to spot trends and solve problems quickly. For example, a company saw a drop in user engagement. The dashboard showed that the onboarding process was too complex. After making it easier and adding support, user engagement and retention improved. Tracking these metrics helps you boost revenue and keep customers happy.

FineBI helps you create saas kpi dashboards that show real-time insights. You connect data from many sources, clean and manage it, and visualize key metrics. FineBI supports collaboration, so your team can share dashboards and work together. You use adaptive layouts and customizable themes to highlight important kpis and monitor performance. FineBI’s data cleaning tools ensure your metrics are accurate and reliable.

Monthly recurring revenue is the total predictable income your business earns from subscriptions each month. You use this metric to measure the health and growth of your saas company. MRR helps you understand how much revenue you can expect every month. It shows if your business is growing or shrinking. You track MRR on your saas dashboard to spot trends and make better decisions.

MRR is one of the most important saas kpis. It gives you a clear picture of your company’s financial stability. You can compare your growth rate to industry benchmarks. For startups with less than $1 million in annual recurring revenue, a median growth rate of 50% year-over-year is excellent. Top-performing companies often exceed 100% growth. These numbers help you set realistic goals and measure your progress.

You calculate MRR by adding up all recurring revenue from active subscriptions. You exclude one-time fees and variable usage charges. You standardize revenue to a monthly amount, even if customers pay quarterly or yearly. You break down MRR into components:

You can also track committed monthly recurring revenue. CMRR factors in new bookings, cancellations, and downgrades. It gives you a clearer forecast of future revenue.

FineBI helps you monitor MRR in real time. You connect data from multiple sources and visualize trends on your saas dashboard. You use self-service tools to clean and process data, ensuring your metrics are accurate. FineBI lets you set up alerts for sudden changes in revenue. You share dashboards with your team to collaborate on strategies that boost MRR.

A leading technology company used FineBI to unify its metrics and kpis. The company reduced inventory costs by 5% and increased operational efficiency by 50%. You can use FineBI to track monthly recurring revenue, compare performance across departments, and make data-driven decisions that grow your saas business.

You need to understand churn rate if you want to measure how well your saas business keeps customers. Churn rate shows the percentage of customers who leave your service during a set period. High churn means you lose more customers, which can hurt your revenue and growth. Low churn means your product keeps users happy and loyal. You track churn on your saas dashboard to spot problems early and take action.

The average churn rate depends on company size. You can use the table below to compare your numbers with industry standards for 2026:

| Company Size | Monthly Churn Rate | Annual Churn Rate |

|---|---|---|

| Small and Medium-sized | 3-5% | 6-10% |

| Mid-market | 1.5-3% | 10-15% |

| Enterprise-level | 1-2% | 5-7% |

You calculate churn using simple formulas. These formulas help you track both customer loss and lost revenue. Here are the most common ways to measure churn in saas dashboards:

For example, if you start with 1,000 customers and lose 20, your customer churn rate is (20 ÷ 1,000) × 100 = 2%. If your MRR is $100,000 and you lose $5,000, your revenue churn rate is (5,000 ÷ 100,000) × 100 = 5%.

You can use FineBI to lower churn and improve your saas metrics. FineBI helps you find patterns in your data and spot why customers leave. For example:

FineBI lets you track kpis and set alerts for sudden changes in churn. You can share dashboards with your team and work together to keep more customers. This approach helps you protect your revenue and grow your saas business.

Customer Lifetime Value (CLV) measures the total revenue you can expect from a customer throughout their relationship with your business. This metric helps you understand how much value each customer brings over time. In the SaaS industry, CLV guides your decisions on marketing, retention, and product development. You use CLV to justify your marketing spend and to assess the profitability of your customer base. For example, a B2B SaaS company with a monthly recurring revenue of $299, a gross margin of 75%, and a monthly churn rate of 5% will have a CLV of $4,485 per customer. Enterprise customers often have much higher CLV, sometimes reaching $46,000 or more, especially when you factor in expansion revenue.

You can calculate CLV using several approaches. The most common method multiplies the average customer value by the average customer lifespan. This gives you a clear estimate of the total revenue from each customer. The table below summarizes the main methods:

| Method | Description |

|---|---|

| Average Customer Value | The average revenue generated from a customer over a set period. |

| Average Customer Lifespan | The average time a customer stays with your company. |

| CLV Calculation | Multiply average customer value by average customer lifespan. |

To break it down further, follow these steps:

A project management platform, for instance, with an annual subscription of $1,200, a gross margin of 70%, and an annual churn rate of 25%, would have a CLV of $3,360.

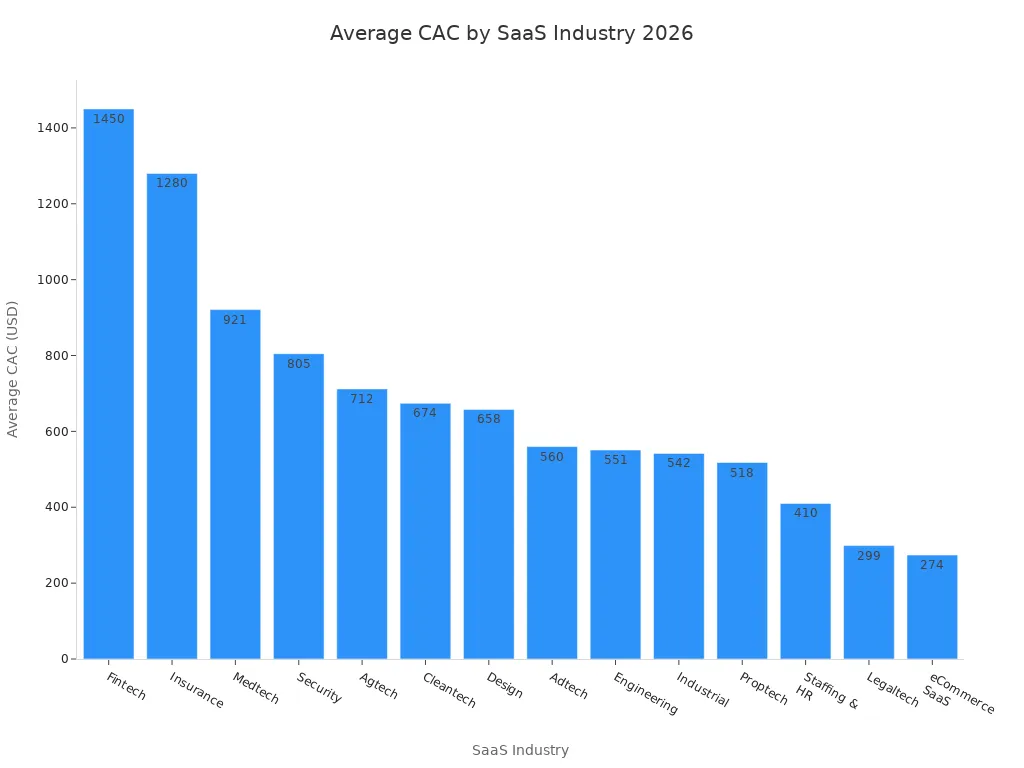

Customer Acquisition Cost (CAC) shows how much you spend to gain a new customer. You use this metric to measure the efficiency of your sales and marketing efforts. CAC helps you understand if your spending leads to profitable growth. In the saas industry, keeping CAC low while increasing revenue is a key goal. You compare CAC with other saas metrics and kpis to see if your business model is sustainable. If CAC rises faster than revenue, you may need to adjust your strategy.

The average CAC varies by industry. You can use the table below to compare your numbers with 2026 benchmarks:

| SaaS Industry | Average CAC |

|---|---|

| Fintech | $1,450 |

| Insurance | $1,280 |

| Medtech | $921 |

| Security | $805 |

| Agtech | $712 |

| Cleantech | $674 |

| Design | $658 |

| Adtech | $560 |

| Engineering | $551 |

| Industrial | $542 |

| Proptech | $518 |

| Staffing & HR | $410 |

| Legaltech | $299 |

| eCommerce SaaS | $274 |

You calculate CAC by dividing your total sales and marketing costs by the number of new paying customers. This simple formula gives you a clear view of how much you spend to acquire each customer. You use your saas dashboard to track CAC and compare it with other kpis. Best practices for calculating CAC include:

You check these metrics regularly to spot patterns and make quick decisions. Tracking CAC helps you control spending and improve revenue.

You use FineBI to optimize CAC and improve your saas kpis. FineBI connects data from multiple sources, cleans it, and visualizes CAC trends on your saas dashboard. You set up alerts for sudden changes in acquisition costs. You share dashboards with your team to find ways to lower CAC and boost revenue. FineBI helps you analyze which channels bring in the most valuable customers. You use these insights to adjust your marketing strategy and increase profitability. By focusing on accurate metrics, you make smarter decisions and grow your saas business.

Net Promoter Score (NPS) measures how likely your customers are to recommend your product or service to others. You use NPS to understand customer loyalty and satisfaction. In the saas industry, NPS is a key metric for tracking how well your company meets customer needs. You ask customers to rate their likelihood to recommend your service on a scale from 0 to 10. Scores of 9 or 10 are promoters, 7 or 8 are passives, and 0 to 6 are detractors. You subtract the percentage of detractors from the percentage of promoters to get your NPS. In 2026, the average NPS for saas companies is 30. This score shows a balance of customer loyalty across the industry.

You can calculate NPS using several reliable methods. Your saas dashboard should make it easy to collect, organize, and analyze NPS responses. The table below shows the most common ways to calculate NPS for saas kpis:

| Method | Description |

|---|---|

| Excel or Google Sheets | Organize NPS responses with COUNTIF and subtract detractors' percentage from promoters'. |

| NPS Calculator | Input NPS response data to get the score automatically. |

| NPS Tool | Trigger surveys, collect insights, and visualize NPS data automatically. |

You choose the method that fits your workflow. Each method helps you track customer loyalty and spot trends in your metrics.

Tip: Regularly review your NPS alongside other kpis to understand how customer satisfaction impacts revenue and retention.

You track active user metrics to understand how many people use your product every day, week, or month. These metrics show you how engaged your users are and help you spot trends in usage. DAU, WAU, and MAU measure unique users over different time periods. The DAU/MAU ratio is a key indicator of product stickiness. If your ratio is above 20%, you see high engagement, which means users find daily value. Ratios between 10% and 20% show moderate engagement, while less than 10% signals low engagement and possible retention risks.

You use these benchmarks to compare your product with industry standards and set goals for improvement.

You need to track user engagement to improve your product and increase revenue. Your saas dashboard helps you monitor how users interact with your platform. You can use several strategies to get the most accurate insights:

Avoid tracking vanity metrics that do not connect to business outcomes. Make sure every metric you track leads to actionable insights.

FineBI gives you powerful tools to analyze user activity and engagement. You connect data from multiple sources and visualize active user metrics on your saas dashboard. You use drag-and-drop features to build dashboards that show DAU, WAU, and MAU trends. FineBI lets you set up alerts for drops in engagement, helping you respond quickly. You share dashboards with your team to focus on key kpis and improve customer retention. With FineBI, you see how changes in engagement affect revenue and other saas kpis. You make data-driven decisions that help your business grow.

Expansion revenue is the extra income you earn from existing customers. You get this revenue when users upgrade their plans, buy add-ons, or choose new features. This metric helps you grow your business without spending more on marketing. You focus on upselling and cross-selling to maximize the value of each customer. Expansion revenue gives you a more predictable income stream and helps you scale your saas company faster. When expansion revenue is higher than the revenue lost from churned customers, you reach negative churn. This is a sign of healthy growth in saas businesses.

Tip: Expansion revenue is often more cost-effective than acquiring new customers. You can use this metric to measure the success of your upsell and cross-sell strategies.

You need to track expansion revenue on your saas dashboard to understand how your business grows. You can use a simple process to calculate this metric:

Here is a table to help you organize the calculation:

| Source | Monthly Recurring Revenue (MRR) |

|---|---|

| Upsells | $2,000 |

| Cross-sells | $1,500 |

| Total | $3,500 |

You use this formula to track expansion revenue as part of your saas kpis. This helps you see which strategies work best and where you can improve.

Gross margin shows how much revenue you keep after paying for the costs to deliver your service. You use this metric to measure the financial health of your business. Most traditional saas companies have an average gross margin between 80% and 90%. AI-first saas businesses usually see lower margins, around 50% to 60%. High gross margin means you keep more revenue to invest in growth, product development, and customer support. You track gross margin on your saas dashboard to compare your performance with industry standards and set realistic goals.

You need accurate methods to calculate gross margin in your saas dashboard. You start by identifying all costs related to delivering your service. These costs include servers, hosting, licensing, onboarding, customer support, partner fees, and salaries for core functions. You subtract these costs from your annual recurring revenue to find your subscription gross margin.

Here is a table showing common cost types:

| Cost Type | Description |

|---|---|

| Shared Costs | Costs like rent, utilities, and depreciation allocated based on headcount and location. |

| Information Technology Costs | Costs related to IT infrastructure necessary for saas operations. |

| Administrative Personnel Costs | Costs associated with administrative support allocated to departments. |

You use these details to ensure your metrics are accurate and your saas kpis reflect true business performance.

Tip: Always review your cost structure regularly. This helps you spot changes and keep your calculations up to date.

Average Revenue Per User (ARPU) tells you how much revenue you earn from each customer over a set period. In saas, ARPU helps you understand the value each user brings to your business. You use this metric to compare different customer segments and spot trends in your revenue streams. ARPU gives you a clear view of how your pricing, product features, and customer engagement affect your bottom line. When you track ARPU on your saas dashboard, you see which strategies increase revenue and which need improvement.

You calculate ARPU by dividing your total recurring revenue by the number of active users or customers during a specific time frame. For example, if your monthly recurring revenue is $50,000 and you have 1,000 active users, your ARPU is $50. This simple formula helps you measure the effectiveness of your pricing and sales efforts. Your saas dashboard should let you break down ARPU by product, region, or customer type. This way, you can identify which segments generate the most revenue and which need more attention. Tracking ARPU alongside other saas metrics and kpis gives you a complete picture of your business performance.

Tip: Regularly review ARPU to spot changes in customer behavior and adjust your pricing or product offerings as needed.

You can use FineBI to analyze ARPU and find ways to boost revenue. FineBI connects to your data sources and visualizes ARPU trends on your saas dashboard. You can segment your customer base, compare ARPU across different groups, and track the impact of new features or pricing changes. FineBI lets you set up alerts for sudden drops or spikes in ARPU, so you can act quickly. By sharing dashboards with your team, you ensure everyone focuses on the right kpi and works together to increase revenue. With accurate metrics and real-time insights, you make smarter decisions that drive growth and improve your saas kpis.

You need to know how many leads turn into paying customers. This is your lead-to-customer conversion rate. In saas, this metric shows how well your sales and marketing efforts work. You want a high conversion rate because it means your team turns more leads into revenue. A low rate can signal problems with your sales process or product fit. You should compare your rate to industry benchmarks. Many saas companies see conversion rates between 5% and 15%. Tracking this metric helps you spot issues early and improve your sales funnel.

You can track your conversion rate easily with a saas dashboard. Start by collecting data from your CRM and marketing tools. Count the number of leads and the number of new customers for a set period. Use this formula:

Conversion Rate = (Number of New Customers ÷ Number of Leads) × 100

Your dashboard should show this metric alongside other saas kpis. You can break down conversion rates by channel, campaign, or sales rep. This helps you see which strategies bring in the most revenue. Use tables or charts to compare performance over time. Set alerts for sudden drops in conversion so you can act fast.

FineBI helps you optimize your conversion rate by bringing all your data together. You can connect sales, marketing, and customer data in one place. Use visual tools to spot trends and find bottlenecks in your funnel. FineBI lets you build custom dashboards that highlight key metrics and kpis. You can share these dashboards with your team to focus on improving revenue. With real-time insights, you make quick decisions and test new strategies. FineBI supports your efforts to turn more leads into loyal customers and grow your saas business.

You need clear and actionable dashboards to track saas metrics and kpis. Start by defining unified metric standards across your organization. Use simple layouts that highlight the most important kpi and revenue trends. Choose visualizations that make complex data easy to understand. For example, use line charts to show revenue growth and bar charts to compare customer segments. Set up filters so you can view metrics by product, region, or time period. Share dashboards with your team to encourage collaboration and faster decision-making.

Tip: Review your dashboards regularly. Update them as your business goals change to keep your metrics relevant.

FineBI gives you powerful tools for monitoring saas dashboard performance. You connect data from many sources and create interactive dashboards with drag-and-drop features. FineBI supports real-time filtering, so you see the latest revenue and customer data instantly. You set up alerts for sudden changes in kpis, such as drops in revenue or spikes in churn. FineBI’s role-based access control keeps sensitive metrics secure while allowing your team to work together. You use templates to save time and ensure consistency across dashboards.

You gain real-time insights with FineBI. The platform updates dashboards automatically when new data arrives. You spot trends in revenue, customer retention, and other key metrics without delay. FineBI lets you annotate dashboards and share them with your team. Everyone can comment and suggest actions based on the latest kpis. The BOE customer story shows how unified dashboards improved operational efficiency by 50% and reduced inventory costs by 5%. You use these insights to make quick decisions and drive business growth.

Note: Real-time collaboration helps your team respond to changes in revenue and customer behavior faster.

You gain a clear view of your business when you track saas dashboard metrics and key performance indicators. You see how revenue changes and how customer actions affect growth. FineBI helps you visualize saas kpis, monitor customer trends, and act on insights. You use modern BI tools to improve revenue, understand saas metrics, and make better decisions.

Tip: Review your metrics often to keep your saas business strong and your revenue rising.

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Client Dashboard Software for Agencies in 2026

Compare the top client dashboard software for agencies in 2026 to find the best tools for reporting, integration, customization, and client management.

Lewis

Feb 05, 2026

Best Law Firm KPI Dashboard Templates for 2026

Compare top law firm KPI dashboard templates for 2026 to track metrics, improve financial performance, and choose the best fit for your firm's needs.

Lewis

Feb 05, 2026

Unlocking Better Decisions with Streamlined Board Dashboards

Board dashboards streamline data, reduce overload, and enable faster, more confident decision-making for boards aiming for success in 2026.

Lewis

Feb 05, 2026